Tag Archive: newslettersent

Expectations and Acceptance of Potential

The University of Michigan reports that consumer confidence in September slipped a little from August. Their Index of Consumer Sentiment registered 95.3 in the latest month, down from 96.8 in the prior one. Both of those readings are in line with confidence estimates going back to early 2014 when consumer sentiment supposedly surged.

Read More »

Read More »

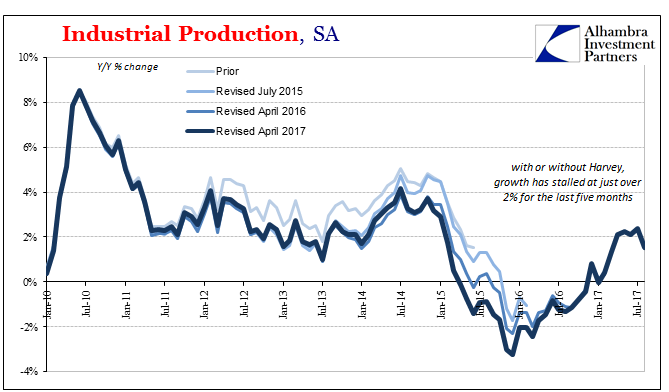

IP Weathers Storms But Not Cars

In late August 2006, ABC News asked more than a dozen prominent economists to evaluate the impacts of hurricane Katrina on the US economy. The cataclysmic storm made landfall on August 29, 2005, devastating the city of New Orleans and the surrounding Gulf coast. The cost in human terms was unthinkable, and many were concerned, as people always are, that in economic terms the country might end up in similar devastation.

Read More »

Read More »

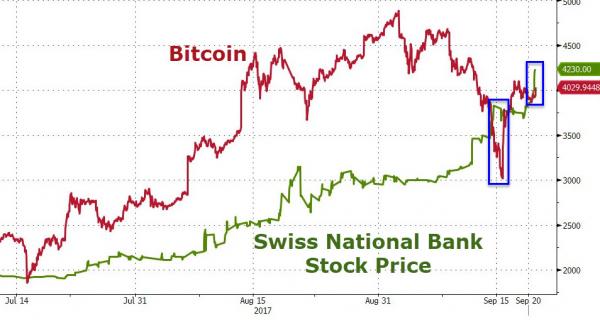

Swiss National Bank Bubble Regains Lead Over Bitcoin

But as Bitcoin rebounded from its China challenges, it overtook The SNB once again as bubbliest bubble. However, a 13% spike in the share price of The Swiss National Bank today has put an end to that leaving the central bank back in first place among the melter-uppers...

Read More »

Read More »

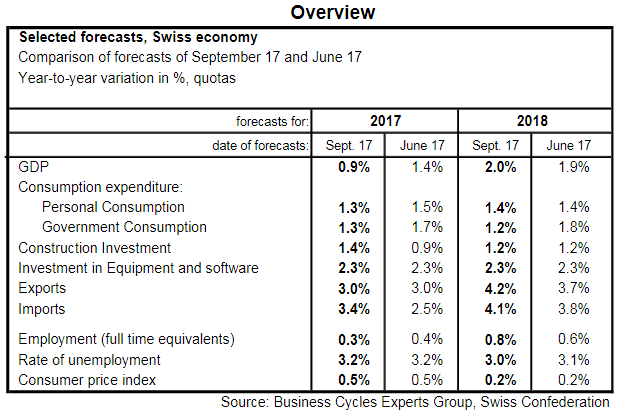

Swiss economy resumes stronger growth

Economic forecasts by the Federal Government’s Expert Group – autumn 2017* - Because of the weak performance in the first half of the year, the Federal Government’s Expert Group anticipates only moderate GDP growth of 0.9% in 2017.

Read More »

Read More »

FX Daily, September 22: Markets Limp into the Weekend

The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships.

Read More »

Read More »

Swiss Mystery: Someone Keeps Flushing €500 Bank Notes Down The Toilet

While there are several comments one can make here, “dirty money”, “flush with cash” and “flushing money down the toilet” certainly coming to mind, perhaps the ECB was on to something when it warned that €500 “Bin Laden” bills (which it has since discontinued to print) tend to be used by criminals. The reason for … Continue reading »

Read More »

Read More »

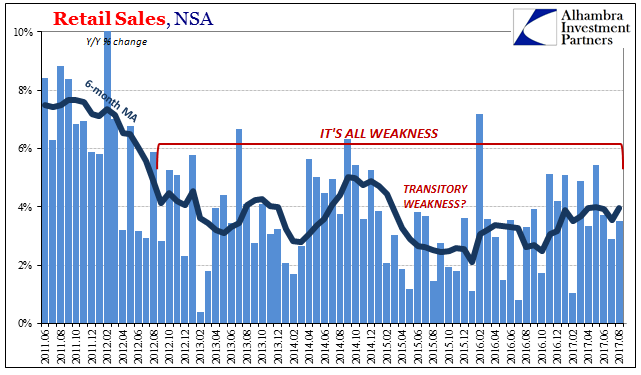

Retail Sales and the End of ‘Reflation’

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times.

Read More »

Read More »

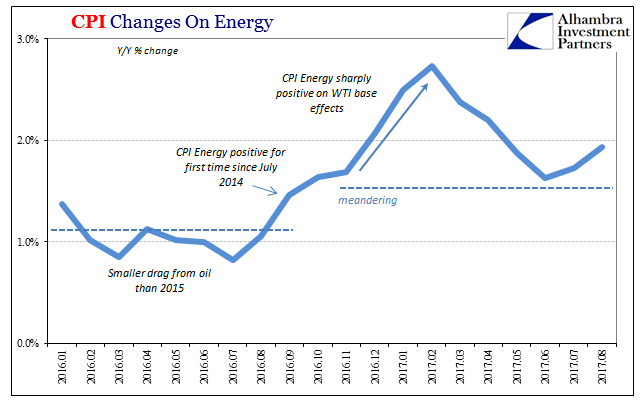

The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal reasons.”

Read More »

Read More »

Digital-Currency Milestone: Somebody Just Bought A House With Bitcoin

A day after Bridgewater Associates Founder Ray Dalio claimed that bitcoin was “definitely in a bubble” partly because he said the digital currency was too difficult to spend, CoinTelegraph is reporting that the first-ever bitcoin-only real-estate transaction has been completed in Texas.

Read More »

Read More »

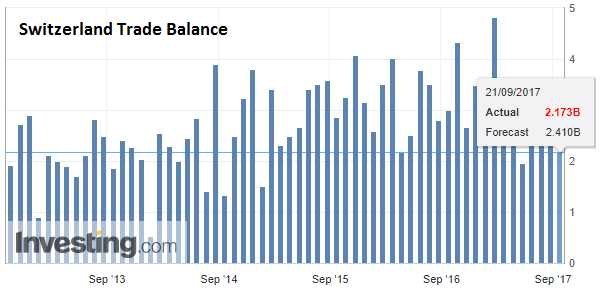

Swiss Trade Balance August 2017: Dynamism of Imports

In August 2017, Swiss foreign trade grew stronger both at entry and exit. With growth of 9.9%, imports were much more dynamic than exports (+ 3.9%). The balance of trade closed with a surplus of 2.2 billion francs.

Read More »

Read More »

FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

The market has mostly interpreted the Fed's action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses are somewhat mysterious, the Fed clearly signaled its bias toward hiking rates one more time this year and three next year.

Read More »

Read More »

Boris Johnson Threatens To Resign If Theresa May “Goes Against His Brexit Demands”, Pound Rises

In confirmation that Theresa May's upcoming Florence speech this Friday is not only what many have called "the most important day for Brexit since the referendum", but also the most opaque, the Telegraph reports that UK Foreign Secretary Boris Johnson will resign as before the weekend if Theresa May veers towards a “Swiss-style” arrangement with the EU in her upcoming speech.

Read More »

Read More »

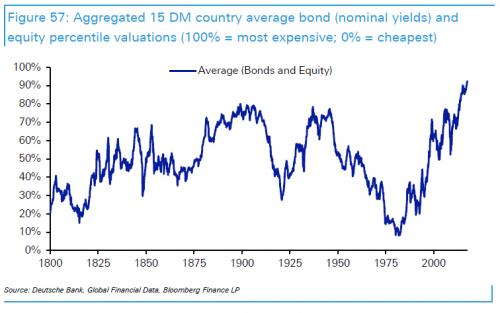

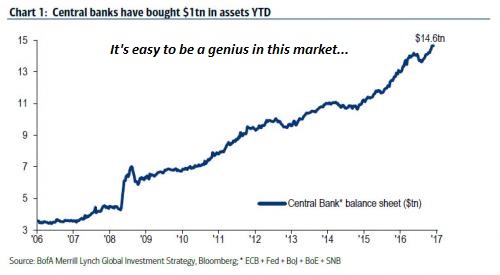

“This Is Where The Next Financial Crisis Will Come From” – Deutsche Bank

In an extensive, must-read report published on Monday by Deutsche Bank’s Jim Reid, the credit strategist unveiled an extensive analysis of the “Next Financial Crisis”, and specifically what may cause it, when it may happen, and how the world could respond assuming it still has means to counteract the next economic and financial crash.In our first take on the report yesterday, we showed one key aspect of the “crash” calculus: between bonds and...

Read More »

Read More »

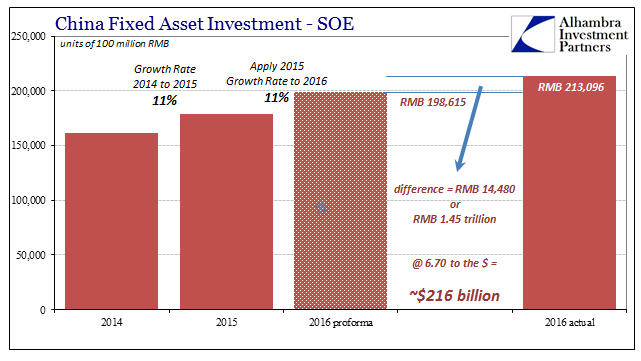

A Clear Anchor

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE). By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP

Read More »

Read More »

Pourquoi l’accès à vos dépôts bancaires, épargnes et capital retraite est rendu difficile?

Les dépôts bancaires servent de base à l’activité bancaire classique. Réserves fractionnaires et autres créations monétaires bancaires privées vont prendre appui dessus. Qu’une part importante des clients retire ses dépôts et la banque s’écroule. Il est donc indispensable qu’on y touche le moins possible, spécialement quand votre confiance s’évapore.

Read More »

Read More »

FX Daily, September 20: Shrinkage and Beyond

After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed's experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon.

Read More »

Read More »

Swiss Tourist Industry Wins Support from Parliament

A majority of parliament wants to restrict online reservation platforms in a bid to protect the Swiss hotel sector. The House of Representatives on Monday overwhelmingly approved a proposal and followed the Senate demanding that Swiss hotels will be allowed to offer lower prices for their accommodation on their websites than online travel fare aggregators, including Booking.com.

Read More »

Read More »

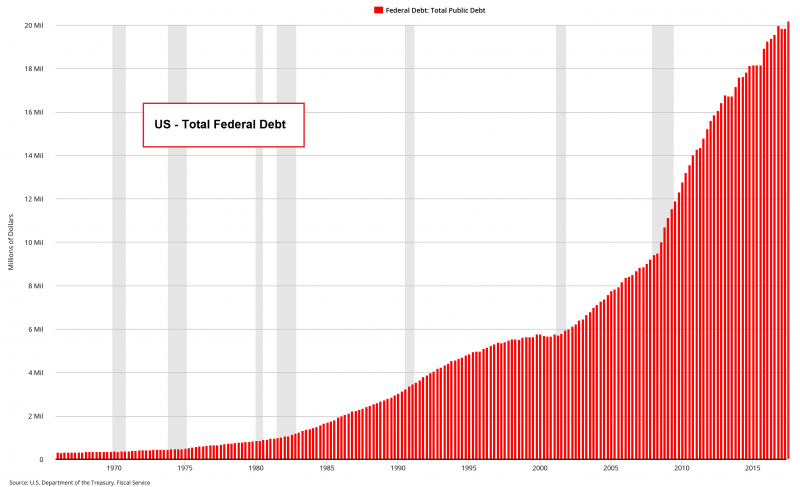

Dear Jamie Dimon: Predict the Crash that Takes Down Your Produces-Nothing, Parasitic Bank and We’ll Listen to your Bitcoin “Prediction”

This is the begging-for-the-overthrow-of-a-corrupt-status-quo economy we have thanks to the Federal Reserve giving the J.P. Morgans and Jamie Dimons of the world the means to skim and scam the bottom 95%. Dear Jamie Dimon: quick quiz: which words/phrases are associated with you and your employer, J.P. Morgan?

Read More »

Read More »

US Debt: To Hell In A Bucket

No-one Cares. “No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.” We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable.

Read More »

Read More »