No-one Cares…“No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.” We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable. “The voters certainly don’t care about the federal debt,” he continued. “They keep electing the same spendthrifts to office. And the politicians know the voters don’t care. They also know that making more and more promises is the formula for getting reelected. “Deep down, the aging masses know they need massive amounts of government debt to pay their social security, medicare, and disability checks. On top of that, many of the so-called gainfully employed are really on corporate welfare; they hang their hats on government contracts to fund their paychecks. “You know as well I do how this crazy debt based fiat money system works. The debt must perpetually increase or the whole financial system breaks down. The best we can hope for is that the ongoing currency debasement merely leads to a subtle erosion of living standards. That’s the best-case scenario. “But, again, no one except maybe a handful of your readers’ gives a rip about the federal debt. Plus, if you’re gonna keep writing about it you need to use better terminology. The federal debt has grown at such a rapid rate that standard dollar units no longer capture what’s going on. The debt numbers are so large it is difficult to distinguish between hundreds of billions and tens of trillions of dollars. |

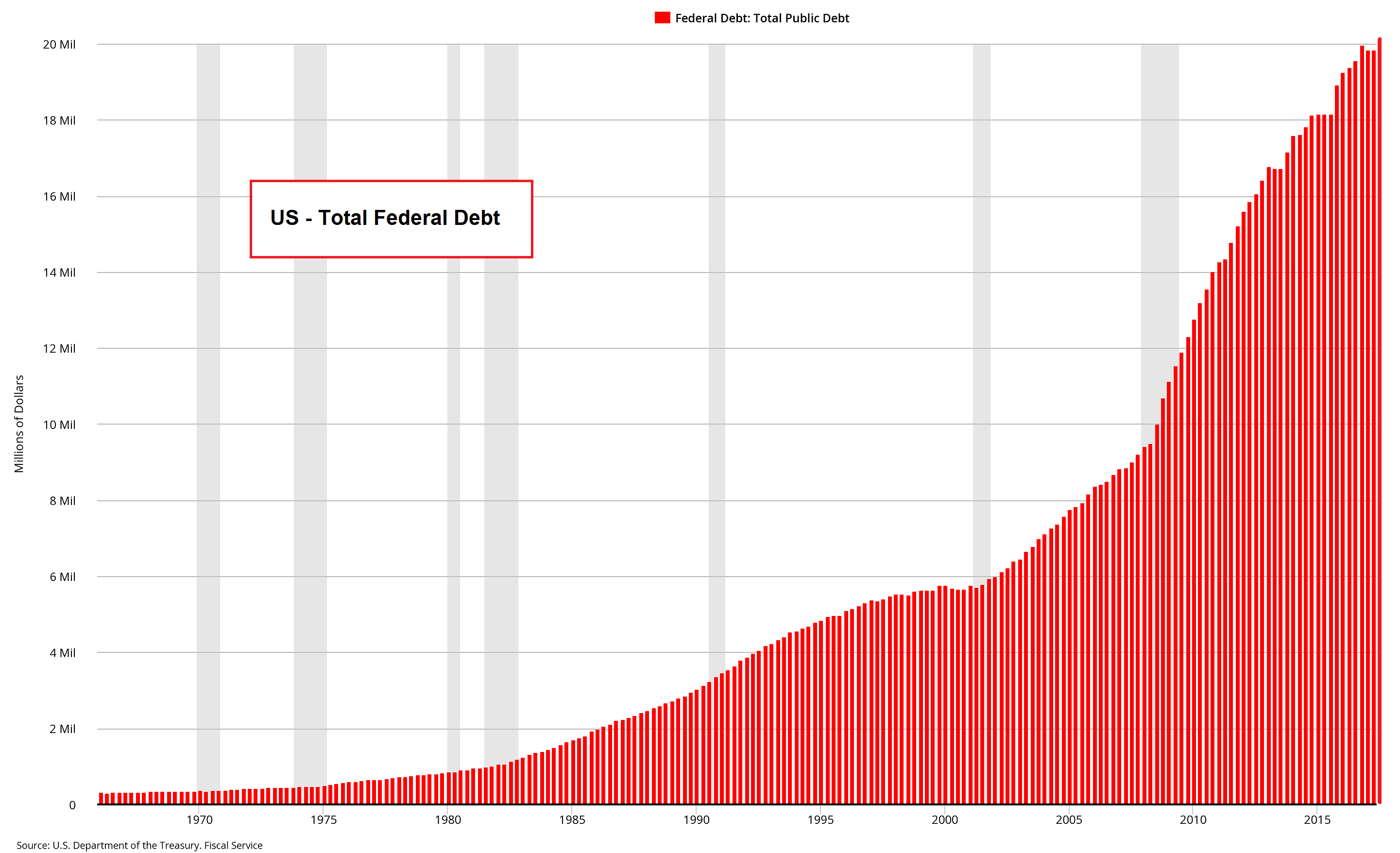

US Total Federal Debt, 1970 - 2015(see more posts on U.S. Federal Debt, )We have added the most recent bar manually, as the charts published by the Fed will only be updated at the end of the quarter. The devastation wrought by the recent hurricanes in Texas and Florida gave Congress a convenient excuse to postpone the debt ceiling debate by until at least December and to wave through a more than $300 billion jump in total federal debt without much ado. It is worth noting that while the growth of the debtberg has accelerated over time, growth in US economic output has concurrently slowed down rather dramatically. The main obstacle to maintaining this state of affairs is that it will sooner or later become mathematically impossible. Perhaps the fact that people don’t care reflects a decline in mathematical literacy? Per experience, throwing more money at public education won’t help – and soon it may no longer even be possible anyway. |

Going Broke at Mach 30“For better perspective, you need to describe the debt growth in astronomical terms. You see, astronomers use light years to adjust for large distances. A light year, as its name suggests, is the distance light travels in one year. One light year converts to light traveling about 5.87 trillion miles per year, excluding leap year of course. “You noted that since President Obama took office in early 2009, at about the time the American Recovery and Reinvestment Act was passed, the U.S. federal debt has increased from $10.6 trillion to nearly $20 trillion. Well, you were wrong. In the several days since you wrote that article, did you see the federal debt jumped to over $20.1 trillion? |

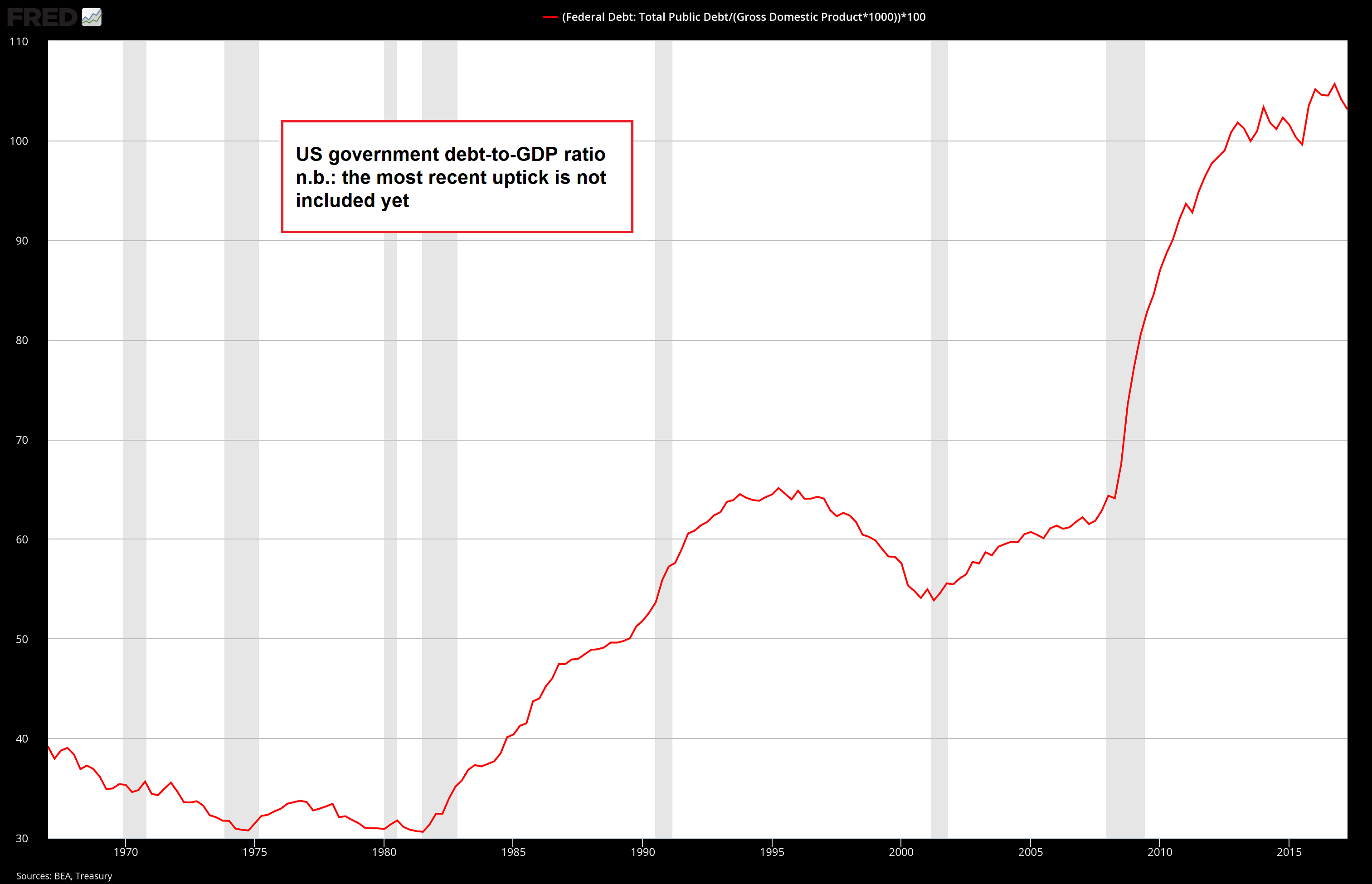

US Debt to GDP Ratio, 1970 - 2015(see more posts on government debt, )In view of the fact that government spending is part of GDP and that GDP is a rather dubious measure of economic output on other grounds as well, a case could be made that this ratio understates the problem. On the other hand, intra-government debt holdings are not netted out either – but with respect to that it needs to be kept in mind that the bulk of this debt represents the claims of future retirees. The so-called “social security lock-box” is essentially a meaningless accounting illusion, since it contains nothing but debt anyway. The money the government receives for the purpose of funding pensions is spent the moment it is received. |

| “Apparently, after Congress suspended the debt limit last Friday, the Treasury went ahead and reported the $300 billion of off balance spending they’d run up over the last six months since hitting the debt ceiling in March. This is what Treasury Secretary Mnuchin meant by resorting to ‘extraordinary measures’ to keep the government humming. Sounds like Enron accounting to us.

“Anyhow, over the last 104 months the federal debt has increased by $9.5 trillion – or at an annual rate of about $1.1 trillion. This equals a rate of increase that’s nearly 20 percent the speed of light. This also pencil’s out to $34,880 of new debt per second. Are you starting to grasp the enormity? “Still, if the speed of light example doesn’t do it for you, how about the speed of sound? When Chuck Yeager first outran sound he reached what was called Mach 1. That equals 767 miles per hour – or 1,125 feet per second. So, at $34,880 of new debt per second, the federal government is running up the debt at a speed that’s over Mach 30. Yes, things have really gotten out of control! |

Mach 2 jet nozzle flow visualized with Schlieren filters. Observe, then close your eyes and imagine it going 15 times faster. That’s the speed at which the federal debt currently grows. What can possibly go wrong? |

To Hell In A Bucket“You’d think that running up a tab at a rate like that would be a lot of fun. But look around. No one, including the upper crust, is having fun. Take that Facebook geek, for example. Zuckerberg! Have you seen the mug on that kid? He wouldn’t know what fun is, if it jumped up and bit him on the behind. “How much longer this government debt binge can go on for is anyone’s guess. One thing is clear, however. It has gone on much longer than any honest person could possibly fathom. “Under George Dubya the federal debt doubled from $5 trillion to $10 trillion. Then under Barry Big Ears the federal debt doubled again to $20 trillion. There are predictions floating around that The Donald will again double the federal debt, taking us to $40 trillion. If he and Chuckles Schumer succeed in obliterating the debt ceiling, he just may pull it off. |

Denizen of the no-fun zone: hyper-rich FB founder Marc Zuckerberg. We would note to this that supporters of leftist causes (we gather Zuckerberg is one of them) for the most part have no sense of humor and seem to regard fun as a deadly sin. We are not entirely sure why, but we suspect that authoritarian ideologies are simply inherently unfunny and therefore make their purveyors and supporters miserable. Unfortunately they sometimes evince a remarkable zeal with respect to spreading their misery far and wide. Just consider how utterly unfunny and burdensome so-called political correctness is. |

“Can you imagine how miserable the economy will be when it’s larded up with $40 trillion in government debt? You’d be lucky if GDP merely flat lined. The whole dang shebang will be crushed under weight of this massive debt. And don’t get me started on corporate and private debt – that’s a whole other story.

“You see where this is all going, don’t you? To hell in a bucket! You’d think runaway government debt would be a big deal for people. But it’s not. As I keep telling you, no one cares about the federal debt.

“If you want people to read your articles, you need to write about Amazon or Apple stock – or crypto-currencies. Tell them prices will double and then double again. That’s what people want to hear. So why not give it to them?”

Charts by: St. Louis Fed

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: government debt,newslettersent,On Economy,On Politics,U.S. Federal Debt