Lockdown DisasterIt has been a rough go for California Governor Gavin Newsom. Late last week it was revealed that the state Department of Public Health had tickled the poodle on its COVID-19 record keeping. Somehow the bureaucrats in Sacramento under-counted new corona-virus cases by as many as 300,000. Perhaps this oversight prompted Newsom to imbibe a little meditation and reflection. At his Wednesday corona-virus news conference, shortly after quoting Voltaire, Newsom offered the following epiphany:

Often the simplest insights into reality are the most essential. We will give Newsom that. Yet, this is hardly an insight. Rather, it is readily obvious… even to a numskull. The world that is failing, where businesses cannot thrive, is a direct consequence of government lockdown orders. And Newsom, more than any other public official, has his fingerprints all over the offense. If you recall, California, under Newsom’s command, was the first state to order lockdowns. It’s a shame he didn’t pause for meditation before committing the state to ruin. The dynamics of what would follow Newsom’s lockdown orders were predictable. When government decrees froze the economy, bills were still due. Yet many people’s incomes, in the form of paychecks, disappeared. For businesses, outstanding accounts payable were still due, while accounts receivable quickly became overdue. In short, the flow of cash, as delivered by an open economy of give and take, broke down. Certainly, Newsom thought he was doing the right thing. He had to keep everyone in the Golden State safe by locking them down. Many governors followed Newsom’s lead, producing the same disastrous results. But that was just the beginning. Soon the uplifters in Washington swung into action… |

|

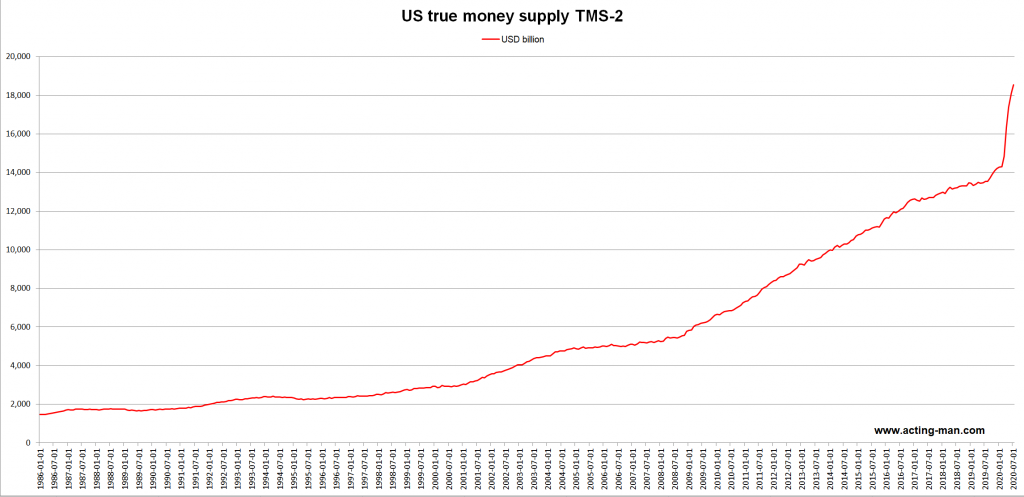

Printing Press MoneyThe opportunity to face the economic depression honestly – through bankruptcies, write downs, and a broad financial purge – came and went with the rollout of massive fiscal and monetary stimulus programs. Crackpot schemes like the CARES Act, the PPP, the PMCCF, and the SMCCF, among others. The general objective of these programs was to replace the personal and business cash flows that the lockdown orders destroyed. The intentions may have been good. But they paved the road to hell, nonetheless. Zealous efforts to paper over the drop off in what people and businesses earn and what they owe, could never be covered for long. What’s more, these programs were flawed from the get go. Because they relied on printing press money – credit conjured from thin air – to make them work. This, no doubt, is a serious flaw. Printing press money may appear to work, in the short term. But it is not without consequences. First, it destroys money that has been earned and saved. Second, it turns the stock market into a barometer for the expansion of the money supply. Yet the relationships between printing press money and the financial and economic distortions it causes are increasingly perilous. The stock market may be the barometer for the expansion of the money supply today. But tomorrow, the stock market could crash, and consumer price inflation could assume the role of money supply expansion barometer. The consequences of mass money debasement are impossible to undo. Once fake printing press money has mixed with the money that has been earned and saved, it cannot be backed out. The veracity of all dollars becomes questionable. The value of all dollars becomes suspect. What’s next? |

|

What You Will Find When You Follow the MoneyWell, what’s next is an extension of what came before. And what comes next can be summed up with one word: “More”. More monetary stimulus. More fiscal stimulus. More spending programs. More federal unemployment checks. More bailouts. More government subsidized loans. More money supply. More Fed purchases of corporate bonds. More debts. More deficits.

|

US money supply TMS-2 |

| More of this. More of that. All of which will be paid for with more printing press money.

Of course, more printing press money means more distortions. Which means more asset bubbles. Which means more inflation. Which means more wealth inequality. Which means more protests. Which means more riots. Which means more chaos. Which means much, much more – of More. We always knew this day would come. But we thought it would be much more sensational when it arrived. We watched the Fed, through willful cleverness, paint itself into a corner over the course of several decades. There is no escape. So the Fed will keep doing more of what it does. More money printing. More dollar debasement. More economic destruction. Finally, more and more people are catching on. They have suspected that there is something wrong; that things don’t quite add up. However, for many years, political and class divisions served as a great distraction to channel their discontent. Slowly, that is changing. More and more people are following the money back to its genesis. And what they find is something so utterly crude, grotesque, and revolting that, like the devil, it hardly seems real. But it is… and it is a catastrophe. |

Tags: Featured,newsletter,On Economy,On Politics