Tag Archive: On Politics

Mapping the Conflict in the Ukraine

Russian Troops in the Crimea

John Kerry is appropriately aghast at the “incredible act of aggression” by Russia in the Ukraine:

“You just don’t in the 21st century behave in 19th century fashion by invading another country on completely trumped up pre-text,” Kerry told the CBS program “Face the Nation.”

Read More »

Read More »

Post-Covid China

The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver.

Read More »

Read More »

COVID in India

I have just returned from a visit to my family in India. It was hard to escape. To get to the US from India, I needed a COVID test. The Indian government has seriously restricted who can provide COVID testing, treatment, and vaccination. Private doctors and hospitals that are not approved face brutal legal consequences if they provide COVID treatment.

Read More »

Read More »

Did You Make Janet Yellen Rich?

The Stress of Losing Billions. Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy.

Read More »

Read More »

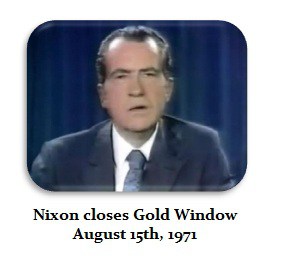

Janet Yellen: Too Dumb To Stop

Autographing Funny Money. The United States Secretary of the Treasury bears a shameful job duty. They must place their autograph on the face of the Federal Reserve’s legal tender notes. Here, for the whole world to witness, the Treasury Secretary provides signature endorsement; their personal ratification of unconstitutional money.

Read More »

Read More »

What You Will Find When You Follow the Money

Lockdown Disaster. It has been a rough go for California Governor Gavin Newsom. Late last week it was revealed that the state Department of Public Health had tickled the poodle on its COVID-19 record keeping. Somehow the bureaucrats in Sacramento under-counted new corona-virus cases by as many as 300,000.

Read More »

Read More »

The Dollar Is Dying

Insulting the Captive Audience. This week, while perusing the Federal Reserve’s balance sheet figures, we came across a rather curious note. We don’t know how long the Fed’s had this note posted to its website. But we can’t recall ever seeing it.

Read More »

Read More »

The Decline of the Third World

A Failure to Integrate Values. The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West.

Read More »

Read More »

The Triumph of Madness

Historic Misjudgments in Hindsight. Viewing the past through the lens of history is unfair to the participants. Missteps are too obvious. Failures are too abundant. Vanities are too absurd. The benefit of hindsight often renders the participants mere imbeciles on parade.

Read More »

Read More »

Real High Crimes and Misdemeanors

World Class Entertainer in the Cross-Hairs. Christmas is no time to be given the old heave-ho. This is a time of celebration, redemption, and excess libation. A time to shop ‘til you drop; the economy depends on it. Don’t get us wrong. There really is no best time to receive the dreaded pink slip. But Christmas is the absolute worst. Has this ever happened to you?

Read More »

Read More »

Banana Republic Money Debasement In America

Addicted to Spending. There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad!

Read More »

Read More »

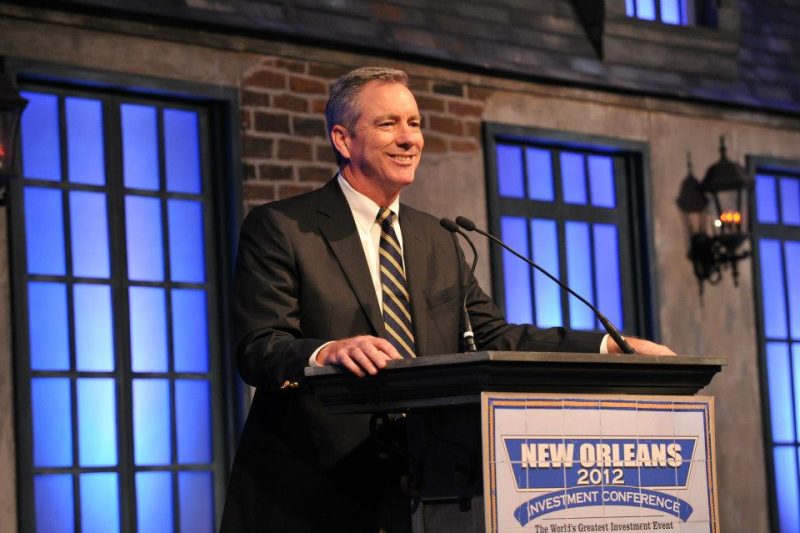

Maurice Jackson Interviews Brien Lundin and Jayant Bhandari

Our friend Maurice Jackson of Proven and Probable has recently conducted two interviews which we believe will be of interest to our readers. The first interview is with Brien Lundin, the president of Jefferson Financial, host of the famed New Orleans Investment Conference and publisher & editor of the Gold Newsletter – an investment newsletter that has been around for almost five decades, which actually makes it the longest-running US-based...

Read More »

Read More »

America’s Road Map to $40 Trillion National Debt by 2028

Planning on Your Behalf. Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life.

Read More »

Read More »

Fed Chair Powell’s Inescapable Contradiction

Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best appreciate the contradiction, we must present the conflict.

Read More »

Read More »

Repo Quake – A Primer

Chaos in Overnight Funding Markets. Most of our readers are probably aware that there were recently quite large spikes in repo rates. The events were inter alia chronicled at Zerohedge here and here. The issue is fairly complex, as there are many different drivers at play, but we will try to provide a brief explanation.

Read More »

Read More »

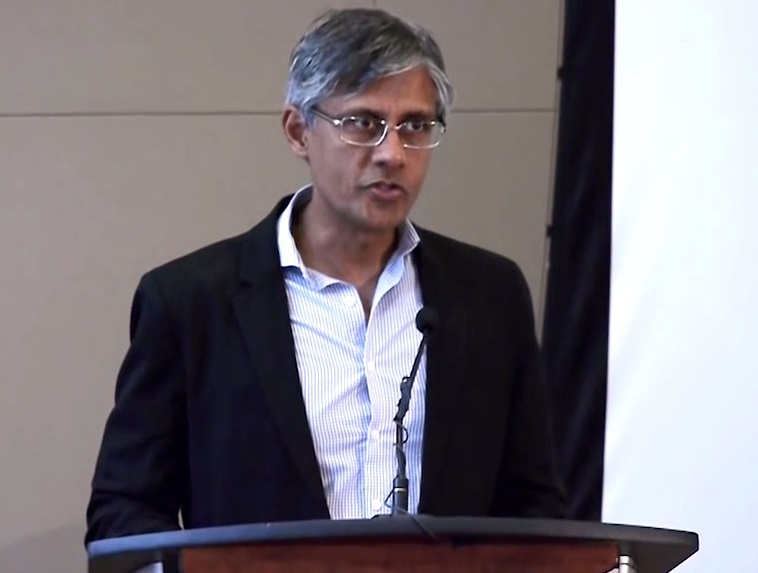

Two Junior Miners Offering Arbitrage Opportunities – an Interview with Jayant Bhandari

Maurice Jackson of Proven & Probable has just conducted another interview with Jayant Bhandari, who is known to long-time readers as a frequent guest author on this site. Below is a video of the interview as well as a link for downloading the transcript of the interview in PDF form. But first here is a list of the topics discussed.

Read More »

Read More »

Is Inflation Beginning? Are You Ready?

Extrapolating The Recent Past Can Be Hazardous To Your Wealth. “Those who cannot remember the past are condemned to repeat it,” remarked George Santayana over 100 years ago. These words, as strung together in this sequence, certainly sound good. But how to render them to actionable advice is less certain.

Read More »

Read More »