Tag Archive: newslettersent

Swiss abroad need Swiss bank accounts

Big Swiss banks should make it easier for Swiss people living abroad to maintain a bank account, finds the Senate. Senators voted 23 to 14 on Tuesday in favour of a motion to make the five largest Swiss banks provide accounts under reasonable conditions. Six senators abstained from the vote, which came during the autumn parliamentary session in Bern.

Read More »

Read More »

FX Daily, September 19: Quiet Tuesday, Follow the Leader

Politics seems to dominate the talking points today. Boris Johnson's weekend op-ed has been rejected by May, and there is talk that Johnson may resign or fired. Sterling is consolidating after pulling back yesterday. Carney said that if the UK does hike it will be gradual and limited. The markets did respond dramatically to the BOE minutes and suggestions by even some of the doves that rates may need to be lifted, but there is still a good reason...

Read More »

Read More »

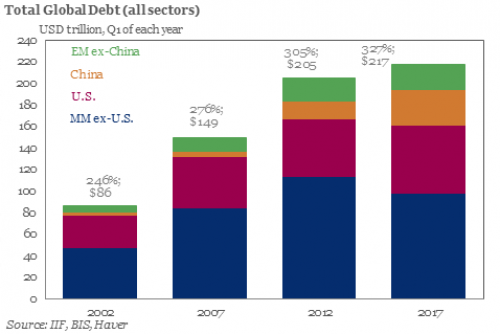

Global Debt Bubble Understated By $13 Trillion Warn BIS

Global debt bubble may be understated by $13 trillion: BIS. ‘Central banks central bank’ warns enormous liabilities have accrued in FX swaps, currency swaps & ‘forwards’. Risk of new liquidity crunch and global debt crisis. “The debt remains obscured from view…” warn BIS.

Read More »

Read More »

One-Tenth Of Global GDP Is Now Held In Offshore Tax Havens

Accurately measuring the scope of global wealth inequality is a notoriously difficult undertaking – a fact that was brought to light last year when the International Consortium of Investigative Journalists published the Panama Papers, exposing clients of Panamanian law firm Mossack Fonseca.

Read More »

Read More »

Scam cryptocurrency shut down by Swiss regulator

The Swiss financial regulator has closed down three companies linked to a fake cryptocurrency E-Coin amid fears that investors may have been conned out of millions of francs. The Swiss Financial Market Supervisory Authority (Finma) said the probe is one of 12 it is conducting into cryptocurrencies. Finma has seized or blocked CHF2 million ($2.07 million) linked to Quid Pro Quo Association, which issued the E-Coins, along with Digital Trading and...

Read More »

Read More »

Harvey’s Muted (Price) Impact On Oil

The impact of Hurricane Harvey on the Gulf energy region is becoming clear. There have been no surprises to date, even though the storm did considerable damage and shuttered or disrupted significant capacity. Most of that related to gasoline, which Americans have been feeling in pump prices.

Read More »

Read More »

FX Daily, September 18: More Thoughts from Berlin

The unexpected weakness in US retail sales and industrial production reported before the weekend did not prevent US yields and stocks from rising. Asia followed suit, and with Japanese markets closed, the MSCI Asia Pacific Index rallied a little more than 1%, the largest gain in two months. Of note, foreigners returned to the Korean stock market, buying about $260 mln today, which cuts the month's liquidation in half. The Kospi rallied 1.3%...

Read More »

Read More »

Bitcoin Price Falls 40percent In 3 Days Underling Gold’s Safe Haven Credentials

Bitcoin price action shows cryptos vulnerable to commentary and government policies. Bitcoin falls to low of $2,980, down by $1,000 in week as China flexes muscles. Volatility major issue: In 3 days btc fell 40% before bouncing 25% off lows. BIS state risks of cryptos cannot yet be fully assessed and says technology still unproven. Apple and Google developing a payment API for cryptos – may give governments full oversight. Bitcoin and cryptos...

Read More »

Read More »

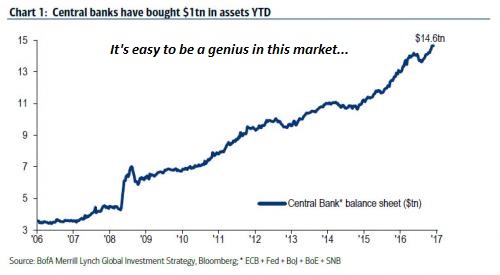

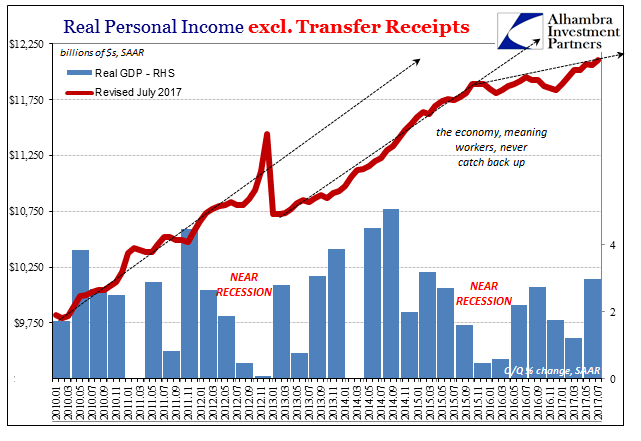

Yes, This Time It Is Different: But Not in Good Ways

Yes, this time it's different: all the foundations of a healthy economy are crumbling into quicksand. The rallying cry of Permanent Bulls is this time it's different. That's absolutely true, but it isn't bullish--it's terrifically, terribly bearish. Why is this time it's different bearish going forward? The basic answer is that nothing that is structurally broken has actually been fixed, and the policy "fixes" have fatally weakened the global...

Read More »

Read More »

When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being different in each and every...

Read More »

Read More »

FX Weekly Preview: FOMC Highlights Big Week

The days ahead are historic. By all reckoning, Merkel will be German Chancellor for a fourth consecutive term. Many observers expect the election to usher in a new era of German-French coordination to continue the European project post-Brexit and in the aftermath of the Great Financial Crisis.

Read More »

Read More »

Swiss universities loved by foreign students

More than half of those doing a doctorate in Switzerland come from abroad, according to a new global education report. Foreign students are especially drawn to courses in the natural sciences. International students make up 17% of those studying at Swiss universities, said the Organisation for Economic Co-operation and Development (OECDexternal link) in its Education at a Glance 2017external link, published earlier this week.

Read More »

Read More »

The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary task should it be found...

Read More »

Read More »

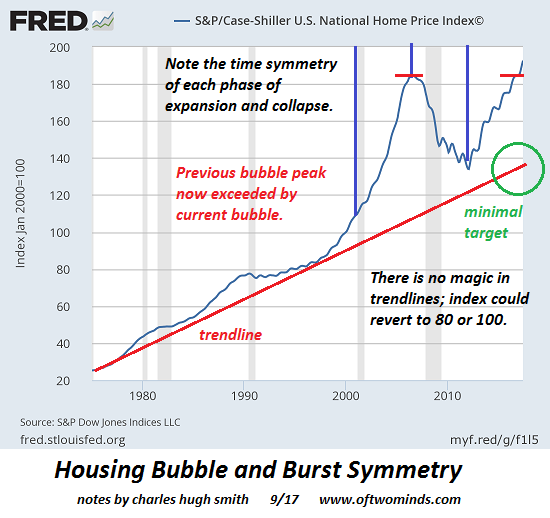

Housing Bubble Symmetry: Look Out Below

Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers. There are two attractive delusions that are ever-present in financial markets:One is this time it's different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data; furthermore, markets are now...

Read More »

Read More »

Place financière genevoise, une noyade dans l’anonymat.

“Avant, à Genève, il régnait une effervescence certaine. Les gens dépensaient de l’argent, certes pas forcément déclaré. Aujourd’hui, ce temps est fini et on ne voit pas vraiment ce qui pourrait extraire la ville et sa place financière de cette stagnation”. Exprimé en privé voici quelques jours par un professionnel de la finance de la cité de Calvin, ce constat rejoint celui de beaucoup, beaucoup d’autres gens ayant connu l’”avant” et qui...

Read More »

Read More »

Geneva and Lausanne remain Switzerland’s toughest home markets

Home vacancy rates in Switzerland’s main cities have all risen over the last few years, bringing some hope to those looking for a place to live. The latest 2017 data confirm this trend. While these percentage shifts might appear big, very low vacancy rates underly them. On 1 June 2012, none of these cities had a vacancy rate above 1%. Zurich (0.29%), Bern (0.48%), Basel (0.13%), Lausanne (0.28%) and Geneva (0.21%) were all well below 1% vacancy...

Read More »

Read More »

Emerging Markets: What has Changed

China plans to issue its first USD-denominated bond since 2004. China’s largest banks banned North Koreans from opening new accounts. The UN Security Council approved new sanctions on North Korea. Relations between Poland and the European Commission remain tense. Brazil’s central bank appears to be signaling discomfort with ongoing BRL strength.

Read More »

Read More »

Gold Up, Markets Fatigued As War Talk Boils Over

North Korea threatens to reduce the U.S. to ‘ashes and darkness’. Markets becoming used to ongoing provocations from North Korea. Russia and China continue to support watered down versions of sanctions on Kim’s regime. Both NATO and Russia running war games on one another’s borders. Putin says Russia will “give a suitable response” to NATOs threatening behaviour.

Read More »

Read More »

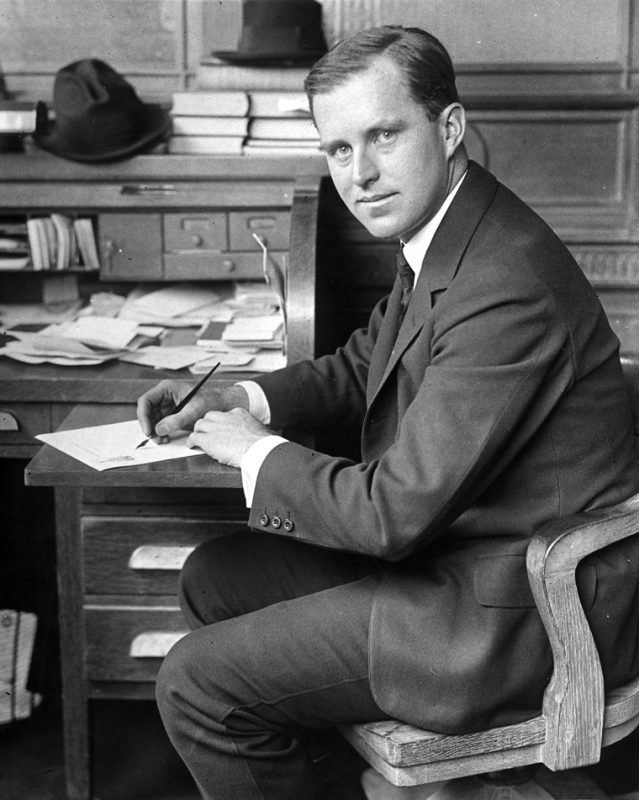

21st Century Shoe-Shine Boys

Anecdotal Flags are Waved. “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.”

– Joseph Kennedy

It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning, and the shoe-shine boy, one Pat...

Read More »

Read More »