Tag Archive: newslettersent

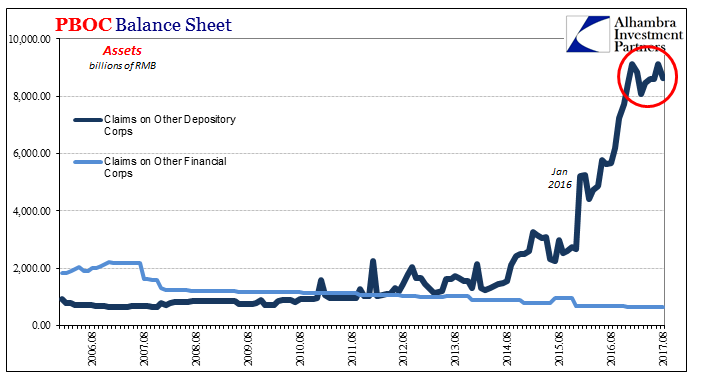

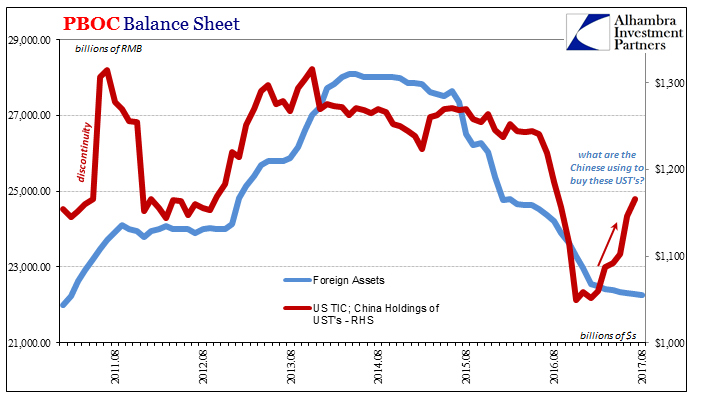

PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.

Read More »

Read More »

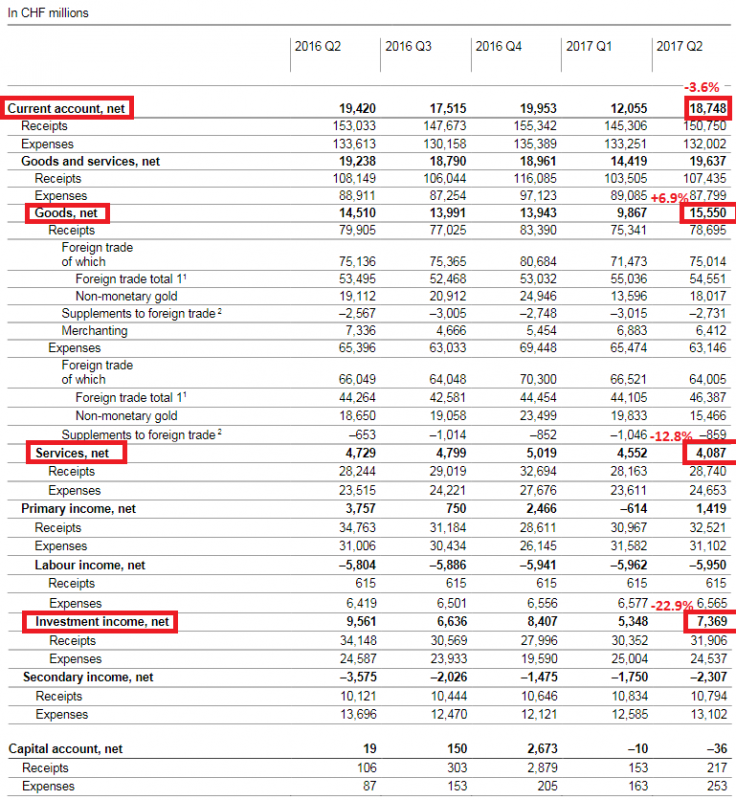

Swiss Balance of Payments and International Investment Position: Q2 2017

Key figures, Current Account: -3.6% against Q2/2016 to 18,748 bn. CHF, Trade Balance: +6.5% to 15,550 bn, Services Balance: -12.8% to 4,087 bn, Investment Income: -22.9% to 7,369 bn.

Read More »

Read More »

FX Daily, September 26: Weekend Election and North Korea Rhetoric Helps Greenback Remain Firm

The US dollar is firmer against most major currencies today. The implications the Jamaica coalition in Germany is understood to be less likely to support a new vision for Europe in the aftermath of Brexit and the Great Financial Crisis. The euro's low for the year was set at the very start near $1.0340. The first quarter or so was spent consolidating the gains in H2 16. It was trading below $1.06 in early April.

Read More »

Read More »

Les Suissesses et les Suisses disent OUI à leurs paysans! ATS

Les Suisses ont accepté par 78,7% de compléter la Constitution par un article sur la sécurité alimentaire. Les Romands ont été les plus enthousiastes. Les Suisses sont très attachés à la sécurité alimentaire. Dimanche, 78,7% d’entre-eux ont dit «oui». Aucun canton n’a refusé.

Read More »

Read More »

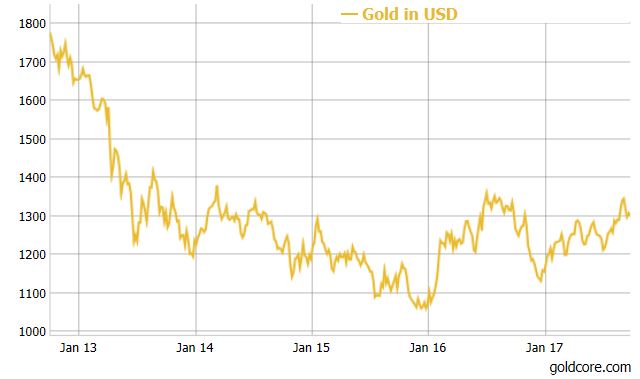

“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week.

Read More »

Read More »

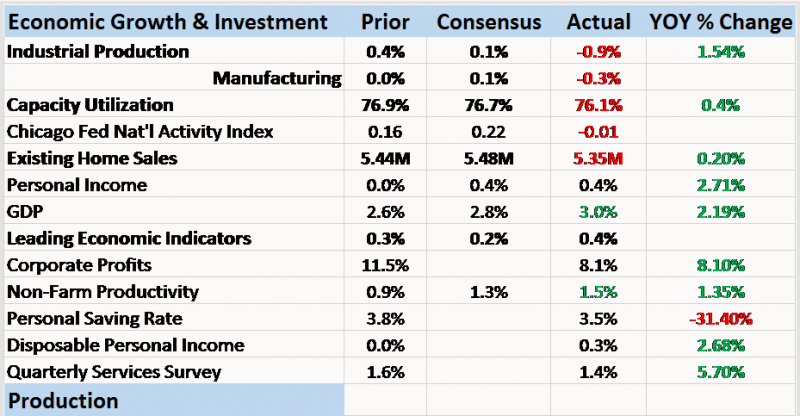

Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble papered over the annoying lack of...

Read More »

Read More »

Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August.

Read More »

Read More »

FX Daily, September 25: Euro and Kiwi Dragged Lower

The end of the Grand Coalition in Germany and the need for a coalition in New Zealand are weighing on the respective currencies. The euro was marked down in Asia and briefly dipped below $1.19 before recovering to $1.1940 by the middle of the Asian session. It was sold to new lows in the European morning after the weaker than expected IFO survey. Today's survey stands in contrast to the recent PMI and ZEW survey and matches the mood of the market....

Read More »

Read More »

FX Weekly Preview: Old and New Drivers in the Week Ahead

Last week's developments will continue to shape the investment climate in the week ahead, and at the same time, new inflation readings from the US, EMU, and Japan will add incrementally to investors' information set.

Read More »

Read More »

Swiss expats buck the pension reform trend

Unlike their compatriots in Switzerland, Swiss voters who live abroad came out massively in favour of a wide-ranging overhaul of Switzerland’s old-age pension scheme. Eleven of Switzerland’s 26 cantons count the votes of Swiss expats separately. An analysis of Sunday’s results shows that in nine of these cantons more than 70% of Swiss abroad backed the “Old Age Security 2020” package, which aimed to guarantee the future financing of...

Read More »

Read More »

First autonomous transport service in Switzerland inaugurated

The launch of two autonomous shuttle buses in Fribourg on Friday marks the first time in Switzerland that such vehicles have been inducted into the regular transport network. The “self-driving” electric minibuses link the Marly Innovation Center (MIC) in the suburbs to the Fribourg Public Transport (TPF) network. The 1.3 km journey takes seven minutes with four stops.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI.

Read More »

Read More »

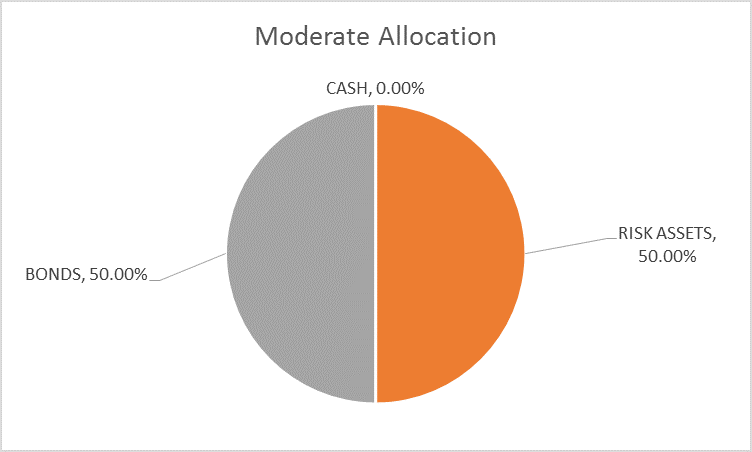

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

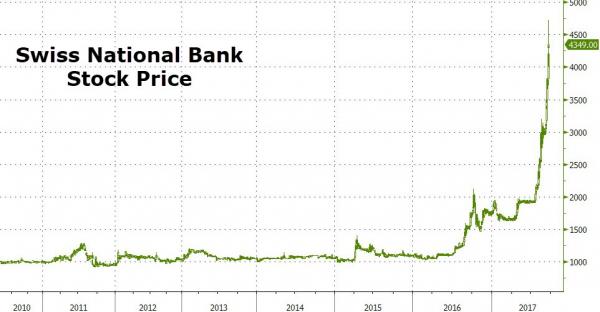

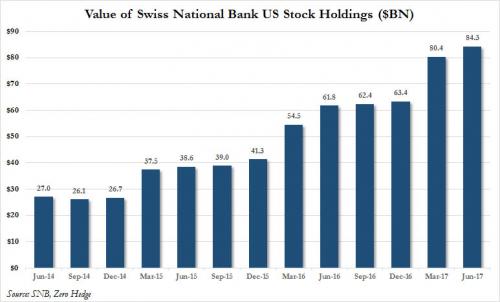

Is The Swiss National Bank A Fraud?

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. That sounds like a 'tulip' bubble-like 'fraud'... The SNB is up over 120% in Q3 so far - more than double 'bubble' Bitcoin...

Read More »

Read More »

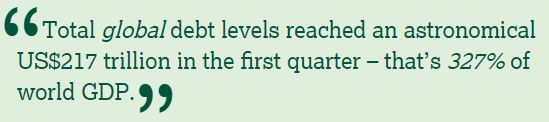

Gold Investment “Compelling” As Fed Likely To Create Next Recession

Gold Investment “Compelling” As Fed Likely To Create Next Recession. Is the Fed about to kill the business cycle? 16 out of 19 rate-hike cycles in past 100 years ended in recession. Total global debt at all time high – see chart. Global debt is 327% of world GDP – ticking timebomb. Gold has beaten the market (S&P 500) so far this century. Safe haven demand to increase on debt and equity risk. Gold looks very cheap compared to overbought markets....

Read More »

Read More »

Abe and BOJ

BOJ is unlikely to change policy. A snap election suggests continuity of policy. US 10-year yield remains one of most important drivers of the exchange rate.

Read More »

Read More »

India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last). Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all tyrants from the map, and...

Read More »

Read More »

Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

"Like watching paint dry," is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen's decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, "have no fear, The SNB knows what it's doing."

Read More »

Read More »

Swiss annual growth forecast takes a cut

Swiss economic growth estimates for the year have been revised down to under 1% by the State Secretariat for Economic Affairs (SECO). This would make it the slowest year since 2009. The stats released Thursday predict a growth rate of 0.9% for 2017. The figure has fallen from previous estimates of 1.4%, and would mark the worst-performing economic year since a 2.2% contraction in 2009.

Read More »

Read More »

Pensions and Debt Time Bomb In UK: £1 Trillion Crisis Looms

£1 trillion crisis looms as pensions deficit and consumer loans snowball out of control. UK pensions deficit soared by £100B to £710B, last month. £200B unsecured consumer credit “time bomb” warn FCA. 8.3 million people in UK with debt problems. 2.2 million people in UK are in financial distress. ‘President Trump land’ there is a savings gap of $70 trillion.

Read More »

Read More »