Summary:

BOJ is unlikely to change policy.

A snap election suggests continuity of policy.

US 10-year yield remains one of most important drivers of the exchange rate.

There is practically no chance that the BOJ changes policy. BOJ shares the common dilemma among major central banks. Growth is ok–above trend, which in Japan is seen as about 0.8%, but price pressures remain weak. The core rate in Japan, which excludes fresh food, is up 0.5% year-over-year. The target is 2%.

The BOJ and SNB are widely understood to be laggards in the long drawn out process of normalization. There have been two recent developments to note in this context. First, Abe looks posed to call as snap election, which the LDP and he will most likely win, which is why the election would be called early in any event. That means the continuation of Abenomics– and may increase the perceived chances that Kuroda gets a second term. In the US, there is a two-term tradition. In Japan, it would appear to be the first time in 50 years that a BOJ governor has a second term. The point is the snap election strengthens the case for continuity.

The second point is that Abe, like Trump, are influencing their central bank, not through rhetoric designed to lobby for a certain policy and challenge the independence of the central bank, but through the power of appointment. Two new members join the BOJ board with this meeting. They seem to be on Kuroda’s side of the activist monetary policy debate and the need to continued stimulus.

In Europe, there is a concern that officials are running out of securities. Some worry that the BOJ buying is adversely impacting liquidity. Draghi seemed to play down these concerns recently. Kuroda too has argued the liquidity is not a problem, which means that purchases (running less than the targeted JPY80 trillion, a year) can continue.

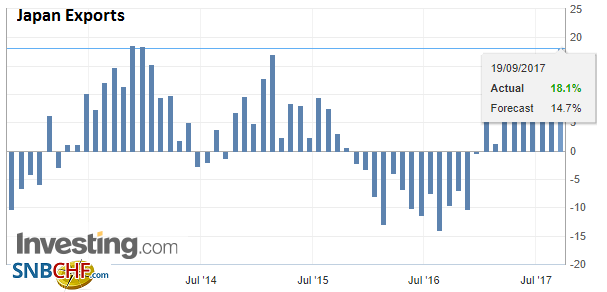

| The stronger world growth is spilling over and helping the Japanese economy. The transmission mechanism is Japanese exports. Last month, Japanese exports were 18.1% higher than a year ago. It is the largest rise since late 2013. In August 2016, Japanese exports were nearly 10% lower from a year ago.

Japanese auto exports to the US are up 28.3% from a year ago, but there is a powerful base effect that may at play after weak auto exports to the US last year. Still, overall Japanese exports to the US were up nearly 22%. Electronic exports to Asia were up 21.6% from a year ago, while exports to China were up over a quarter. Exports to the EU were up a little less than 14%. |

Japan Exports YoY, Aug 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

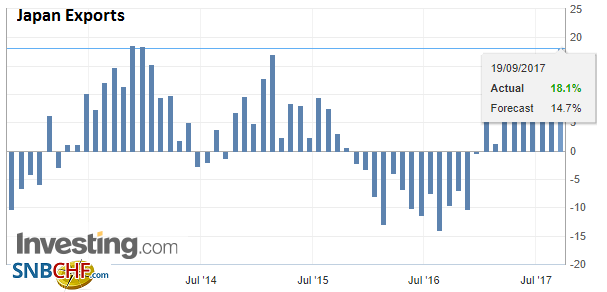

| Imports remain strong, rising 15.2% from a year ago, even though it represents a modest slowing from 16.3% in July. The strength of imports may reflect robust domestic demand. Of note, Japan’s oil imports are off a little more than 1% over the past year. Oil imports from Russia are off nearly 28%, while for the first time in five years, Japan imported oil from South Korea. |

Japan Exports YoY, Aug 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

In the big picture, the dollar-yen exchange rate often seems to be range-bound. When it looks like it is trending it frequently is simply moving to another range. Over the past six months, the range has been roughly JPY108 to JPY115. We suspect Japanese officials would be more comfortable if the dollar did not move below JPY110, but the current range seems acceptable.

In the options market, the discount for dollar calls over puts (25 delta risk reversals) is the smallest (~1.0%) since the end of Q2. This is consistent with expectations is dollar-friendly. However, the cross-currency swap is a different story. Since late August premium the dollar enjoys in the cross-currency swap market (over LIBOR) has fallen by nearly 20% to about 45 bp. The smallest premium this year is about 38 bp and it began the year near 80 bp.

Full story here Are you the author? Previous post See more for Next postTags: $JPY,Bank of Japan,newslettersent