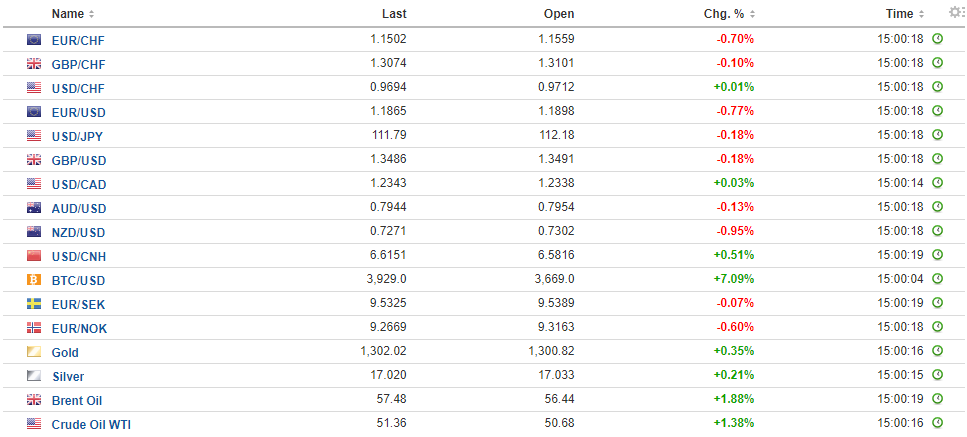

Swiss FrancThe Euro has fallen by 0.37% to 1.1538 CHF. |

EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

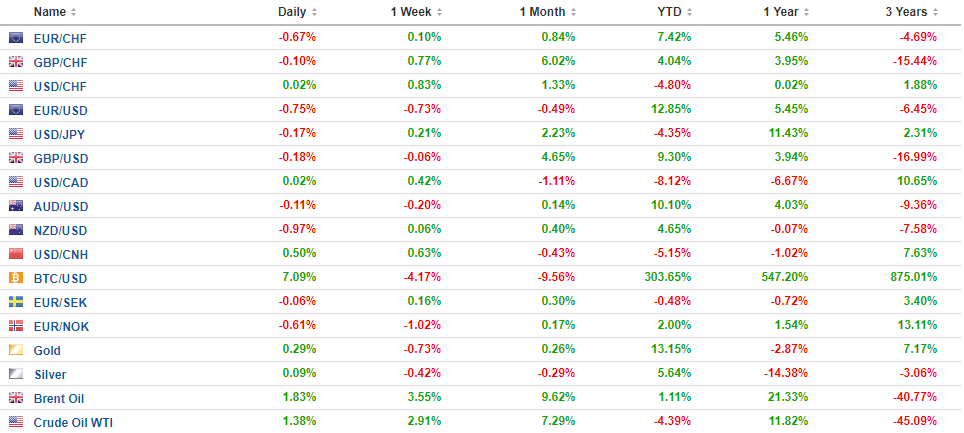

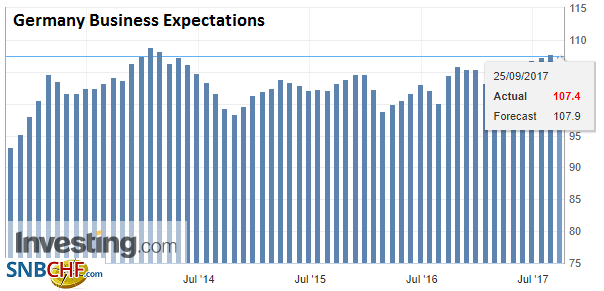

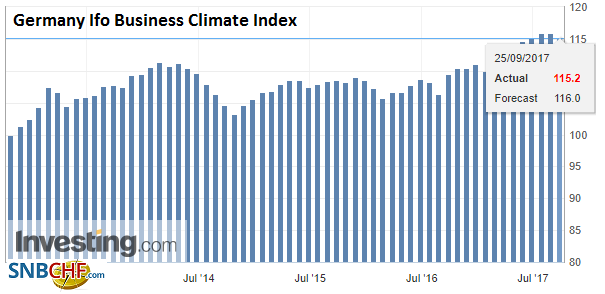

FX RatesThe end of the Grand Coalition in Germany and the need for a coalition in New Zealand are weighing on the respective currencies. The euro was marked down in Asia and briefly dipped below $1.19 before recovering to $1.1940 by the middle of the Asian session. It was sold to new lows in the European morning after the weaker than expected IFO survey. Today’s survey stands in contrast to the recent PMI and ZEW survey and matches the mood of the market. The euro’s low from last week was near $1.1860. In only one session this month, the euro traded below $1.1850. Separately, Macron’s new party did poorly in the weekend’s Senate contests. The upper chamber in France is not elected by popular vote but by mayors and regional officials. The center-right Republicans held their majority. Macron’s labor reforms are not at risk, but Constitutional changes will be more difficult. With labor reforms signed into law, Macron’s attention turns to fiscal issues this week. The draft budget is expected to be presented. It seeks to cut spending and taxes, and reduce the deficit. |

FX Daily Rates, September 25 |

| The New Zealand dollar is the weakest of the majors. It is off nearly 2/3 of 1%, while the euro is off about 0.5% (@~$1.1895). The governing Nationals are about three seats shy of a majority, while Labour is 16 seats short. The New Zealand dollar fell to almost $0.7250 in the first few hours of Asia-Pacific turnover. By early European activity, it was approaching $0.7300. The Australian dollar, which has been trending lower against the New Zealand dollar this month after outperforming over the past couple of months, bounced to almost NZ$1.0985, the 50% retracement objective.

The US dollar held a little below the pre-weekend high against the yen. The pre-weekend low was near JPY111.65, and that seems to be the risk as long euro/short yen cross positions are unwound. Assuming that JPY133.00 is given, losses can extend into the JPY132.00-JPY132.50. |

FX Performance, September 25 |

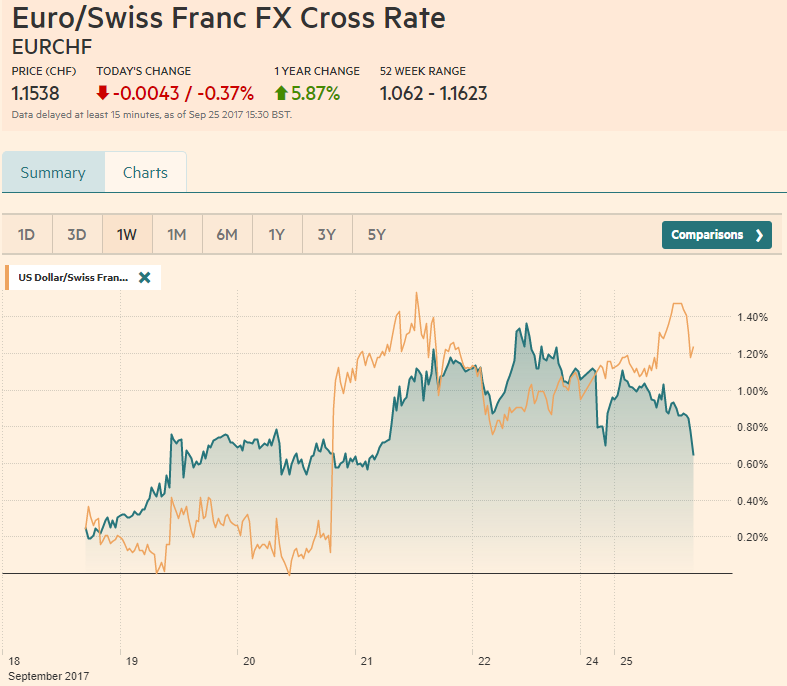

GermanyThe political dynamics in Germany took another turn as AfD party, which was the single biggest winner in the national elections, and emerged as a potentially powerful parliamentary force with about 80 seats faced an important fissure. |

Germany Business Expectations, Sep 2017(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

| The moderate leader (Petry) of the party, which has gone further done the anti-immigration path, has indicated she will not sit with the party in the Bundestag. |

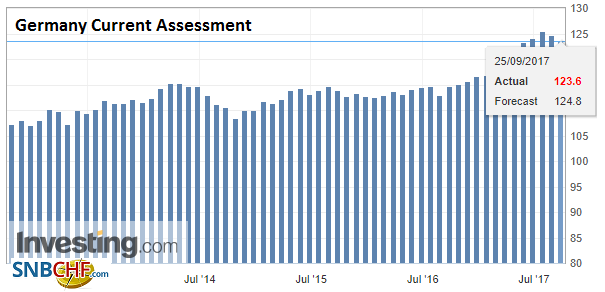

Germany Current Assessment, Sep 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

Germany Ifo Business Climate Index, Sep 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

|

SpainMeanwhile, the confrontation between the independent-minded Catalonians and Madrid escalated over the weekend. The issue is not resolved, but the market appears to be taking it in stride today. Spanish and Italian two-year yields are less than a single basis point firmer, while the 10-year yields are that much softer. Spanish stocks, on the other hand, are underperforming today, losing about 0.6%, while the Dow Jones Stoxx 600 is up about 0.25%. Financials are the biggest drag on the European benchmark and are off 0.50%. |

Spain Producer Price Index (PPI) YoY, Sep 2017(see more posts on Spain Producer Price Index, ) Source: Investing.com - Click to enlarge |

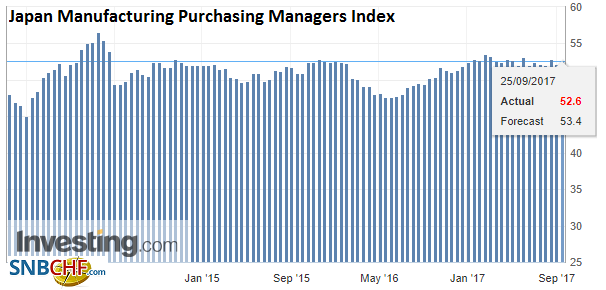

JapanAs rumored last week, Japanese Prime Minister Abe called for a snap election. He will dissolve the lower house on September 28. Reports indicate the election will be held on October 22. In preparation for the polls, Abe unveiled a JPY2 trillion (~$18 bln) spending program aimed at pre-school and higher education. The funds will come from the planned sales tax hike in 2019 that initially was aimed at reducing the debt. The governing coalition has a 2/3 majority in the 475-seat lower house (288 for LDP and 35 for Komeito). The new body will have 10 seats less due to reform meant to reduce the weight given to rural communities. |

Japan Manufacturing Purchasing Managers Index (PMI), Sep 2017(see more posts on Japan Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

The US calendar begins off slowly. The September Dallas Fed report will be skewed by the storm impact. Several Fed officials speak today, including Dudley, Evans, and Kashkari. While these will capture a range of views, Yellen’s speech tomorrow on “Inflation, Uncertainty, and Monetary Policy” is the highlight of the week that sees nearly a dozen Fed officials speak.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,$JPY,EUR/CHF,EUR/GBP,Germany Business Expectations,Germany Current Assessment,Germany IFO Business Climate Index,Japan Manufacturing PMI,Japan Manufacturing Purchasing Managers Index,newslettersent,NZD,Spain Producer Price Index,USD/CHF