The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble papered over the annoying lack of income growth and eroding job security of the new millennium in a way the financial market gains of today can’t.

Rising home prices were able to assuage middle America’s income angst because well over 60% of occupied housing is occupied by the owner. The wealth effect may not be very strong overall but it does seem to be larger for the less wealthy. That is especially so with housing because it is a leveraged asset for most owners. The very wealthy may own their homes outright but the vast majority of Americans do not. So when the value of your house rises by even 10%, leverage of say, 10 to 1, means it can have a pretty dramatic effect on your net worth. A doubling or tripling of your net worth through the magic of borrowed money can go a long way in helping you forget that you haven’t had a raise in a long time.

The more recent financial market exuberance – bubble? I don’t know – doesn’t have the same impact for several reasons. First of all, only about 50% of Americans own stock. Second, the vast majority of it is not leveraged. Third, the average American just doesn’t have much in the way of savings regardless of how it is invested. No matter how high financial markets go, the average American just isn’t going to benefit much directly.

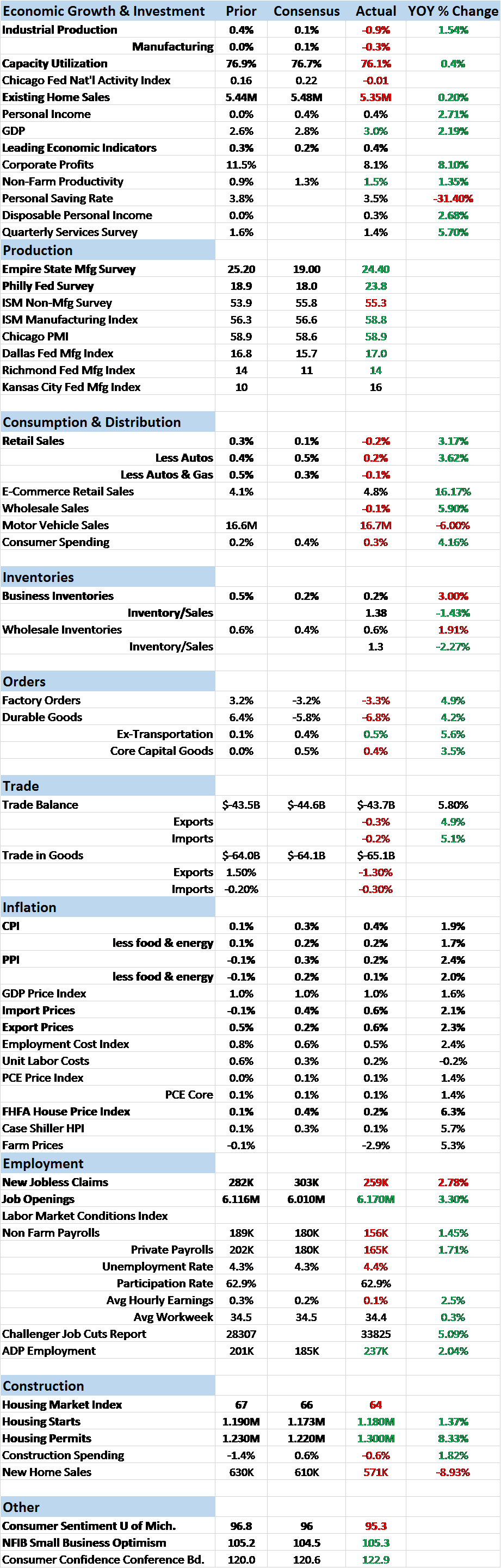

And we see this in the incoming economic data of the last two weeks with stagnant retail sales (-0.2% month to month), industrial production (-0.9%) struggling at levels less than a decade ago, housing stuck in a rut for two years (starts and permits up but still at 2015 levels; existing home sales unchanged year over year) and leading indicators mocking the economic bears with a 0.4 gain in the latest reading. Yes, the economy is still growing and I see nothing in our market indicators to suggest that is about to change. But it isn’t a very satisfying growth and I’m not sure there is anything that would change that in the short term. Magic bullets appear to be in short supply.

There are plenty who will tell you that the economy is merely a tax reform bill away from greatness but I suspect there’s a lot more hope in that feeling than anything else. There’s a lot that goes into allowing an economy to grow to its potential – yes, allowing not making – and taxes are only one part of the equation. Regulatory issues obviously play a role but probably the most important, and one that the politicians have little control over, is monetary policy. And monetary policy is in flux right now, changing in ways that are little understood even by those who practice the economic black art of monetary manipulation.

| Janet Yellen said last week that it was a mystery why inflation has yet to conform to their desire for faster price gains. The list of things the Fed will admit to being clueless about is probably pretty short with the Phillips curve right at the top. I suspect a longer list would be of the things the Fed thinks it knows about and in reality doesn’t know squat. But I digress…

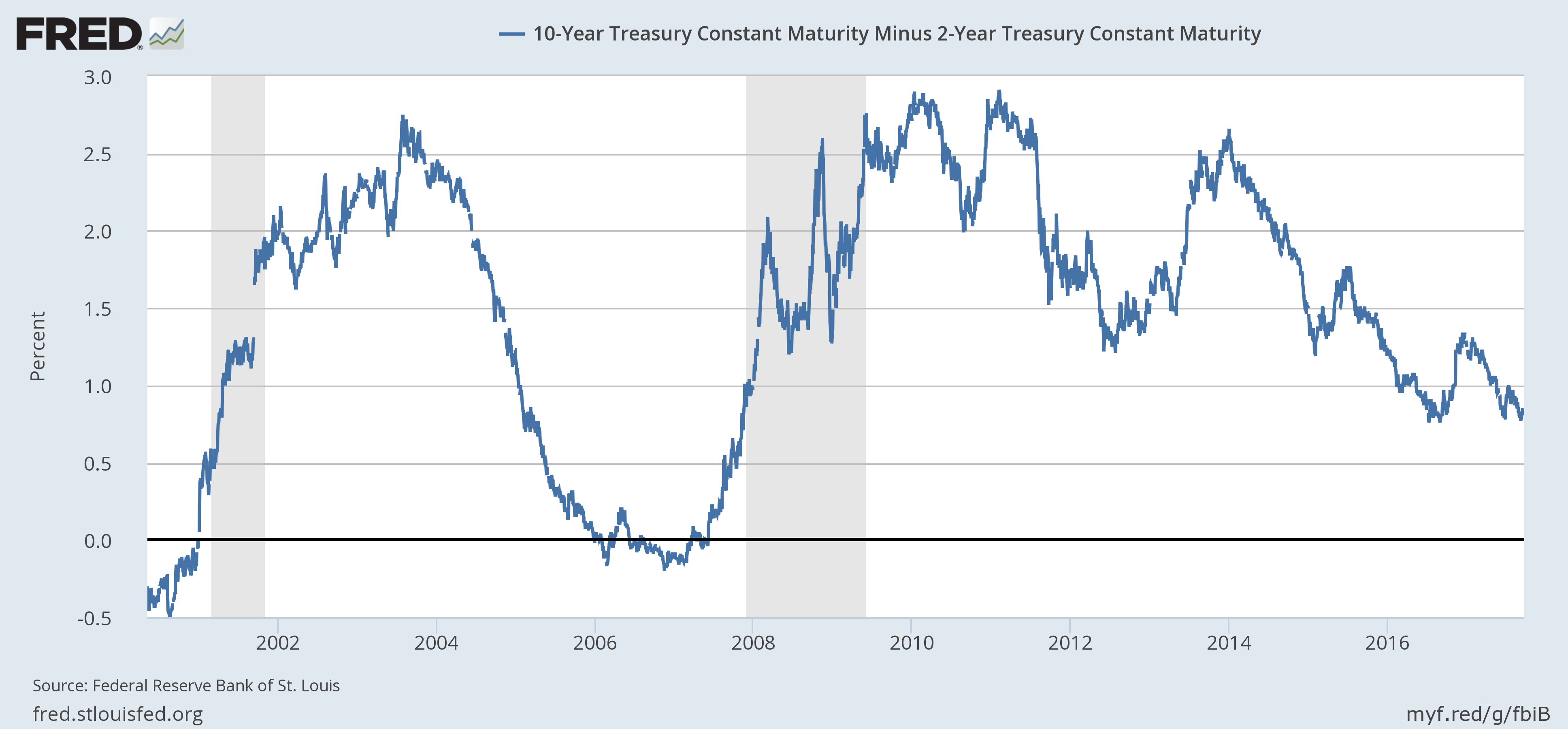

So, while the recent economic data wasn’t that impressive, it didn’t really matter all that much to the markets which were much more interested in what Ms. Yellen might say. And Yellen and Co. have decided that if they say the economy is doing well and conduct monetary policy as if that were true, then folks might actually start to believe it and act accordingly. Hope springs eternal in other words. The Fed didn’t raise interest rates at this meeting but hinted strongly that they would do so at the December meeting. That is what everyone zeroed in on but maybe more interesting was that they once again, lowered the long term neutral rate which is tantamount to throwing in the towel on the economic growth front. This is, apparently, as good as it gets, at least according to the Fed. Or maybe the Fed just thinks we can’t handle the truth. Or maybe I’ve seen one too many Jack Nicholson movies. The Fed also announced that they would start to let their balance sheet shrink. Whether that is bullish or bearish for the economy is just as mysterious to the Fed as their understanding of the connection between wages, growth and inflation. Their own internal research is contradictory with some reporting QE a qualified success and some reporting no impact beyond the distributional effects (in other words, yes, QE exacerbated inequality). How its unwinding will affect the economy and markets is something we’ll only know after the Fed has tried it. Let’s hope that works out better than Obamacare. The effect on markets of the Fed and various other events (hurricanes) was to raise growth and inflation expectations slightly. The yield curve steepened by all of 3 basis points but overall it continues to flatten, pointing to weaker economic growth: |

US 10 Year Treasury Constant Maturity, 2002 - 2017(see more posts on U.S. Treasuries, ) |

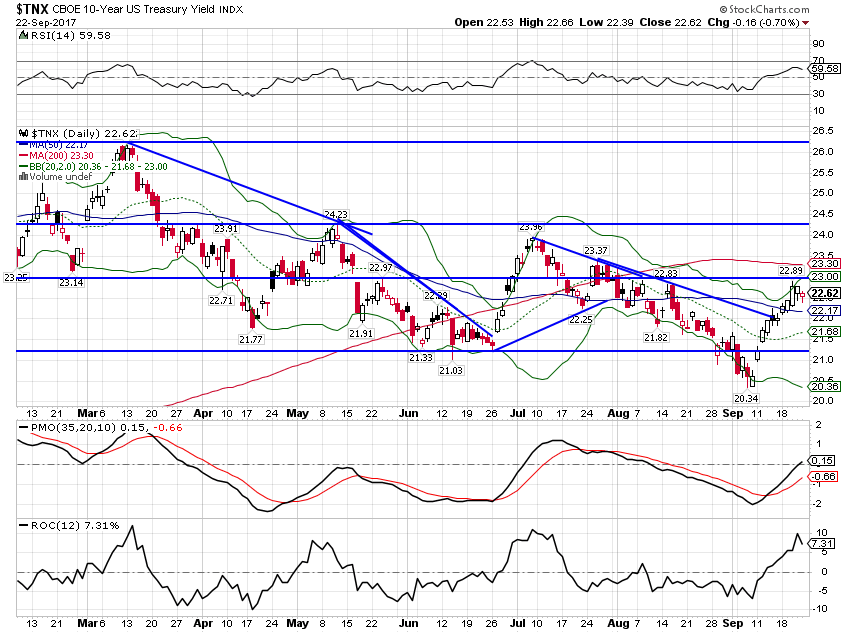

| The 10 year Treasury yield rose strongly from the near 2% level at the last update: |

CBOE 10 Year US Treasury Yield, March - Sep 2017(see more posts on U.S. Treasuries, ) |

| The 10 year TIPS yield moved up 19 basis points, a pretty big move up for two weeks but nothing when given some perspective. Real rates have stayed in a fairly tight range for the last four years. That is why I keep writing the same thing over and over every two weeks. The economy hasn’t changed all that much. The moves of the last two weeks get us right back to where we were a month ago…and 10 months ago….and two years ago….and 4 years ago. |

US 10 Year Treasury Inflation - Indexed Security, Jan 2013 - Jul 2017(see more posts on U.S. Treasuries, ) |

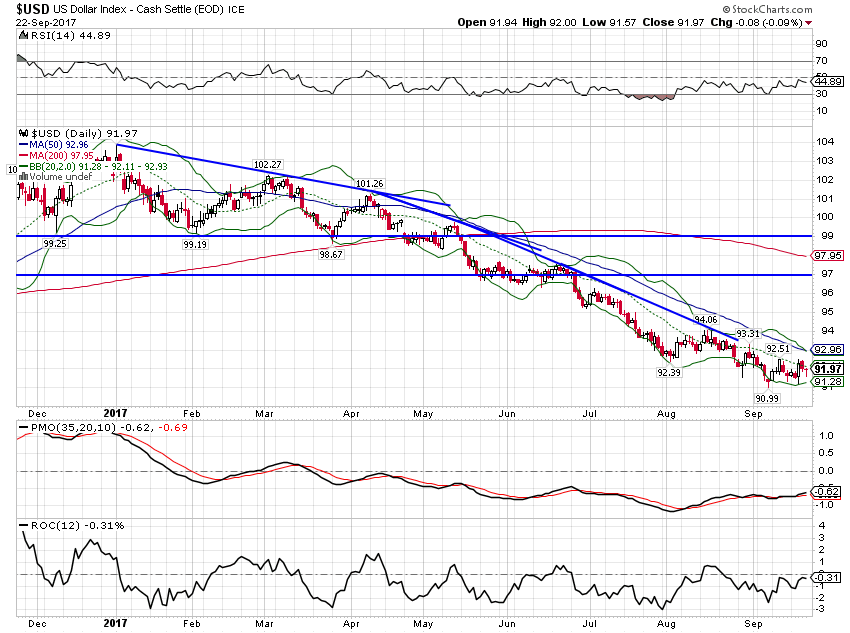

| That firming of real interest rates was enough to stabilize the dollar, at least for now: |

US Dollar Index, Dec 2016 - Sep 2017(see more posts on U.S. Dollar Index, ) |

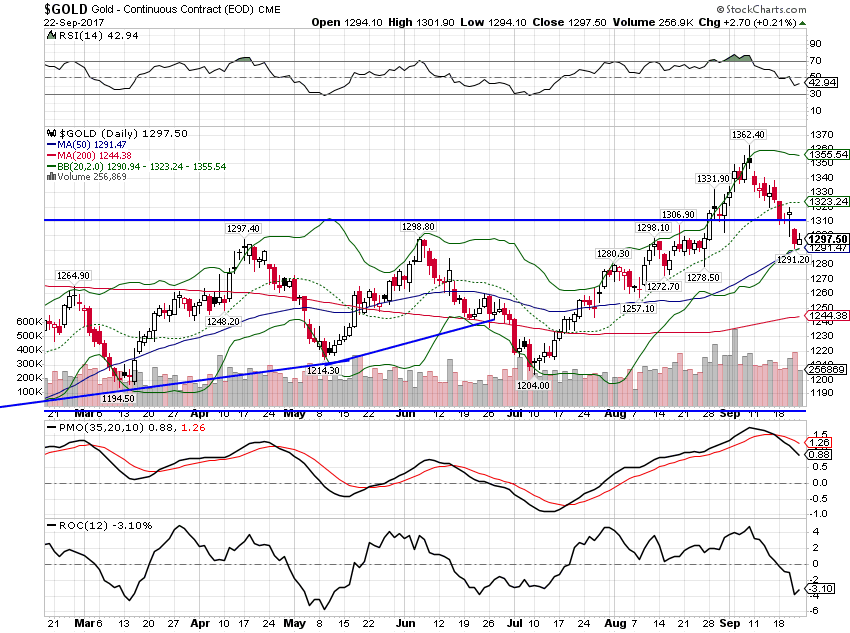

| And that in turn caused a pullback in gold: |

Gold - Continuous Contract, March - Sep 2017(see more posts on Gold, ) |

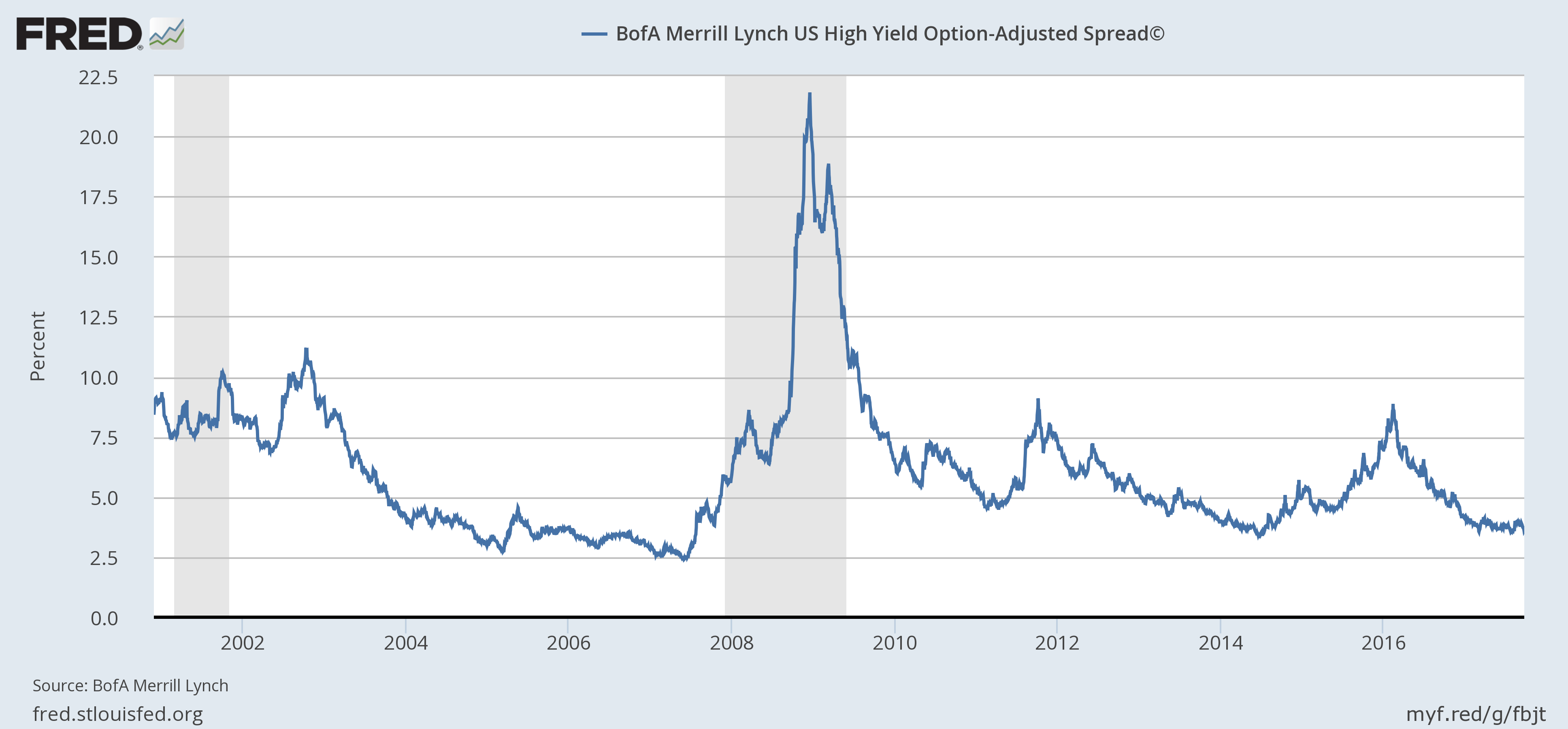

| Credit spreads narrowed to near the lows for the cycle, indicating a healthy – or maybe unhealthy depending on how you look at it – appetite for risk: |

BofA Merrill Lynch US High Yield, 2002 - 2017 |

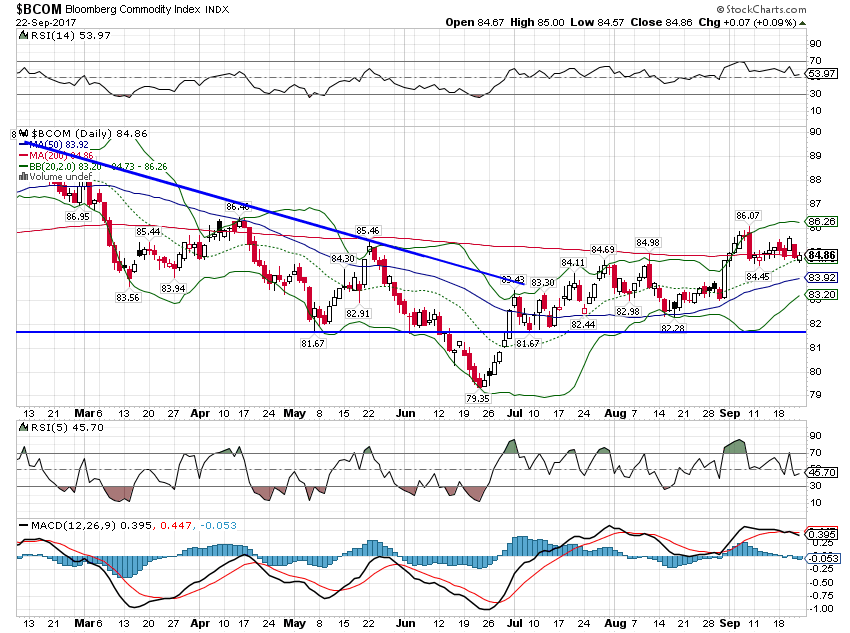

| Meanwhile, commodity prices remained fairly firm, a reflection of the cheap dollar and some renewed enthusiasm regarding global growth (if not US). |

Bloomberg Commodity Index, March - Sep 2017(see more posts on Bloomberg Commodity, ) |

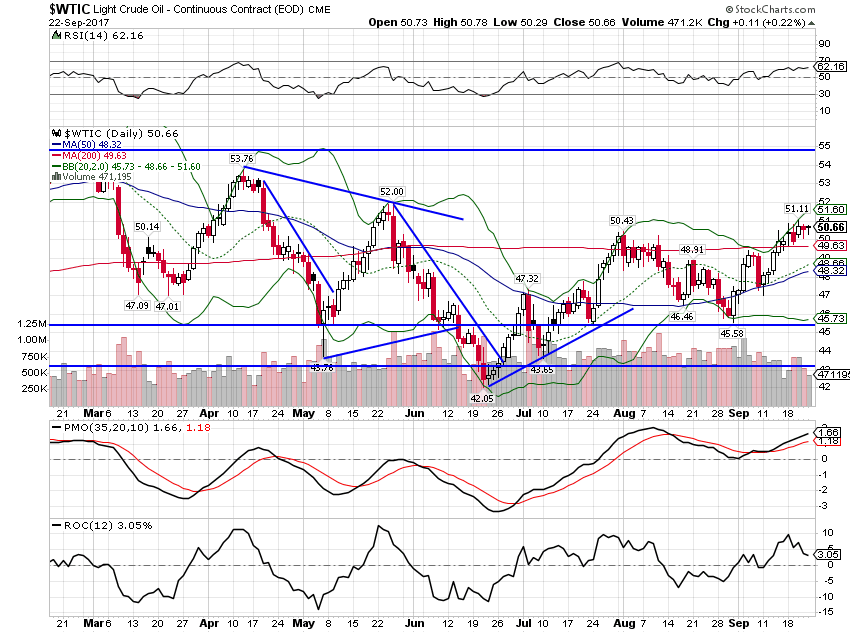

| The firmness in crude oil was a major factor in keeping the commodity indexes well bid. Is the shale revolution faltering? Could be as US production looks to have peaked again…. |

Light Crude Oil - Continuous Contract, March - Sep 2017(see more posts on Crude Oil, ) |

For now, the status quo, despite Americans’ general disgust with the current state of affairs, looks likely to hold. The economy is not in danger of recession. Neither is it in any danger of suddenly finding its inner 1990s and taking off to the upside. I’d love to tell you that Congress was getting its act together and was about to pass a major tax reform bill. But I don’t think anyone makes glasses with that shade of rose. The market sees no reason to price in a major change in fiscal policy and at this point neither do I.

Tags: Alhambra Research,Bi-Weekly Economic Review,Bloomberg Commodity,Bonds,commodities,credit spreads,Crude Oil,currencies,economic growth,economy,Federal Reserve,Federal Reserve/Monetary Policy,Gold,housing bubble,Janet Yellen,Markets,newslettersent,Politics,Quantitative Easing,real interest rates,stocks,tax reform,Taxes/Fiscal Policy,TIPS,U.S. Dollar Index,U.S. Treasuries,US dollar,Yield Curve