Tag Archive: newslettersent

Coop boycotts 150 Nestlé products over price disagreement

According to Swiss broadcaster RTS, Swiss retailer Coop, along with five other members of AgeCore SA, a Geneva-based purchasing alliance, have decided to boycott a large number of Nestlé products in the hope of striking a better deal on price. Sales to AgeCore SA members, which include Coop in Switzerland, Intermarché in France, Edeka in Germany, Conad in Italy, Colruyt in Belgium and Eroski in Spain, represents around 10% of Nestlé’s sales in...

Read More »

Read More »

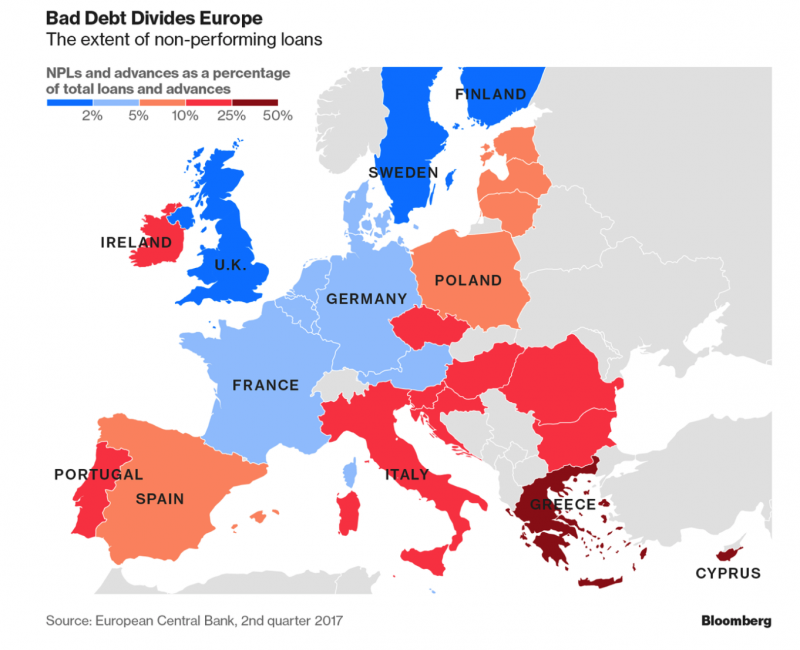

Bank Bail-In Risk In European Countries Seen In 5 Key Charts

Bank Bail-In Risk In Europe Seen In 5 Charts. Nearly €1 trillion in non-performing loans poses risks to European banks’. Greece has highest non-performing loans as a share of total credit. Italy has the biggest pile of bad debt in absolute terms. Bad debt in Italy is still “a major problem” which has to be addressed – ECB. Level of bad loans in Italy remains above that seen before the financial crisis. Deposits in banks in Greece, Cyprus, Italy,...

Read More »

Read More »

FX Daily, February 21: Markets Mark Time

The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has not clarified the situation very much. The equity markets are stalling in front of important chart points as are yields and the dollar.

Read More »

Read More »

Great Graphic: S&P 500 vs Euro Stoxx 600 and Exchange Rates

Today is an important day for equities. After a sharp sell-off earlier this month, stocks staged a recovery last week. The recovery has stalled near retracement objectives, which could be a potential turning point in the market. The Dow Jones Stoxx 600 peaked on January 23 and dropped about 9% through February 9. Through yesterday, it recovered 38.2% of its decline, poking a little above 381.00.

Read More »

Read More »

Cool Video: Bloomberg Interview-Rates, Dollar, and Equites

In large gatherings of people, from airplanes to theater to conferences, we are often told to know the closest exit. The same is true for investing. No matter one's confidence when they buy a security, someone is just as convinced on the other side who is selling the security. Well into this 4.5-minute interview (click here for the link) on Bloomberg's "What'd You Miss" show, Lisa Abramowicz asks the always important question. How will I know I am...

Read More »

Read More »

Vaud – vote on divisive dental tax and care plan

On 4 March 2018, voters in Vaud will vote on a plan to provide basic universal dental care funded by a tax on salaries. The initiative entitled: Reimbursement of dental care, Pour le remboursement des soins dentaires in French, claims that 10% of the population avoid the dentist because of the cost. They also claim links between poor dental health and cancer, diabetes and premature births. Their plan envisages the creation of a network of...

Read More »

Read More »

Swiss financial watchdog publishes ICO guidelines

The Swiss financial watchdog has published guidelines on digital currency fundraisers - known as initial coin offerings - under which it will regulate some ICOs, either under anti-money laundering laws or as securities. The Financial Market Supervisory Authority (FINMA) says the guidelines “also define the information FINMA requires to deal with such enquiries and the principles upon which it will base its responses,” according to a press...

Read More »

Read More »

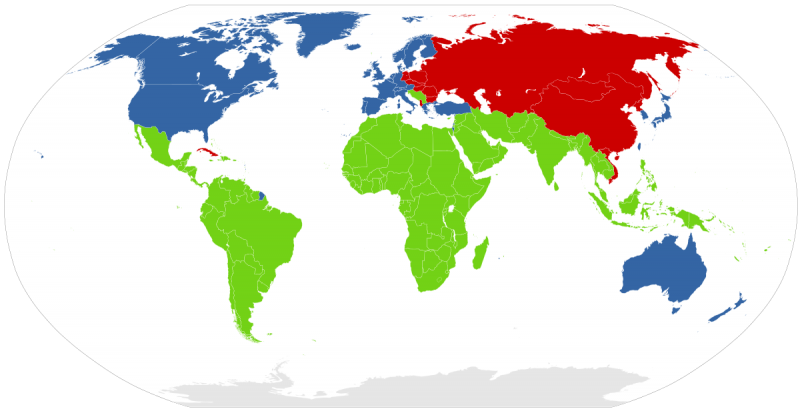

US-China Trade War Escalates As Further Measures Are Taken

US-China Trade War Escalates As Further Measures Are Taken. Trade war between two superpowers continues to escalate. White House likely to impose steep tariffs on aluminium and steel imports on ‘national security grounds’. US may impose global tariff of at least 24% on imports of steel and 7.7% on aluminium. China “will certainly take necessary measures to protect our legitimate rights.”

Read More »

Read More »

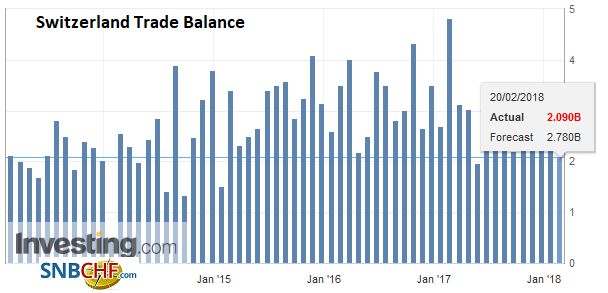

Swiss Trade Balance January 2018: Imports Cross the 17 Billion Franc Mark

Although exports fell in January 2018 from the December peak, their trend remains upward. Imports, for their part, began the year with fanfare to sign a record result. In both traffic directions, chemicals and pharmaceuticals made rain and shine.

Read More »

Read More »

FX Daily, February 20: Dollar Trades Higher, but Stocks Challenged at Key Chart Point

The dollar is finding better traction today, building on the upside reversal seen before the weekend. The news stream has been light and it seems like primarily an issue of positioning rather than a change in sentiment or the consensus narrative. The focus has shifted from monetary policy and idea that the ECB and BOJ are exiting their extraordinary monetary policy to return of the twin deficit problem in the US.

Read More »

Read More »

Weekly Technical Analysis: 20/02/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CAD, USD/CHF

The USDCHF pair approached our waited target yesterday, represented by the bearish channel’s resistance that appears on the above chart, noticing that the price faces good resistance at the EMA50, which forms negative pressure that we expect to push the price to resume its main bearish track again.

Read More »

Read More »

Number plate sale sets new record at auction

A number plate for the Swiss canton of Zug has sold anonymously at auction for CHF233,000 ($253,353), breaking the previous record of CHF161,000. For now, the buyer of the “ZG 10” plate remains unknown, as the item was sold on Wednesday at an anonymous online auction. Several other car and motorcycle plates were auctioned off at the event, the proceeds of which brought more than CHF500,000 to the treasury of the central Swiss canton.

Read More »

Read More »

Gold Up 3.8percent In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years

Gold Up 3.8% In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years. Gold rose as the dollar fell to near a three-year low against a basket of currencies on Friday, heading for its biggest weekly loss in nine months, as a slew of bearish factors including firming inflation and a fall in retail sales and industrial production hit the dollar.

Read More »

Read More »

Our Approaching Winter of Discontent

The tragedy is so few act when the collapse is predictably inevitable, but not yet manifesting in daily life. That chill you feel in the financial weather presages an unprecedented--and for most people, unexpectedly severe--winter of discontent. Rather than sugarcoat what's coming, let's speak plainly for a change: none of the promises that have been made to you will be kept.

Read More »

Read More »

FX Daily, February 19: Monday Market Update

The US dollar is narrowly mixed in uneventful turnover. Of note, the dollar selling seen in Asia last week slacken today and the greenback moved above the pre-weekend highs seen in the US. It is the first time in eight sessions, the dollar has risen above the previous day’s high against the yen. Europe seems to be losing interest though, with the dollar near JPY106.60.

Read More »

Read More »

FX Weekly Preview: Four Key Numbers in the Week Ahead

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four "numbers" that can illuminate the path ahead.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally.

Read More »

Read More »

Switzerland tops latest financial secrecy index

While Switzerland isn’t the most financially secretive nation in the Tax Justice Network’s recently published report, its combination of size and secrecy pushed it into first place, the worst rank in the Financial Secrecy Index 2018. Size is factored in because it measures the damage a nation’s financial secrecy has on the world, says The Tax Justice Network.

Read More »

Read More »

Is The Gold Price Heading Higher? IG TV Interview GoldCore

Is The Gold Price Heading Higher? IG TV Interview GoldCore. Research Director at GoldCore, Mark O’Byrne talks to IG TV’s Victoria Scholar about the outlook for the gold price. In this interview, Mark O’Byrne, research director at Goldcore, says the fact that the gold price did not spike during last week’s equity sell-off was to be expected.

Read More »

Read More »

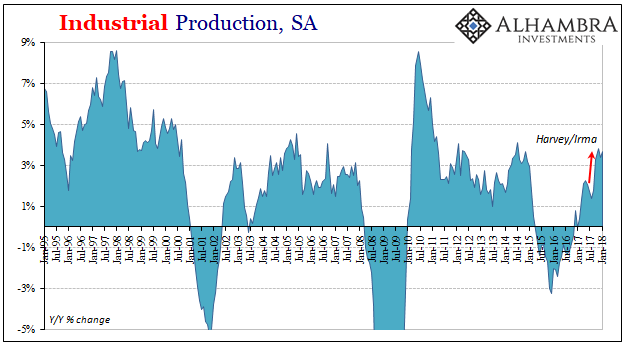

US IP On The Other Side of Harvey and Irma

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017).

Read More »

Read More »