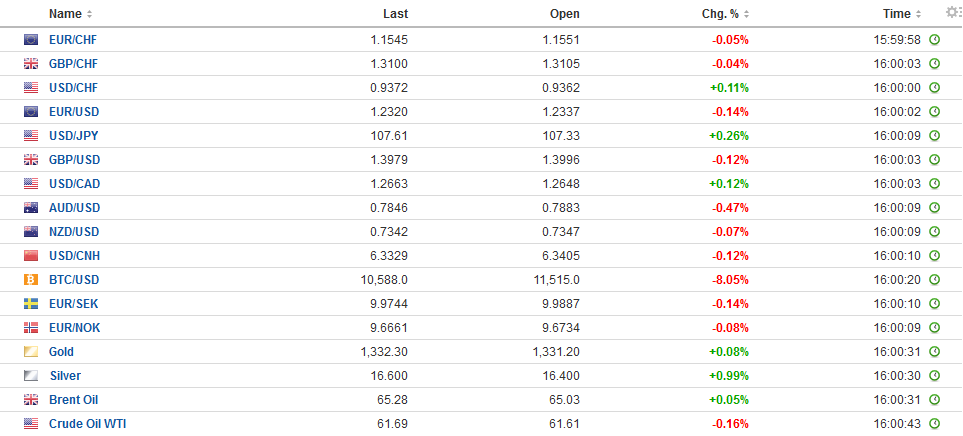

Swiss FrancThe Euro has fallen by 0.02% to 1.1544 CHF. |

EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

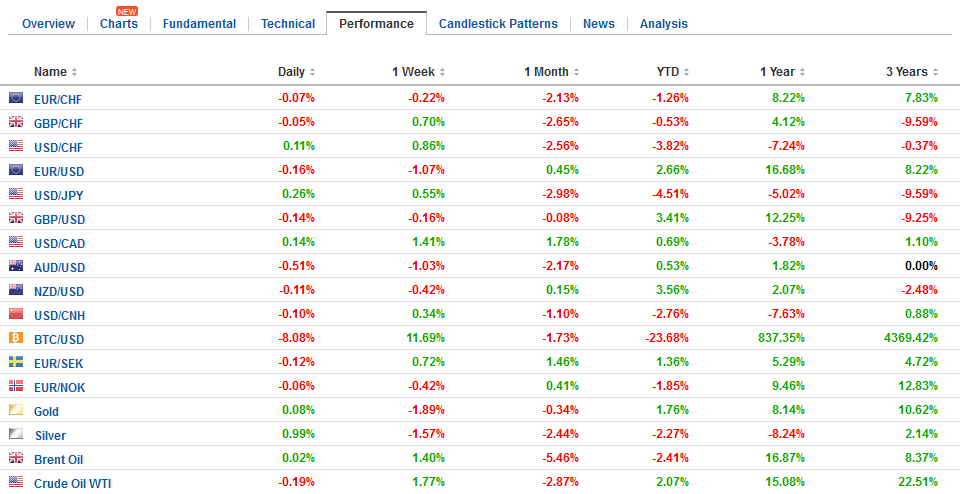

FX RatesThe economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has not clarified the situation very much. The equity markets are stalling in front of important chart points as are yields and the dollar. The MSCI Emerging Market Index is up nearly one percent, rebounding from yesterday’s 0.55% loss and stalling near the trying to get a toehold above the 50% retracement of the drop earlier this month. MSCI Asia Pacific Index rose a milder 0.35% but is stalled at a similar retracement objective. Of note, foreign investors continue to sell South Korean and Philippines, while buying Taiwan shares as local markets re-opened, and small in buying in Indonesia. Taiwan’s Taiex jumped 2.8%, while Hong Kong bounced back 1.8%, and the A-shares index rose 2.3%. Europe’s Dow Jones Stoxx 600 is off 0.5% in late morning turnover, and telecom is the only sector that is resisting the selling pressure. The index is generally moving sideways for the fourth session, after stalling at the 38.2% retracement last week. Yesterday the S&P 500 snapped a six-day advance and US shares are a little heavy now. |

FX Daily Rates, February 21 |

| Bond yields are mixed. Asia-Pacific yields eased and European core rates have slipped, but the peripheral yield are flat to slightly higher. Australia’s 10-year yields fell four basis points and is back through the similar US rate. The drop in yields comes despite news that wages growth was a little stronger than expected in Q4 rising 0.6% in for a 2.1% year-over-year pace. The Australian dollar is wrestling with sterling for the weakest of the major currencies today–off nearly 0.4%. The Aussie has been sold to a new five-day low and appears to be finding a bid near $0.7840.

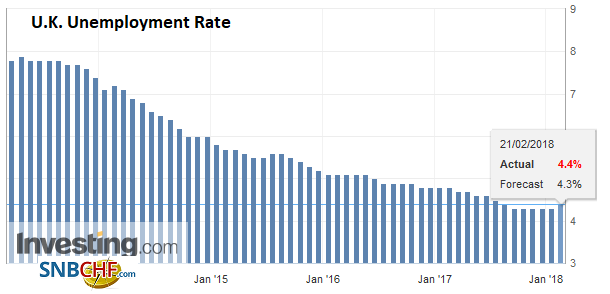

Sterling has been weakened by two developments. First, some 62 Conservatives have pressed Prime Minister May for a quick and clean break from the EU (hard line). May is expected to clarify the response to the EU’s negotiating position. Second, the UK’s unemployment rate unexpectedly ticked up (4.4% from 4.3%) in the three-months through December for the first time in a couple of years, though the jobless claims fell in January. Employment growth in the last quarter of 2017 was half (88k vs 165k) expected. Sterling has also slipped to a new five-day low. It is currently testing support near $1.3930. A clean break may spur a move toward $1.3800 in the coming days. The euro, which was turned back from the GBP0.8900 area last week found demand near GBP0.8800. The euro extended this week’s losses to $1.2300. The $1.2340 area which was breached yesterday and seemed to cap it today represented a 61.8% retracement since $1.22 was seen on February 11. A move below $1.2280 would send it back to the month’s low. There is a 744 mln euro option struck at $1.23 that expires today. |

FX Performance, February 21 |

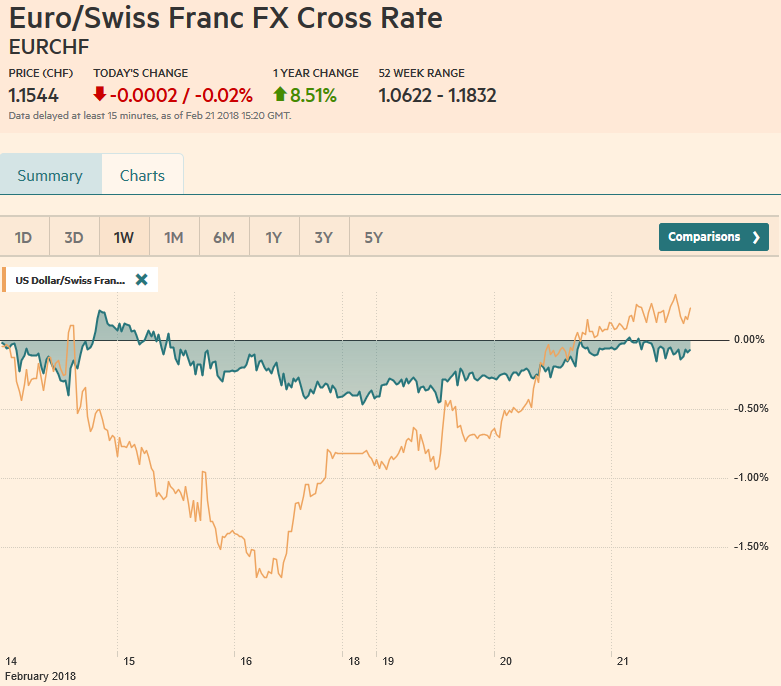

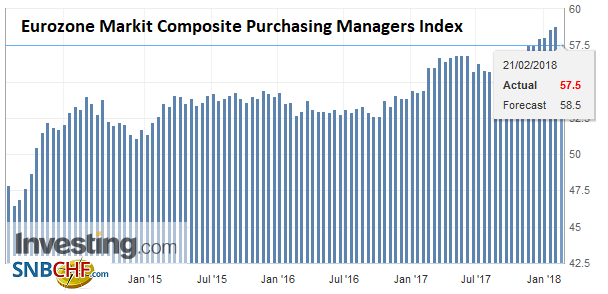

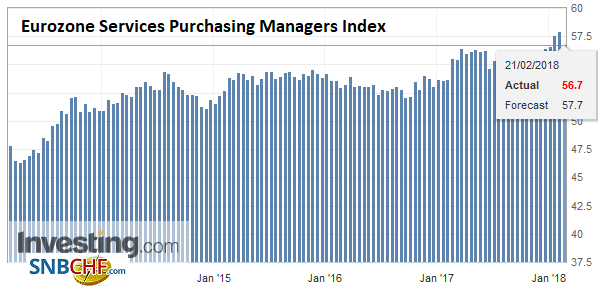

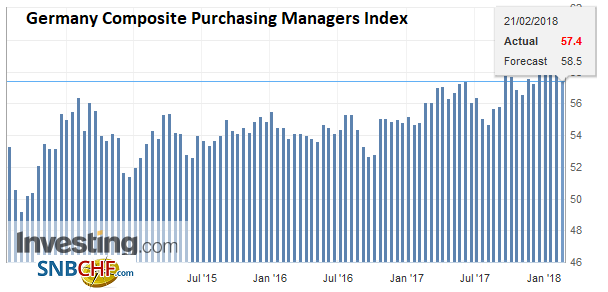

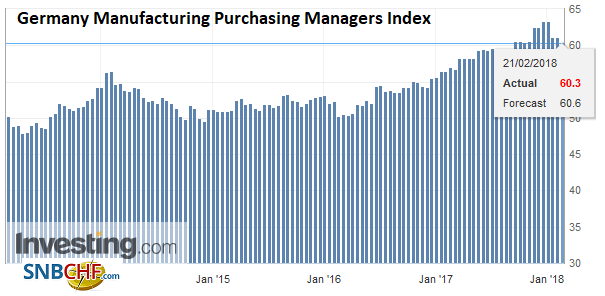

EurozoneMarkit reported softer eurozone flash February PMI. The manufacturing fell to 58.5 from 59.6 and the service PMI fell to 56.7 from 58.0. |

Eurozone Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| The composite reading of 57.5 (from 58.8) returns the much-watched indicators to November levels, and has begun the whispers that the growth momentum has peaked. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Feb 2018(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

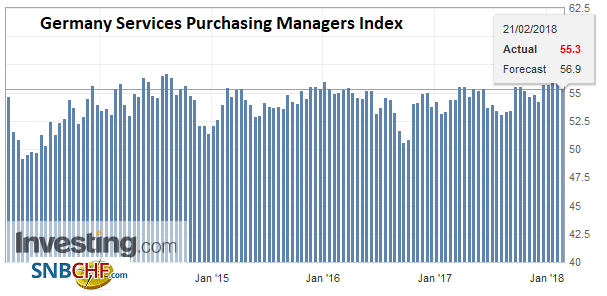

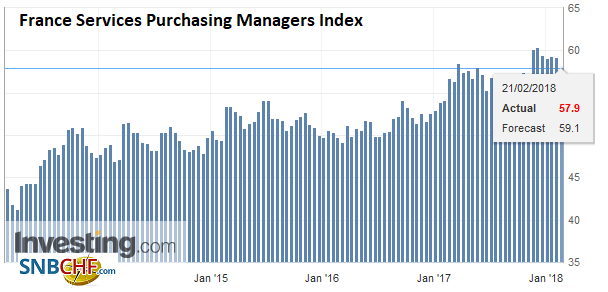

| New orders, output and employment eased, though factory gate prices price at their fastest pace since early 2011. Only country details are available in the flash reading from Germany and France, and the readings for both countries fell. |

Eurozone Services Purchasing Managers Index (PMI), Feb 2018(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Composite Purchasing Managers Index (PMI), Feb 2018(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

Germany Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

Germany Services Purchasing Managers Index (PMI), Feb 2018(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

|

France |

France Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

France Services Purchasing Managers Index (PMI), Feb 2018(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

|

United Kingdom |

U.K. Unemployment Rate, Dec 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

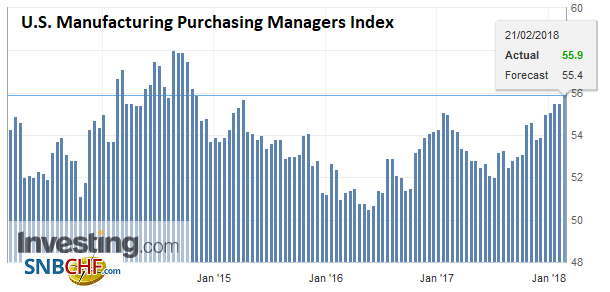

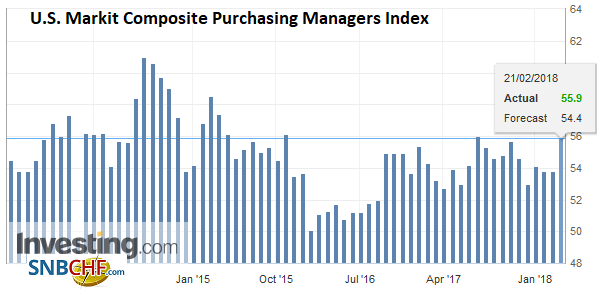

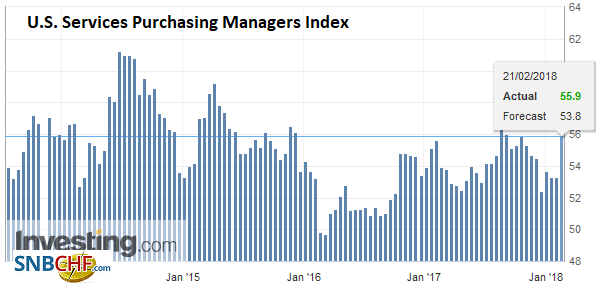

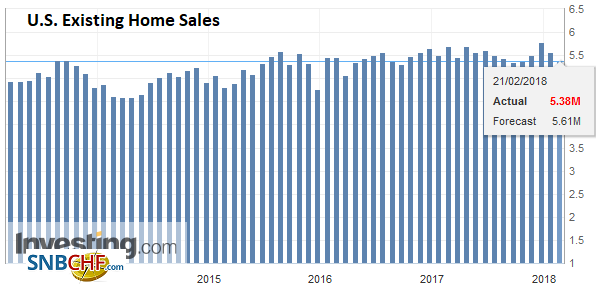

United StatesThe focus in North America will be on the performance of US equities. In terms of data the preliminary Markit PMIs may draw some interest, and existing home sales for January may surprise on the upside (0.5% expected). |

U.S. Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| The FOMC minutes from the January meeting, Yellen’s last, will be released, and although some have tried playing up their significance, we are skeptical. |

U.S. Markit Composite Purchasing Managers Index (PMI), Feb 2018(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| It is clear that the FOMC statement teed up the Fed to hike rates “further” this year. Many suspect the next dot plot will anticipate four hikes this year rather than three. |

U.S. Services Purchasing Managers Index (PMI), Feb 2018(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

| Perhaps the most important part of the minutes will be references to how the members are thinking about fiscal policy. It also seems clear that official confidence in the strength of the economy and that inflation will move toward its target has grown. |

U.S. Existing Home Sales, Jan 2018(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

Japan |

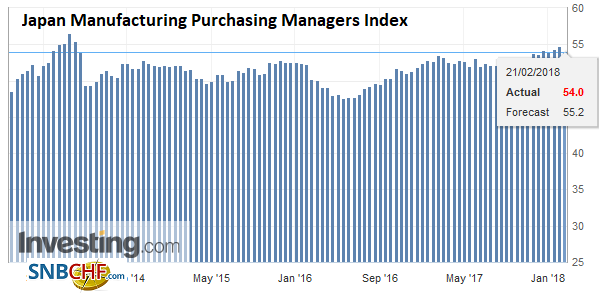

Japan Manufacturing Purchasing Managers Index (PMI), Feb 2018(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

The dollar is rising against the yen for the fourth session. It approached JPY108 in Asia. Last week, it seemed that the Asian session was likely to sell dollar-yen, but this week, it has come back with an apparent bias toward buying dollars. Japan also reported a softer preliminary manufacturing PMI (54.0 vs. 54.8), which could be linked to the appreciation of the yen.

Operationally, we remain concerned that only changing policy at FOMC meetings with press conferences, and only having press conferences every other meeting unnecessarily denies the central bank degrees of freedom. We argue that a press conference after every meeting, like the BOJ and ECB hold, makes sense from a communication, transparency, and operational point of view.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,France Manufacturing PMI,France Services PMI,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,Japan Manufacturing PMI,newslettersent,U.K. Unemployment Rate,U.S. Existing Home Sales,U.S. Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI,USD/CHF