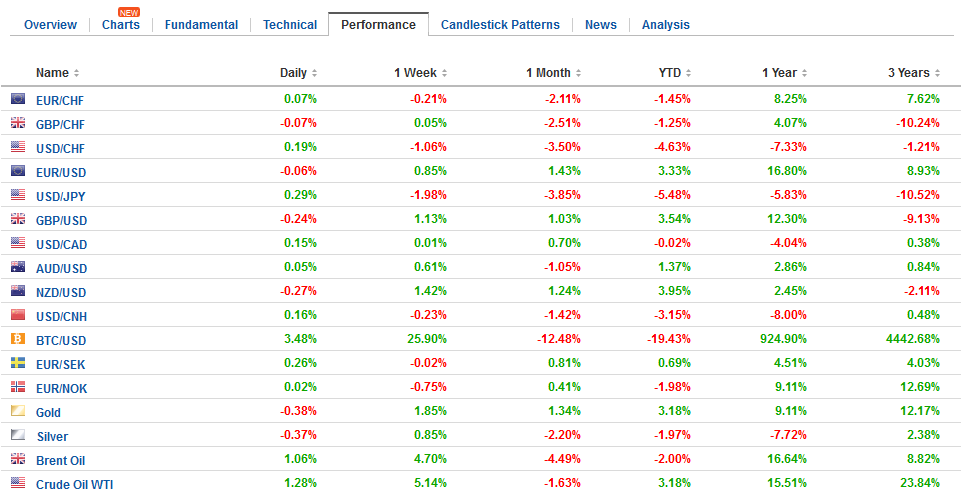

Swiss FrancThe Euro has risen by 0.09% to 1.152 CHF. |

EUR/CHF and USD/CHF, February 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is narrowly mixed in uneventful turnover. Of note, the dollar selling seen in Asia last week slacken today and the greenback moved above the pre-weekend highs seen in the US. It is the first time in eight sessions, the dollar has risen above the previous day’s high against the yen. Europe seems to be losing interest though, with the dollar near JPY106.60. The euro dipped below the pre-weekend low and buyers emerged near $.1.2390. For a third session, sterling demand appeared just below $1.40. The dollar-bloc currencies are firm, but largely confined to the previous session’s range. Among emerging markets, the South Korean won is the strongest, gaining about 0.9%, perhaps encouraged by the return of foreign investors into the equity market, and it seems particularly the KOSDAQ while jumped 3.3% higher. Part of this is catch-up. It hadn’t traded since the middle of last week. After the gap higher opening it continued to advance, and closed a little above the 50% retracement of the recent slide. Central and Eastern European currencies are firm, while the Philippine peso and Thai baht are the laggards. The Turkish lira and South African rand are off about 0.33%. |

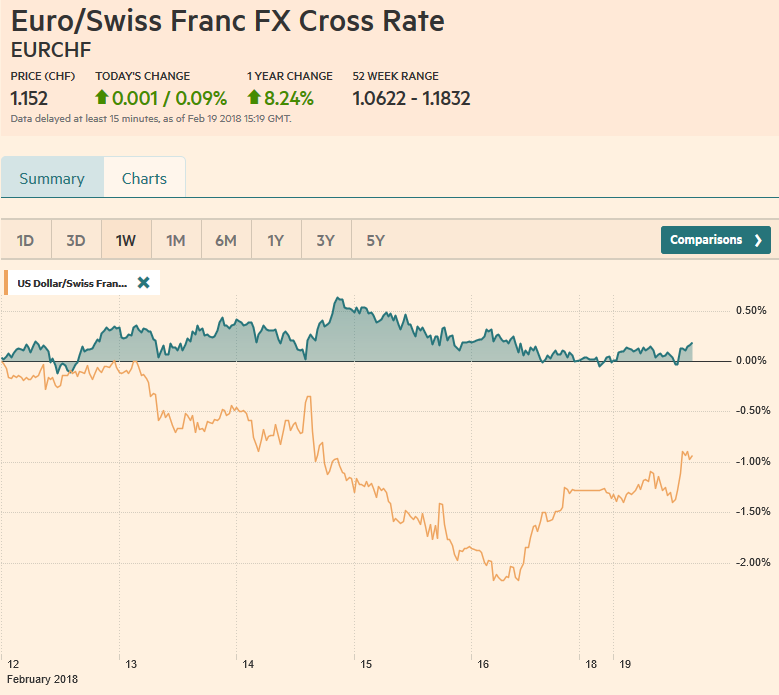

FX Daily Rates, February 19 |

| Asian equities advanced, with the MSCI Asia Pacific Index up 0.9%; extending its recovery for a sixth consecutive session. It has retraced nearly 50% of the recent slide. European markets are struggling and nursing a small loss through the morning. Two sectors are advancing today, energy and financials. Bond markets are under pressure in Europe with Italy and Spain’s 10-year yields rising 4-5 bp, while the core is a little less. Greek 10-year bond yields are off nearly 5 bp following Fitch’s credit upgrade ahead of the weekend to B from B- (positive outlook).

In Europe, the Latvian Central Bank Governor Rimsevics was questioned by anti-corruption authorities and house and office were reportedly searched. He is under pressure to resign or at least recuse himself during the investigation. Separately it appears, the country’s third largest bank is coming pressure as well. The ECB has declared a temporary moratorium on the debt operations of ABLV Bank. There have been numerous accusations against the bank for improprieties, culminating in last week US Treasury push to ban ABLV from the US financial system due to its transaction related to the North Korea missile program. The Latvian central bank will lend ABLV 97.5 mln euros (ELA?) and bought government bonds from ABLV yesterday to bolster its liquidity. The bank’s bonds have been suspended from the NADZQ Riga bourse where the bonds trade. Last week, VISA limited its service for more than 9000 bank clients. |

FX Performance, February 19 |

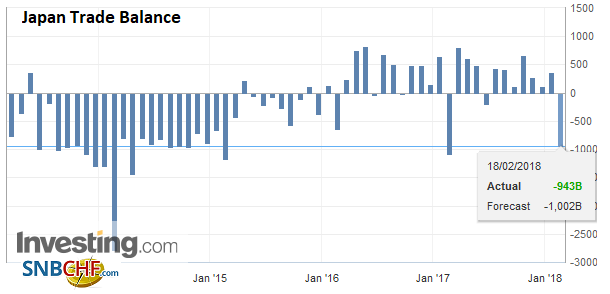

JapanJapan reported a slightly smaller than expected trade deficit for January, which is typically a soft month. The monthly deficit is the first since May last year. Trade with Asia is distorted by the Lunar New Year. |

Japan Trade Balance, Jan 2018(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

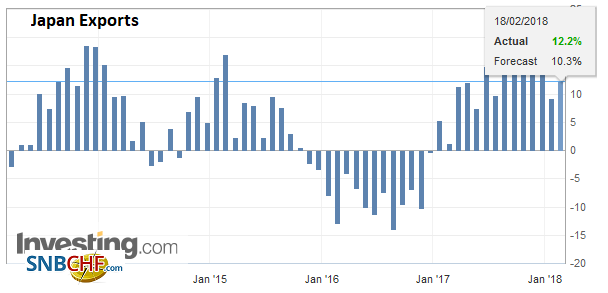

| Exports were up 12.2%. Exports to China, were up 30.8% from a year ago, while exports to the US rose 1.2%. Exports to all of Asia rose 16%, and exports to the EU rose 20.8%. The Reuters survey found a median forecast of 10.3% after a 9.3% rise in December (year-over-year). |

Japan Exports YoY, Jan 2018(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

| Imports rose 7.9%, while the Reuters survey found a median expectation of 8.3%. |

Japan Imports YoY, Jan 2018(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent,USD/CHF