Tag Archive: newslettersent

Bi-Weekly Economic Review: One Down, Three To Go

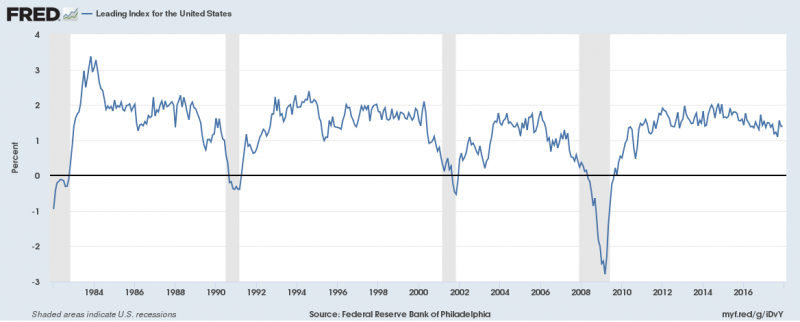

We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of recession, it is rare and unpredictable.

Read More »

Read More »

Swiss rail cargo to cut over 750 jobs in the hunt for efficiency

The cargo division on the Swiss Federal Railways has announced plans to cut 760 jobs in the coming years. The company currently employs around 2,300 staff in Switzerland. Company boss Nicolas Perrin revealed the job cut measures on Saturday in the weekly Schweiz am Wochenende. According to him, the administrative section of the firm is still too big despite already planning a reduction of 80 posts.

Read More »

Read More »

Digital Gold Provide the Benefits Of Physical Gold?

Will digital gold provide the benefits of physical gold? Digital gold and crypto gold products claim to combine efficiencies of blockchain with value of gold. They are yet to provide the same benefits or safety as owning physical gold. National mints jumping in on the ‘sexy blockchain’ act. BOE declares bitcoin ‘not a currency;’ Royal Mint launches blockchain gold product.

Read More »

Read More »

FX Daily, February 28: It Takes Powell to Convince the Market that Yellen was Right

Many market participants think they heard Fed Chair Powell give a fairly strong signal that he favored a more aggressive course. The implied yield on the December Eurodollar futures rose five basis points to 1.535%. The December Fed funds futures contract rose three basis points.

Read More »

Read More »

Great Graphic: Has Position Adjustment Begun in Treasury Futures?

This Great Graphic from Bloomberg shows the net large speculative positioning in the 10-year note futures over the past five years. They began last year with a huge next short position of more than 400k contracts.

Read More »

Read More »

Swiss Sugar Industry Calls for Action as Prices Crumble

The Swiss sugar industry is facing stiff competition from Europe and is calling for political measures to save the industry. At a press conference in Bern on Friday, industry representatives warned that the scrapping of European quotas had flooded the Swiss market with cheap European products.

Read More »

Read More »

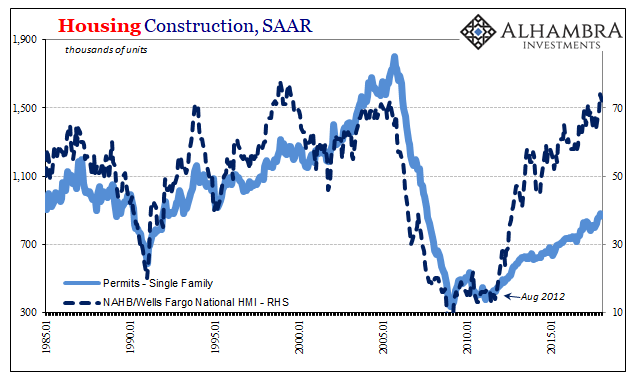

New Home Sales (Predictably) Fall Out of the Boom, Too

New home sales were down sharply again in January 2018. For the second straight month, the level of purchase activity fell substantially despite what are otherwise always described as robust or even booming economic conditions. Like the sales of existing homes, the sales of newly constructed units should be both moving upward as well as being significantly more than stuck at this low level.

Read More »

Read More »

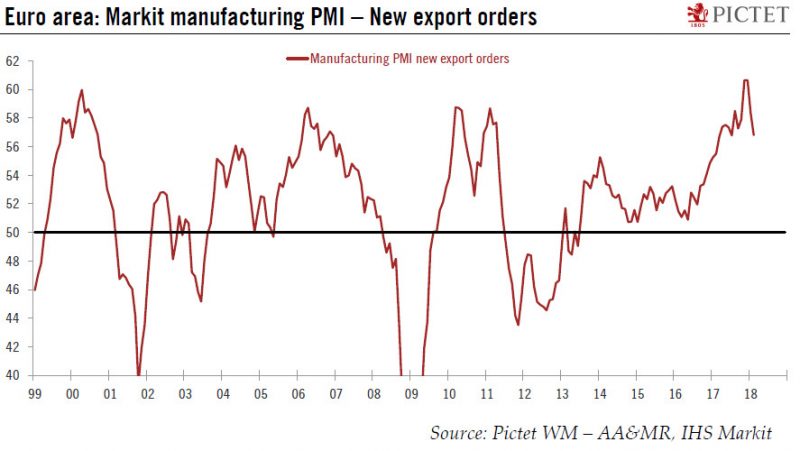

Europe chart of the week – Business surveys

There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014. National business surveys painted a similar picture.

Read More »

Read More »

FX Daily, February 27: Markets Tread Water; Powell is Awaited

The capital markets seem unusually subdued. The US dollar is mostly slightly firmer, except against the euro and Swiss franc among the majors. The MSCI Asia Pacific Index managed to eke out a small gain (0.2%), for a third advancing session, without the help of China, Taiwan, Korea or India. It was really a Japanese story. The Nikkei rallied 1.1%, while excluding Japan the MSCI benchmark was off 0.25%.

Read More »

Read More »

Exports sweeten turnovers for Swiss chocolate makers

Despite a decline in domestic consumption, sales of Swiss chocolate grew by 3.1% in 2017 thanks to foreign demand. On Thursday, the Federation of Swiss Chocolate Manufacturers (Chocosuisse) reported total sales of CHF1.85 billion ($1.98 billion) for the year. The volume of chocolate sold also increased by 2.7% to 190,731 tons.

Read More »

Read More »

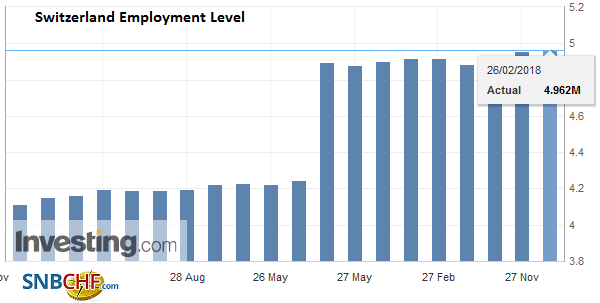

Lake Geneva Region Attracts Most Cross-Border Workers

Switzerland continues to attract large volumes of cross-border workers, notably in the Lake Geneva region and around the city of Basel. At the end of last year, 318,002 people were crossing the border each day to work in Switzerland, according to data published by the Federal Statistics Officeexternal link on Friday. This is an increase of 1.7% compared with December 2016.

Read More »

Read More »

Swiss federal finances – surplus of billions in 2017

While many national governments, such as the US and UK, regularly spend more than they collect, Switzerland managed a CHF 2.8 billion surplus in 2017. In addition, CHF 2 billion of withholding tax is expected, which would push the surplus up to CHF 4.8 billion.

Read More »

Read More »

Haunted by Ghosts of the Old Eastern Bloc

Jerome Powell, the new Chairman of the Federal Reserve, just completed his third week on the job. He’s hardly had enough time to learn how to operate the office coffee maker, let alone the all-in-one printer. He still doesn’t know what roach coach menu items induce a heinous gut bomb.

Read More »

Read More »

FX Daily, February 26: Dollar Slides as Equities Extend Recovery

The US dollar has begun the new week on heavy footing. It is being sold against virtually all the currencies, major and emerging market currencies. There is one exception, and although the local market is not open, the Mexican peso is under some pressure that could be linked to a dispute between the President of Mexico and the US that prompted the former to cancel a visit to the latter.

Read More »

Read More »

FX Weekly Preview: Three Drivers in the Week Ahead: Data, Speeches, Politics

There are three distinct classes of drivers in the week ahead. The first is high frequency data. The most important of the economic reports include the preliminary estimate of the February inflation in the euro area, the US January income, and consumption data alongside the Fed's preferred inflation measure, the core PCE deflator, and Japanese retail sales and industrial production figures.

Read More »

Read More »

Swiss hotel bookings on a high note

After several difficult years, the Swiss hotel industry is recovering. There were 37.4 million overnight stays in 2017 – 5.2% more than in the previous year and nearly as many as the record years of 1990 and 2008. The increase came from locals as well as foreigners. Total domestic demand increased by 4.2% to 16.9 million overnight stays – the highest number of Swiss-based guests ever, the Federal Statistical Office reported on Thursday.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »