Tag Archive: newslettersent

D-day for Australia’s Real Estate Bubble?

Unknowable Degrees of Bubble Insanity Back in February, we brought you an update on the truly insane real estate bubble in Australia (see: “Australia’s Housing Bubble – In the Grip of Insanity” for details) in the wake of Jonathan Tepper of Variant Perception reporting on an eye-opening fact-finding tour in Sydney.

Read More »

Read More »

FX Daily, November 03: Political Angst Drives Markets

GBP/CHF rates are trading below 1.20 on the exchange, providing those clients holding CHF with some of the best rates they’ve seen in the past six years. The Pounds woes have been well documented but with a key day of economic data releases ahead, is it all about to change?

Read More »

Read More »

US Political Anxiety Stems Bond Sell-Off

Bond yields have been rising in the US and Europe since the summer. There are some country-specific considerations and some generalized factors. Anxiety over US politics has helped bonds recover some lost ground.

Read More »

Read More »

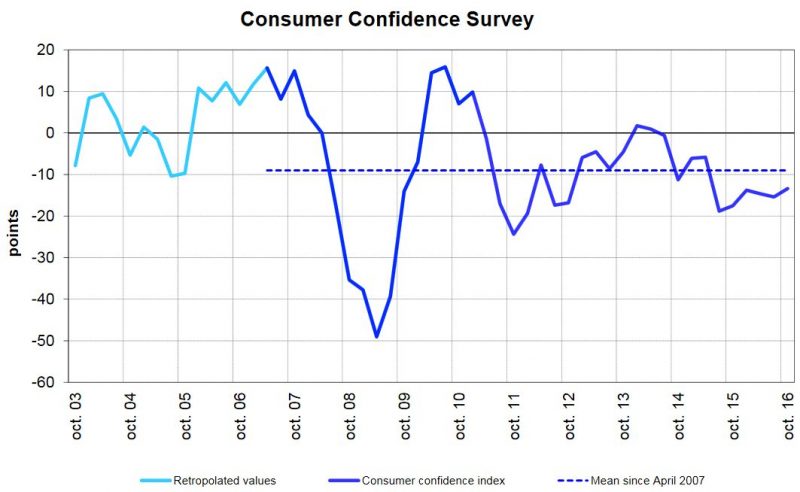

Swiss Consumer Sentiment Still Lukewarm

The latest survey shows that there was hardly any change in consumer sentiment in Switzerland between July and October 2016*. The index currently stands at -13 points and has consistently come in at a value below its long-term average for over a year now. However, consumers believe that the outlook for the economy over the coming months is considerably better than in July. The assessment of price trends also underwent an upward adjustment.

Read More »

Read More »

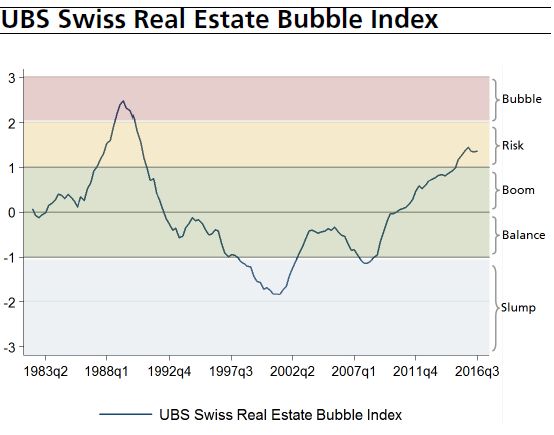

Swiss real estate market UBS Swiss Real Estate Bubble Index 3Q 2016

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Read More »

Read More »

Der SNB-Milliardengewinn täuscht Stärke vor. Tatsächlich ist die SNB so schwach wie nie.

Voller Stolz präsentiert die SNB ihr Zwischenergebnis für die ersten 9 Monate dieses Jahres: 28.7 Milliarden Franken Gewinn. Und die Medien kolportieren diese Zahlen unbedarft. Die Devisenreserven der SNB seien erneut gestiegen wird da behauptet; und zwar allein in diesen neun Monaten um 73 Milliarden auf sage und schreibe 666 Milliarden Franken. Solche Schlagzeilen sind oberflächlich und lenken von der grossen Gefahr ab, in welcher sich die SNB...

Read More »

Read More »

FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

The single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring.The dollar is broadly lower as are stocks. The surge in global yields has been arrested.

Read More »

Read More »

Recessions, Predictions and the Stock Market

Only Sell Stocks in Recessions? We were recently made aware of an interview at Bloomberg, in which Tony Dwyer of Cannacord and Brian Wieser of Pivotal Research were quizzed on the recently announced utterly bizarre AT&T – Time Warner merger. We were actually quite surprised that AT&T wanted to buy the giant media turkey. Prior to the offer, TWX still traded 50% below the high it had reached 17 years ago.

Read More »

Read More »

EC Pushes Back on (8) Draft Budgets

Long before the UK referendum, many argued that monetary union was undermining the European Union. Many had expected Greece to be forced out not once but twice. There is a cottage industry of books forecasting the demise of EMU.

Read More »

Read More »

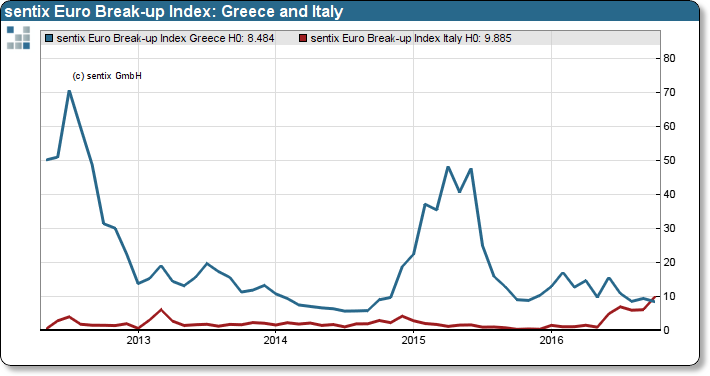

Great Graphic: Sentix Shows a Shift

The risk that the eurozone implodes over the next year has risen, but is still modest. Italy has surpassed Greece as the most likely candidate. The December referendum is the second part of Renzi's political reforms.

Read More »

Read More »

SNB Line in Sand Breaks, EUR/CHF under 1.08

We have always emphasized that the SNB intervenes between 1.08 and 1.0850. Even if there was no change in sight deposits the 1.08 "line in sand" broke.

Read More »

Read More »

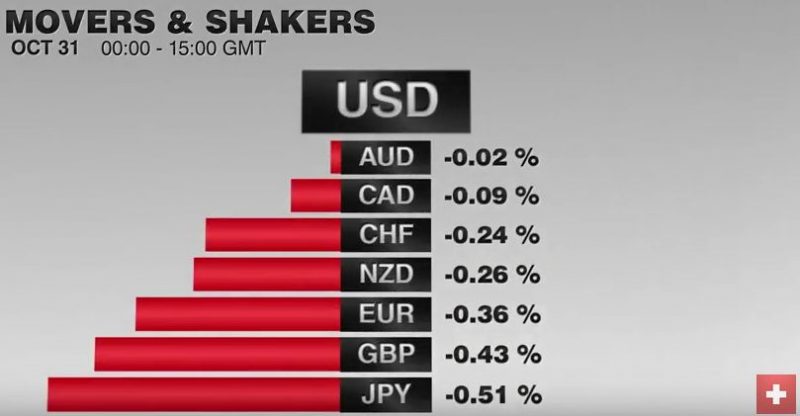

FX Daily, November 01: Dollar and Yen Slip in Quiet even if Eventful Turnover

The US dollar is posting minor losses against most of the major currencies today.The Japanese yen is the exception, as the greenback continues to straddle JPY105. There have been several developments today, and the US also has a full economic calendar today. The most important of the developments was the upbeat message from the Reserve Bank of Australia.

Read More »

Read More »

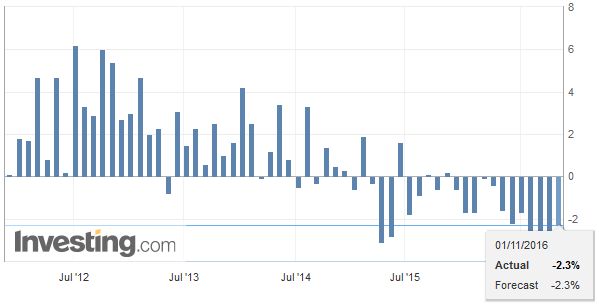

Swiss Retail Sales -2.7 percent nominal (YoY) and -2.3 percent real (YoY)

Real turnover in the retail sector also adjusted for sales days and holidays fell by 2.3% in September 2016 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 0.2%.

Read More »

Read More »

You Didn’t Build That!

Collectivism Across Party Lines “There is nobody in this country who got rich on his own — nobody.” – Elizabeth Warren, campaign speech 2011. “If you’ve got a business – you didn’t build that. Somebody else made that happen.”

Read More »

Read More »

When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Last year, I posted an article titled "If Sweden and Germany Became US States, They Would be Among the Poorest States" which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly reached the point of dogma with many leftists that European countries enjoy higher standards of living thanks to more government regulation and...

Read More »

Read More »

Und nun kommt der Nobelpreisträger daher und will uns weismachen, wir müssten den Mindestkurs wieder einführen

„Es kostet fast nichts, Franken im richtigen Umfang zu drucken.“ Das sagte der Wirtschaftsnobelpreisträger Joseph Stiglitz am World Economic Forum (WEF) in Davos anlässlich eines Interviews mit dem Tages-Anzeiger.

Read More »

Read More »

FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

he latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump's fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton's emails and the national polls have narrowed.

Read More »

Read More »

Risk Happens Fast

As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn't for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast.

Read More »

Read More »