Tag Archive: newslettersent

Great Graphic: French Premium over Germany Continues to Grow

European premiums over Germany typically increase in a rising interest rate environment. France's premium is at the most in two years. France is still set to turn back the challenge from Le Pen.

Read More »

Read More »

Thoughts about the Fed’s Balance Sheet

Several regional Fed presidents want to begin talking about shrinking Fed's balance sheet. Leadership does not appear to have great urgency, so don't expect anything in this week's statement. First step more hikes, then refrain from reinvesting payments and maturities, but slowly.

Read More »

Read More »

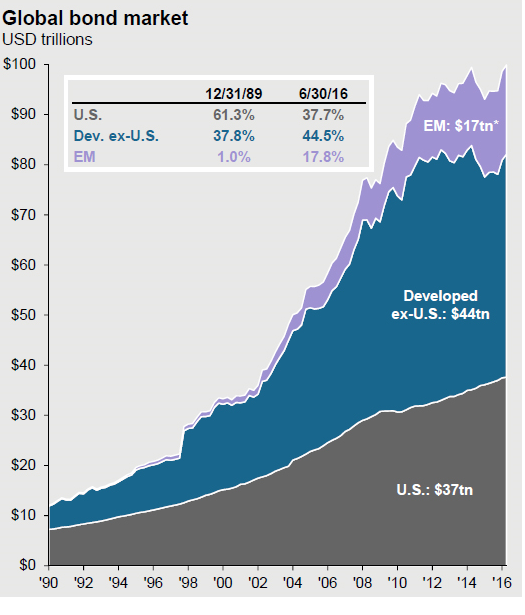

Why Our System Is Broken: Cheap Credit Is King

You want to fix the economic system, reduce political bribery and reduce rising income inequality? Shut off the cheap unlimited credit spigot to banks, financiers and corporations. Cheap credit--newly issued money that can be borrowed at low rates of interest--is presented as the savior of our economic system, but in reality, it's why our system is broken.

Read More »

Read More »

More than 3,000 state beneficiaries in Geneva admit not declaring assets or other income

Last October, Geneva state councillor Mauro Poggia, had his department send out close to 91,000 letters to those receiving social benefits, asking them to contact the authorities if they had failed to declare any assets or income. Laurent Paoliello, a spokesperson from the DEAS, said they received 3,200 letters back. So far, we haven’t been through all the letters, he said.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

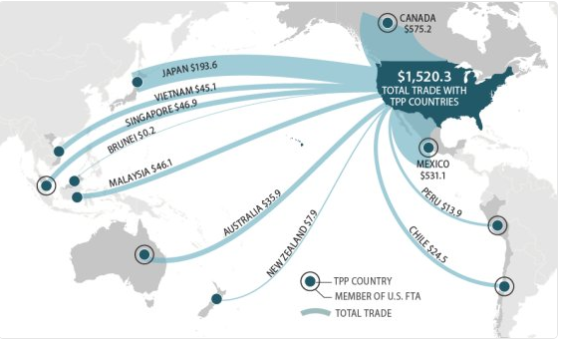

Trade is Trump’s Centerpiece

Investors are anxiously awaiting more details on the new US Administration's economic policies and priorities. Part of the challenge is that the cabinet represents a wide range of views and it is not clear where the informal power lies, or whose call is it. In terms of economic policy, trade is being given priority. It is seen as the key to the jobs and growth objectives.

Read More »

Read More »

Precious Metals As Safe Havens – Reassessing Their Role

New research confirms that not just gold but also the other precious metals – silver, platinum and palladium bullion – act as safe havens, especially from ‘Economic Policy Uncertainty.’ This is something that is particularly prevalent today due to the ‘Hard Brexit’ impact on the UK and the Eurozone, risk of trade wars and heightened financial and geopolitical risk under the Trump Presidency.

Read More »

Read More »

Pressure on Greece Mounts, New Crisis Looms

Greece needs to implement its commitments in the next few weeks or it faces a new crisis. The more the government implements its commitments, the less public support it draws. New elections in Greece cannot be ruled out.

Read More »

Read More »

France’s FN sets out unorthodox economic plans to support a euro exit

France's National Front will combine the euro exit at the heart of its economic platform with a cocktail of unorthodox policies including money printing, currency intervention and import taxes, a top party official told Reuters. A key measure in the presidential platform National Front (FN) leader Marine Le Pen will unveil this weekend will be to break France's dependence on market financing by reserving the right to order the central bank to buy...

Read More »

Read More »

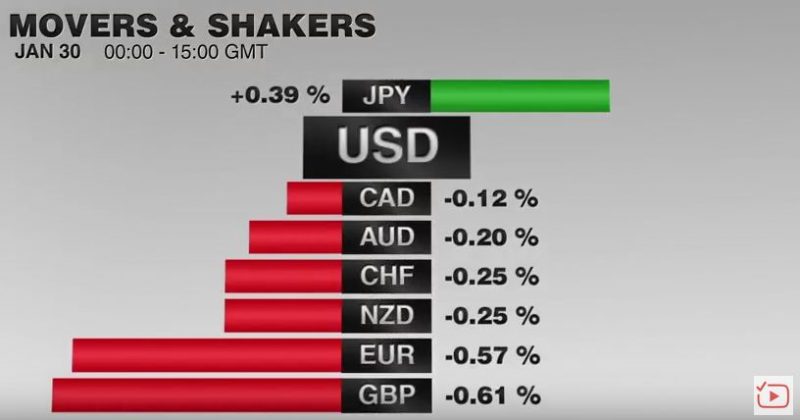

FX Daily, January 31: Markets Look for Solid Footing

The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday's drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar's losses yesterday, which it is consolidating today.

Read More »

Read More »

Ending Taxation on Monetary Metals

Imagine if you asked a grocery clerk to break a $20 bill, and he charged you $1.40 in tax. Silly, right? After all, you were only exchanging one form of money for another. But try walking to a local precious metals dealer in more than 25 states and exchanging a $20 bill for an ounce of silver.

Read More »

Read More »

Trump and the Dollar

US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk.

Read More »

Read More »

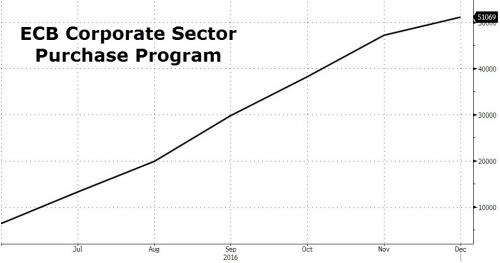

ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB's nationalization of the European corporate bond sector continues. In the ECB's latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding.

Read More »

Read More »

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

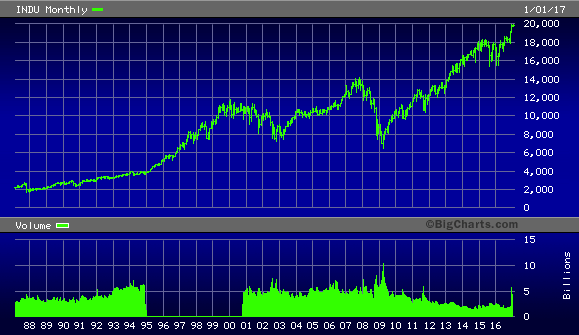

Dow 20K, US Debt $20 Trillion, Trump and Gold

By Jan Skoyles, Editor Mark O’Byrne

In case you’ve been hiding under a rock, the Dow Jones Industrial Average reached 20,000 earlier this week for the first time in its 132 year history to much media fanfare.

Bigcharts via Financial Sense

Since Trump’s election US market indicators, including the Dow have been ticking up – it has been labelled the Trump rally. This latest milestone is something that the new President is happy to take credit for....

Read More »

Read More »

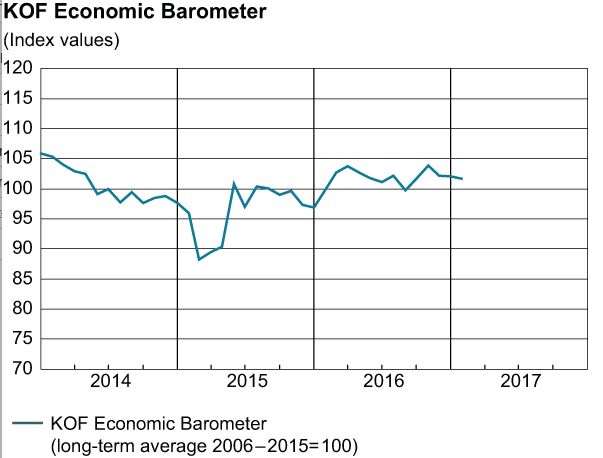

Why 2017 Could See the Collapse of the Euro – Stiglitz

2017 could be the year that the euro collapses according to Joseph Stiglitz writing in Fortune magazine and these concerns were echoed over the weekend by former Bundesbank vice-president and senior European Central Bank official, Jürgen Stark, when he said that the ‘destruction’ of the Eurozone may be necessary if countries are to thrive again.

Read More »

Read More »

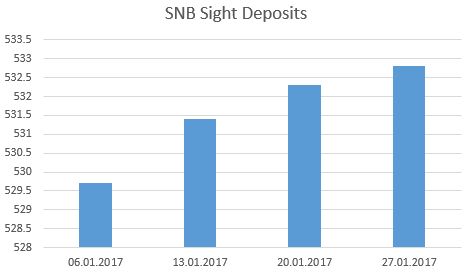

Weekly Sight Deposits and Speculative Positions: Strong Swiss Trade Balance: SNB allows EUR/CHF to 1.0680

With the strong Swiss trade balance, the SNB let EUR/CHF fall to 1.0680. SNB intervenes for 0.5 bn CHF. Speculators are net short CHF with 13.6K contracts against USD, nearly unchanged.

Read More »

Read More »