Tag Archive: newslettersent

Uncertainty and concern follow voter rejection of Switzerland’s company tax reform

Speaking to Tribune de Genève, Serge Dal Busco, Geneva’s minister of finance, voiced his concerns about last Sunday’s rejection of Switzerland’s planned company tax reform. At the same time he remains optimistic about the chances of a new federal corporate tax reform project.

Read More »

Read More »

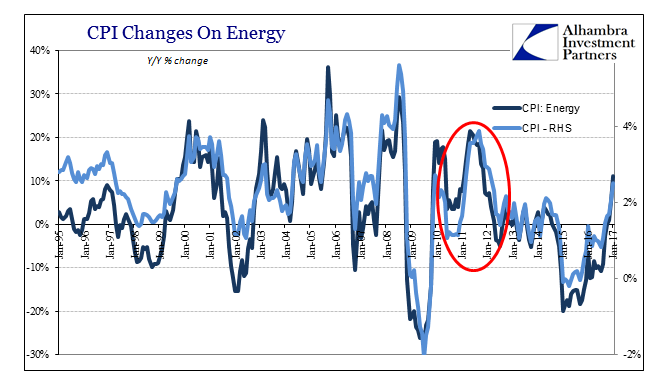

U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of...

Read More »

Read More »

Swiss analysis: Switzerland’s gender pay gap – what the detail reveals

In 2014, the average gross annual salary for a full-time male worker in Switzerland was CHF 81,000, CHF 10,000 or 12.5% higher than that of an average woman. But what does this high level difference mean? Inspired by the Swedish statistician Hans Rosling, who passed away recently, I decided to dig deeper to see what was behind this top line pay difference.

Read More »

Read More »

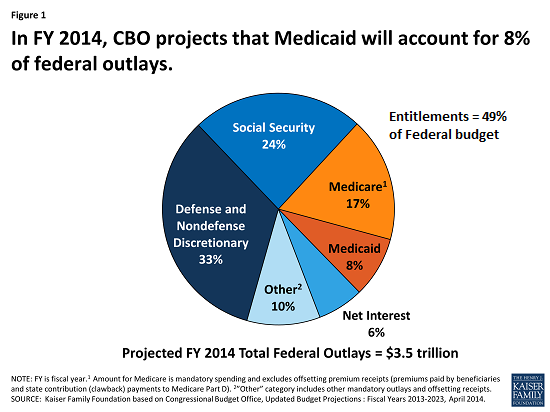

This Is How the Status Quo Unravels: As the Pie Shrinks, Everybody Demands Their Piece Should Get Bigger

The politics of the past 70 years was all about horsetrading who got what share of the growing pie: the "pie" being cheap energy, government revenues and consumption, sales and profits. Horsetrading over a growing pie is basically fun. There's always a little increase left for the losers, so there is a reason for everyone to cooperate in a broad political consensus.

Read More »

Read More »

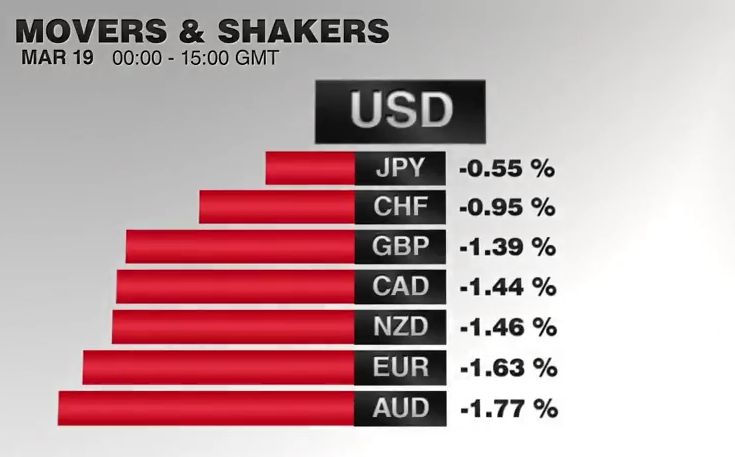

FX Daily, February 16: Corrective Forces Emerge, Tempering the Dollar’s Rally

The Dollar Index had moved higher for ten consecutive sessions before reversing yesterday's gains to close lower. Yesterday and today's losses have seen the Dollar Index retrace 38.2% of the advance since February 2. That retracement objective was near 100.80. The 50% retracement is found near 100.50 and the 61.8% retracement by 100.20.

Read More »

Read More »

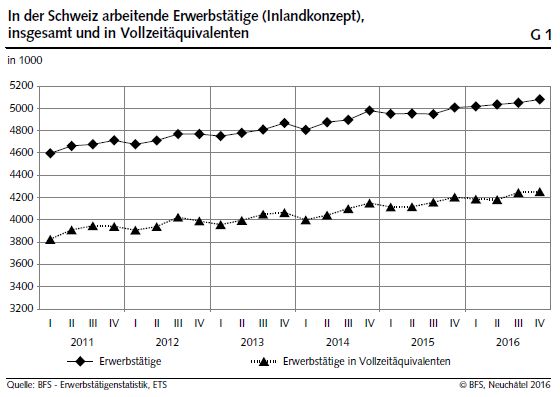

Swiss Labour Force Survey 4th quarter 2016: Number of employed persons + 1.5percent; unemployment rate (ILO) 4.3percent

The number of employed persons in Switzerland rose by 1.5% between the 4th quarter 2015 and the 4th quarter 2016. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) decreased from 4.7% to 4.3%. The EU's unemployment rate fell from 9.1% to 8.2%. These are some of the results from the Federal Statistical Office.

Read More »

Read More »

Swiss unemployment rises. French-speaking cantons worst affected.

The unemployment rate across Switzerland climbed by 0.2% to 3.7% in January, and regional differences were clear. Across French and Italian-speaking cantons the rate averaged 5%, while across the German-speaking cantons it was 3.1%.

Read More »

Read More »

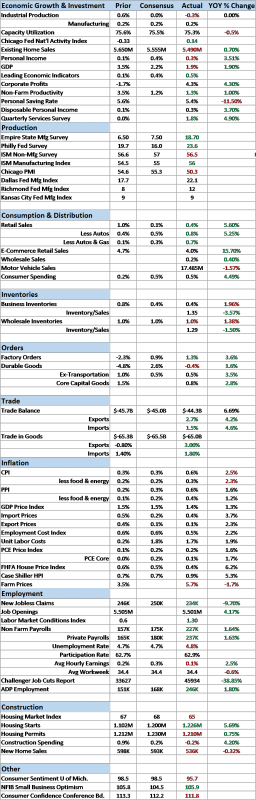

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

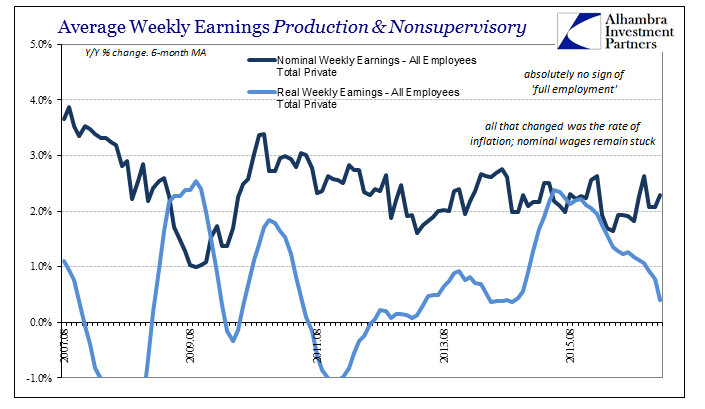

Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them.

Read More »

Read More »

FX Daily, February 15: Yellen Helps the Dollar Extend Streak

The Dollar Index's ten-day rally was at risk yesterday, but Yellen's reiteration of the commitment to continue to lift rates gradually helped extend the streak to eleven sessions.This surpassed the streak around the election (November 7-November 18). With today's gains, it may draw closer to what appears to be the long streak, 14 sessions between April 30, 2012 and May 17.

Read More »

Read More »

China Net Imported 1,300t Of Gold In 2016

For 2016 international merchandise trade statistics point out China has net imported roughly 1,300 tonnes of gold, down 17 % from 2015. The importance of measuring gold imports into the Chinese domestic gold market – which are prohibited from being exported – is to come to the best understanding on the division of above ground reserves in and outside the Chinese domestic market.

Read More »

Read More »

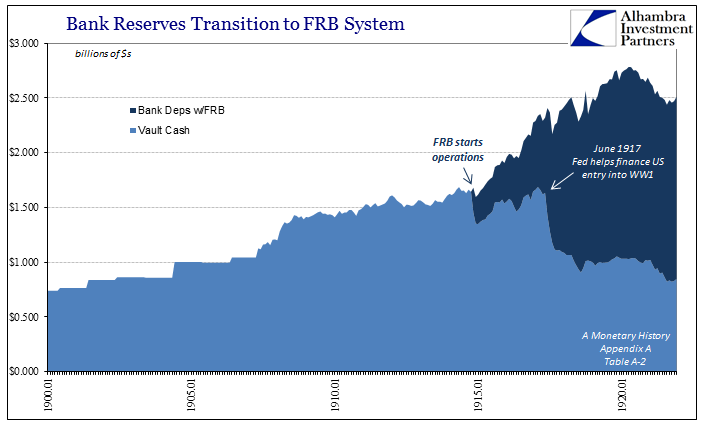

A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

Lies, Damn Lies, and Taxes

President Trump hinted at the end of last week that the Administration's tax proposals would be aired in the next two or three weeks. This seems to be a signal of its inclusion in his address to both houses of Congress on February 28. This is not quite a State of the Union speech, but similar and precisely what Obama did in February 2009.

Read More »

Read More »

Greece and the Return of the Repressed

Don't expect a deal between Greece and its official creditors until late spring or early summer. Grexit is still not a particularly likely scenario. It was the European governments not Greece which put other taxpayers' skin in the game.

Read More »

Read More »

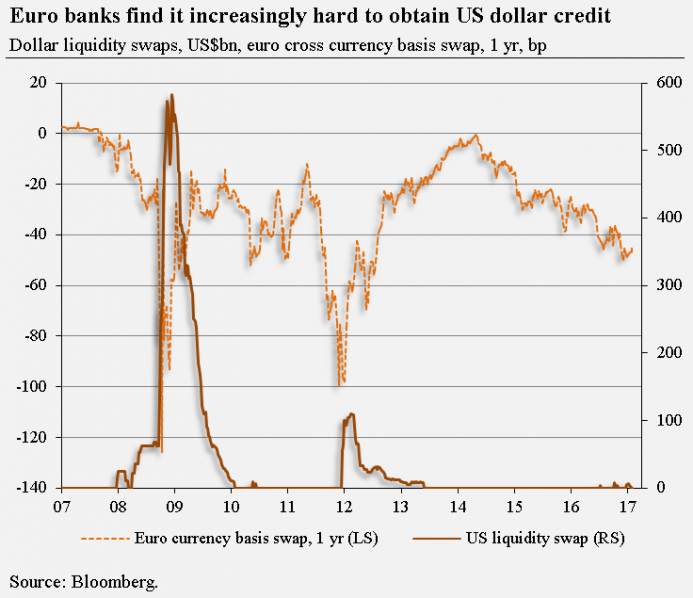

What Will Trump Do About The Central-Bank Cartel?

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

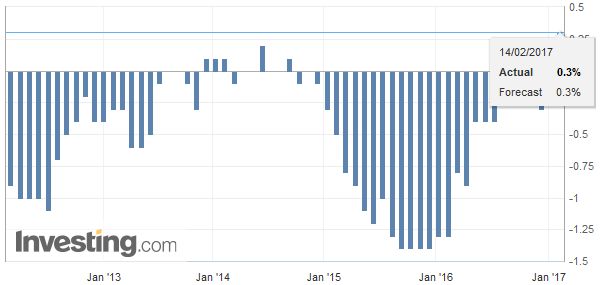

Swiss Consumer Price Index in January 2017: Up +0.3 percent against 2016, remained unchanged in January

The Swiss Consumer Price Index (CPI) remained unchanged in January 2017 compared with the previous month at 100.0 points (December 2015=100). Inflation was 0.3% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

What is Good for the Dollar is Bad for Gold

The Dollar Index is powering ahead, moving higher for the eighth consecutive session. Over the past 100 sessions, gold and the Dollar Index move in the opposite direction more than 90% of the time. The technical condition of gold is deteriorating.

Read More »

Read More »

Want to Bring Back Jobs? It’s Impossible Unless We Fix these Four Things

It's your choice, America--you can keep your cartels and the captured government that enables and protects them, or you can fix what's broken and unaffordable. If there is any goal that might attract support from across the political spectrum, it's creating more fulltime jobs in the U.S. But this laudable goal is dead-on-arrival (DOA) unless we first fix these four things. Why is job growth stagnating? Many point to automation, and yes, that is a...

Read More »

Read More »