Tag Archive: newslettersent

FX Daily, March 10: US Jobs Data: Deja Vu All Over Again?

A week ago, after nine Fed officials had spoken, the market widely expected Yellen and Fischer to confirm that the table was set for a rate hike later this month. They did, and the dollar and US interest rates fell. Now, after a strong ADP jobs report (298k), everyone recognizes upside risk to today’s national report, and the dollar has lost its upside momentum against most major currencies, but the Japanese yen.

Read More »

Read More »

Solid US Jobs Report in line with Expectations

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k).

Read More »

Read More »

Low strength cannabis sales explode across Switzerland

According to an article in Tribune de Genève, some cigarette vendors are desperately searching for supplies of the drug to meet demand. Recently kiosques in Geneva started selling low strength cannabis like they sell cigarettes. Some kiosque owners are over the moon, while others desperately search for a supplier.

Read More »

Read More »

James Rickards: Long-Term Forecast For $10,000 Gold

James Rickards: Long-Term Forecast For $10,000 Gold. James Rickards, geopolitical and monetary expert and best selling author of the ‘The New Case for Gold’ has written an interesting piece for the Daily Reckoning on why he believes gold will reach $10,000 in the long term.

Read More »

Read More »

Same Country, Different Worlds

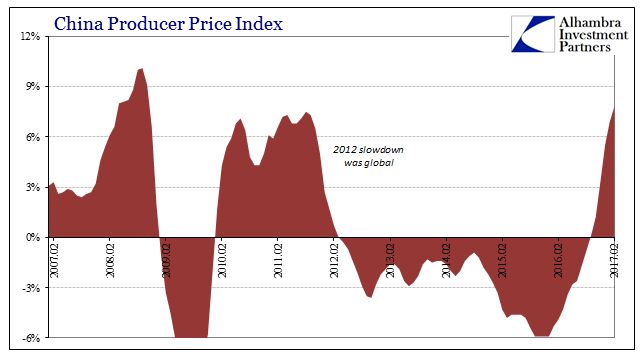

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to some far off location nowhere...

Read More »

Read More »

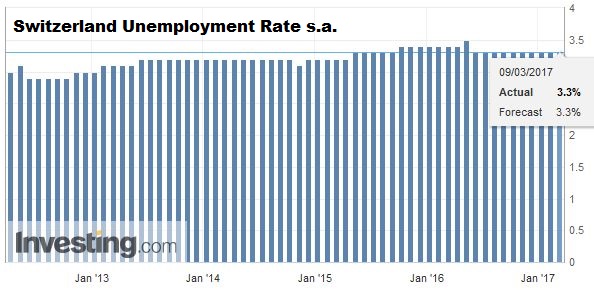

Switzerland Unemployment in February 2017: Decreased from 3.7 percent to 3.6 percent, seasonally adjusted unchanged at 3.3 percent

Registered unemployment in February 2017 - According to the State Secretariat of Economic Affairs (SECO) surveys, 159'809 unemployed persons were registered at the Regional Employment Centers (RAV) at the end of February 2017, 4'657 less than in the previous month. The unemployment rate thus fell from 3.7% in January 2017 to 3.6% in the reporting month.

Read More »

Read More »

FX Daily, March 09: Pre-ECB Squaring Lifts Euro in a Strong USD Context

The euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday's highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week.

Read More »

Read More »

Swiss score highest number of patents per capita. Again.

According to the European Patents Office (EPO), once again Switzerland topped the per capita patents ranking in 2016, with 892 applications per million inhabitants. Second and third places went to the Netherlands (405) and Sweden (360), followed by Denmark (334) and Finland (331). The first non-European country was Japan in ninth place (166), well above the EU average of 122.

Read More »

Read More »

Dutch Election: Where Rubber Meets the Road

Populism-Nationalism is not sweeping the world. The populist-nationalist party in the Netherlands will most likely not be a member of the next govt. There is little appetite for a referendum on EU. Nexit may be a clever slogan, but is highly improbable.

Read More »

Read More »

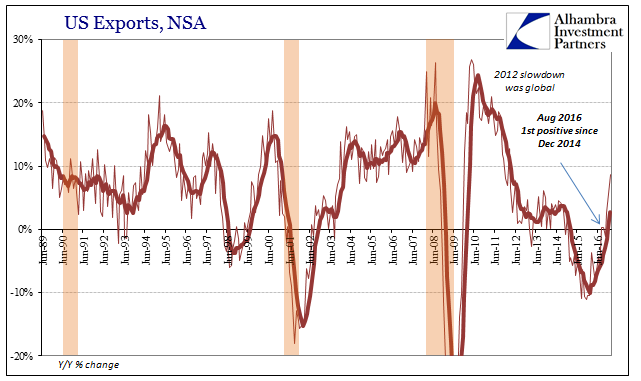

US Trade Skews

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it.

Read More »

Read More »

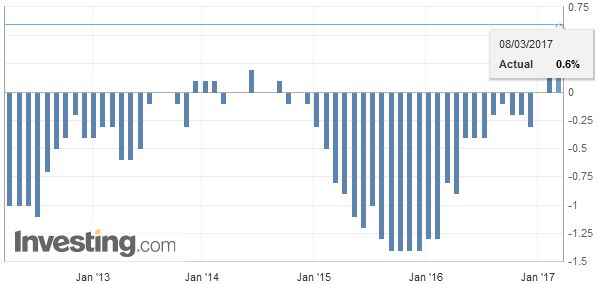

Swiss Consumer Price Index in February 2017: Up +0.6 percent against 2016, +0.5 percent against last month

The Swiss National Bank will have difficulties to weaken the Swiss Franc, because she is obliged to maintain her mandate, the avoidance of inflation. Already in January 2015, she gave up, because continuing interventions - at the excessively high euro rate of 1.20 - could have endangered her inflation mandate.

Read More »

Read More »

FX Daily, March 08: Dollar Bid as Rates Firm

The US dollar is moving higher against nearly all the other major foreign currencies today. As far as we can tell, the driving force remains interested rate considerations. US rates are rising in absolute terms and about Europe and Japan. The US 10-year yield is moving above the downtrend that has been in place since the day after the Fed hiked rates last December.

Read More »

Read More »

Switzerland ranked best country despite relatively low GDP per capita

In a new ranking by US News, Switzerland is described as a nation with cultural contributions disproportionate to its small size. Swiss citizens have won more Nobel Prizes and registered more patents per capita than any other nation.

Read More »

Read More »

A Few Thoughts about the US Labor Market

The 94 mln people POTUS claims are not working is true but terribly misleading. What happened to agriculture a century ago is happening to manufacturing. New industries are less labor intensive than smokestack industries.

Read More »

Read More »

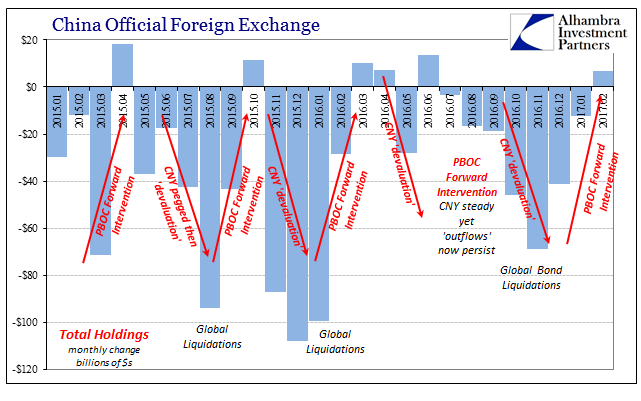

China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece.

Read More »

Read More »

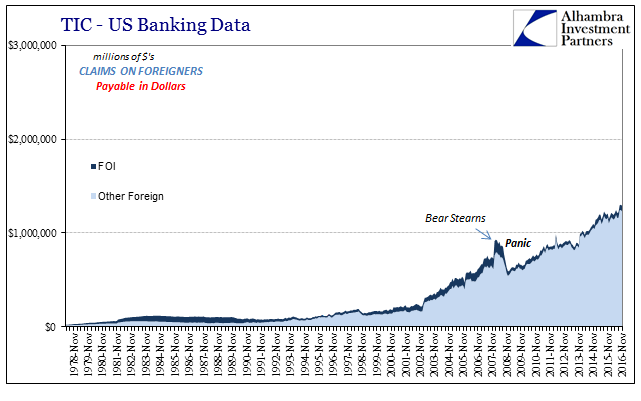

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

Switzerland ranked world’s worst currency manipulator

The Economist magazine placed Switzerland first in a recent ranking of currency manipulators. According to the analysis, China, commonly thought of as the world’s champion at keeping its currency’s value artificially low, appears to be doing the opposite: actively trying to push the value of its currency up. On the other hand, Switzerland that has been working hardest to artificially devalue its money.

Read More »

Read More »

FX Daily, March 07: Greenback Continues to Recover from the Late Pre-Weekend Slide

The US dollar has continued to recover from the slide on what still largely appears to have been a buy the rumor sell the fact response to Yellen's speech just before last weekend. Yellen was the last of around 11 Fed officials that spoke last week, and nearly all but Bullard signaled readiness to hike rates at next month's meeting.

Read More »

Read More »

Speculative Blow-Offs in Stock Markets – Part 2

As noted in Part 1, historically, blow-patterns in stock markets share many characteristics. One of them is a shifting monetary backdrop, which becomes more hostile just as prices begin to rise at an accelerated pace, the other is the psychological backdrop to the move, which entails growing pressure on the remaining skeptics and helps investors to rationalize their exposure to overvalued markets.

Read More »

Read More »