Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 10(see more posts on EUR/CHF, ) |

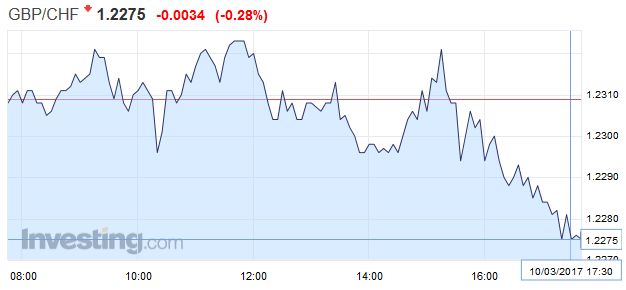

GBP/CHFSterling vs the Swiss Franc has fallen to its lowest level in two months as the Pound is continuing to be dragged down by what is happening with the uncertainty caused by when Article 50 will be triggered. Article 50 has been debated in the House of Lords and a challenge concerning the rights of Europeans living in the UK has been brought by the Lords. They want to keep the rights of European citizens living in the UK and protect the rights of those living on the continent. However, the fact that there has been another challenge to the Brexit bill has caused a delay and the uncertainty has caused problems for the Pound. Brexit secretary David David has reaffirmed that Article 50 will be triggered in March but as yet no date has been officially announced. Another reason for the strength of the Swiss Franc vs the Pound is due to its safe haven status. With Dutch elections now just 5 days away things are looking a little wobbly in the Eurozone and with the French elections due to start in late April this is another reason why the Swiss Franc has maintained its strength. The expectation in the Netherlands is that far-Right leader Geert Wilders will win but he may struggle to maintain his position as he will need to form a coalition and the other parties involved have spoken out saying they will not join him. This could see even further strength for the Swiss Franc so if you’re looking to sell Swiss Francs to buy Sterling towards the end of next week may be the opportunity. In the short term if you’re buying Swiss Francs it may be worth organizing this prior to the upcoming Dutch and French elections. |

GBP/CHF - British Pound Swiss Franc, March 10(see more posts on GBP/CHF, ) |

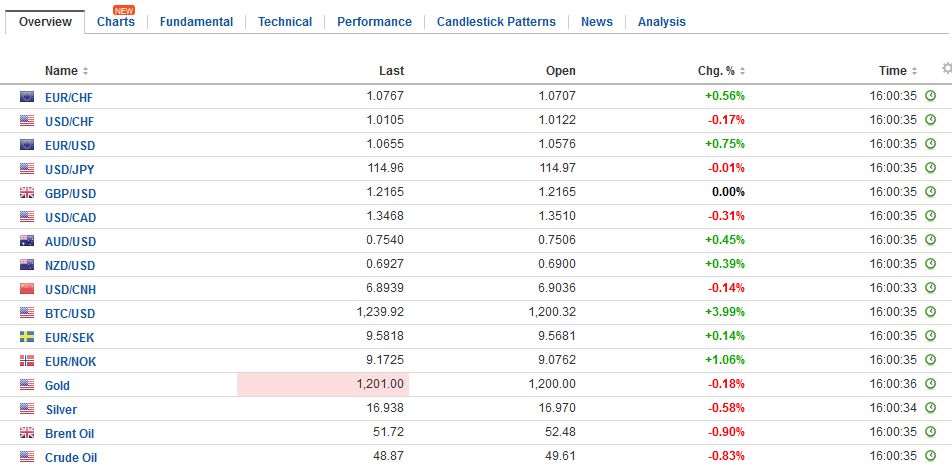

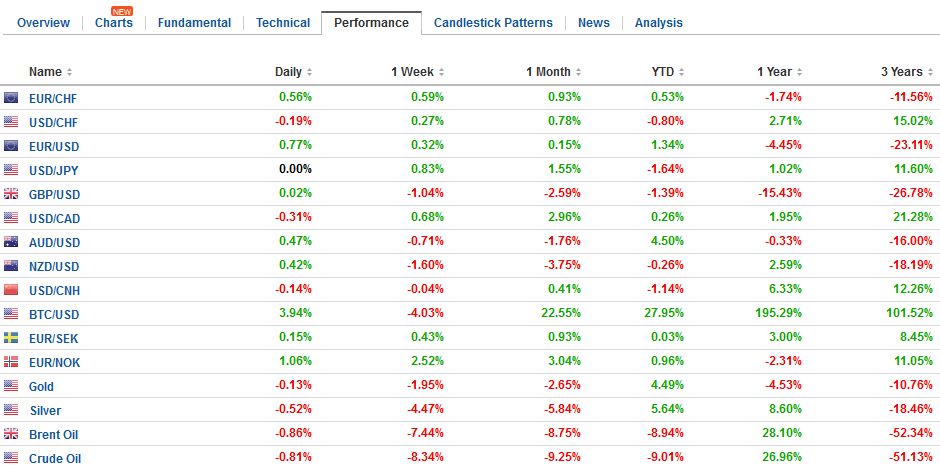

FX RatesA week ago, after nine Fed officials had spoken, the market widely expected Yellen and Fischer to confirm that the table was set for a rate hike later this month. They did, and the dollar and US interest rates fell. Now, after a strong ADP jobs report (298k), everyone recognizes upside risk to today’s national report, and the dollar has lost its upside momentum against most major currencies, but the Japanese yen. Many seem to recognize the risks of long dollar positions today. There are three sets of possibilities. First, the US jobs report is seen as strong, and the dollar sells off, as last week on buy the rumor sell the fact activity. Second, the jobs report could be strong, and the market sees the pace of Fed tightening accelerating, and the dollar rallies. Third, the jobs report could be disappointing, and the dollar sells off. In two of the three scenarios the dollar weakens. On the other hand, what is different now compared with last week is that the dollar is softer before the event. The US dollar’s momentum stalled yesterday, helped by a bout of euro short covering that helped trigger a broader short-covering advance in many of the major currencies. The spark came from the ECB’s Draghi, who made it clear that the central bank’s risk assessment was shifting toward a more balanced view as the downside risks eased. Nevertheless, the fact that the staff’s forecast that inflation next year will be lower than this year warns against over-emphasizing a subtle change in signaling. Most participants did not expect another rate cut from the ECB. Most did not expect a new long-term loan facility, especially given that the current ones are still open. Although Draghi said that asset purchases could be accelerated if needed, investors recognize that a gradual winding down is more likely than a fresh expansion. With the negative deposit rate of 40 bp, there is some thought that the ECB could reduce the negativity before completely ending is asset purchase program. But this does not appear particularly likely in the next several months, and, moreover, it may look a bit different if inflation peaks, as we expect, in Q2. |

FX Daily Rates, March 10 |

| While we recognize the dollar has scope to weaken a bit more, we suspect it will not be a repeat of next week. Those that want to pick a near-term dollar top may be reluctant to make much of stand when it may be easier after next week’s FOMC meeting. This view still can see the euro moving toward $1.0640-$1.0680, and sterling testing the $1.22 area. The Australian dollar can push toward $0.7545-$0.7560, while the US dollar can ease back to the CAD1.3430-CAD1.3450 area. Such price action would leave the technical tone intact.

At stake today is also the nine-day drop in US 10-year Treasury prices, which pushed the yield back to 2.62%, the highest since the Fed hiked in mid-December. The nine-day move saw the yield rise by 30 basis points. The yield is slightly lower now. If there were a single factor to explain why the dollar is above JPY115, making a two-month high, we would suggest it is the rise in US yields, which drives the 10-year interest rate differential. The dollar has not closed above JPY115 since January 11. There is large option expires today at JPY115 (~$1.3 bln) and JPY116 (~$1.3 bln). We note that the January 19 high was set near JPY115.60 and the 61.8% of the dollar’s decline since the early January high is a touch below JPY116. The dollar’s advance has also lifted it through a trendline drawn from the highs beginning at the JPY115.60 area. That trendline, which some see as the top of a larger wedge, comes in now near JPY114.60, which corresponds with the 38.2% retracement of the dollar’s leg up since the mid-week low near JPY113.60. Both the UK and France reported disappointing January manufacturing data. In France, manufacturing output fell 1.0%. The market expected an increase of around 0.5%. And the December series was revised to show a 1.0% decline rather than a 0.8% fall. The broader measure of industrial output fell 0.3% compared with expectations of a 0.5% gain. |

FX Performance, March 10 |

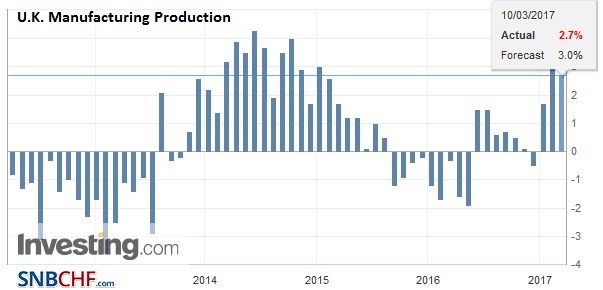

United KingdomIn the UK, manufacturing output fell 0.9%, which was a little more than the market expected. A pullback had been expected after the heady rise in December which was revised to 2.2% from 2.1%. |

U.K. Manufacturing Production YoY, February 2017(see more posts on U.K. Manufacturing Production, ) Source: Investing.com - Click to enlarge |

| Headline industrial output fell 0.4%, a tad less than the market expected. Construction spending also disappointed. It fell 0.4% in January; twice the loss the median forecast anticipated but also follows a strong December gain (1.8%). |

U.K. Industrial Production YoY, February 2017(see more posts on U.K. Industrial Production, ) Source: Investing.com - Click to enlarge |

| Lastly, helped by the 1.6% rise in exports and a smaller 0.9% rise in imports, the UK reported a GBP1.966 bln trade deficit. The median expectation in the Bloomberg survey was for a GBP3.1 bln shortfall after GBP2.026 bln deficit in December (which was initially reported as a GBP3.304 bln deficit). |

U.K. Trade Balance, February 2017(see more posts on U.K. Trade Balance, ) Source: Investing.com - Click to enlarge |

Canada also reports February jobs data. The market looks for some mean reversion after two months of more than 45k job gains. In the past two months, Canada has grown A small decline is expected by the median forecast. It has grown 86k net new full-time jobs. Given that Canada is roughly one-tenth the size of the US, that would be as if the US created 860k new jobs in December-January instead of the 385k it did.

In summary, look for next week’s events (FOMC meeting, Dutch election, and G20 meeting) to limit the dollar’s downside, barring a significant disappointment that makes participants doubt the certainty of a hike next week. Rather than a repeat of last week buy the rumor sell the fact, we suspect the opposite, with most of the dollar’s decline likely since yesterday’s ECB meeting. The two week’s of rising US yields (a tenth day of rising 10-year yields would be longest such streak since the mid-1970s) warns of a potential turning point in the market.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,gbp-chf,newslettersent,U.K. Industrial Production,U.K. Manufacturing Production,U.K. Trade Balance