Tag Archive: newslettersent

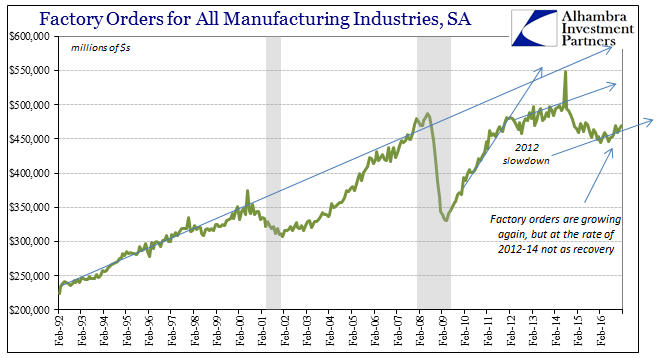

Manufacturing Back To 2014

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but.

Read More »

Read More »

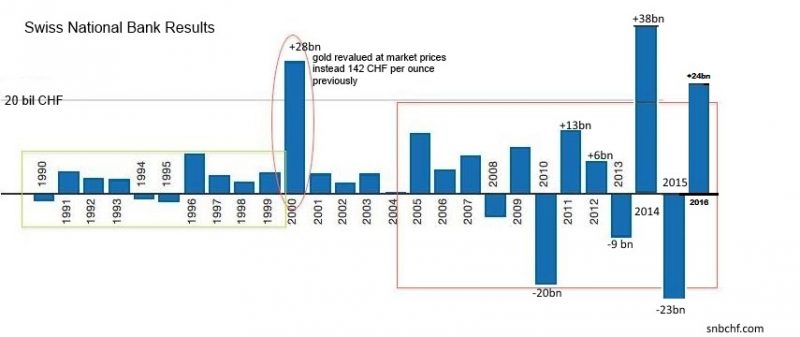

Swiss National Bank Results 2016 and Comments

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion.

Read More »

Read More »

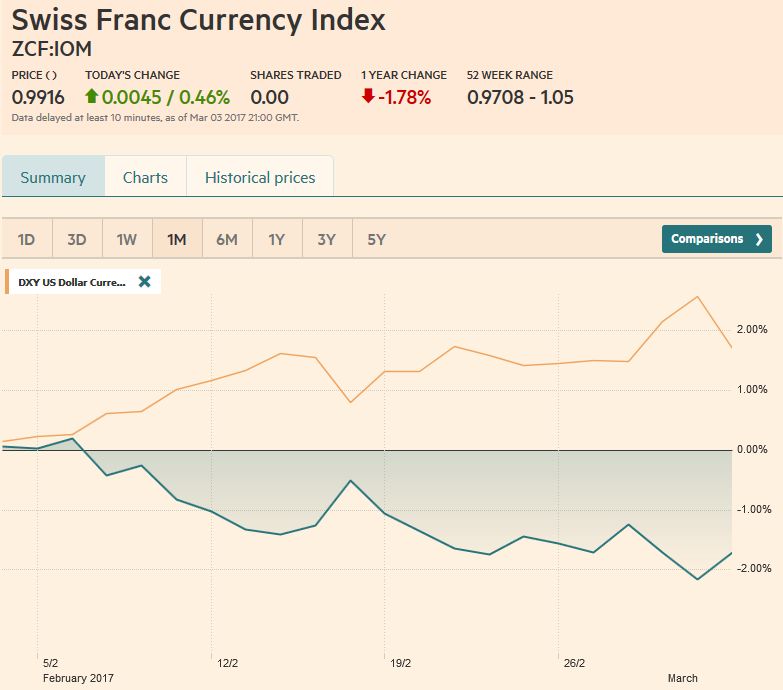

FX Daily, March 06: The Dollar Gives Back More Before Consolidating

The US dollar's pre-weekend pullback was extended in early European turnover but appeared to quickly run out of steam. The prospect of a constructive US employment report at the end of the week, especially given the steady decline in weekly initial jobless claims to new cyclical lows, underscores the likelihood that the Fed hikes rates next week. Bloomberg puts the odds above 90%, while the CME estimates a nearly 80% chance.

Read More »

Read More »

Speculative Blow-Offs in Stock Markets – Part 1

Why is the stock market seemingly so utterly oblivious to the potential dangers and in some respects quite obvious fundamental problems the global economy faces? Why in particular does this happen at a time when valuations are already extremely stretched? Questions along these lines are raised increasingly often by our correspondents lately. One could be smug about it and say “it’s all technical”, but there is more to it than that. It may not be...

Read More »

Read More »

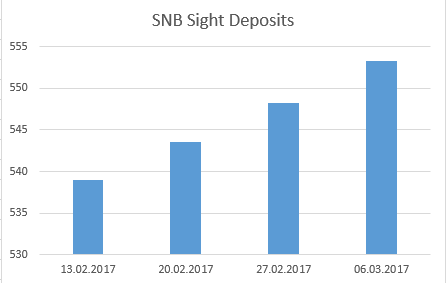

Weekly Sight Deposits and Speculative Positions: Each week an intervention record.

Once again a massive SNB intervention and a post Trump election record: 5,1 billion, at far too expensive FX rates: EUR rate of 1.0648 and USD/CHF over parity.

Read More »

Read More »

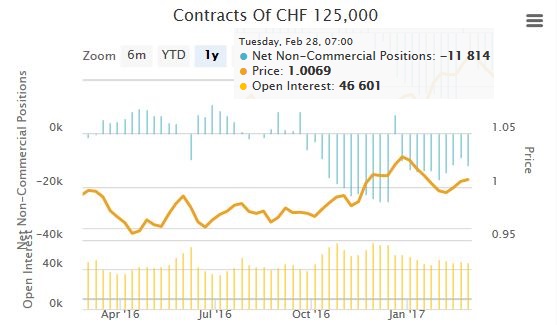

Weekly Speculative Position: More CHF Shorts, Less EUR Shorts this time

Speculators reduced their EUR net short positions, on a potential reduction of ECB quantitative easing. At the same time, they increased the CHF net shorts.

Read More »

Read More »

FX Weekly Preview: Four Sets of Questions and Tentative Answers for the Week Ahead

The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week's discussion of the drivers in terms of four sets of questions and offer some tentative answers.

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM FX was mostly softer last week, though it ended the week firmer, buoyed by outsized MXN gains Friday. The Fed is sending very strong signals for a March hike, which should keep EM FX on its back foot. However, with the March 15 FOMC embargo coming into effect, there will be no Fed speakers after Kashkari on Monday. Jobs data on Friday will be the highlight, but given the Fed’s signals, we do not think a soft report will derail a hike next...

Read More »

Read More »

Sender must now pay Swiss Post for customs checks

Currently, anyone ordering something from outside Switzerland, must pay Swiss Post an administrative charge if their package attracts import tax (duty and/or VAT). In addition, they must pay Swiss Post an additional CHF 13 if the parcel needs to be opened, usually because the package has been poorly labelled.

Read More »

Read More »

FX Weekly Review, February 27 – March 04: Dramatic Shift in Fed Expectations Spurs Dollar Gains, but Now What?

The pendulum of market sentiment swung hard and fast toward a Fed rate hike in the middle of March. The signals from Fed officials, including Governor Brainard and Powell, spurred the move. According to Bloomberg, the market had discounted a 90% chance of a hike before Yellen and Fischer spoke. A week ago, Bloomberg calculations showed a 40% chance of a move.

Read More »

Read More »

Government stops tax rises on Swiss cigarettes

Swiss cigarette prices will not rise over the coming years unless manufacturers increase the underlying price. On Tuesday, Switzerland’s Council of States (upper house), withheld permission to allow the Federal Council (cabinet) to continue hiking the tax on smokes.

Read More »

Read More »

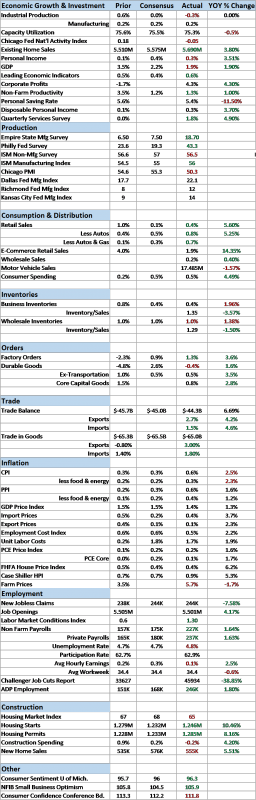

Bi-Weekly Economic Review

Economic Reports Scorecard. The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher.

Read More »

Read More »

Swiss government drops plan to restrict lobbyists’ access to parliament

One year after Switzerland’s Council of States (upper house) voted in favour of controlling lobbyists’ access to parliament, the draft proposed implementation plan has been rejected by the commission in charge of it.

Read More »

Read More »

The Resilience of Globalization and the US Dollar

Populism-nationalism is not really a wave sweeping across the world. Where it succeeded was where a center-right party in a two-party system embraced part of the populist agenda. Center-right parties in Europe are not embracing key agenda for populist-naitonalist, but appear to be tacking to the right on domestic issues.

Read More »

Read More »

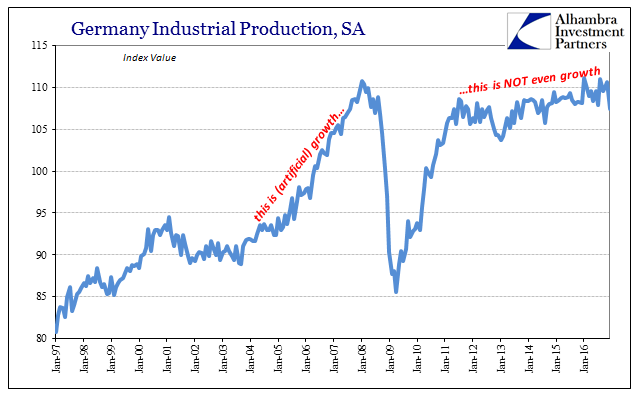

Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony.

Read More »

Read More »

Emerging Markets: What has Changed?

A Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. Bulgaria’s interim government said it may apply to join the eurozone within a month. South Africa’s main labor union Cosatu accepted a government-proposed minimum wage.

Read More »

Read More »

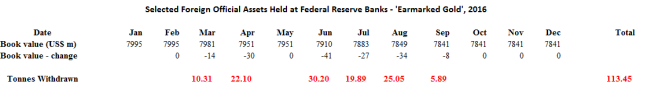

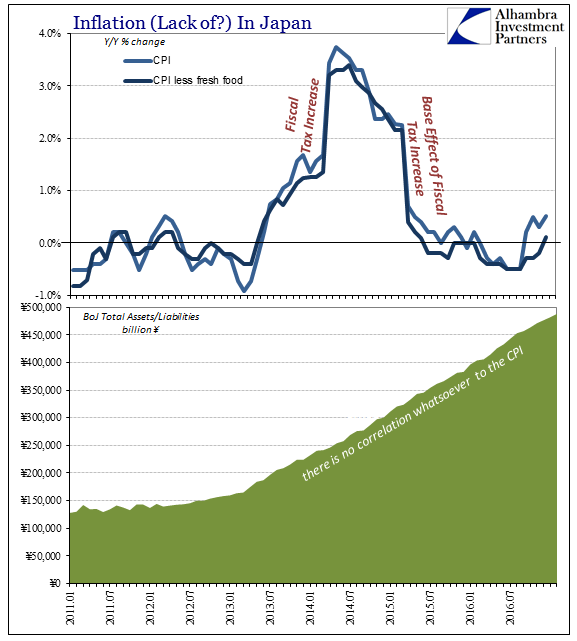

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »