Tag Archive: newsletter

Issuance calendar for Confederation bonds and money market debt register claims in 2023

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows: The FFA plans to issue bonds with a face value of CHF 8 billion in 2023. Taking account of bonds maturing in 2023, the volume of bonds outstanding will increase by CHF 3.4 billion.

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #8

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

A trade plan for natural gas futures

The example shows a real setup and possible trade plan, but more than that, it shows swing traders in general how to look and plan their entries (with a technical reasoning and trigger), and their stop loss as well as take profit targets, as they assess their 'risk reward ratio' (also mentioned as reward vs risk ratio, which is the more precise description of the ratio itself). And how a higher or lower ratio relates to the probability of them...

Read More »

Read More »

Solution found in construction labour dispute

Construction workers and trade unions in Switzerland have reached an agreement in a long-running labour dispute. Builders will receive CHF150 ($158) more a month in effective wages from next year and minimum wages will increase by CHF100 a month.

Read More »

Read More »

SNB-Vize Schlegel signalisiert neuen Zinsschritt im Dezember

SNB-Vize Martin Schlegel hat angedeutet, dass die Schweizerische Nationalbank die Leitzinsen im Dezember erneut anheben wird. Er betonte die Notwendigkeit, das starke Wachstum der Konsumentenpreise zu bekämpfen.

Read More »

Read More »

The 1st Factor Impacting the World Order: Supply/Demand Imbalance

The first factor impacting the world order is an imbalance between supply and demand. #inflation #economics #principles #raydalio

Read More »

Read More »

Precious Metals “Off to the Races” in 2023? – MWU – 11.29.22

As we head into the holiday season, Santa promises to bring more rate hikes and slowing economic data, plus a stocking full of crypto fraud. Does this mean a happy New Year for the precious metals? Host Craig Hemke sits down with Dave Kranzler of The Mining Stock Journal and The Short Seller’s Journal to break down all the gold and silver news you need as we head towards year end.

You can check out all our bullion products here:...

Read More »

Read More »

KENNT IHR MEINE WORKSHOPS?

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Alasdair Macleod, Rafi Farber: Will the Fed break the markets?

#AlasdairMacleod, #RafiFarber: Will the Fed break the markets?

The #FederalReserve has been hiking interest rates at an unprecedented clip throughout the year in an effort to bring inflation back under control. Yet is hasn't been a smooth path, with pressure building in the foreign markets, while the stock, bond, and real estate markets at home have been sinking as well.

This has led many to wonder if the Fed will be able to keep hiking rates...

Read More »

Read More »

Silver Warning : This Is About To Happen To Gold & Silver – Alasdair Macleod | Silver Forecast

Silver Warning ?: This Is Abo To Happen To Gold & Silver - Alasdair Macleod | Silver Forecast

#AlasdairMacLeod #Silver #goldprice

Credits: Alasdair MacLeod

Twitter: https://twitter.com/MacleodFinance

Full Interview: _jplU5_sM&t=0s

--------

FAIR-USE COPYRIGHT DISCLAIMER

Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, commenting, news...

Read More »

Read More »

Mir geht der Stift: DAS erwartet uns 24. Dezember 2022!! (Ich glaube es nicht…)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

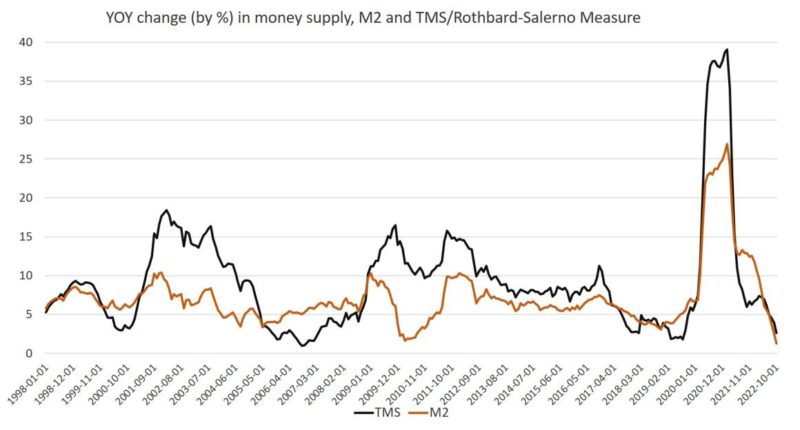

Money-Supply Growth in October Fell to a 39-Month Low. A Recession Is Now Almost Guaranteed.

Money supply growth fell again in October, dropping to a 39-month low. October's drop continues a steep downward trend from the unprecedented highs experienced during the thirteen months between April 2020 and April 2021. During that period, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to 2013.

Read More »

Read More »

Erfolgreich Leben: Karriere Tipps & Planung für alle Altersgruppen | Vortrag TU Darmstadt

3.? *https://amzn.to/3V6SbsO - jetzt vorbestellen!

2.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

1.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch *https://amzn.to/3nAM7IU

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ - WKN: 663307

„ME Fonds - PERGAMON“ - WKN: 593117

https://www.elsaessermarkus.de/

_...

Read More »

Read More »

Was passiert wenn die Credit Suisse Pleite geht? #shorts

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Ganzes Video: _LKWH-ck

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei...

Read More »

Read More »

Die ersten 1.000 € in 2023 investieren! So würde ich 1.000 Euro investieren

Wie 1.000 Euro investieren um langfristig finanziell frei zu werden?

Gratisaktie bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts &...

Read More »

Read More »

Apple Aktien jetzt verkaufen?!

In der Vergangenheit war es finanziell die klügere Entscheidung, Apple-Aktien statt einem iPhone zu kaufen. Warum sich das nun aus meiner Sicht ändert, erkläre ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/AppleVerkaufenBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 iPhone 14 Pro Unboxing

2:58 AAPL Chart

4:32 Probleme des Konzerns

7:40 Die 80:50 Regel

14:20 Solltest du...

Read More »

Read More »

FOREX QUICK: AUDUSD and NZDUSD retrace back below MA support

Sellers in the AUDUSD and NZDUSD have taken the pair back below MA support in the short term. Can the sellers maintain control after the failed break above resistance targets?

Read More »

Read More »

Vortrag in Regen am 17.12.2022

Https://www.regentreff.de/vortrag-dezember-2022/

Vortrag von Claudio Grass am Samstag, 17. Dezember 2022 in Regen

Der «Great Reset»

und was es wirklich bedeutet

Claudio Grass stellt die «geistigen Täter» der heutigen Gesellschafts- und Systemkrise vor und erklärt, was hinter dem Schlachtruf «der lange Marsch durch die Institutionen» steckt. Er beleuchtet die Geschichte des Geldes und des heutigen Bankensystems. Was bedeutet Inflation...

Read More »

Read More »

Max Otte: Diesen Aktien gehört die Zukunft

Eine Aktie, fünf Tage, pure Performance: https://bit.ly/3EFn8wY Die "Aktie der Woche", jeden Sonntag aktuell in Ihr E-Mail-Postfach geliefert. Jetzt ausprobieren!

Es gibt zahlreiche Unternehmen, Produkte und Plattformen, die aus dem Alltag nicht mehr wegzudenken seien, meint Fondsmanager Max Otte vom Institut für Vermögensentwicklung.

Welche Firmen das sind und warum gerade diese Aktien zu seinen Basis-Investments gehören, erklärt Otte...

Read More »

Read More »