Tag Archive: newsletter

Schwarze Schwäne – Krieg, Inflation und ein energiepolitischer Scherbenhaufen

Prof. em. Hans-Werner Sinn, Präsident a.D. des ifo Instituts

12. Dezember 2022

https://www.ifo.de/veranstaltung/2022-12-12/schwarze-schwaene-krieg-inflation-und-ein-energiepolitischer

Schwarze Schwäne sind Ereignisse, die man vor kurzem für undenkbar hielt. Unter diese Definition fällt die aktuelle galoppierende Inflation, aber auch die veritable Energiekrise, die eine grundlegende Revision des Modells der grünen Transformation der Wirtschaft...

Read More »

Read More »

Top 5 Gold Buyers’ Motives Revealed

In the worst kept secret ever, #China last week revealed itself to be the #MysteryGoldBuyer that has had twitter all of a Twitter for weeks.

Yep, for the first time in three years China released its “official” gold holdings and confirmed that they have upped their reserves to 1,980 tonnes. But how much did they really buy and why are they (along with other central banks) stocking up at a record-making pace? Watch Dave Russell of GoldCore bring...

Read More »

Read More »

Knallt es JETZT an den Märkten?

Es ist die spannendste Woche zum Jahresende. Mehrere wichtige Termine stehen auf dem Wirtschaftskalender und die Volatilität steigt. Was das für dich bedeutet und worauf du achten solltest, um keine verherenden Verluste zu erleiden, erkläre ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/KnalltJetztMarktBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 FED und Inflation...

Read More »

Read More »

Photovoltaik 2023: Keine Steuern mehr! Rendite durchgerechnet

Eine Photovoltaik-Anlage wird 2023 noch viel interessanter. Ab 2023 zahlt Ihr nämlich keine Steuern mehr auf PV-Anlagen. Günstiger Strom und keine Steuern: Da muss sich Photovoltaik doch erst recht lohnen - oder? Saidi hat es durchgerechnet

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Angebote vergleichen - von...

Read More »

Read More »

The CPI came in weaker but there are some retracements in the USD and stocks

Dollar lower but off the lowest levels. Stocks show some upside reluctance too.

The USD moved lower and the stocks moved higher after the weaker CPI data, but there is some backtracking going on that needs monitoring from a technical perspective. In this report Greg Michalowski of Forexlive.com takes a technical look at the EURUSD, USDJPY, GBPUSD, AUDUSD and the S&P and Nasdaq indices.

Read More »

Read More »

Unfassbar! So gehen sie mit DEINEM Geld um! 53% zahlen jetzt NORMALVERDIENER!

Der Lohnzettel bietet keine Gesamtübersicht über alle Steuern, die du als Bürger jedes Jahr zahlst. Die tatsächlich gezahlten Steuern werden durch die Einkommensbelastungsquote ermittelt.

Gratisaktie bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot * Steuern mit Kopf auf Youtube https://www.youtube.com/c/SteuernmitKopf?app=desktop

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

??5...

Read More »

Read More »

Hans-Werner Sinn: deutsche Energiewende ist gescheitert! Die wahren Gründe (Stimmt das?)

Hans-Werner-Sinn: Energiewende zerstört die deutsche Wirtschaft (Was steckt dahinter?)

✘ Abonniere hier den Kanal:►► https://bit.ly/3j64j9V ?

Video auf dem Kanal von Grenzen des Wissens

►► &t=2137s

Hans-Werner-Sinn ist der Meinung das wir derzeit eine Energiewende ins nichts erleben. Die aktuelle Meinung von Hans Werner Sinn ist dass die deutsche Wirtschaft Herzkrank ist. Die Industrie in Deutschland leidet extrem unter den grünen EU...

Read More »

Read More »

CPI: Hot or Not? | 3:00 on Markets & Money

(12/13/22) The much-anticipated CPI report for November clocked-in at 7.1%, a cooler-than-expected .1% vs. at .3% expected rate, and year-over -year CPI is 6.0%, also less than expected. [NOTE: This report was recorded prior to this morning's CPI release.] Monday's markets rallied just slightly above the 200-DMA, holding firm above the important 100-DM, trading sideways for the past month. The softer-than-expected CPI could provide lift in the...

Read More »

Read More »

The Sad Saga of FTX & Sam Bankman-Fried

(12/13/22) It's "CPI Tuesay" [an this show was aire BEFORE toay's CPI release]. Expectations are for weaker numbers, which woul spike markets at the open, which the Fe woul hate. The Fe meeting commence toay--an they alreay know what the CPI number is. What happens when the reality of this year's rate hikes hit next year? Christmas shopping for Mrs. Roberts is always a challenge. PPI was hot; will CPI follow suit? What happens if......

Read More »

Read More »

Breite Risikostreuung oder Konzentration bei Aktien? Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

US CPI ahead of FOMC Outcome Tomorrow

Overview: The dollar

softer against the G10 currencies ahead of today’s CPI report and the FOMC meeting

the concludes tomorrow. Emerging market currencies are most mixed. The

Hungarian forint leads the complex with around a 1% gain on news of a

preliminary deal struck with the EU. The South African rand is the worst

performer, off around 0.8%, as impeachment proceedings against Ramaphosa

proceed. Global equities are mostly higher today after the...

Read More »

Read More »

BX Swiss: Test Trades in Swiss Francs via a Decentralized Public-Blockchain.

Together with major Swiss banks, the Swiss stock exchange BX Swiss is taking the financial market infrastructure for tokenized securities to the next level. In a test, trades on BX Swiss were settled for the first time directly in Swiss francs via a decentralized public-blockchain.

Read More »

Read More »

BX Swiss: Test Trades in Swiss Francs via a Decentralized Public-Blockchain.

Together with major Swiss banks, the Swiss stock exchange BX Swiss is taking the financial market infrastructure for tokenized securities to the next level. In a test, trades on BX Swiss were settled for the first time directly in Swiss francs via a decentralized public-blockchain.

The test was conducted as part of a proof of concept under the auspices of the Capital Markets Technology Association (CMTA). In the process, structured products were...

Read More »

Read More »

CPI, FED, EZB, großer Verfall ?️?️?️

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Kostenfrei beim exklusiven Community-Treffen dabei sein:

https://attendee.gotowebinar.com/register/7345339532793300236?source=YT (zeitlich begrenzt!)

Nach einem starken November, der den S&P 500 kurz über seine EMA200 ausbrechen sah, hat sich der Dezember ganz anders verhalten. Der S&P 500 hat seit dem Monatswechsel 3,6% verloren. Die Woche wird es entscheidend sein, was die EZB, die FED die BOE...

Read More »

Read More »

New Swiss rail timetable expands offer to tourist regions

Swiss Federal Railways has launched a new timetable, which offers more regional services and direct links between eastern and western Switzerland, and additional connections to popular tourist regions.

Read More »

Read More »

Mache nicht DAS wenn du reich werden willst! (Der Trottel-Effekt ?) #shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Geld von der KFZ Versicherung zurück bekommen #shorts

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

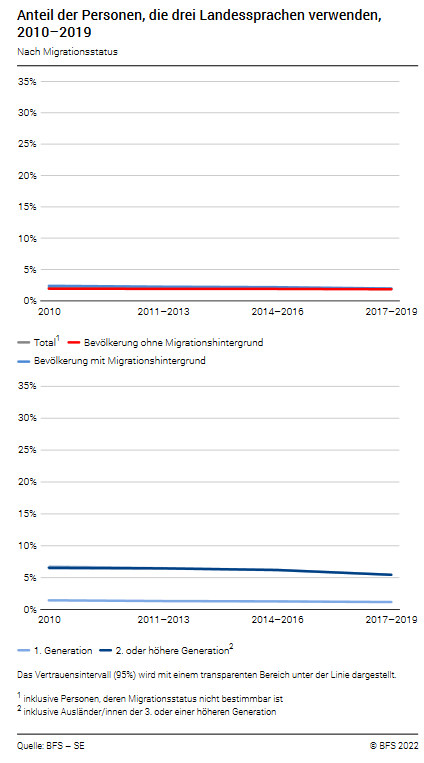

Since 2012, the population with a migration background has increased by 4 percentage points in Switzerland

The share of the permanent resident population aged 15 or more with a migration background increased from 35% to 39% between 2012 and 2021, according to data from the Swiss Labour Force Survey (SLFS). With a few exceptions, the population with a migration background fares less well in many areas of life than the population without a migration background.

Read More »

Read More »

The “Barbarous Relic” Helped Enable a World More Civilized than Today’s

One of history’s greatest ironies is that gold detractors refer to the metal as the barbarous relic. In fact, the abandonment of gold has put civilization as we know it at risk of extinction. The gold coin standard that had served Western economies so brilliantly throughout most of the nineteenth century hit a brick wall in 1914 and was never able to recover, or so the story goes.

Read More »

Read More »