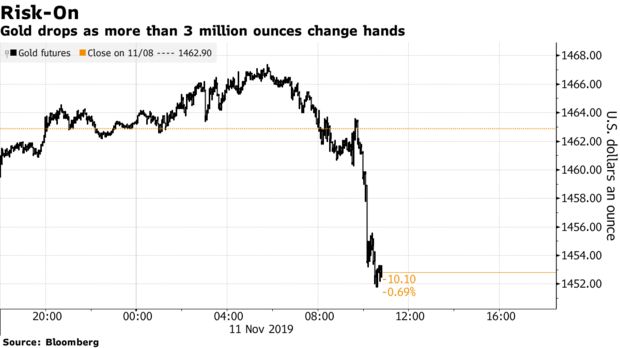

| ◆ Gold price falls to a three-month low as concentrated selling of COMEX gold futures contracts equal to over 3 million ounces are sold in 30 minutes

◆ 33,596 contracts were aggressively sold in the 30 minutes between 10:00 and 10:30 a.m. New York time which is more than triple the 100-day average for that time of day ◆ This pushed the most active gold contract to as low as $1,448.90 an ounce, the lowest since August 5 as reported by Bloomberg (see chart below) ◆ It is all very predictable and has been going on for many years now. It is another exaggerated and manipulated “correction” either for profit purposes or official intervention to depress gold prices ◆ Gold closes just 0.4% lower on the day which was encouraging and support is at $1,450/oz level and then at the $1,400/oz level ◆ The price weakness provides another gift to gold and silver bullion coin and bar buyers focused on long term wealth preservation and growth |

Gold drops as more than 3 million ounces change hands |

Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newsletter