Tag Archive: Daily Market Update

Marriage of Gold and Cryptocurrencies: A New Future?

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency.

Read More »

Read More »

Is ESG Investment the Future of Gold & Silver?

‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked.

Read More »

Read More »

Is The Bull Market Over For Gold?

Gold has not made new highs in many months. Gold peaked last year at US$2067 on August 6. The 7 month down leg of more than 18% as been deep enough and long enough that some commentators are now saying that the bull market has now turned to a bear market for gold. Losing faith is understandable because falling prices feel bad. But this week we want to show that current prices may not reflect reality.

Read More »

Read More »

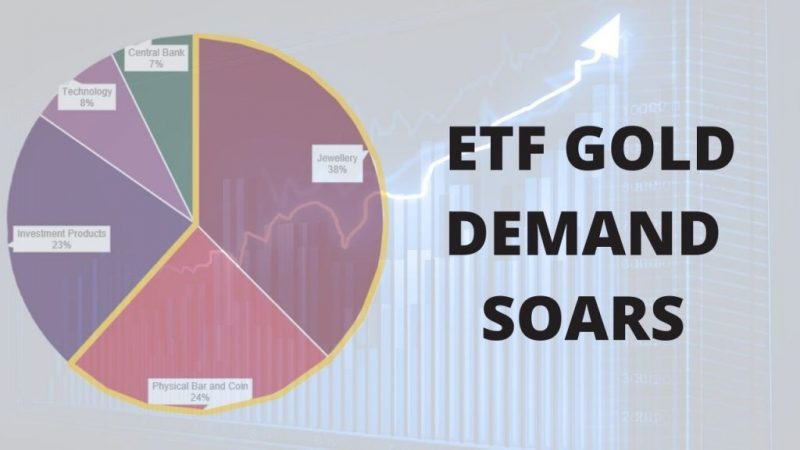

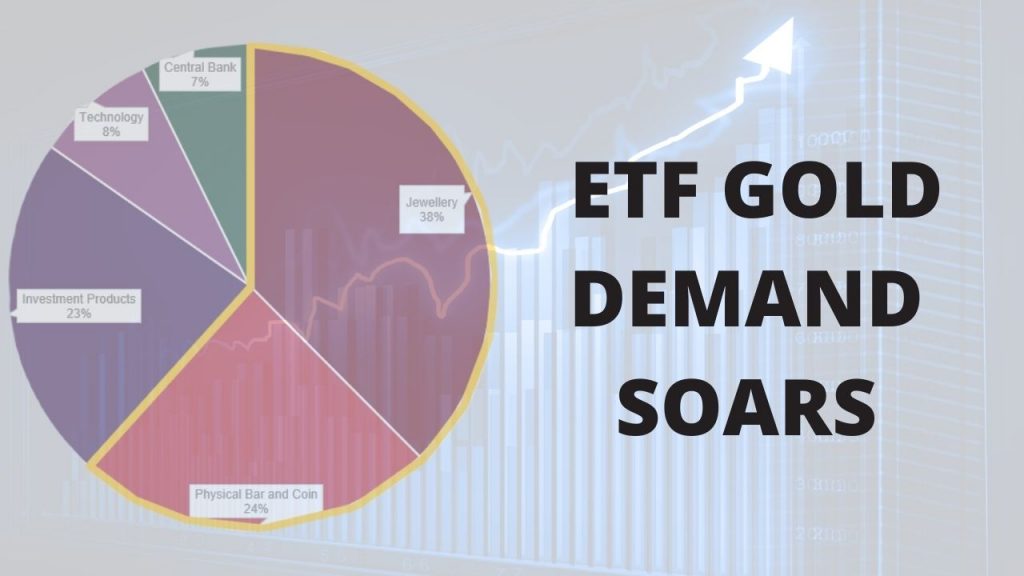

ETF Gold Demand Soars while Consumer Demand Slows

ETF gold demand from investors has soared over the past year. The unprecedented fiscal and monetary stimulus were rolled out to tackle the effects of Covid -19. However, consumer demand, particularly but not surprisingly, jewellery demand slumped.

Read More »

Read More »

Central Banks Will Still Do “Whatever It Takes”!

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels.

Read More »

Read More »

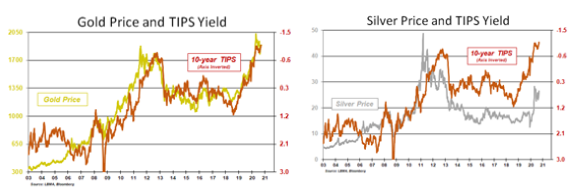

How High is Too High for Rising Government Bond Yields?

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1.

Read More »

Read More »

Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the...

Read More »

Read More »

$1.9 Trillion American Rescue Plan Positive for Gold

The Massive $1.9 Trillion American Rescue Plan is Just the Start. Massive $1.9 Tr. American rescue plan to affect markets Yellen takes over at US Treasury, what to expectMore spending initiatives to comeHow all this is positive for gold and silver prices. The Biden Administration’s policies are positive for gold and silver prices.

Read More »

Read More »

Gold to $2,300 and Silver to $35 by Year End – 2021, the Year the Barometer Explodes?

The US dollar set for further dramatic declines?Negative interest rate policy spreadingIncreased global liquidity in attempt to ignite a recoveryDemocrats’ win paves way for massive stimulus packagesGold and silver set to rally strongly in a perfect storm.

Read More »

Read More »

The Great Reset vs. The Great Reset

In baseball, there is a situation where a base runner is sprinting to home plate and can’t see what is happening behind him. Totally focused on scoring, he doesn’t know if the outfielder is throwing a ball that will reach home plate first. That’s where we get the phrase “out of left field.” (If the ball were coming from right field, the runner could actually see it.)

Read More »

Read More »

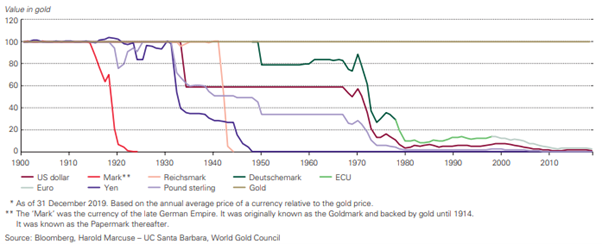

There is No Denying that Cash is Trash!

Governments are likely to continue printing money to pay their debts with devalued money. That’s the easiest and least controversial way to reduce the debt burdens and without raising taxes.

Read More »

Read More »

Biden Transition and Vaccine Hopes Weigh on Gold for Now

Today we are taking our monthly look at the charts for gold and silver. We have now received news of 3 Covid19 vaccines that are seeking approval following successful trials and markets have sat up and listened.

Read More »

Read More »

What is “The Great Reset” and How to Prepare

“The Great Reset” is a term that we are hearing more frequently in the financial news today, but what exactly is “The Great Reset”?

In Episode 16 of The Goldnomics Podcast, Stephen Flood, Mark O’Byrne and Dave Russell discuss “The Great Reset” and how it could impact investors, what they can do now to prepare themselves and their finances and the role that gold plays in protecting your wealth.

Listen or watch the podcast here...

Read More »

Read More »

Prepare For ‘No-Deal Brexit’ – Own Physical Gold To Protect Your Wealth

The Brexit deadline of December 31st, the date beyond which the transition or implementation period cannot be extended, now looms large and the dreaded “No-Deal” Brexit outcome looks increasingly possible by the day.

Read More »

Read More »

Why High Net Worth Investors are Opting for Physical Gold Vs ETFs, Digital Gold & Crypto-Currencies

As we continue to await the official result of the US Election, in the short-term financial markets remain volatile.

Read More »

Read More »

Is the US Election the “Cork in the Bottle” for Gold and Silver?

Today we are taking our weekly look at the charts for gold and silver.

Republicans and Democrats continue to play the “will they, won’t they?” game over another stimulus package in a Covid19 ravaged US economy. An agreement on a package will ultimately be seen as positive for the markets but, with the US Election just weeks away this may prove to prolong negotiations or postpone decisions until the results of the election are clear and...

Read More »

Read More »

Gold and Silver Set for a Breakout?

Today we are taking our weekly look at the charts for gold and silver. Corvid 19, the US Election and US Financial Stimulus talks have given gold plenty to digest over the last week. On a short term basis gold has been taking a lot of signal from the fortunes of the stock markets and increased hopes of agreement of a financial stimulus package gave a boost to both stock markets and the gold price.

Read More »

Read More »

Precious Metals Nowhere Near Cycle Highs – Brace for Gains!

In today’s video GoldCore’s Mark O’Byrne is interviewed by the Wealth Research Group, discussing the start of a new bull run for gold and silver and what we can expect.

Read More »

Read More »

Demand for Gold is Expected to Grow Exponentially in 2021

2021-05-06

by Stephen Flood

2021-05-06

Read More »