Home › 6a) Gold & Monetary Metals › 6a.) GoldCore › Marriage of Gold and Cryptocurrencies: A New Future?

Permanent link to this article: https://snbchf.com/2021/04/flood-marriage-gold-cryptocurrencies-new-future/

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: decreased by 5.6 billion francs compared to the previous week

8 days ago -

USD/CHF stays above 0.9100 nearing the highs since October

22 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

23 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

22 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

28 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 5.6 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Trade Republic: Geschäftsmodell in Gefahr!

Trade Republic: Geschäftsmodell in Gefahr! -

EURUSD trades to new lows for the day/week and approaches a key target support level

EURUSD trades to new lows for the day/week and approaches a key target support level -

1 Bier für 20€ – Warum Du die Inflation unterschätzt

1 Bier für 20€ – Warum Du die Inflation unterschätzt -

“Deutsche müssen weniger konsumieren, reisen, Fleisch essen und Auto fahren!”

“Deutsche müssen weniger konsumieren, reisen, Fleisch essen und Auto fahren!” -

“Komm in meine WhatsApp-Gruppe” – Xenias schlechtester Tipp

“Komm in meine WhatsApp-Gruppe” – Xenias schlechtester Tipp -

AUDUSD bounces ahead of the 100-day MA today. What next technically for the pair?

AUDUSD bounces ahead of the 100-day MA today. What next technically for the pair? -

Fremdgeld-Challenge – Der FAKE Traum vom schnellen Geld

Fremdgeld-Challenge – Der FAKE Traum vom schnellen Geld -

Hast Du Deine Finanzen im Griff? #shorts

Hast Du Deine Finanzen im Griff? #shorts -

USDCHF:Buyers had their shot with a move above the 200 bar MA on the 4-hour chart. They missed.

USDCHF:Buyers had their shot with a move above the 200 bar MA on the 4-hour chart. They missed. -

Lance Roberts Discusses Why Unexpected Recessions Happen

Lance Roberts Discusses Why Unexpected Recessions Happen

More from this category

Market Pushes the Yen Lower, Helped by a Broadly Firmer Greenback

Market Pushes the Yen Lower, Helped by a Broadly Firmer Greenback7 May 2024

- It’s the PPI Once More!

6 May 2024

- Get Ready for Weaker Growth and Higher Inflation. The Consensus Was Wrong.

6 May 2024

- The Fallacy of “Racism Equals Power Plus Prejudice”

6 May 2024

Yen Slips, Yuan Jumps, Dollar is Mostly Softer

Yen Slips, Yuan Jumps, Dollar is Mostly Softer6 May 2024

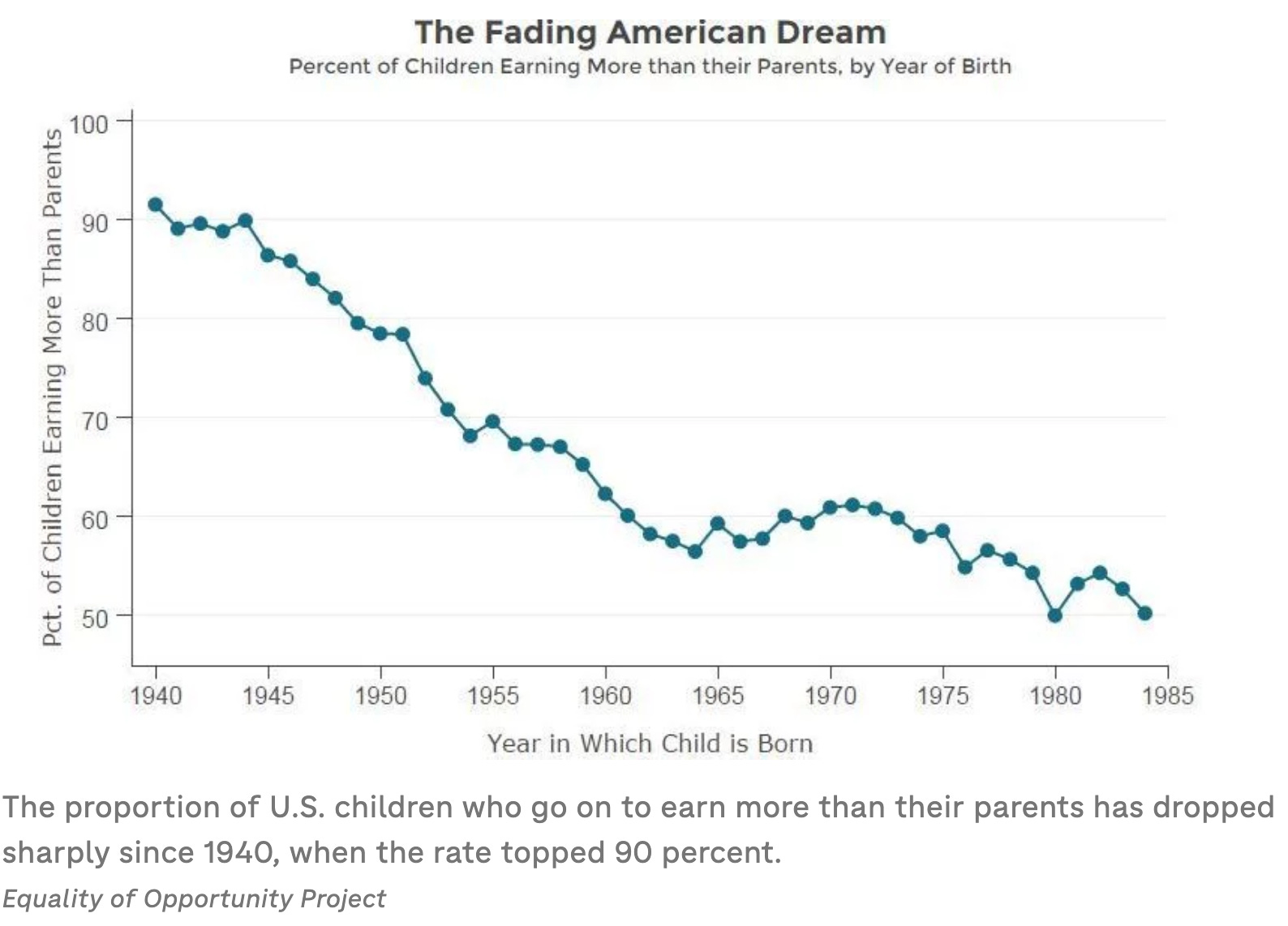

Killing the Golden Goose: Millennials Earn Less Than Their Parents Did

Killing the Golden Goose: Millennials Earn Less Than Their Parents Did6 May 2024

- There Is No Prosperity without Private Property

6 May 2024

- Conservatives Are Wrong on Economics. Here’s How to Fix the Problem.

5 May 2024

- Javier Milei vs. the Status Quo

5 May 2024

- Privatize Driver’s Licenses

5 May 2024

- Does Libertarianism Reject Communities? Libertarianism Actually Strengthens Them

5 May 2024

- Low Time Preference Leads to Civilization

5 May 2024

- Why the West Is Giving Up on Individual Rights

5 May 2024

- Cowardice, Not Courage, Led House Republicans to Side with the Democrats

5 May 2024

- The FBI and CIA Are Enemies of the American People

5 May 2024

- The Homo Economicus Myth

4 May 2024

- How State-Sponsored Universities Distort Campus Activism

4 May 2024

May 2024 Monthly

May 2024 Monthly4 May 2024

- Consumer Confidence

4 May 2024

- Public Schools and the State’s Omnipotent Bayonet

4 May 2024

Marriage of Gold and Cryptocurrencies: A New Future?

Published on April 16, 2021

Stephen Flood

My articles My videosMy books

Follow on:

The debate between relatively new digital cryptocurrencies versus ‘tried and true’ gold has dominated most precious metals related websites. But what if gold and cryptocurrencies were combined? According to a Bloomberg article a NYC Real Estate Mogul, after learning about cryptocurrencies from his son, is putting this concept to work by securing a minimum of $6 billion in gold reserves to back his new cryptocurrency.

The concept of pegging a digital currency to an external reference is not a new one. Called stablecoins the idea is to back the currency with something permanent. Using gold reverts currency back to the origins of how our traditional banking system started and helps ‘stabilize’ price instability.

In the future, will digital currencies (when combined to physical gold or physical silver) offer a new opportunity for re-inventing the old banking system? Today banks and governments rely upon one another.

They both serve the economy but are interlinked in such a way that one can save the other in times of turmoil – governments step in to save banks and banks in turn support government through bond purchases.

The Historical Failings of Fiat Currencies are Repeating

It was not always this way, on the other hand, looking back to history, fiat currency grew out of a barter system, where families or companies issued transferable notes against their hard assets. Those notes [ie. 1oz note of Johann’s gold vault in Dusseldorf] were exchangeable into the physical assets. The buying power value of a note was directly tied to the credibility of the issuer. Also, notes which could not be converted into the hard asset, usually silver or gold, were considered fraudulent.

References to government issued notes date back to the 1300s in China. Western world governments were issuing credit notes ‘paper money’ by the 1700s, with these notes backed by a ratio of gold and silver. On the other hand, during times of war, countries would turn to ‘fiat currencies’. For instance, the US government halted notes backed by gold as well as silver during the American civil war. To fund the war effort, the government issued a fiat currency referred to as “Greenbacks”.

Moving forward government-issued money was exchangeable for gold upon demand in the 19th and early 20th. Under the gold standard, a country’s physically available gold supply limited the amount of money that the government could issue. As such, all currencies on the gold standard system had fixed exchange rates. However, problems with this system ensued during WW1 as warring countries found it necessary to dramatically increase domestic money supplies. Stresses in the system developed. By the end of the Great Depression, most countries had cancelled the currency for gold redemption policy. Also, in August 1971 President Nixon permanently canceled the convertibility of dollars into gold.

Gold Backed Cryptocurrencies – The Future?

Today central banks issue their own paper currency whensoever needed. This is where trouble can begin. How much paper issuance is too much? And how much is too little? Also, which amount of issuance will keep the government in power for the longest period of time? Who gets to decide what problems are important enough to ‘need’ issuance and what is not important enough?

One of the benefits that both gold and cryptocurrency investors point out is that these assets are an alternative to government issued fiat currencies that are plagued with the ‘troubles’ above.

Referring back to the concept introduced above of combining gold with a cryptocurrency plants the seed of an idea that would come full circle back to private hard asset pools for which a representation of that pool is accepted as currency. Importantly the asset pool is not a government entity – or even owned by one person. Moreover, It is important that there is no scheme method plan, acceptable amount of leverage or printing of the hard assets.

Inflation is Here! Watch the Video to Learn More

We are not endorsing the fund proposed by the NYC Real Estate Mogul: but the concept of how it could change the banking system as we know it today. And as stated in the opening paragraph it combines the benefits of the new digital age of cryptocurrencies with the ‘tried and true’ hard asset of gold.

Let us imagine that Jeff Bezos bought up 20 gold mines with total contained gold of 50 billion ounces. Next, let us imagine that he created and issued a digital currency backed by this gold. If Jeff pledged that any holder of the digital currency could turn up at the mine and exchange the digital currency for an ounce of gold and that his digital currency would never exceed the ounces backed by the gold … would you use that digital currency? As cryptocurrencies evolve, having a ‘hard asset’ to back them could become paramount!

The above example is exactly akin to what the Bloomberg article suggests is happening. It is clear that a marriage of digital currency to physical gold would pull the value of physical gold far higher than it is today and could return it to a larger role in the money system.

Have You Watched GoldCore TV’s Interview with Jim Willie Yet?

Follow on:

No related photos.

Tags: Commentary,crypto,Cryptocurrencies,cryptocurrency,Currency,Daily Market Update,Digital currency,Featured,Gold,gold news,newsletter