Home › 6a) Gold & Monetary Metals › 6a.) GoldCore › Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Permanent link to this article: https://snbchf.com/2021/01/flood-gold-inflation-hedge/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

8 hours ago -

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

1 day ago -

USD/CHF Price Prediction: Consolidates within short-term uptrend

6 days ago -

USD/CHF trades around 0.8630, recovers recent losses due to less-dovish Fed

6 days ago -

USD/CHF Price Prediction: Pull back unfolding after higher high

7 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 4.2 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Knowing Yourself

Knowing Yourself -

10-22-24 Is the Stock Market Party Over?

10-22-24 Is the Stock Market Party Over? -

How Lower Interest Rates Are Impacting the Real Estate Market

How Lower Interest Rates Are Impacting the Real Estate Market -

USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

-

Dein ETF Anbieter ist pleite – was dann?

Dein ETF Anbieter ist pleite – was dann? -

What Happens if Israel Attacks Iran’s Oil – Mike Mauceli, Hooshang Amirahmadi

What Happens if Israel Attacks Iran’s Oil – Mike Mauceli, Hooshang Amirahmadi -

The True Cost of the American Dream – John MacGregor

The True Cost of the American Dream – John MacGregor -

COMING SOON: Die Finanzfluss Software 🤩

COMING SOON: Die Finanzfluss Software 🤩 -

Create Generational Wealth And Pass It Down To Your Kids – Andy Tanner, Del Denney

Create Generational Wealth And Pass It Down To Your Kids – Andy Tanner, Del Denney -

Bitcoin: Millionen-Chance oder Verbots-Kandidat?

Bitcoin: Millionen-Chance oder Verbots-Kandidat?

More from this category

- USD/CHF depreciates to near 0.8650, downside risk seems restrained due to higher US yields

22 Oct 2024

Global rankings: where Switzerland gets good marks – and where it could do better

Global rankings: where Switzerland gets good marks – and where it could do better21 Oct 2024

Swiss steel workers hold demonstration to save their plant

Swiss steel workers hold demonstration to save their plant21 Oct 2024

Switzerland keeps its four three-star Michelin restaurants

Switzerland keeps its four three-star Michelin restaurants21 Oct 2024

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar

USD/CHF Price Forecast: Corrects to near 0.8630 despite upbeat US Dollar21 Oct 2024

- Why the Money Supply Is Growing Again

21 Oct 2024

SWISS extends cancellation of Tel Aviv flights

SWISS extends cancellation of Tel Aviv flights21 Oct 2024

- Why People Pay Higher Prices for Some Goods Relative to Others

21 Oct 2024

Proportion of Swiss who are ‘news deprived’ reaches record high

Proportion of Swiss who are ‘news deprived’ reaches record high21 Oct 2024

The Dollar and Gold Firm

The Dollar and Gold Firm21 Oct 2024

American Express to take over UBS’s stake in Swisscard

American Express to take over UBS’s stake in Swisscard21 Oct 2024

Swiss workers say flexible working hours would lead to less stress

Swiss workers say flexible working hours would lead to less stress21 Oct 2024

- The Birth of “Irrational Exuberance”

21 Oct 2024

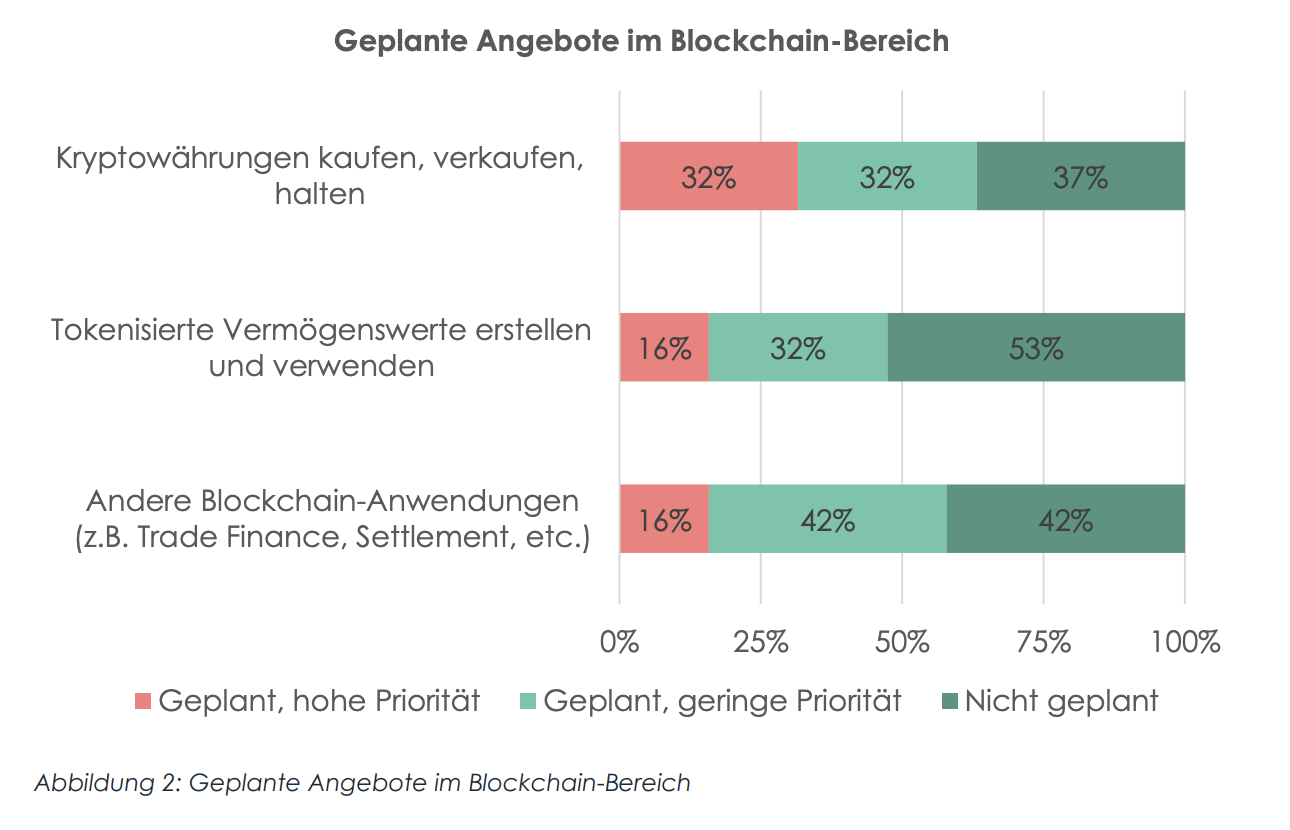

Swiss Banks Embrace Blockchain, Prioritizing Cryptocurrencies, HSG Study Finds

Swiss Banks Embrace Blockchain, Prioritizing Cryptocurrencies, HSG Study Finds21 Oct 2024

Roche’s big bet on big diseases

Roche’s big bet on big diseases20 Oct 2024

- Hayek on the Welfare State

20 Oct 2024

- Ctrl+Alt+Regulate: The DMA’s Misguided Reboot of Competition

20 Oct 2024

- What is Old School Economics?

20 Oct 2024

- Yes, Car Seat Laws Reduce the Birth Rate

20 Oct 2024

Week Ahead: Is the Closeness of the US Election a Source of Dollar Demand?

Week Ahead: Is the Closeness of the US Election a Source of Dollar Demand?19 Oct 2024

Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Published on January 28, 2021

Stephen Flood

My articles My videosMy books

Follow on:

.

Massive fiscal and monetary stimulus has been pumped into economies around the world to help ease the economic devastation for both individuals and businesses.

Building on hope for herd immunity being reached and restrictions being lifted towards yearend, the question arises: Is CPI inflation on the horizon?

Central banks are generally forecasting inflation to be in the range of their 2% targets for the next several years, and although, inflation expectations have risen sharply since the March 2020 low, they are still not out of line to pre-coronavirus levels.

US 10-year Breakeven Inflation Rate, 2019-2020

- Click to enlarge

US M2 Money Supply, 2019-2020

- Click to enlarge

Wheat and Copper Prices, 2020

- Click to enlarge

Some have compared the re-opening of the economy to the roaring 1920s – the new age of economic prosperity and spending. Three things are needed for consumer price inflation to take hold: too much money, chasing, to few goods. Currently, the only piece missing is the chasing – and once the vaccine reaches a significant majority of the population chasing of goods and services is likely to gain momentum – and demand will outstrip supply in key sectors of the economy. Part of it, will of course be temporary, but part of it is growth of a new economy with reduced global trade and increase emphasis on made at home products. In the coming new age of spending and inflation – gold is a tried-and-true inflation hedge!

Have You Seen this Must-See Inflation Episode of GoldCore TV – Watch it Now

We leave the reader with a quote from Milton Friedman to ponder…

So, every time there’s the threat of a contraction in the economy, they’ll over stimulate the economy, by printing too much money. The result will be a rising roller coaster of inflation, with each high and low being higher than the preceding one”

Full story here Are you the author?Follow on:

No related photos.

Tags: Commentary,Daily Market Update,Featured,money printing,Money Supply,newsletter