Tag Archive: newsletter

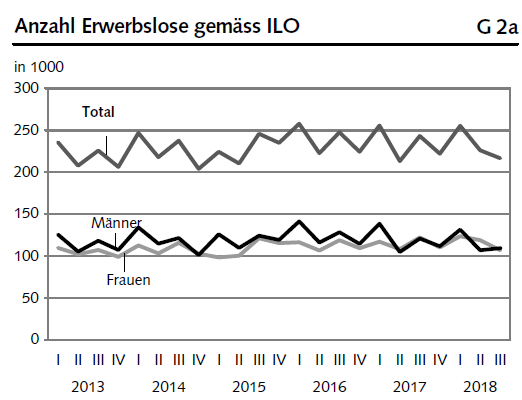

Swiss Labour Force Survey in 3nd quarter 2018: 1.2percent increase in number of employed persons; unemployment rate based on ILO definition falls to 4.4percent

The number of employed persons in Switzerland rose by 1.2% between the 3rd quarter 2017 and the 3rd quarter 2018. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined by 0.6 percentage points to 4.4%. The EU's unemployment rate decreased from 7.3% to 6.5%.

Read More »

Read More »

Financial institutions raided over mobile pay deals

The Swiss Competition Commission has searched the premises of Credit Suisse and UBS, PostFinance and the credit card companies Swisscard and Aduno for allegedly boycotting mobile payment methods such as Apple Pay and Samsung Pay. The Competition Commission said on Thursday it had opened an investigation on Tuesday.

Read More »

Read More »

The Implicit Desperation of China’s “Social Credit” System

Other governments are keenly interested in following China's lead. I've been pondering the excellent 1964 history of the Southern Song Dynasty's capital of Hangzhou, Daily Life in China on the Eve of the Mongol Invasion, 1250-1276 by Jacques Gernet, in light of the Chinese government's unprecedented "Social Credit Score" system, which I addressed in Kafka's Nightmare Emerges: China's "Social Credit Score".

Read More »

Read More »

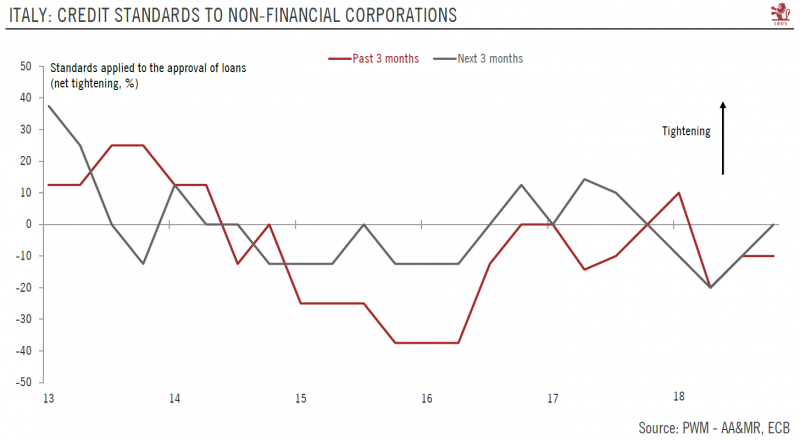

Italian government sticks to its 2019 deficit plan

The minor concessions continued in the revised plan presented to the European Commission are unlikely to dissuade Brussels from launching sanctions.In a letter to the European Commission on 13 November, the Italian government confirmed that it would aim for a budget deficit at 2.4% of GDP in 2019 and reasserted its real growth forecast of 1.5% for next year.

Read More »

Read More »

FX Daily, November 14: Dollar Comes Back After Yesterday’s Profit-Taking

Overview: Investors are on pins and needles today. Oil prices are trying to stabilize after WTI's outsized 7% fall yesterday, its largest in three years. Global equities are heavier, dragged down by energy, but also larger than expected Q3 contractions in Japan and Germany, and a mixed bag of Chinese data that showed possible stabilization of the industrial sector though weaker consumption.

Read More »

Read More »

Visana insurance president commits suicide

The president of the Swiss insurance firm Visana, Urs Roth, committed suicide on Monday, the firm has announced. In recent years, several top Swiss executives have taken their lives. “It is with great sadness that we inform you about the death of our Chairman of the Executive Board, Mr. Urs Roth, who took his own life yesterday," Visana said in a brief statement.

Read More »

Read More »

Cool Video: Euro Pressured Lower

As a long-term dollar bull, I was happy to accept Bloomberg TV's invite to come to the set on the day that the Dollar Index made new highs for the year and the euro punched through the $1.1300 support that has held since mid-August.

Read More »

Read More »

China’s Pooh Lesson

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.

Read More »

Read More »

FX Daily, November 13: Weak Turn-Around Tuesday

Overview: The US dollar has a heavier bias against most of the major and emerging markets currencies, but the pullback is shallow, and the greenback's underlying strength is still evident. Asian equities were mixed. Concern that Apple may be reducing orders weighed on suppliers, but news that China and US trade talks are resuming boosted sentiment, allowing Chinese stocks to recover helped lift the Australian and New Zealand dollars.

Read More »

Read More »

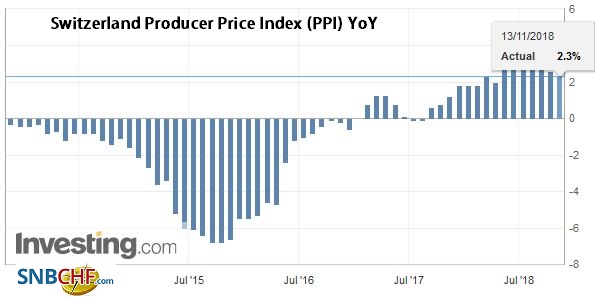

Swiss Producer and Import Price Index in October 2018: +2.3 percent YoY, +0.2 percent MoM

The Producer and Import Price Index increased in October 2018 by 0.2% compared with the previous month, reaching 103.4 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products, petroleum and natural gas. Compared with October 2017, the price level of the whole range of domestic and imported products rose by 2.3%.

Read More »

Read More »

Switzerland signs up to ‘Paris Call’ for a safer internet

In Paris on Monday, several hundred governments and tech companies – and Switzerland – signed a new charter for trust and security online. In the so-called ‘Paris Call’, launched by French President Macron at the UNESCO Internet Governance Forum in Paris, signatories pledged to support “an open, safe, stable, accessible, and peaceful cyberspace” where international law applies, and individual rights are protected.

Read More »

Read More »

Cool Video: Fox Biz TV Broad Economic Discussion

I joined Charles Payne on Fox Business TV for a broad economic discussion today. Payne, like many, are concerned that the Fed continues to tighten and worries this is going to end the business cycle. He also argued that the strong dollar was a significant threat of US multinational earnings.

Read More »

Read More »

FX Daily, November 12: Sterling’s Losses Lead Dollar Rally

Overview: The US dollar is enjoying broad gains against most major and emerging market currencies. Sterling, dragged down by Brexit concerns, is leading the way. With today's losses, sterling has shed nearly 3.7 cents over the last four sessions. The euro, for its part, is at a new 17-month low (~$1.1250).

Read More »

Read More »

Swiss National Bank Unexpectedly Sold US Stocks In Q3, Dumping Over 1 Million Apple Shares

The SNB’s latest 13-F form filings (yes, the Swiss central bank lists its US equity holdings like the hedge fund that it is) to the SEC were released this week. And, like every other quarter, we take a closer look to see what stocks the world's only hedge fund central bank that prints money out of thin air bought, and on rare occasions, sold. This was one of those rare quarters.

Read More »

Read More »

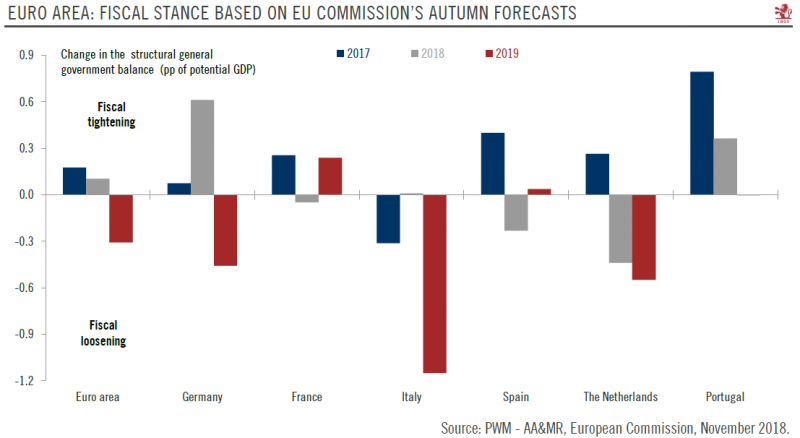

Euro area’s fiscal policy to turn supportive of growth next year

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.

Read More »

Read More »

Study finds ‘worrying’ suicide rates among Swiss farmers

The suicide rate among Swiss farmers is almost 40% higher than the average for men in rural areas, a study has found. The main causes are fears about the future and financial worries. A survey by the Swiss National Science Foundation (SNSF), reported in the SonntagsZeitung, found that between 1991 and 2014, 447 Swiss farmers took their lives.

Read More »

Read More »

FX Weekly Preview: DOTS in the Week Ahead: Divergence, Oil, Trade and Stocks

The Federal Reserve's confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would, in effect, allow the borrowers...

Read More »

Read More »

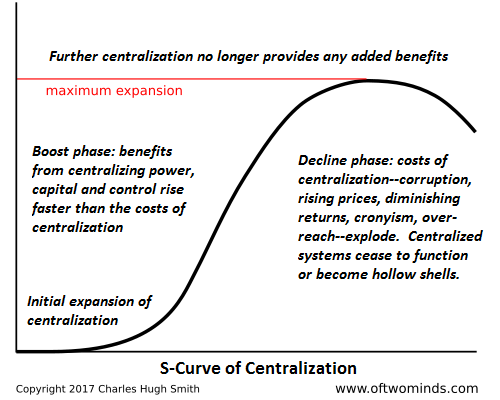

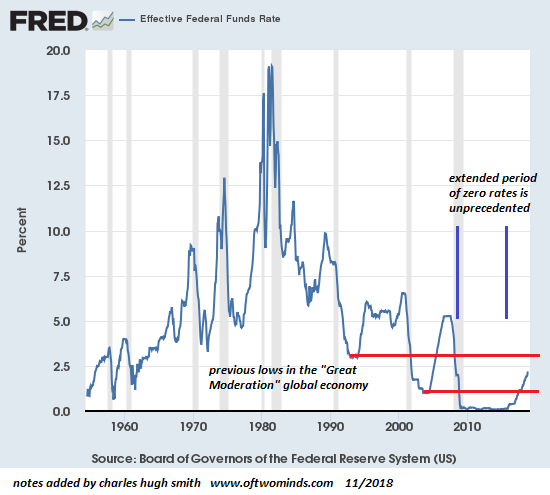

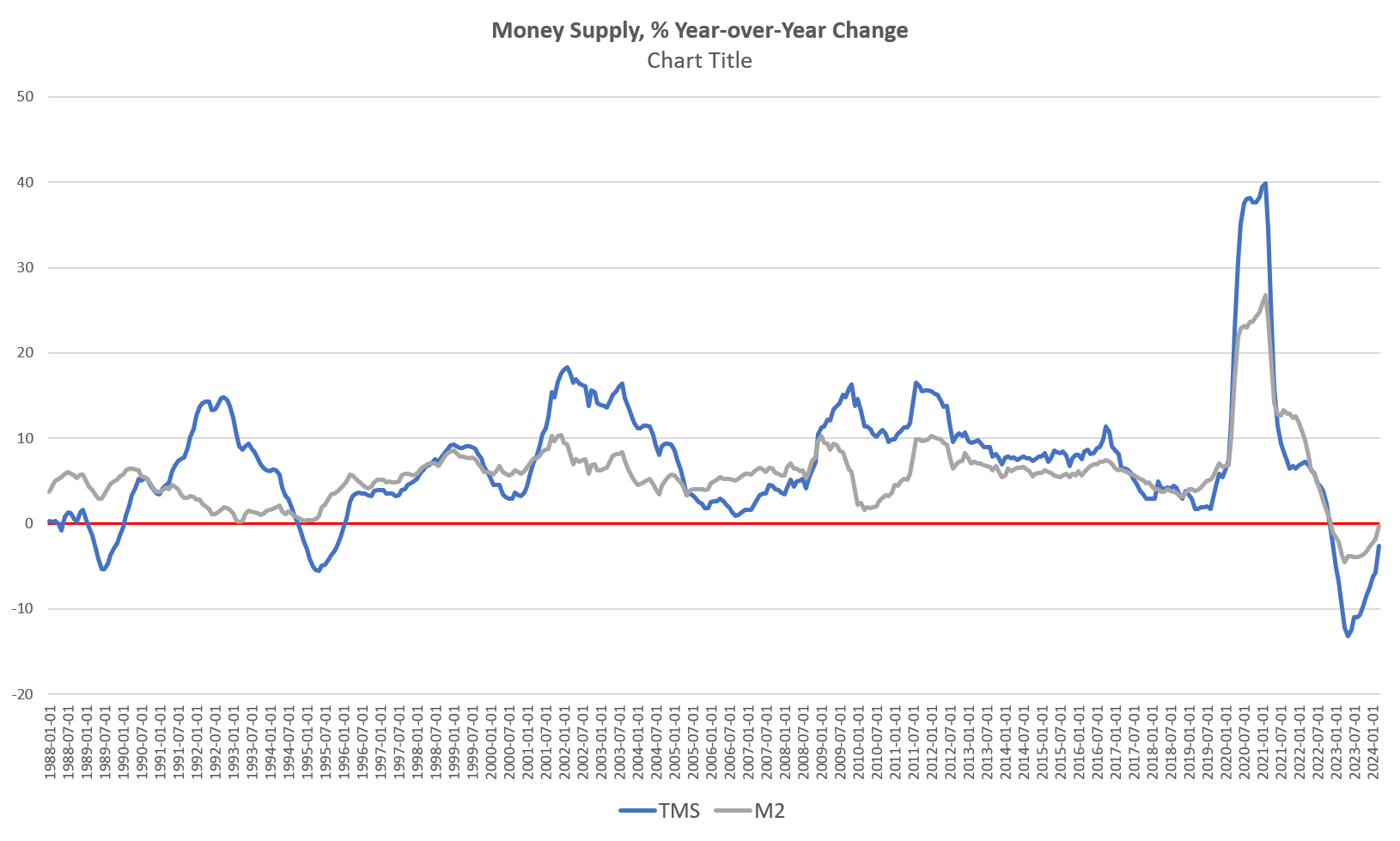

Understanding the Global Recession of 2019

Isn't it obvious that repeating the policies of 2009 won't be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of dollars of bonds and iffy assets...

Read More »

Read More »

PKB private bank officials under investigation for fiscal fraud

Eighteen managers at the Swiss private bank PKB Privatbank are being investigated in Italy for fiscal fraud and money laundering, according to an Italian prosecutor. The Milan Public Prosecutor's Office, led by Francesco Greco, is carrying out the investigation against the officials, who are residents in Italy where PKB owns the Italian private bank Cassa Lombarda.

Read More »

Read More »