Tag Archive: newsletter

Immopreneur Kongress 2018 – Die Pflichtveranstaltung für innovative Immobilien-Investoren

Sichere dir jetzt dein Ticket für den nächsten Immopreneur Kongress 2019: http://bit.ly/IPK19YT

Immopreneur.de:

▶ http://immopreneur.de

Immopreneur.de Blog:

▶ http://immopreneur.de/blog/

Immopreneur Instagram:

▶ https://www.instagram.com/immopreneur.de/

--------------------------------------

Bestelle Dir hier das neue Buch DAS SYSTEM IMMOBILIE (fast) kostenlos!

▶ http://bit.ly/DasSystemImmobilieYT

--------------------------------------

Du...

Read More »

Read More »

SNB appoints new delegate for regional economic relations for Central Switzerland

With effect from 1 October 2018, Gregor Bäurle will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Central Switzerland region. He succeeds Walter Näf, who is taking on a new position, representing the SNB in the Swiss delegation to the OECD in Paris as of 1 January 2019.

Read More »

Read More »

FX Daily, September 25: Greenback Remains at the Fulcrum

The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few exceptions in Asia, where the Indonesian rupiah and the Chinese yuan are off about 0.3%, while the Indian rupee and Malaysian ringgit are around 0.2% lower.

Read More »

Read More »

Swiss Health Insurance Costs to Rise Further in 2019

More bad news for Swiss household budgets was released today for residents of all but three Swiss cantons. Health insurance premiums in 2019 will be on average 1.2% higher than in 2018 across Switzerland as a whole. However, within this figure there are significant cantonal variations.

Read More »

Read More »

Monthly Macro Monitor – September 2018

Alhambra Investments CEO Joe Calhoun shares his opinions of the economy and market based on the most recent economic reports.

Read More »

Read More »

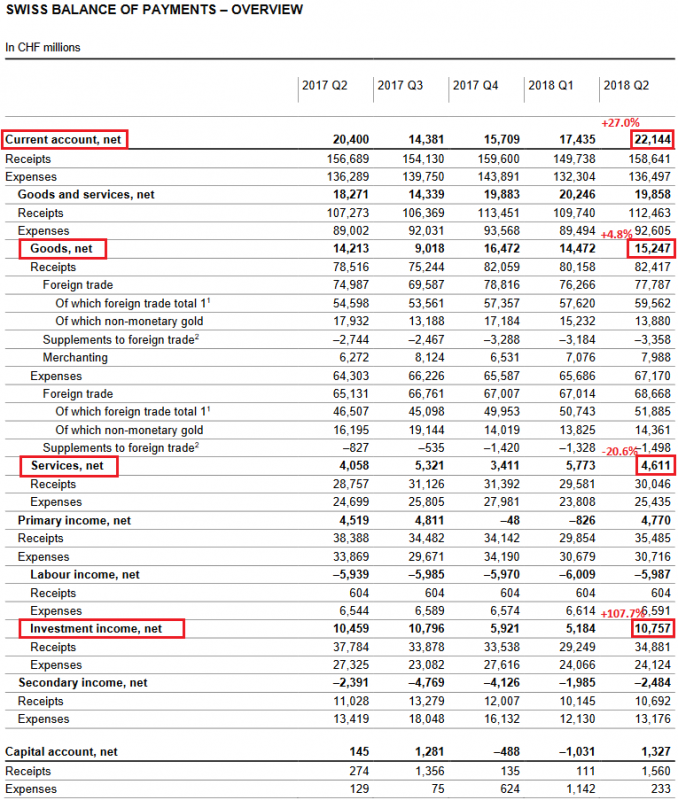

Swiss Balance of Payments and International Investment Position: Q2 2018

Key figures: Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF, Goods Trade Balance: Up 4.8% against Q1/2018 to 15.2 bn., Services Balance: Minus 20.6% to 4.6 bn., Investment Income: Plus 107.7% to 10.7 bn. CHF.

Read More »

Read More »

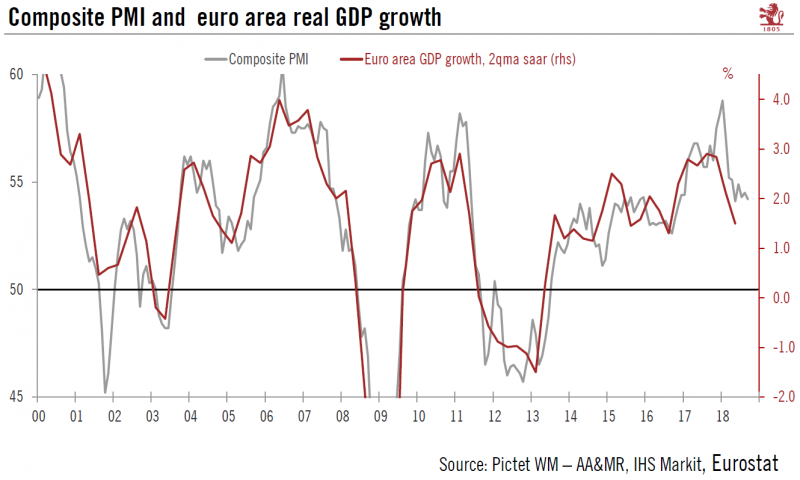

Business Indicators Present a Contrasting Picture of the Euro Area

Euro area flash composite PMI dipped slightly to in September and came in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since June 2013.

Read More »

Read More »

Thousands demonstrate in Bern for equal pay

A national rally in favour of equal pay and against discrimination has taken place in the Swiss capital, attracting some 20,000 people, according to organisers. Unions, political parties and supporting organisations said in the run-up to the rally on Saturday that although equality was enshrined in the constitution 37 years ago and the law had been in force for 22 years, even today power and money are distributed differently among women and men.

Read More »

Read More »

FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors' understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME's model, there is about an 85% chance of December hike discounted as well.

Read More »

Read More »

The Four Disastrous Presidential Policies That Are Destroying the Nation

It's admittedly a tough task to select the four most disastrous presidential policies of the past 60 years, given the great multitude to choose from. Here are my top choices and the reasons why I selected these from a wealth of policy disasters.

Read More »

Read More »

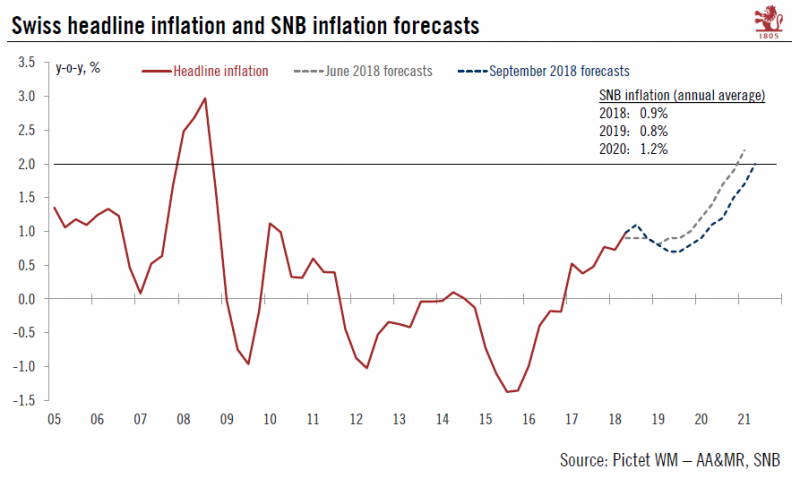

Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged.

Read More »

Read More »

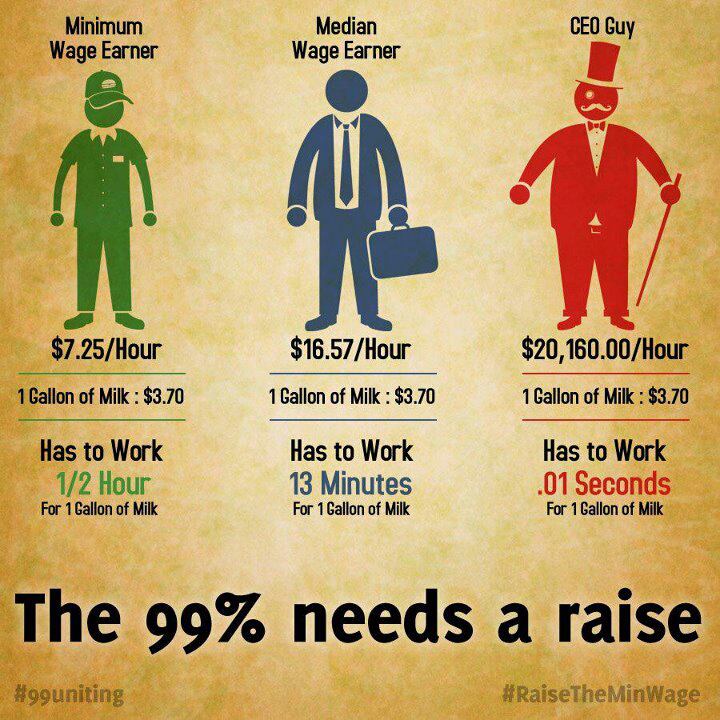

Swiss CEOs still the best-off in Europe

A report on the salaries of CEOs across Europe has found that Switzerland once again tops the table, ahead of Great Britain and Germany. The report also discovers that salaries have risen over the past year.

Read More »

Read More »

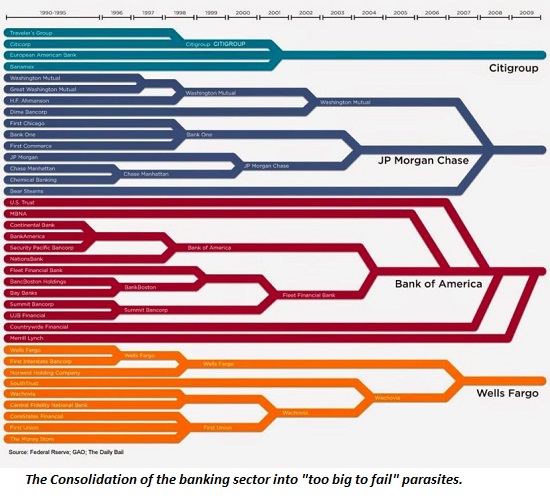

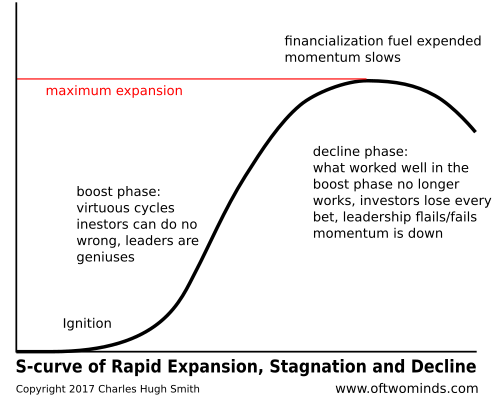

When Does This Travesty of a Mockery of a Sham Finally End?

Credit bubbles are not engines of sustainable employment, they are only engines of malinvestment and wealth destruction on a grand scale. We all know the Status Quo's response to the global financial meltdown of 2008 has been a travesty of a mockery of a sham--smoke and mirrors, flimsy facades of "recovery," simulacrum "reforms," serial bubble-blowing and politically expedient can-kicking, all based on borrowing and printing trillions of dollars,...

Read More »

Read More »

Swiss investors launch $100m blockchain start-up factory

A consortium of Swiss investors has launched a private equity vehicle that aims to collect up to $100 million with the long-term goal of getting 1,000 blockchain companies off the ground internationally every year. The Swiss company Crypto Valley Venture Capital (CV VC) launched its initial “Genesis Hub” incubator in Zug, home to Switzerland’s Crypto Valley, on Thursday.

Read More »

Read More »

Portfolio Re-Balancing and the Dollar

Boosted by tax reform, deregulation, and strong earnings growth, US equities have motored ahead, leaving other benchmarks far behind. As the Great Graphic here shows, most of the other benchmarks are lower on the year. The S&P 500 (yellow line) is up 8.8% for the year before the new record highs seeing seen now, while the Dow Jones Stoxx 600 from Europe (purple line) is still off 1.7%.

Read More »

Read More »

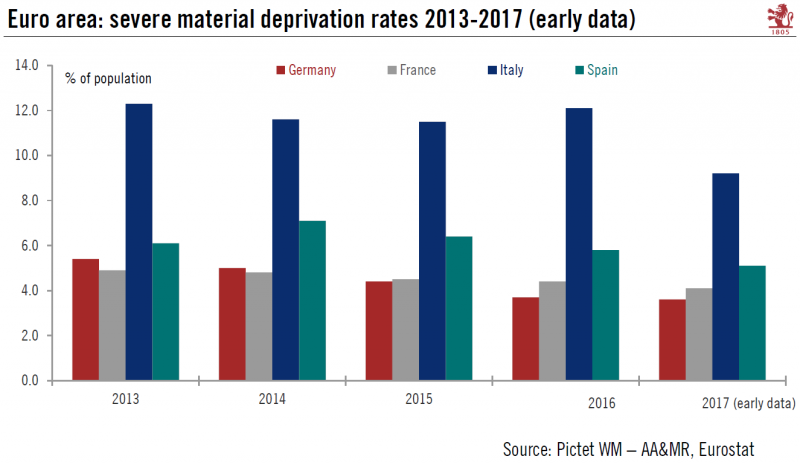

Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus.Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase instalments or other loan payments;...

Read More »

Read More »

Le Conseil fédéral se moque des personnes âgées!

Le Conseil fédéral se distingue par 2 points tout compte fait complémentaires. Le premier est son soutien indéfectible à la politique expansionniste et ruineuse de la BNS, dont il a la responsabilité au plan constitutionnel. Celle-ci mobilise les richesses du pays, puis les convertit en monnaies étrangères, pour enfin les investir dans des actifs plus ou moins pourris, plus ou moins risqués, voire plus ou moins condamnés.

Read More »

Read More »

FX Daily, September 20: The Mixed Performance Makes it Difficult to Talk about The Dollar

Sometimes the dollar is the key mover, but sometimes, like today, it seems to be the fulcrum, reflecting disparate moves among other currencies. While the euro is at two-month highs, the yen is near two-month lows. The euro is bouncing off two-month lows and the 100-day moving average against sterling. Most emerging market currencies are advancing against the dollar today.

Read More »

Read More »