Tag Archive: newsletter

Swiss investments in Turkey drop by half

The severe policies of President Recep Tayyip Erdogan have led to Swiss companies decreasing their investments in Turkey by 50% compared to the average over the past decade, Swiss Public Television SRF reports. Over the last ten years, Swiss companies have on average invested some CHF200 million ($202 million) in Turkish markets, but today the figures amount to roughly half that.

Read More »

Read More »

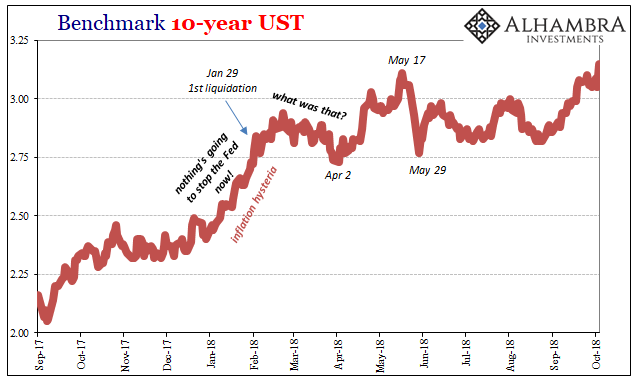

A Few Questions From Today’s BOND ROUT!!!!

On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates.

Read More »

Read More »

FX Daily, October 04: Dollar Consolidates Gains while Yields Continue to Rise

The US dollar is consolidating yesterday's gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself is the news.

Read More »

Read More »

Study finds Swiss economy is looking up, but risks abound

Switzerland's GDP is on track this year to increase by 2.9%, according to a forecast by Zurich's KOF Swiss Economic Institutepublished Wednesday. This positive outlook is tempered by concerns over the potentially negative impact of global trade wars and a no-deal Brexit on the neutral nation.

Read More »

Read More »

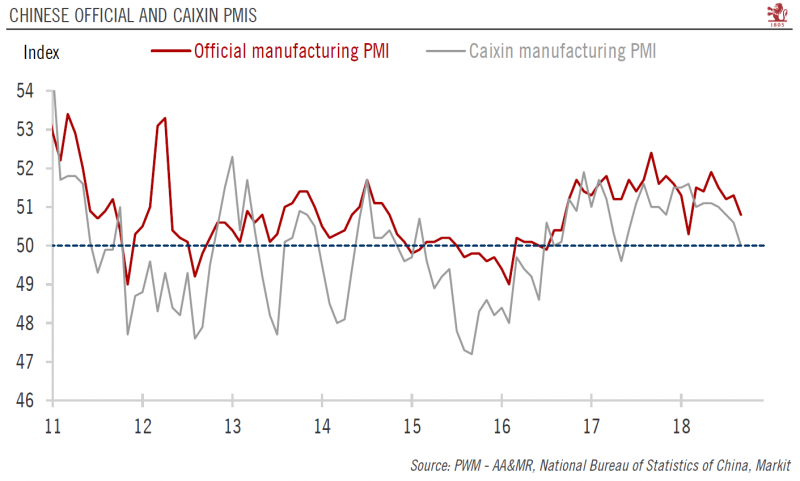

Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4.China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4.In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June.

Read More »

Read More »

Pensions Now Depend on Bubbles Never Popping (But All Bubbles Pop)

We're living in a fantasy, folks. Bubbles pop, period. The nice thing about the "wealth" generated by bubbles is it's so easy: no need to earn wealth the hard way, by scrimping and saving capital and investing it wisely. Just sit back and let central bank stimulus push assets higher.

Read More »

Read More »

Strong Swiss agricultural output recorded despite droughts

Swiss agricultural production is up in 2018, driven largely by bigger hauls of wine, fruit and milk, according to the latest official statistics. Productivity is also on the rise. The yearly production estimate of CHF10.6 billion ($10.7 billion) released on Tuesday by the Federal Statistical Office represents an increase of 2.7% on 2017 figures.

Read More »

Read More »

Cool Video: Bloomberg Clip from Discussion on Emerging Markets

In my first television appearance since joining Bannockburn Global Forex, I joined Tom Keene and Francine Lacqua on the Bloomberg set. In this nearly 2.5 min clip, we talk about the Indonesia rupiah and the dollar's move above the IDR15000 level for the first time since the 1997-1998 Asian financial crisis.

Read More »

Read More »

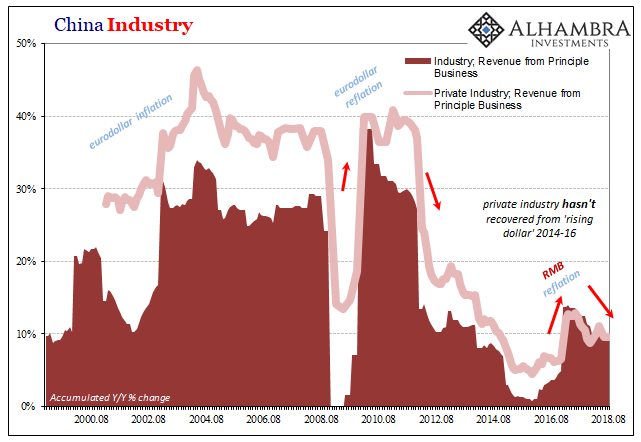

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

FX Daily, October 02: Greenback Advances

The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower, with 1.2% losses in Taiwan and South Korea and 2.5% drop in Hong Kong and in the H-shares that trade there.

Read More »

Read More »

A Word About the Q2 COFER Report

The IMF reports the most authoritative currency allocation of global reserves at the end of every quarter with a quarter delay. Invariably, an economist, strategist, or journalist is inspired to write why some data nugget confirms the demise of the dollar as the dominant currency.

Read More »

Read More »

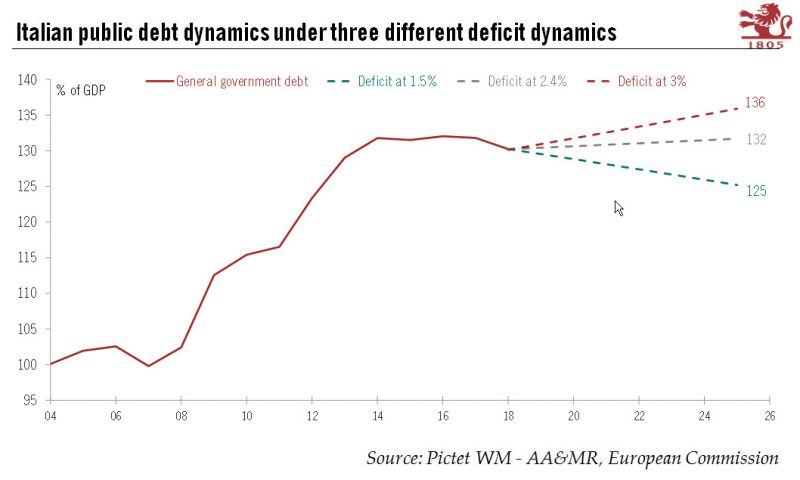

Italy tests the EU’s tolerance

The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general.Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019.

Read More »

Read More »

Tax amnesty ends for undeclared EU assets

The automatic exchange of information between Switzerland and the European Union came into effect on Monday. Owning property abroad without declaring it will no longer be possible. The deadline of September 30 ended the possibility of coming forward voluntarily, reported Swiss public television, RTS, on Sunday. For latecomers who have assets outside Switzerland and who failed to declare them, doing so now can no longer be considered voluntary.

Read More »

Read More »

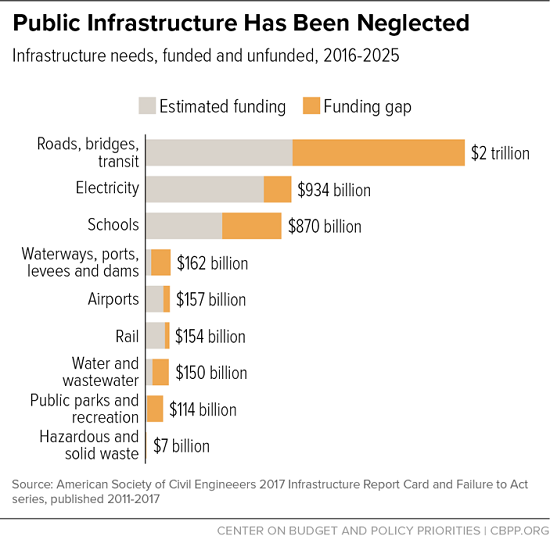

Fixing Infrastructure Isn’t as Simple as Spending Another Trillion Dollars

It isn't easy to add new subway lines or new highways, and so "solutions" don't really exist. If there's one thing Americans can still agree on, it's that America needs to spend more on infrastructure which is visibly falling apart in many places. This capital investment creates jobs and satisfies everyone's ideological requirements: investment in public infrastructure helps enterprises, local governments and residents.

Read More »

Read More »

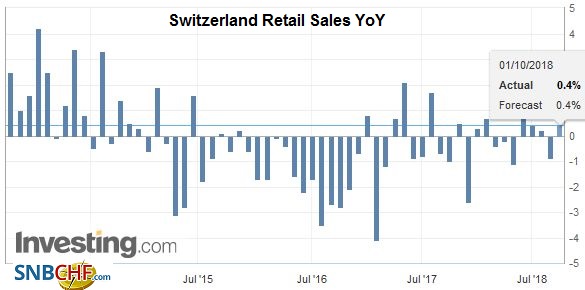

Swiss Retail Sales, August 2018: +1.1 percent Nominal and +0.4 percent Real

Turnover in the retail sector rose by 1.1% in nominal terms in August 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.3% compared with the previous month.

Read More »

Read More »

FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar is firm. China's mainland and Hong Kong markets are closed for a national holiday.

Read More »

Read More »