Tag Archive: newsletter

“DAX Long oder Short?” mit Marcus Klebe – 07.03.23

HIER geht´s direkt Zur Webinar-Serie: Traden mit kleinem Konto

https://register.gotowebinar.com/register/3876278094922468952?source=mk

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 10.03.23

HIER geht´s direkt Zur Webinar-Serie: Traden mit kleinem Konto

https://register.gotowebinar.com/register/3876278094922468952?source=mk

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international...

Read More »

Read More »

Marc Faber: The lies of mainstream are now exposed

Marc Faber: The lies of mainstream are now exposed

Marc Faber: The lies of mainstream are now exposed

__________________________________________________

#marcfaber

__________________________________________________

Enjoyed the video? Comment below! ?

? Subscribe to KAIZ ADAM here ?? https://www.youtube.com/channel/UCKqG4UIYFN0R5APuuhtM7dQ?sub_confirmation=1

❤️ Enjoyed? Hit the like button! ?

__________________________________________________...

Read More »

Read More »

Week Ahead: February ISM Services and Auto Sales to Show January US Data were Exaggerated

A key issue facing

businesses and investors is whether the US January data reflects a

reacceleration of the world's largest economy or whether it was mostly a

payback for extremely poor November and December 2022 data and seasonal

adjustments and methodological distortions. Given the centrality of the US

economy and rates, it is not simply a question for America, the Federal

Reserve, and investors, but the implications are much broader. The issue...

Read More »

Read More »

Business Cycle Intel Report

Mark uses Intel Corporation, the computer chip manufacturer, as a barometer of the business cycle. He looks at the stock price in recent years, its production capacity expansion, and the company's very recent cost- and dividend-cutting moves.

Check out Mark Thornton's free book, The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century: Mises.org/Curse

Be sure to follow Minor Issues at...

Read More »

Read More »

Making Nonsense from Sense: Debunking Neo-Calvinist Economic Thought

A few years ago I wrote about some of the errors made by economists who try to apply what they believe are Christian principles to both Austrian and neoclassical economic analysis. These economists believe that the standard economic way of thinking is not only fatally flawed but actually immoral, and that an entire new paradigm must be brought to economics.

In the mid-1990s, I taught economics as an adjunct at a Christian college near Chattanooga,...

Read More »

Read More »

Digitale Diktatur? – CO2-Konto auf Ebay!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Schulden am Limit + Marktausblick

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

▬ ANGEBOT ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

https://www.andre-stagge.de/mastermind-seminar-tradingpsychologie/

Wir leben in einer Welt mit:

• Hohen Schulden

• Hohen Zinsen (im Verhältnis zu den letzten 10 Jahren)

• Hoher Inflation

Was das für Dich und Deine Investments bedeutet?

Die immer weiter steigenden globalen Renditen sind ein Problem in einer hoch verschuldeten Welt. Notenbanken können die Zinsen nicht...

Read More »

Read More »

Dr. Andreas Beck & Fabian Behnke: Vanguard steigt aus!

Dr. Andreas Beck & Fabian Behnke im Gespräch: Anleger sollen nachhaltig investieren, so will es die EU Regulierung. Aber wollen die Anleger das auch? Warum geht mit Vanguard einer der größten Asset Manager einen anderen Weg?

► Zum Global Portfolio One von Dr. Andreas Beck: https://globalportfolio-one.com/

► Zum E-Book „Grüne Geldanlagen nur für Farbenblinde“ von Dr. Andreas Beck und Lucas von Reuss: https://esgi-index.com/...

Read More »

Read More »

Fed President Worries the Fed Risks a Repeat of the 1970s!

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Since the Fed’s last move, incoming economic data is emboldening the hawks. A superficially strong U.S. jobs report combined with stubbornly high inflation readings suggest central bankers have more work to do.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2023/02/24/fed-risks-triggering-1970s-do-over-new-sound-money-win-002688

Do you own precious...

Read More »

Read More »

The Politicization of Procreation: The Ultimate in “the Personal Is Political”

Gloria Steinem declared, "The personal is political." Today, politics has reached into family life and even procreation itself, an unhappy trend for unhappy people.

Original Article: "The Politicization of Procreation: The Ultimate in "the Personal Is Political""

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

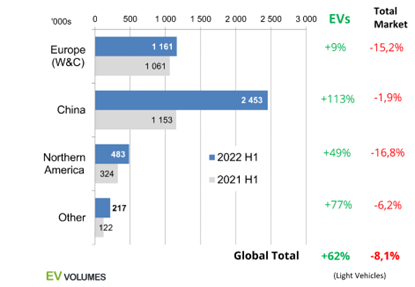

China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market

China has become a global leader in the electric vehicles (EVs) sector, and Western governments are worried that its comparative advantage will become entrenched. Once again, mainstream pundits blame China’s success on government subsidies and unfair competition. This is just a pretext to argue for more government support in a sector which, from the very beginning, has not been driven by genuine consumer demand but by a political green agenda....

Read More »

Read More »

DIE AMERIKANER TRETEN UNS IN DEN HINTERN!

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf...

Read More »

Read More »

Raising Money Smart Kids

Here is an encore presentation of the February 23, 2023 Lunch & Learn on Raising Money Smart Kids, with RIA Advisors Director of Financial Planning, Richard Rosso, CFP, with Senior Advisor, Danny Ratliff, CFP.

-------

0:00 - Intro/Disclaimer

1:25 - Grandparents' opportunities for generational influence of grandkids

2:12 - What is a Money Script?

5:33 - Know Yourself

7:44 - Money Avoidance/Money Worship

13:48 - Money Focus

18:54 - Money...

Read More »

Read More »

The Economics of National Divorce, Part II

Tom Woods joins the show for a look at the hottest political topic of the day, namely national divorce. This is a spirited discussion of the politics, economics, and mechanics of how America might break up.

Watch "The Economics of National Divorce, Part I" with Ryan McMaken: Mises.org/HAP352

[embedded content]

Read More »

Read More »

Mill at a Loss

On John Stuart Millby Philip KitcherColumbia University Press, 2023; 152 pp.

John Stuart Mill wasn’t Murray Rothbard’s favorite philosopher, and Philip Kitcher’s short book would confirm this dislike. Rothbard viewed Mill as a fuzzy thinker, overly prone to compromise and averse to firm principles. These qualities are among those that lead Kitcher to praise Mill, but Rothbardians nevertheless have much to learn from Kitcher, who is a leading...

Read More »

Read More »

Wie geht es weites? Kritik an Thomas der Sparkojote & Aktien mit Kopf

Quellen:

https://www.politifact.com/factchecks/2022/apr/13/one-america-news/scientific-evidence-does-not-support-ivermectin-tr/

https://www.nejm.org/doi/full/10.1056/nejmoa2115869?fbclid=IwAR1NlJl7hSnUjazcpMfgsBGu9v6PA9nywjrGDBp0Y0XkZacddq0ivNBJUvU

https://www.npr.org/sections/coronavirus-live-updates/2021/09/04/1034217306/ivermectin-overdose-exposure-cases-poison-control-centers...

Read More »

Read More »

Buch: Widerstand – Warum zwischen linker und rechter Politik eine Schlacht der Gene wütet, P. Mende

✘ Werbung:

Buch ► https://amazon.de/Widerstand-zwischen-rechter-Politik-Schlacht-ebook/dp/B08RJZKXKN

Im Tierreich gibt es zwei grundlegend unterschiedliche #Strategien zur #Vermehrung und Überleben. Die #r-Strategie: Möglichst viele Nachkommen, um die man sich nicht kümmert. Die alleine zurecht kommen müssen. Beispiele: Lachse, Kaninchen. Auf der anderen Seite gibt es Spezies, die die #K-Strategie verfolgen und nur wenige Nachkommen haben und diese...

Read More »

Read More »