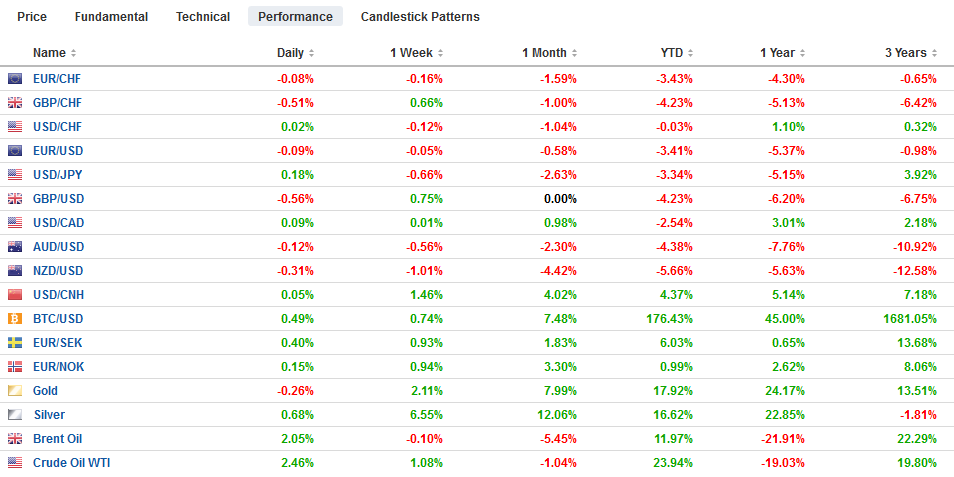

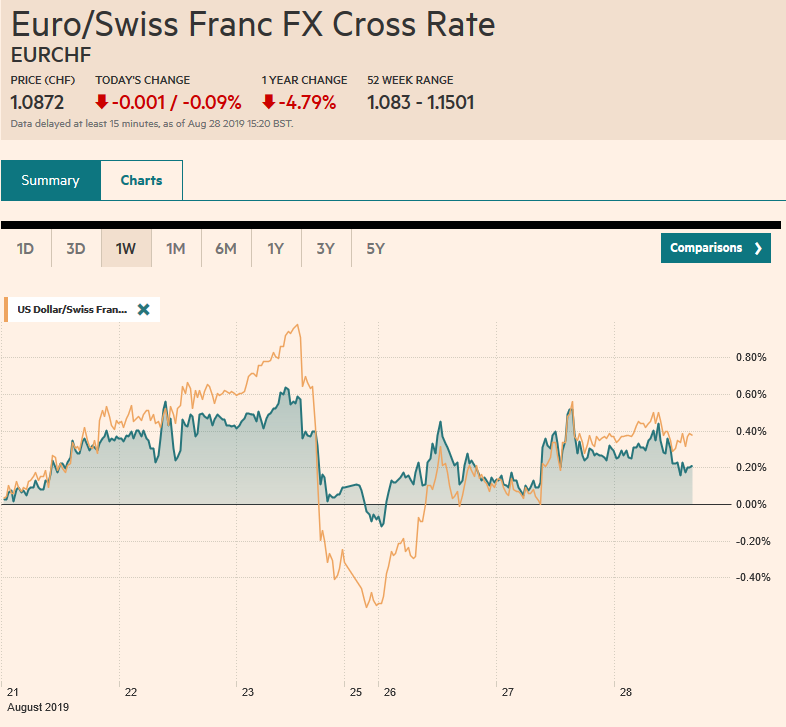

Swiss FrancThe Euro has fallen to 1.0872 or by 0.09%. |

EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The capital markets have turned quiet. There have been no more headline bombs about trade, and China set the dollar’s reference rate much lower than projected. Asia Pacific equities were mixed. Hong Kong, China, India, and Singapore were on the downside, while Taiwan, Korea, and Australia rose. European markets hare heavy, and the Dow Jones Stoxx 600 is about 0.4% lower near midday in London. A lower close would be the fourth in the past five sessions. US shares are little changed. The six basis point decline in the US 10-year yield yesterday dragged down yields today. Greek bonds continue to play catch-up, and the 10-year yield is off six basis points at a new low below 1.74%. The dollar is firmer against the major currencies, with sterling paring its recent gains leading on the downside and about a 0.8% loss (~$1.2195). The greenback is stronger against most of emerging market currencies, but Turkey, South Africa, and Mexico are seeing demand for their currencies. Gold is consolidating yesterday’s recovery, while oil prices are extending yesterday’s gain, helped by a large (11.1 mln barrel) drop in oil inventories, according to the API, a storm threatening to disrupt the US southeast, and a report indicating that OPEC compliance was nearly 160% last month (i.e., lower output than agreed). |

FX Performance, August 28 |

Asia Pacific

Bank models projected a sharply lower Chinese fix for the US dollar. A Reuters survey found a median expectation of CNY7.1027 while the Bloomberg survey found a median of CNY7.1126. The PBOC set the dollar’s reference rate at CNY7.0835. The gap between the models and the fix was among the largest. It would seem to suggest officials are stepping up their efforts to slow the yuan’s depreciation. To be sure, both on and offshore yuan are weaker, the rates are converging (e.g., CNH7.17 and CNY7.1640) as the dollar’s upside momentum has eased. And to be sure, the dollar gained against the yuan for the 10th consecutive session.

The Bank of Japan’s next policy meeting is on September 19. The issue is that the 10-year yield is holding beyond where yield curve control is targeting. The BOJ introduced yield curve control three years ago next month. The goal was to steepen the curve, which meant putting a floor under the long-term yield. After a couple of adjustments, the BOJ now allows the 10-year yield to move in a 20 bp band on either side of zero. The problem is that the 10-year yield has fallen below the floor on a sustained basis. The yield has not closed above minus 20 bp since August 8. The BOJ has reduced the amount of long-term bonds it buys but to little effect. Meanwhile, the yen’s strength will feed through to a weaker inflation impulse and may weigh on exports as the yen’s rise contrasts with weakness of many regional currencies, including South Korea and China.

The dollar is consolidating in about 25 tick range against the yen above JPY105.65. There is a roughly $925 mln option at JPY105.80 that will be cut today. If the dollar does not take out JPY106.20, it will be the third session of that lower highs are recorded. Yesterday’s low was near JPY105.60, just ahead of support seen by JPY105.50. There has been no follow-through buying of the Australian dollar after Monday’s strong recovery. Instead, the Aussie is leaking lower and has pushed through yesterday’s low (~$0.6745), and marginal additional losses in North America would not be surprising.

Europe

The Democratic Party in Italy (PD) and the Five Star Movement (M5S) still appear to be negotiating whether a government can be cobbled together out of the existing parliament configuration. The talks seem torturous, which may not mode well for its longevity if it is successful, and this is before addressing the 2020 budget. Separately but related, the index of Italian bank shares has gained about 8% from the three-year low reached on August 13. After rising 2.7% in the first two sessions this week, it is trading a little heavier today as the negotiations intensify. President Matarella may give the parties a week to see if the talks can be successful, according to reports.

Much ink has been spilled noting that the details of Q2 German GDP showed weakness in exports, but that seems to be well understood and documented before yesterday’s report. What is more surprising is the extent of fiscal masochism. It is well beyond the “black zero” mantra of both the CDU and SPD. Consider that Germany had a 45.3 bln euro budget surplus (~$50 bln) in the first half of the year or 2.7% of GDP. Yes, German autos were overly dependent on diesel and China (and as China tries to facilitate a stronger auto market, Germany will benefit), but the fiscal tightness is part of the story too that is pushing Europe’s largest economy into a recession. The German economy has contracted in two of the past four quarters, and the Bundesbank recently warned that growth may not have returned here in Q3.

Like many of us, UK Prime Minister Johnson hears want he wants. Neither Merkel nor Macron endorsed a re-opening of the Withdrawal Agreement on substantive issues or a dilution of the backstop for the Irish border. Although you would not necessarily know it by listening to UK officials the ball is and has been in the UK court. In effect, the EU, which has been amazingly united in negotiations with the UK, says to the new UK government, ok, if you don’t like the backstop, come up with a viable alternative, of which merely jettisoning it is not an option. Johnson, like May, cannot square the circle. Specifically, this means continuing to honor the Good Friday Agreement while leaving the EU.

The euro is a 15 tick range below $1.11, where a 1.8 bln euro option expires today. The pre-weekend low was near $1.1050, and this is the risk if $1.1080 is taken out. Yesterday’s high was near $1.1115. Sterling rose to new highs for the month yesterday, poking briefly through $1.23. It is on its back foot today and approached the 20-day moving average around $1.2150 in the London morning. The UK parliament returns from its summer break next week, and there is talk that Johnson will seek to suspend parliament. Prorogue requires the Queen’s permission. It would be seen as overtly political to reject it, but given the purpose, to avoid a defeat in parliament, the Queen’s rejection to such a request could be in this Alice-in Wonderland world we live in could actually be on the side of democracy and representative government. Support is seen near $1.2130.

United States

The economic calendar is light today for North America. There are two features. Banixco’s inflation report and the Fed’s Barkin speaks in shortly after midday in Virginia. The economic calendar turns more active in the next couple of days, and it is a long weekend in the US, with the markets closed on Monday for Labor Day.

The op-ed piece from former NY Fed President Dudley, calling for the Federal Reserve not to sanction or enable President Trump’s trade policy by not cutting rates continues to be a big talking point. Even many who are critical of the Trump Administration think that Dudley went too far and may put the Fed in an awkward position, where it is “damned if does and damned if it doesn’t” cut rates. This seems to exaggerate the impact of the op-ed piece. The January fed funds futures closed unchanged yesterday, confirming no change in market expectations. The implied yield settled at 1.525% yesterday. The average effective fed funds rate is 2.12%, which implies almost 60 bp of easing has been discounted. The market remains convinced of two more rate cuts this year and is split on the third. It is that third cut that seems to be data-dependent. As we have noted before, the mid-course adjustment language is (intentionally?) reminiscent of Greenspan’s use of the term, which preceded a series of three rate cuts. We argue that the Fed’s mandate is to achieve full employment and stable prices amid financial stability. It does not have the luxury of choosing which shocks it responds to or whether it approves the shock or not. The issue is what kind of shock is hitting the economy. Is it financial, or is it in the real economy? On the other hand, we know that a financial shock could spill over, as in 2007-2008 and hit the real economy.

Argentina remains in focus today. The dollar rose 1.75% against the peso following comments by opposition leader Fernandez that complained that the IMF’s last loan simply financed capital flight, which seems at least partly true and especially after Fernandez won the recent primary. The peso’s decline would have likely been greater, but in seven operations, it sold a little more than $300 mln from its reserves to support the currency. The intervention was the most in the past year since Sandleris became Governor of the central bank. The failure to roll over the full ARS321 bln LELIQ that was also expiring may have contributed to pressure on the peso.

Separately, Brazil’s central bank also stepped up its intervention. A couple of weeks ago. Brazil’s central bank said it would auction dollars from its reserves and at the same time offer reverse currency swaps, which offset the intervention’ impact on reserve holdings. Yesterday it surprised with a dollar auction that was not sterilized, and this broke the real’s downward momentum. After the Argentine peso, the Brazilian real has been the weakest among emerging market currencies (-22% and -7.5% respectively, coming into today’s session) this month.

The Canadian dollar has fallen for six consecutive weeks as the market shifted toward pricing in a rate cut in October and it seems much of the move has taken place. A consolidative phase has materialized. The US dollar eased to a two-week low yesterday (CAD1.3225) but has returned to straddle the CAD1.33 area. The upper end of the range is near CAD1.3345. The dollar is also consolidating near the best level of the year against the Mexican peso and is hovering a little below MXN20.00. Support is seen near MXN19.90.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,ARS,Brexit,Currency Movement,EUR/CHF and USD/CHF,Federal Reserve,newsletter