Tag Archive: FX Daily

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

FX Daily, April 28: Oil’s Slides before Steadying, while Easing of Lockdowns Support Risk-Taking

Overview: Equities are building on yesterday's gains. The MSCI Asia Pacific Index rose 2% yesterday and edged higher today. Shanghai and Austalia stand out as exceptions. In Europe, the Dow Jones Stoxx 600 is extending yesterday's 1.8% gain to reach its best level since March 11. Today would be the fourth advance in the past five sessions. US shares are firmer.

Read More »

Read More »

FX Daily, March 18: Bonds Join Equities in the Carnage

Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again.

Read More »

Read More »

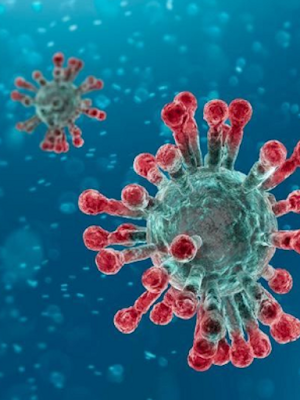

FX Daily, February 28: Fallout Accelerates

Overview: The dramatic response by investors to Covid-19 continues unabated and worse. The slide is accelerating. The S&P 500 posted a 4.4% loss yesterday, its worst session since 2011, and the sell-off is continuing. Many markets in Asia Pacific, including Japan, China, Korea, Australia, India, Singapore, and Thailand, fell by more than 3%.

Read More »

Read More »

FX Daily, February 26: Dramatic Investor Adjustment Continues

Overview: The warning by the US Center for Disease Control and Prevention that Americans should prepare for an outbreak of Covid-19 sent the S&P 500 tumbling to an 11-week low and the 10-year Treasury yield to a record low near 1.30%. The volatility of the S&P (VIX) jumped to its highest level since 2018. The sell-off in global equities continues unabated.

Read More »

Read More »

FX Daily, February 24: Stocks Slammed and Yields Drop as Virus Containment Fails

Overview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a nearly 4% decline. The national holiday in Japan spared local equities.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Daily, January 17: China and the UK Surprise in Opposite Directions

Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe's Dow Jones Stoxx 600 is at new record highs and appears set to take a four-day streak into next week. US shares are trading firmly.

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

FX Daily, December 11: Sterling Holds Firm Despite Tighter Poll

Overview: The capital markets continue to tread water as investors await this week's key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde's first ECB meeting at the helm. Global equities continue consolidating the recent gains. Asia Pacific equity markets were mostly higher.

Read More »

Read More »

FX Daily, December 6: And Now for the Employment Report

Overview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600 is paring this week's losses, but it is still off around 0.9% through the European morning session.

Read More »

Read More »

FX Daily, December 4: Hope Springs Eternal

Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide.

Read More »

Read More »

FX Daily, December 2: PMIs Provide Latest Fuel for Equity Markets

Mostly better than expected manufacturing PMI readings for December, including in China, is providing the latest incentive for equity market bulls. Led by the Nikkei, which was aided by a weaker yen major equity markets in Asia Pacific rallied and recouped most of the nearly 1% loss before the weekend. Europe's Dow Jones Stoxx 600 is also shrugging off the pre-weekend loss and to challenge the multiyear high recorded last week.

Read More »

Read More »

FX Daily, November 27: In Search of New Incentives

Overview: The global capital markets are subdued. There have been few developments to induce activity. Even President Trump's claims that the talks with China are in the "final throes" failed to excite. Equities are extending their advance. Bonds are little changed, and the dollar is mostly firmer. The MSCI Asia Pacific Index and Europe's Dow Jones Stoxx 600 advanced for the fourth consecutive session.

Read More »

Read More »

FX Daily, November 26: Some Are More Equal Than Others

Overview: Neither optimistic comments from Federal Reserve Chairman, that the economic glass is more than half full, nor a seemingly positive spin on the weekend fall calendar between Chinese and US officials have succeeded in deterring some profit-taking today.

Read More »

Read More »

FX Daily, November 25: Hong Kong, China, and UK Election Hopes Fan Modest Risk-Taking

Overview: The combination of the victory of the pro-democracy movement in Hong Kong and an apparent concession by China on intellectual property rights is helping bolster risk appetites to start the week. Equities are higher. Hong Kong's Hang Seng led Asia Pacific equities with a 1.5% gain, the second biggest this month. Korea and India's bourses also gained more than 1%.

Read More »

Read More »

FX Daily, November 22: Europe’s Flash PMI Disappoints and Hong Kong Shares Advance Ahead of Sunday’s Election

Overview: Equities in the Asia Pacific managed to mostly shrug off the drag of the losses in US equities yesterday. China and India could not escape the pull, but most other bourses were higher, led by Singapore and Hong Kong. It was the second consecutive week that the MSCI Asia Pacific Index fell. The US and European benchmarks are paring this week's small losses.

Read More »

Read More »

FX Daily, November 21: Markets Hear What it Wants from China’s Chief Negotiator, but HK maybe New Obstacle

Overview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and follow-through selling was seen in Asia Pacific and Europe.

Read More »

Read More »

FX Daily, November 20: Dollar Snaps Back

Overview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1% declines in South Korea and Australia.

Read More »

Read More »

FX Daily, November 19: Hong Kong Stocks Rally as Stand-Off Continues

Overview: The run-up in equities continues to be the dominant development in the capital markets. Although the Japanese and South Korean bourses fell, the rise in Australia, China, Hong Kong, and Taiwan underpin the MSCI Asia Pacific Index. The Hang Seng's gains (1.5% on top of yesterday's 1.3% rise) is notable as the situation on the ground remains intense and unresolved.

Read More »

Read More »