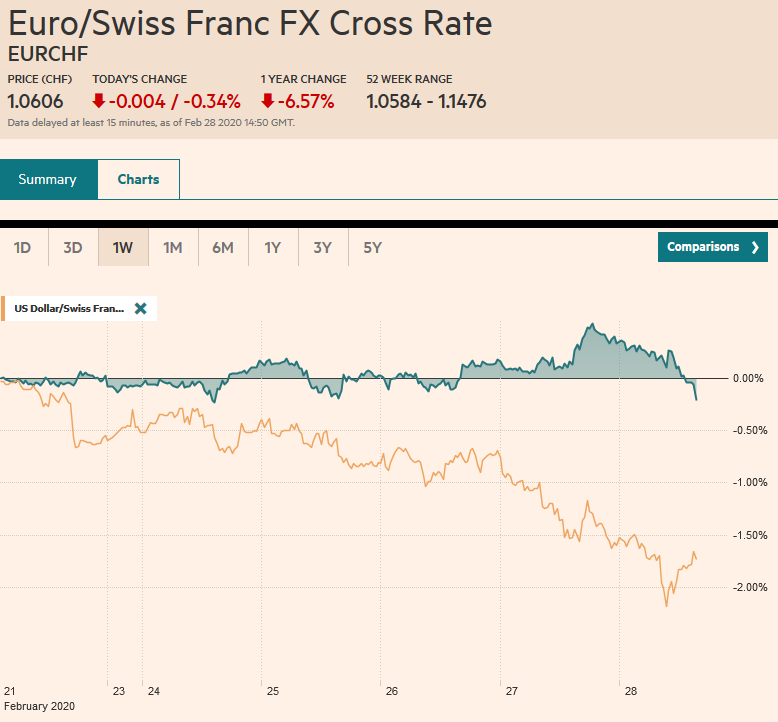

Swiss FrancThe Euro has fallen by 0.34% to 1.0606 |

EUR/CHF and USD/CHF, February 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The dramatic response by investors to Covid-19 continues unabated and worse. The slide is accelerating. The S&P 500 posted a 4.4% loss yesterday, its worst session since 2011, and the sell-off is continuing. Many markets in Asia Pacific, including Japan, China, Korea, Australia, India, Singapore, and Thailand, fell by more than 3%. The Dow Jones Stoxx 600 is off more than 3% near midday in Europe. Yields are tumbling (~5-9 bp today), which pushes the US 10-year yield below 1.2% and the 2-year yield below 1%. Peripheral European bond yields are rising as they are regarded as risk-assets. Italy’s 10-year benchmark yield is up 10 bp, accounting for half of this week’s increase. The US dollar continues to serve as the fulcrum of the foreign exchange market. The yen, Swiss franc, and euro, the main funding currencies, are extended their gains against the dollar, while the other major currencies, led by the New Zealand dollar (after the country’s first virus case has been reported). The JP Morgan Emerging Markets Currency Index has fallen every day this week (~ -1.75%) after four sessions last week(~ -1%). Gold is acting more like an asset than a safe haven. It was nearly flat on the week coming into today, and it is off about $15 today. The slide in oil prices is being extended for the sixth session. Today’s 3.6% drop brings the cumulative fall to about 16% as it threatens to push below $45. |

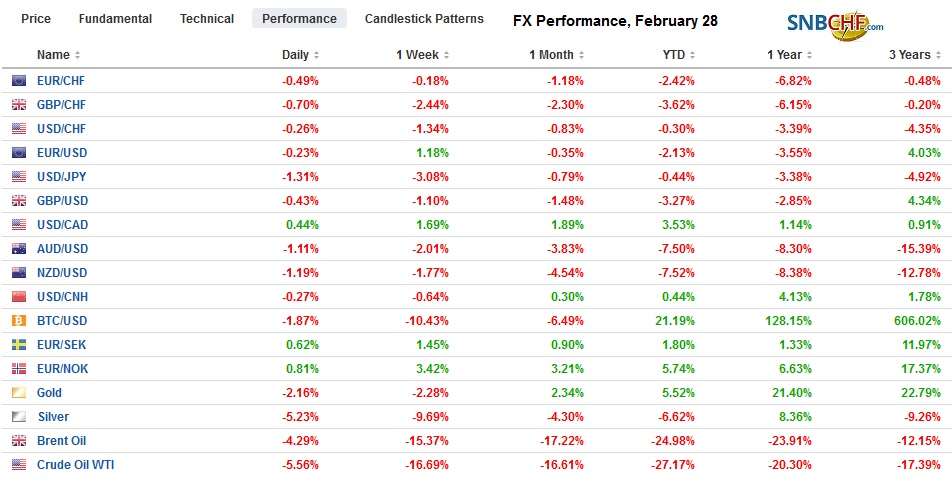

FX Performance, February 28 |

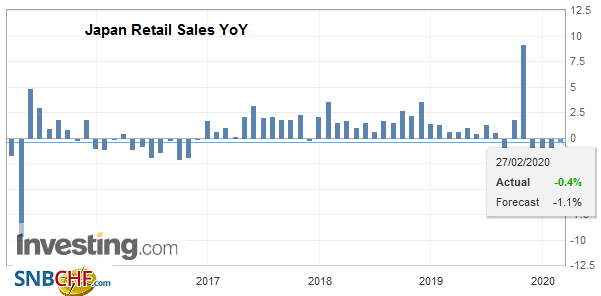

Asia PacificWhile many economists are warning that the Japanese economy may contract this quarter, Tokyo reported stronger than expected January retail sales and industrial production. The 0.6% rise in retail sales compares with a median forecast in the Bloomberg survey for a 0.1% decline. Industrial output rose by 0.8%. The median in the Bloomberg survey was for a 0.2% gain. On the other hand, the employment data disappointed. The January employment rate unexpectedly rose to 2.4% from 2.2%, and the jobs to applicant fell below 1.50 for the first time since May 2017 after a methodological change. |

Japan Retail Sales YoY, January 2020(see more posts on Japan Retail Sales, ) Source: investing.com - Click to enlarge |

South Korea rolled out some fiscal measures that include rental subsidies for small businesses and a temporary tax break on auto purchases. An extra budget is being planned. Separately, Korea reported January industrial output fell 1.3%, which was slightly better than expected. The report likely picks up the distortion of the Lunar New Year more than that impact of the virus. Cases in Korea have surpassed 2000. Australia’s Prime Minister Morrison indicated that a modest and targeted fiscal stimulus is being put together.

It appears China is slowly returning to work. Bloomberg estimates that it was operating at 60%-70% of normal up from 50%-60% last week. Meanwhile, banks, apparently under pressure, are not reporting delinquencies and granting borrowers forbearance and allowing them to skip debt servicing payments, according to press reports.

The dollar finished last week near JPY111.60. It is now near JPY108.60. Today’s nearly 1% drop brings this week’s loss to about 2.7% this week to end a three-week rally. It finished January near JPY108.35. There is an option for almost $740 mln at JPY108.70 that expires today. A break of JPY108.30 (200-day moving average is ~JPY108.40) would bring the year’s low (~JPY107.65) into view. The Australian dollar has risen twice in the past 11 sessions and is lower again today. It has risen in one week so far this year and is off about 1.5% this week. Australia’s 10-year yield is at record lows (~81 bp). The central bank meets next week, and about a 30% chance of a cut appears to have been discounted. A break of $0.6500 would target the $0.6400 area, but more observers are talking about the 2008 low near $0.6000. The US dollar finished the mainland session below CNY7.0 today for the first time since February 19. It fell by almost 0.7% this week, which offsets the gain from the previous week in full. Officials have helped facilitate an amazingly steady yuan over these past two chaotic weeks.

Europe

France reported January household consumption unexpectedly fell 1.1%. Economists in the Bloomberg survey had a median forecast for a flat report after a 0.3% decline at the end of last year. Separately, it confirmed that the economy contracted by 0.1% in Q4 19. France, along with Germany and Italy, is reporting February inflation figures ahead of next week’s aggregate report. French CPI was flat in February for a 1.6% year-over-year increase, slightly less than January. Deflationary forces are tightening their grip on Italy. Consumer prices fell by 0.4% in February. CPI has fallen in three of the past four months. The year-over-year rate is at a lowly 0.3%.

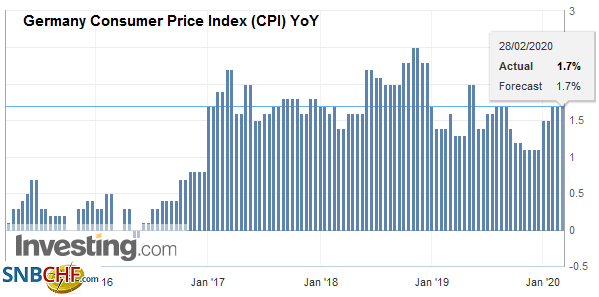

| German states reported a mixed month for CPI, and the net effect is expected to produce an unchanged year-over-year rate of 1.6%. Germany’s EU-harmonized measure rose by 1.7% in 2018 and 1.5% in 2019. Italy’s lower inflation is a way to close the competitive gap, and Itay’s external sector (net exports) seems to be reflecting this, at least in part. |

Germany Consumer Price Index (CPI) YoY, February 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

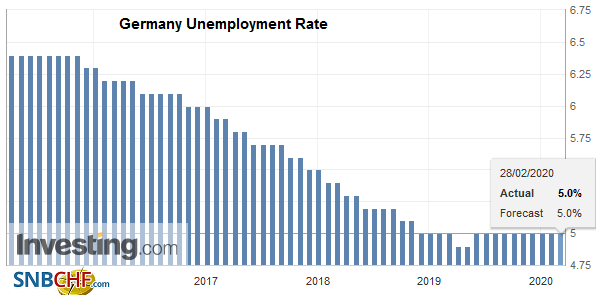

| Lastly, we note that German unemployment queues fell by 10k in February, while economists had forecast almost a 5k increase. It is the third decline in four months, but the President of the Bundesbank warned that its 0.6% GDP forecast for this year was being jeopardized by the virus. |

Germany Unemployment Rate, February 2020(see more posts on Germany Unemployment Rate, ) Source: investing.com - Click to enlarge |

The euro has risen by around two cents this week as short-covering, and the unwinding of carry-trades drove it a little through $1.1050. Recall that it finished last year near $1.1240 and fell to roughly $1.0780, which was tested as recently as a week ago. This week’s gains have nearly retraced (61.8%) of the decline (~$1.1065). Above there, the market will test the February high and the 200-day moving average near $1.11. There is an option for about 775 mln euros at $1.1055 that expires today. Initial support is seen near $1.0980. Note that on Monday, there is an option at $1.10 for 2.8 bln euros that will be cut. For its part, sterling is flat within yesterday’s range (~$1.2860-$1.2945). It rose once this week and once last week after a five-day advance was recorded (February 10-14). Sterling’s lowest weekly close this year was the first week in February near $1.2890. This is at risk today. Bounces appear to have become increasingly shallow, and a break of the $1.28 area would likely trigger stops. It has not traded below there since last November.

America

There is talk that Fed Chairman Powell will be meeting other central bankers this weekend, which is spurring speculation of coordinated action. This does not seem particularly likely even though the derivatives markets are showing a bias toward easier monetary policy. The ECB and BOJ policy rates are below zero, and each has expressed a reluctance to consider additional rate cuts now. The ECB wants governments with fiscal space to use it. The market has been very aggressive in pricing in Fed cuts. The implied yield of the December 2020 fed funds futures contract has fallen by more than 40 bp this week and 50 bp over the past two weeks. The market appears to have priced in the risk that the first cut is delivered by the March 18 meeting.

Fed officials have given no sign that this is even a remote possibility, and some economists have pushed back against expectations of a Fed cut claiming that monetary policy is not an effective tool for the supply shock of Covid-19. Yet, if growth potential is falling, R* (neutral interest rate) is lower than it previously was, and that means that monetary policy is tighter than perceived. Last year, when the Fed cut three times, the logic was always the same and is directly applicable now. With inflation below target in the US, insurance to extend the recovery is cheap. Judging by some of the corporate announcements, the impact of the coronavirus is arguably just as potent and disruptive, if not more so, that last year’s trade and Brexit risks.

US data is expected to continue to show a reasonably good start to the year. Personal income, the fuel of consumption, is expected to have increased by 0.4% in January while consumption is expected to match December’s 0.3% increase. The deflators are expected to tick up to 1.8% and 1.7% for the headline and core measures, respectively. The merchandise trade balance for January is forecast to be little changed around $68.5 bln. A rise in wholesale and retail inventories are also expected. The Chicago PMI is projected to rise from the January reading of 42.9 but will remain below the 50 boom/bust level. Lastly, the University of Michigan’s consumer confidence is expected to have softened.

Canada reports Q4 GDP. It is expected to have slowed markedly to 0.3% annualized from 1.3% in Q3. The Bank of Canada meets next week, and the market is pricing in about 8 bp of easing or about a 30% chance of a cut. A week ago, there was a little more than a 20% chance of a cut. Mexico has reported a monthly trade surplus last November and December. It likely swung back into deficit in January. Mexico’s typically reports among the largest monthly deficits in January for the year.

The precipitous decline in oil prices and equities have offset the larger US discount to Canada on two-year borrowing (now around 28 bp vs. 6 bp a week ago) on the Canadian dollar. The Canadian dollar has fallen about 1.65% this week against the greenback, largely in line with the other dollar-bloc currencies. The US dollar is traded at its best level against the Loonie since May 2019 as it pushes above CAD1.3450. Last June’s high was near CAD1.3565, but last year’s high was closer to CAD1.3665. The US dollar also trading at new highs for the year against the Mexican peso. Near MXN19.80, the dollar has risen about 4.7% this week against the peso after last week’s nearly 2% advance.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,COVID-19,Currency Movement,EUR/CHF,federal-reserve,FX Daily,Germany Consumer Price Index,Germany Unemployment Rate,Japan Retail Sales,newsletter,USD/CHF