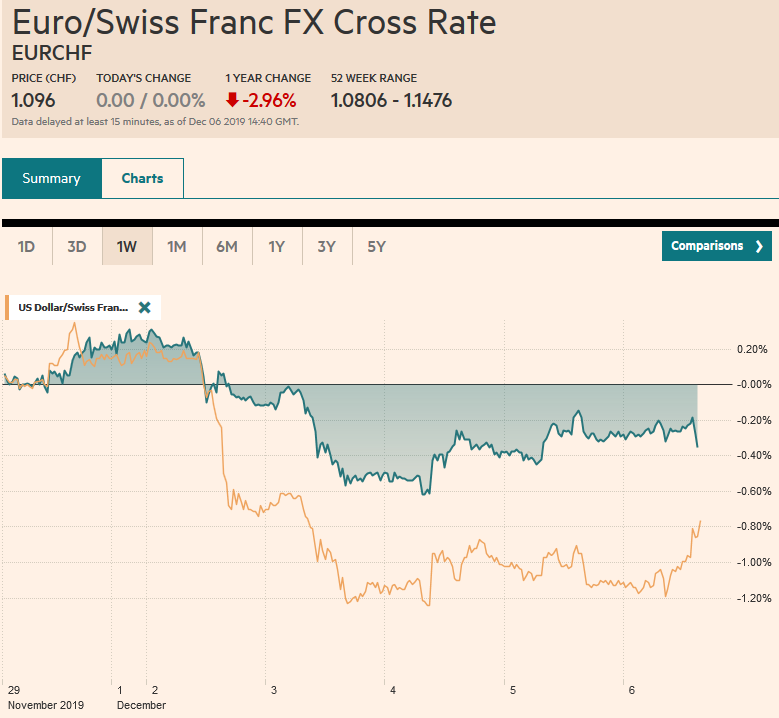

Swiss FrancThe Euro has risen by 0.26% to 1.0977 |

EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600 is paring this week’s losses, but it is still off around 0.9% through the European morning session. US shares are also firmer, and much depends on the reaction to the employment data, but the S&P 500 is off about 0.75% for the week ahead of the jobs report. Benchmark 10-year bond yields are narrowly mixed on the day. Yields in the East were 2-3 bp firmer, while European yields are a little lower. The US 10-year is dipping back below 1.80% and is off about 2 bp on the week ahead of the jobs report. The dollar is mostly quiet. Sterling is slipping on profit-taking ahead of the weekend, and near $1.3130 is still up 1.5% this week. The New Zealand dollar is the strongest of the majors today, gaining 0.3% to bring the weekly rise to about 2.2%. It is the fourth consecutive weekly advance, and if today’s gains are maintained, it would be the biggest gain since early 2017. Growing confidence that the economy is past the worst, in contrast to Australia, has helped underpin the Kiwi. Emerging market currencies are mostly firmer, and the JP Morgan Emerging Market Currency Index is up for a third day and has gained nearly 1% this week to end a five-week drop. Gold is a little softer on the day, but near $1.475, it is up about 0.7% on the week, the best since the end of October. Oil prices are flat as this week’s strongest gain since in nearly six months (~5.8%) are consolidated as the market tries to make sense of the 500k barrel a day cut that OPEC is discussing. |

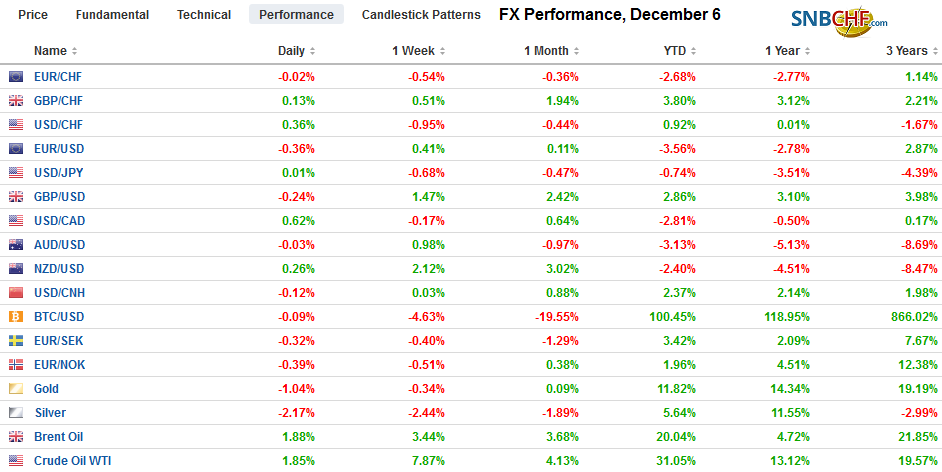

FX Performance, December 6 |

Asia Pacific

Many observers’ understanding of the main obstacle to the so-called phase one of a trade agreement between the US and China is split between Beijing’s demand for tariff roll back and Washington’s demand for a fixed dollar amount of the Chinese agriculture market that will be reserved for US farmers. This is the basis of a potential quid pro quo. Trump had previously claimed that phase one was about 60% of the overall agreement he envisaged. Therefore, the logic would seem to be that 60% of the tariffs should be unwound, and that does not count the December 15 threatened tariff. The US is reluctant because the tariff is understood as the way to ensure compliance, and Trump insists it cannot be a fair deal because China has the advantage now. The US bilateral deficit with China has fallen by about $50 bln this year, but this has done very little for the overall US trade balance. The average deficit so far this year is a little more than $52 a month. In the first ten months of 2018, the monthly average shortfall was $51.3 bln.

Japan’s household consumption tanked in October as the sales tax increase had brought purchases forward, and the typhoon aggravated an already weak situation. The 5.1% year-over-year drop was half again as large as expected, though it is not quite as bad as the month after the last time Japan hiked the sales tax (April 2014 and in May spending imploded 8%). There appear to be downside risks to the forecasts that the Japanese economy is contracting at an annualized pace of 2.7% here in Q4. Separately, adjusted for inflation, real cash earnings rose 0.1% year-over-year in October, which may help illustrate why a sales tax increase from 8% to 10% can be disruptive.

The US dollar is in about a fifth of a yen range through the European morning. The dollar consolidating its biggest loss against the yen in two-months, having fallen by about 0.8% this week (~JPY108.60). Resistance is seen in the JPY108.80-JPY109.00 area today. The week’s low was set a little below JPY108.45. Despite some disappointing data this week, the Australian dollar has risen in three of the four sessions coming into today and is firm today though within yesterday’s range. Thus far today, it has been confined to less than a fifth of a cent range above $0.6830. It is up about 1.2% for the week to end a four-week drop. The Chinese yuan is edging higher today for its third consecutive advance. It is virtually flat on the week.

Europe

Germany disappoints. The unexpected decline in October factory orders reported yesterday was followed a stunningly poor industrial production data today. There was a broad range of forecasts in the Bloomberg survey from a 0.6% gain to a 0.7% loss. It actually dropped 1.7% on the month and drove the year-over-year decline to 5.3%, the most since the Great Financial Crisis. The output of autos and machinery remains depressed, leading to a 4.4% decline in capital goods production. However, there were more positive impulses from consumer goods (0.3%) and basic goods (1.0%). The magnitude of the drop warns that next week’s aggregate report for the EMU will be weaker than the 0.2% decline that economists had forecast.

The weakness of factory orders and industrial output is not likely to substantially change the debate in Germany. It seems that nearly every observer outside of Germany wants Berlin to boost fiscal spending, but the government remains reluctant. The German political and economic elites, for the most part, do not embrace Keynesian demand management through fiscal policy that dominates the thinking in so many other countries. It appears to require a political change in Germany to alter this. The Social Democrats, the junior party in the Grand Coalition with Merkel, concludes its conference this week. Despite the selection of new leaders that are critical of the coalition agreement, there is a reluctance to leave the coalition immediately and force elections. It would do miserably. However, the likely strategy that will be embraced may call for new demands from Merkel’s CDU/CSU that may still lead to political tensions in Germany next year.

The euro is in a narrow range as it straddles the $1.11-level. Wednesday’s range (~$1.1065-$1.1115) is still operative. In the bigger picture, the euro has been in a roughly $1.10-$1.12 range for two months. There is an option for about 800 mln euros at $1.11 that expires today and a slightly larger option at $1.1075 that also will be cut. Sterling reached $1.3165 yesterday to extend the re-pricing exercise for a fifth consecutive session. However, the buying interest faded, and sterling is struggling to maintain positive momentum today. Initial support is seen near $1.3100, where a GBP753 mln expiring option is struck. There is another option for GBP335 mln at $1.3170 that also expires today.

America

Barring a significant surprise, today’s US employment data are unlikely to change minds about the state of the economy. Growth in Q4 is slowing, and the question is the magnitude and significance. Our back-of-the-envelop estimate of 1% is not looking out of place. The significance may lie with whether there is a recovery in the first part of next year. The return of the GM strikes will inflate the rise in November non-farm payrolls. If one adds 40k (last month, the US lost 36k manufacturing jobs to October’s 128k one gets to the year’s average (~167k), and the median forecast in the Bloomberg survey is for a 183k. Most but not all of the labor market readings, like the ADP estimate, the four-week average of weekly initial jobless claims for the survey week, and the Conference Board’s job availability point warn of a disappointment. The Empire State and Philadelphia Fed surveys point in opposite directions. The ISM manufacturing survey showed some weakness, while the non-manufacturing survey found growth. The unemployment rate may have slipped back to 3.5%, the trough after ticking up to 3.6% in October. Hourly earnings a likely to have held steady at 3.0%, having peaked in February at 3.4%. The average workweek is expected to have remained at 34.4 hours.

Canada reports November employment data, as well. Canada’s job market has performed better than America’s this year. Consider that, on average, it has created 28.3k full-time jobs a month, which is twice the pace of the first ten months of 2018. The economy is roughly one-tenth the size of the US. Canada lost 16k full-time jobs in October after gaining almost 100k in the previous two months. Full-time posts are expected to have risen around 10k in November. Permanent full-time workers saw their average hourly rate increased 4.4% year-over-year in October and may have ticked back up to the cyclical high of 4.5% in November.

Around CAD1.3180, the US dollar has fallen about 0.8% against the Canadian dollar, the most in nearly two months. The more constructive tone of the Bank of Canada has been the main driver. It has hardly moved today as the employment data are awaited. Canada’s jobs data last month disappointed, and another disappointment could see the Canadian dollar underperform almost regardless of the US report. We note that the Canadian two-year premium over the US widened to nearly nine basis points, the most in two-years. As we have argued before, rather than a linear relationship, the relationship between interest rate differentials and the dollar may be cyclical, and the last phase of a significant dollar rally seems to be signaled by interest rate differentials moving against the greenback.

Latam currencies have been battered recently, but this week, several have recovered, and this has taken some pressure of the Mexican peso. The dollar peaked on Tuesday near MXN19.63, below the previous week’s high (~MXN19.67), and has trended lower. A loss today would extend the pullback for the fourth session. It traded to almost MXN19.34 yesterday and is still offered today. The next support area is seen around MXN19.26-MXN19.28. While there have been some positive signals about the USMCA, the market is less sanguine. This is reflected at PredictIt, where odds of passage this year by the US Congress has been halved to 15% from the start of the week.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,EUR/CHF,FX Daily,jobs,newsletter,USD/CHF