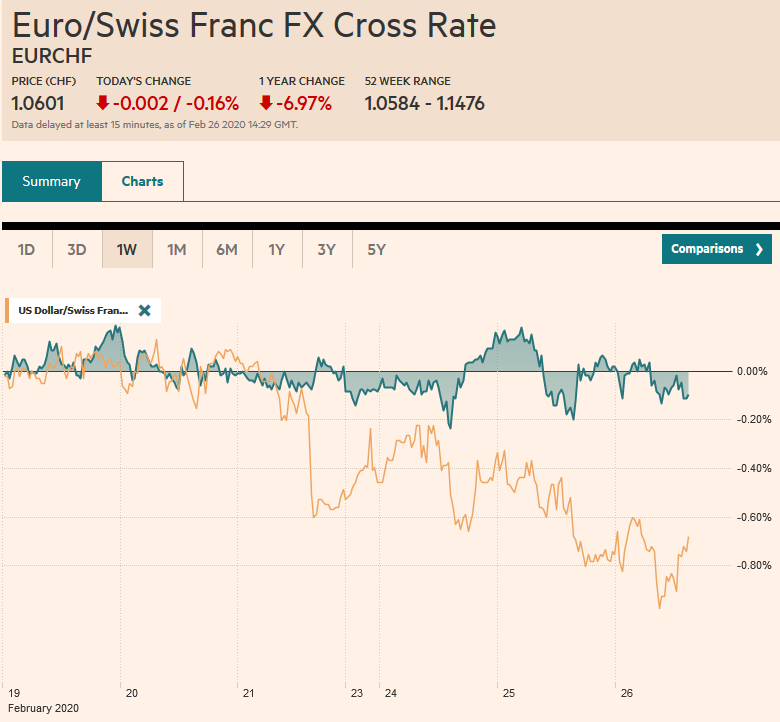

Swiss FrancThe Euro has fallen by 0.16% to 1.0601 |

EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The warning by the US Center for Disease Control and Prevention that Americans should prepare for an outbreak of Covid-19 sent the S&P 500 tumbling to an 11-week low and the 10-year Treasury yield to a record low near 1.30%. The volatility of the S&P (VIX) jumped to its highest level since 2018. The sell-off in global equities continues unabated. Thailand (-5%) and Australia (-2.3%) led the carnage in the Far East. The MSCI Asia Pacific Index was sold through its 200-day moving average yesterday, and the Dow Jones Stoxx 600 did so in early morning activity today after gapping lower. However, as the morning progressed, the benchmark was paring its losses and moved back above its 200-day moving average. US shares have pared their earlier losses. The 200-day moving average is a couple percentage points lower near 3045. Bond yields are not responding as strongly to the fifth consecutive losing session for global equities as they did previously. Most core yields are slighter softer, while the European peripheral bonds are being shunned like risk assets, and yields are mostly 3-5 bp higher there. The US 10-year is near 1.33%. The dollar is mixed, but firm against most of the major currencies, but the Swiss franc and the euro. The Australian dollar and sterling are the weakest so far today, off about 0.4%. The JP Morgan Emerging Markets Currency Index is trading at new multi-year lows, led by the South African rand, Korean won, and Mexican peso. Gold, which counter-intuitively fell yesterday (~-1.5%), is back on track, gaining around 1% today. Demand concerns and rising US inventories have pushed April WTI briefly below $49 a barrel. |

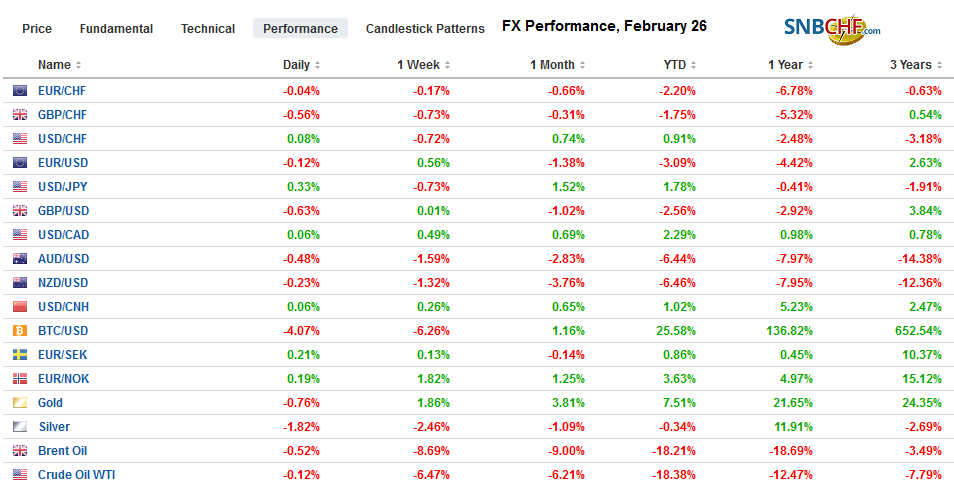

FX Performance, February 26 |

Asia Pacific

There has been a dramatic market reaction in the last few days, but as recently as this past weekend at the G20 meeting, the IMF seems to be naively in denial. It shaved its 2020 world growth forecast by 0.1%. Given the accuracy of private and public sector economists in forecasting GDP, a 0.1% adjustment gives a sense of precision that is not justified. The IMF also shaved its forecast for China by a little more, but at 5.6%, it is still unreasonably high. It said it was looking at more dire scenarios.

It is still five months away, but the Tokyo Olympics will likely be at risk if the coronavirus cannot be contained in the next two-three months, according to the longest-serving senior official on the International Olympics Committee. More likely than relocating or rescheduling the games, the Olympic official, suggested they would be canceled. The decision would be made in conjunction with the World Health Organization.

Hong Kong is taking bold action. It unveiled a stimulus program that is worth a little more than 4% of (2018) GDP. It includes a one-time cash disbursement of HKD10k ($1285) per person. The deficit will widen from 1.3% to about 4.8% of GDP. Even with the fiscal support, the economy may still contract as much as 1.5%, according to officials, or grow by as much as 0.5%. Separately, Hong Kong reported a sharp fall in January exports (-22.7%) and imports (-16.4%). The decline was a combination of the Lunar New Year, fewer working days, and the coronavirus disruption.

The dollar recovered from the dip yesterday below JPY110 to reach almost JPY110.60 in Tokyo. Technically, near-term potential extended to JPY110.80-JPY111.00. There is a roughly $500 mln option that expires today at JPY110.45. Over the past three sessions, the Australian dollar had carved a shelf near $0.6585. It was sold through there before Europe opened and is struggling to regain its footing. Still, the intraday technicals suggest it can occur in the North American session. The PBOC set the dollar’s reference rate at CNY7.0126, a little weaker than the bank models implied. The dollar continued to knock on the KRW1220 area for the third session. The three-year high recorded in 2019 is found near just above KRW1223. Tomorrow the central bank is widely expected to deliver a 25 bp rate cut (to 1%).

Europe

While the market is pricing in aggressive Fed easing, with a little more than two rate cuts discounted, it sees little from the ECB. The ECB’s deposit rate stands at minus 50 bp, but the effective rate is closer to minus 45 bp. The overnight index swaps are a couple of basis points lower over the next couple of months. By the end of the year, there appears to be about 10 bp of easing priced into the OIS market.

Italy, which has been most infected by the Covid-19 in Europe, is economically vulnerable after contracting by 0.3% in Q4 19. After rising to its best level in about a year and a half on February 18, an index of Italian bank shares fell almost 18% to today’s lows, from which it is staging a bit of a rebound. By late in the morning, the bank index has turned marginally higher on the day, as the four-day skid slows.

The euro’s modicum of strength in recent days has surprised many observers, though our reading of the charts suggested this was likely. The recent resilience appears to be similar to the Swiss franc and yen. While conventional wisdom thinks of it as safe-haven, it seems the driver is really the use of those currencies by institutional and levered participants to fund their purchases of higher-yielding or more volatile assets. As those higher-yielding or more volatile assets are sold, the funding currency is bought back. The unwindings of these trade structures spur a short-covering bounce.

The euro reached a two-week high earlier today a little shy of $1.09, meeting the (38.2%) retracement objective of this month’s decline. It appeared to run out of steam in early European activity in the $1.0890-$1.0900 area was approached, which houses expiring options for 2.5 bln euros. There is another option at $1.0870 for 855 mln euro that rolls off today and option for 1.8 bln euros at $1.0850 that also expires today. A move above $1.09 runs may run into resistance near the 20-day moving average (~$1.0910) that has held on an intraday basis since February 3 and the next retracement objective (~$1.0935). Sterling closed above $1.30 yesterday for the first time in a week but is surrendering those gains today. It is approaching yesterday’s low near $1.2915. The intraday technical studies suggest some corrective upticks are likely in North America today.

America

The CDC warning stands in stark contrast to the reassuring words offered Trump and Kudlow. Clarida, the Vice-Chair of the Federal Reserve, repeated the mantra of the economy and policy being “in a good place.” He said it was too soon to speculate on the virus impact, but that is, in part, the anticipatory mechanism of the market and is arguably warning officials that the downside risks are mounting. Ironically, even a few days ago, some observers were warning that the market was under-estimate the significance of Covid-19. The market has adjusted. The S&^P 500 is off about 8% over the past four sessions. Yields have tanked. The 30-year Treasury yield (~1.81%) is continuing to fall below the Fed’s 2% inflation target, and the 3-month to 10-year yield curve is increasingly increasing inverted. The December 2020 Fed funds futures contract implies a 1.0% average rate at the end of the year.

Today’s North American calendar is light. The two main reports are the US January new home sales and Mexico’s December 2019 retail sales. Existing homes sales fell in each of the last three months of 2019 but are expected to have begun the new year with a pop. A 3.5% increase would bring new home sales to a 718k annual rate. The cyclical high was set last June near 729k. Mexican data from last year was rendered moot by Q4 GDP revision yesterday, showing the economy contracted by 0.1% in the quarter for a 0.5% contraction year-over-year.

Speculation that the Bank of Canada could cut rates as early as next week, coupled with the drop in oil prices and the risk-off move, keeps the Canadian dollar on the defensive. The US dollar continues to straddle the CAD1.3300 area. There is an option for $550 mln at CAD1.3310 that expires today. Initial support is seen near CAD1.3265. The unwinding of carry trades continues to weigh on the Mexican peso. Just like it had been the best performer this year, it has been the worst since the start of the last week, shedding about 3.25%. A move above MXN19.22 finds little resistance until the MXN19.50-MXN19.60 area. The Dollar Index peaked on February 20, near 99.90. It has found support a big figure lower. Resistance is seen in the 99.30-99.40 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,EUR/CHF,FX Daily,Hong Kong,Italy,newsletter,Olympics,USD/CHF