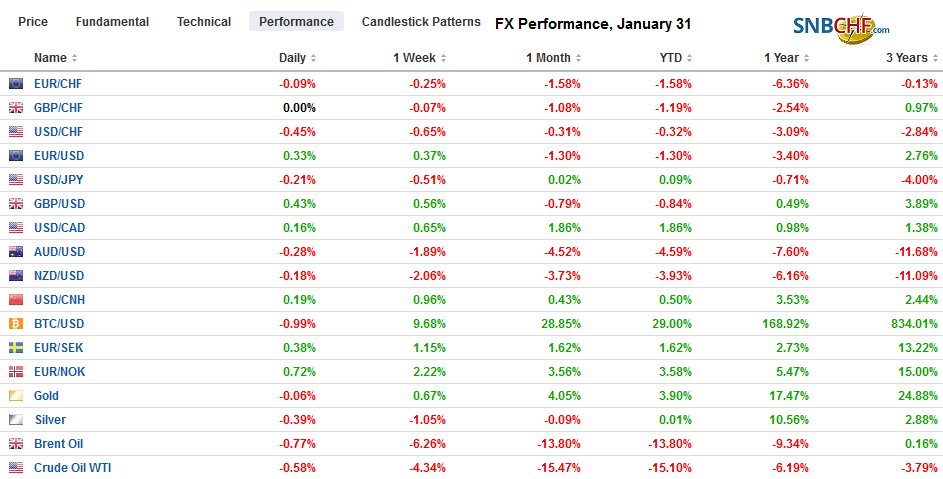

Swiss FrancThe Euro has fallen by 0.09% to 1.0681 |

EUR/CHF and USD/CHF, January 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It was as if the World Health Organization’s recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled. In the Asia Pacific, Japan, Taiwan, and Australian equities firmed, while disappointing data weighed on European equities. The Dow Jones Stoxx 600 is off about 2.5% this week, its largest decline in October. The S&P 500 is trading about 0.5% lower. Benchmark 10-year yields are edging lower. The US 10-year is holding below 1.60% for the second consecutive session, and the 30-year is just above 2.0%. The dollar is mostly higher, with sterling resisting the tug as the UK is prepared to leave the EU tonight. Emerging market currencies are also heavy, as risk is mostly shunned. The JP Morgan Emerging Market Currency Index is off 1.25% this week, the most since last August. Gold is firm, and near $1580 is up a little more than 0.5% on the week. Oil is steady to firmer today, but March WTI is down 3.25% this week, its fourth consecutive weekly loss, and is holding just above key support near $52 |

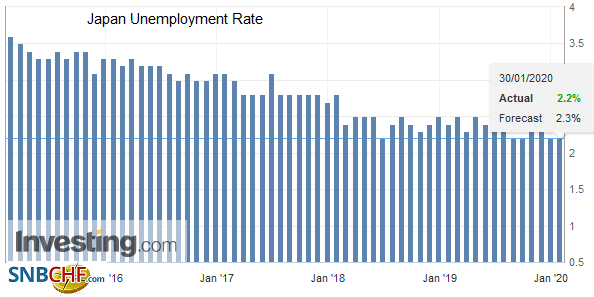

FX Performance, January 31 |

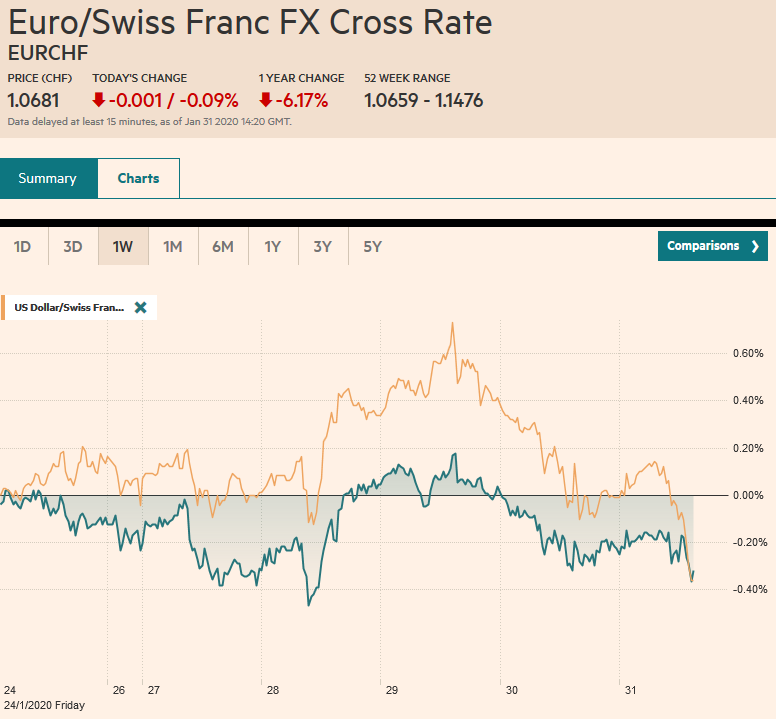

Asia PacificThe World Health Organization declared a global health emergency, which is a cue for more national and international action and resources. At the same time, it opined that restrictions on travel and trade were unnecessary now, though it does not clear than any actual curbs have been rescinded. WHO officials also praised China national leaders for their aggressive response, which included building a new hospital in 10 days. However, it appears local officials may have been slow to respond initially. China’s official PMI did not show the stress of the coronavirus but did indicate the manufacturing sector was vulnerable before the health crisis. The January manufacturing PMI slipped to 50.0 from 50.2. The non-manufacturing sector performed better, rising to 54.1 from 53.5. The composite eased to 53.0 from 53.4. The officially extended Lunar New Year holiday ends February 2, but provinces and cities that account for around 2/3 of the country’s GDP will remain shut for about another week. |

China Manufacturing Purchasing Managers Index (PMI), January 2020(see more posts on China Manufacturing PMI, ) Source: investing.com - Click to enlarge |

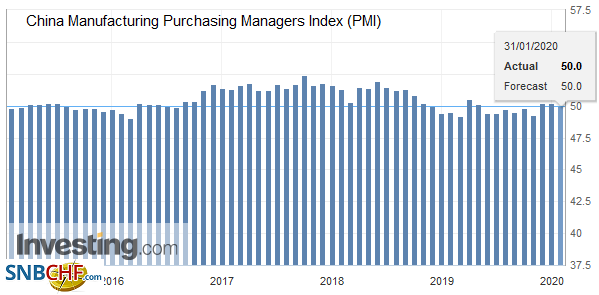

| Japan’s retail sales disappointed, but the industrial output jumped 1.3%, its first increase in three months. December retail sales rose by 0.2% compared with expectations for nearer a 1% gain. Recall that retail sales plummeted in October (sales tax increase and typhoon) and surged 4.5% in November. The rise in industrial production featured a strong rise in equipment that produces flat panel displays. Nevertheless, industrial output fell about 4% in Q4 and will drag GDP lower. Japanese unemployment was steady ay 2.2%, a 27-year low. Separately, South Korea also reported better than expected industrial output figures for December. The 3.5% jump was the most in three years. Expectations for less than a 1% increase. The data is consistent with an uptick in the region before the coronavirus struck. |

Japan Unemployment Rate, December 2019(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

The dollar rose to almost JPY109.15 before falling out of favor and slipped back to session lows below JPY108.90. However, the intraday technicals suggest the downside may be limited ahead of the weekend. At the same time, there are about $1.2 bln in options struck between JPY109.00 and JPY109.20 that expire today that suggest progress to the upside will be slow in any event. The dollar has closed lower against the yen in eight of the past ten sessions. The target of the head and shoulders top in the Australian dollar projects toward $0.6670, and with today’s loss, it is has approached $0.6680. The intraday and daily technical indicators are stretched, and it is through its lower Bollinger Band (two standard deviations below the 20-day moving average) seen a little below $0.6710. The US dollar edged up against the offshore yuan (CNH) and has risen by almost 0.9% against it since the mainland market closed. A commensurate move against the onshore yuan puts the dollar close to CNY7.0.

EuropeAt his last meeting as BOE Governor, Carney pulled the proverbial rabbit out of a hat. Many observers had counted five officials that had sounded particularly dovish lately, including Carney himself. The close call that investors collective discounted was not so close after all. It was the same 7-2 vote as the previous two meetings. The central bank cut its growth forecasts for this year and next by 0.4% to 0.8% and 1.4% respectively. Nevertheless, the message the market took away was one of a hawkish hold. The implied yield of the December short-sterling interest rate futures rose 5.5 bp to a two-week high, and sterling snapped a five-day losing streak. It successfully retested the week’s low near $1.2975 and rebounded to briefly trade above $1.3100. It is pushing above yesterday’s highs today. |

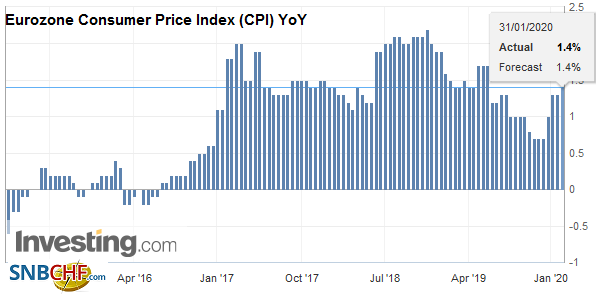

Eurozone Consumer Price Index (CPI) YoY, January 2020(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

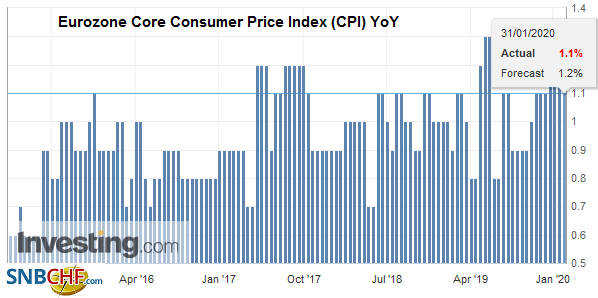

| News from the euro-area disappointed. France and Italy unexpectedly reported their economies contracted in Q4 19 (0.1% and 0.3%, respectively). Spain surprised on the upside with 0.5% growth. These national figures translate into Q4 EMU growth of 0.1% rather than the 0.2% economists expected after a 0.3% expansion in Q3. Compounding the challenge, consumer prices fell 1% in December, while the year-over-year rate edged up to 1.4% from 1.3%, while the core rate eased to 1.1% from 1.3%. |

Eurozone Core Consumer Price Index (CPI) YoY, January 2020(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The UK is set to leave the EU later today after a turbulent 47 years of membership. The British pound is firm, having reached a six-day high near $1.3140 in early European turnover. The intraday charts warn it may be difficult to extend the gains much more ahead of the weekend. Also, there is a GBP240 mln option at $1.3150 that will be cut today. Sterling finished last week just below $1.3100. The euro has been confined to about a fifth of a cent range today. Yesterday’s $1.1040 was the high for the week, and it will be challenged today. There is an option for roughly 975 mln euros struck there. Additional resistance is seen in the $1.1050-$1.1065 band.

America

Today’s report of December personal income and consumption data do not really offer new information. It was already embedded in yesterday’s estimate of Q4 GDP. The 2.1% annualized clip matched the Q3 pace, but the composition was different, though private non-residential investment fell (1.5%) for the third consecutive quarterly decline. Consumption was soft, rising at 1.8% down from 3.2% and disappointing forecasts for a 2% increase. Residential investment was the strongest in a couple of years, as we have seen with housing starts. Trade, as in net exports, contributed 1.48 percentage points to Q4 GDP, the most in a decade. Imports fell sharply, and this probably is not sustainable. Inventories shaved growth by nearly 1.1 percentage points. With the GM strike, auto part imports were impacted, cut inventories, and output (weaker auto output took about 0.8 percentage points off Q4 GDP). The underlying signal comes from the private final domestic sales, which excludes the government, trade, and inventories. It rose 1.4% at an annualized pace in Q4, the slowest in four years. Given Boeing’s output cuts in Q1 20 and the disruption caused by the virus, officials will likely look past Q1 data.

Canada reports November GDP figures today. They are too dated to have much impact. Economists expect the economy was flat after contracting by 0.1% in October. The year-over-year rate may have ticked up to 1.4% from 1.2%. Mexico reported Q4 19 GDP was flat yesterday, which was slightly better than fared. The year-over-year pace remained at 0.3% as it was in Q3. The central bank meets on February 13 and is expected to cut the 7.25% overnight target rate. Separately, the ink on the US signing of the USMCA hardly even dry, and Mexico warns that it will retaliate if the US carries through with threats of tariffs on Mexico’s seasonal produce exports.

The US dollar is rising against the Canadian dollar for the fourth session this week. It reached CAD1.3245, the highest level since December 10 and pushed above the 200-day moving average (~CAD1.3230) for the first time December 3. While we had expected the US dollar to recover after trading below CAD1.30 earlier this month, the technical indicators are now stretched. The risk-reward is shifting and may not favor new US dollar longs. The US dollar has edged up against the Mexican peso for the second consecutive week, over which time it has not even risen 1%. When risk appetites return, the peso is likely to be a major beneficiary.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China,China Manufacturing PMI,EMU,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,FX Daily,Japan,Japan Unemployment Rate,newsletter,USD/CHF