Tag Archive: FX Daily

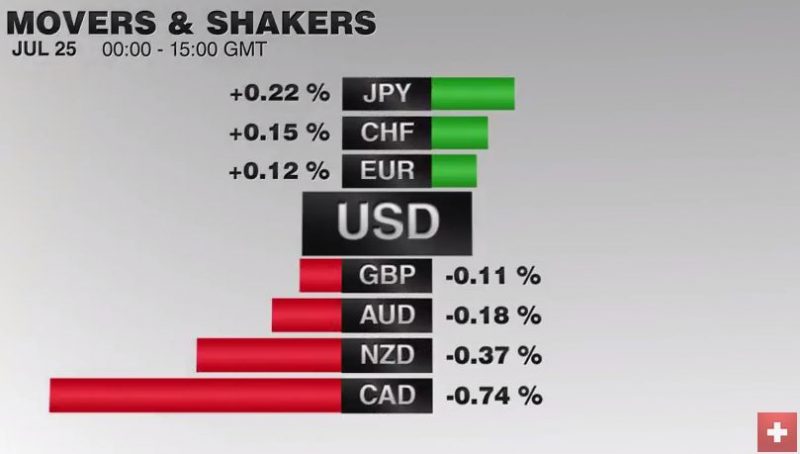

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »

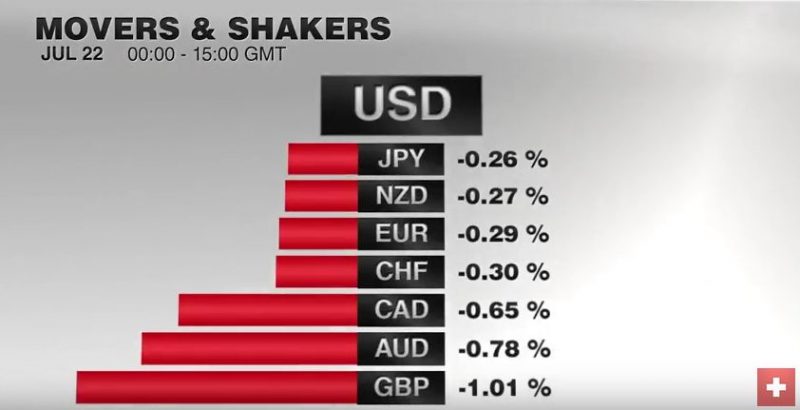

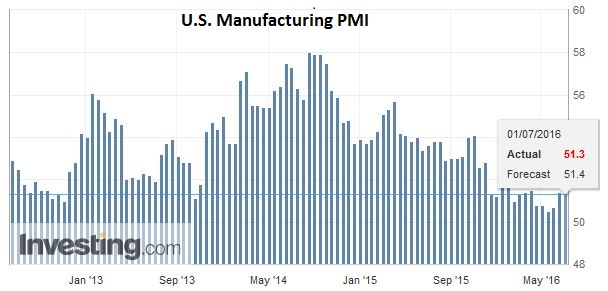

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »

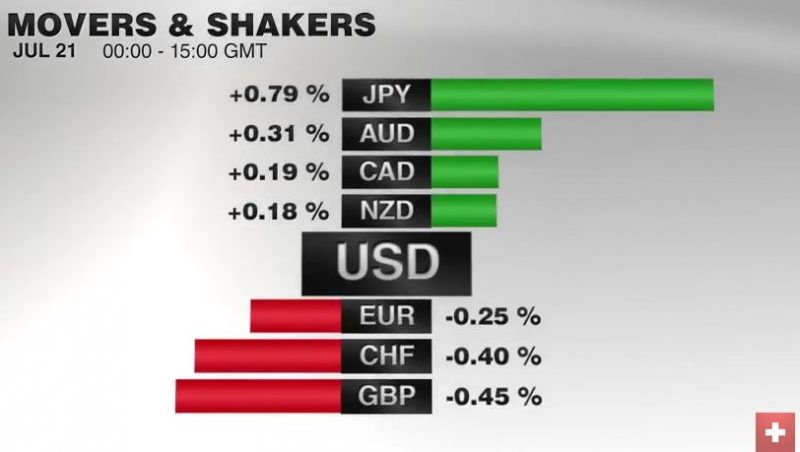

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »

FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

It is a bizarre turn of events. Just like the Game of Throne's Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered from the Brexit decision, equity markets have, and fear of contagion has died down.

Read More »

Read More »

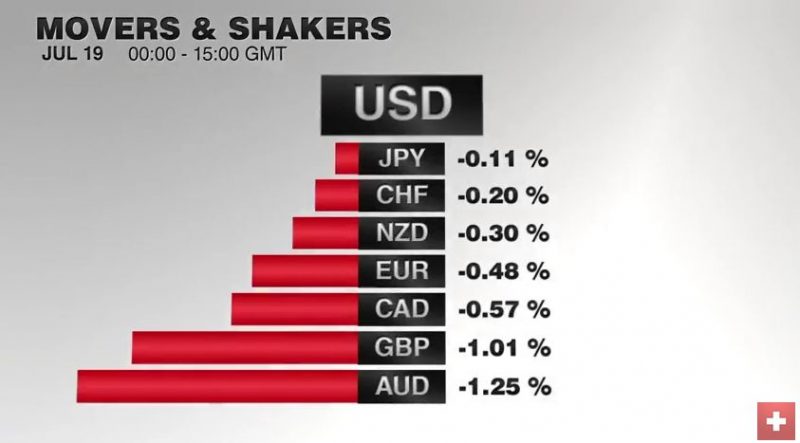

FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today.

Read More »

Read More »

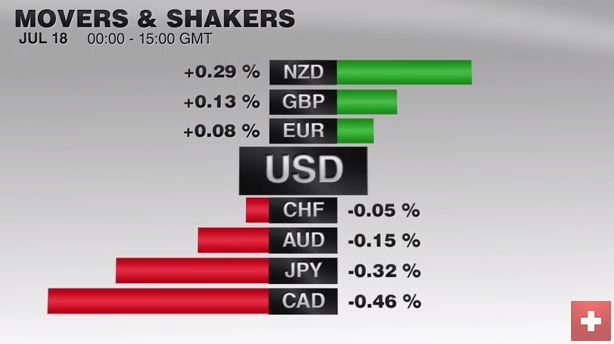

FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign direct investment and comments from a hawkish member of the MPC suggesting not everyone is onboard necessarily for a rate cut next month.

Read More »

Read More »

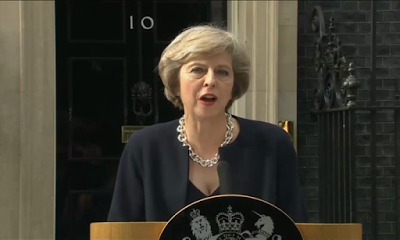

FX Daily, July 14: Will BOE Ease on May Day?

After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new government are particularly relevant. First, May demonstrates strategic prowess by putting those like Johnson and Davis, who campaigned for Brexit, to lead the negotiations with the EU, while putting Tories who favored remaining in the EU in the internal ministries.

Read More »

Read More »

FX Daily, July 13: Sterling and Yen Momentum Slows

The two main developments in the foreign exchange market this week in recent days has been the opposite of what has transpired over the past several weeks. Sterling moved higher quickly. The yen moved down just as fast. Over the past five sessions through late-morning levels, sterling has gained 2.5% while the yen has shed 2.8%.

Read More »

Read More »

FX Daily, July 12: Easing Political Uncertainty Encourages Animal Spirits

Further risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180.

Read More »

Read More »

FX Daily, July 11: Dollar Extends Gains

The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities.

Read More »

Read More »

FX Daily, July 07: Sterling Bounces Two Cents, but Does not Appear Sustainable

Amid a better if not strong risk appetite, sterling has rallied two cents from yesterday's lows near $1.28 to poke through the $1.30 level in the European morning. It was helped by an industrial production report that was better than expected. Industrial and manufacturing output fell 0.5% in May. This was around half of the expected decline after a strong April advance (2.1% and 2.4% respectively).

Read More »

Read More »

FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

What a difference a few days make. Many saw last week's equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now. Bond yields in the US, Japan, and Germany, are at new record low. Japan's 20-year bond yield briefly dipped below zero for the first time.

Read More »

Read More »

FX Daily, July 05: Sterling Hammered to New Lows, Yen Pops, SNB intervenes

The British pound has been hammered to fresh lows just above $1.3115. The euro is moving toward GBP0.8500. The immediate catalyst is three-fold. First, one of the UK's largest property funds has moved to prevent retail liquidation. Second, the BOE reversed an earlier decision on the capital buffer for banks, which is tantamount to easing policy by boosting the banks' lending capability by as much as GBP150 bln.

Read More »

Read More »

FX Daily, July 01: Markets Head Quietly into the Weekend

EUR/CHF finished the week after Brexit with slight improvement of 0.18%. The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney's comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08.

Read More »

Read More »

FX Daily, June 30: Calm Continues, but Rot Below the Surface

During the week the Swiss Franc lost momentum. It could regain speed only on June 30, after BoJ Carney's speech.

Read More »

Read More »

FX Daily, June 29: Fragile Calm Ahead of Quarter-End

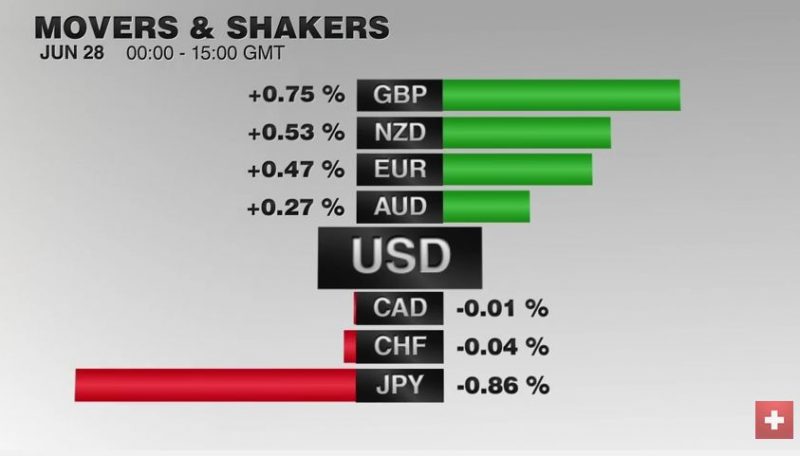

Sterling is firmer, but quarter-end considerations seem to be the key driver. Poor Japanese retail sales keep focus on policy response likely next month. New Zealand and Australian dollars are leading today's advance against the US dollar.

Read More »

Read More »

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

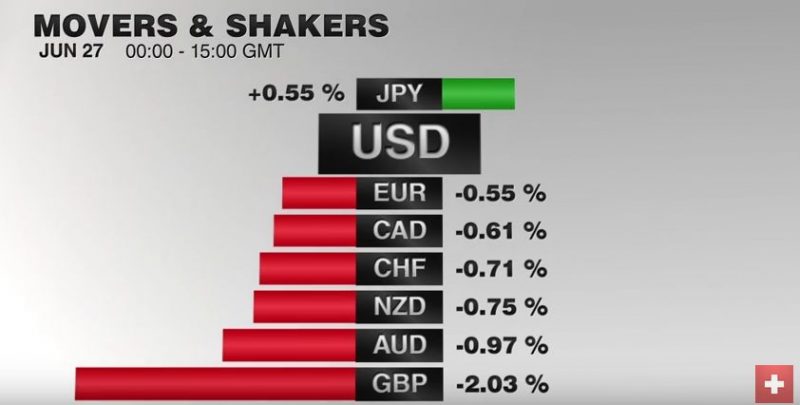

FX Daily, June 27: Post-Referendum Confusion Continues

Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to medium-term negative economic implications.

Read More »

Read More »

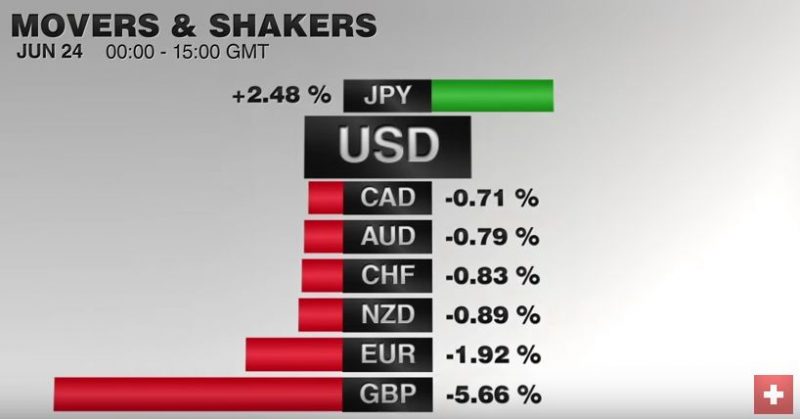

FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

The UK's decision to leave the EU spurred a dramatic risk-off move through the capital markets. The dollar, yen, and gold soared. Equities and emerging market assets sold off hard. The SNB had to intervene.

Read More »

Read More »

FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK's referendum is underway. The capital markets are

continuing the move that began last week with the murder of UK MP Cox.

The tragedy seemed to mark a shift in investor sentiment. Sterling

bottomed on June 17 just ahead...

Read More »

Read More »