The MSCI Asia-Pacific Index fell 4%, while the MSCI Emerging Market equity index is off 3% before Latam markets open. Dow Jones Stoxx 600 in Europe is off 6.6%, with financials being tagged with a nearly 10% decline. The FTSE 100 is off 4.6% with health care is the only sector even a slight gain. The UK financial sector is off 11%.

Sterling had initially rallied to poke through the $1.50 level for the first time since last years. As it became evident that the Brexit was going to win, sterling crashed to $1.3230 before stabilizing.

As the results became official, the capital markets began stabilizing. The Swiss National Bank and the Danish central bank have intervened and remain active, according to reports. On the other hand, the BOJ does not appear to have intervened, though the yen soared. The dollar plummeted to JPY99.00 before rebounding to a little beyond JPY103.

Investors and policy makers are contemplating the implications. They are far-reaching. What we know is that Prime Minister Cameron will step down by October. He will trigger the now-famous Article 50 that begins the formal two-year negotiating period. That responsibility will fall to his successor. There are three candidates that have been touted: Johnson, the former Mayor of London, Gove, the Justice Minister, and May the Home Secretary. Johnson appears to be the early and strong favorite.

The victory for Brexit emboldens the nationalist forces in the other countries. For example, in France and Italy, nationalist parties are calling for their own referendum. Scotland is in the difficult position. Although it is fiercely pro-Europe, the turn-over was lighter than expected, and there will be pressure to have another referendum to leave the UK. Previously, the EU particularly encouraging the Scottish independence in part to prevent precedent for other.

There seems to be a meme in the markets that among the nationalist forces that Brexit will encourage is Trump’s candidacy for the US presidency. We are skeptical, but we’ll watch the upcoming polls, and the events market, which has seen new money favoring a Trump victory.

That said, the fact that the three markets, the capital markets, bookmakers, and the events markets all had are badly wrong, and many polls under-estimated the strength the Brexit vote, the tools we use have been compromised. We quickly recognized the significance of Cox’s murder, but it only managed to slow and not reverse the swing toward Brexit.

The European heads of state are holding a previously scheduled summit on June 28-29. Several key officials warned during the campaign that a decision to leave would meet an uncompromisingly firm EC. The logic that made them treat Greece as an example leads to the same treatment of the UK. The UK just lowered the barrier to exit, and that barrier needs to be resurrected in some fashion.

Merkel and Hollande may take a page from football to find that strong defense is a good offense. They may choose to demonstrate the commitment to the European project by agreeing to new measures of integration. Defense and/or security areas may be more promising at this juncture than economic or financial.

Spain holds elections this weekend. Rajoy, the former Prime Minister, and caretaker since last December will likely see his fortunes wane. His center-right PP was still polling as the biggest political party in Spain, though shy of a majority. His most likely coalition partner was demanding he step down as a condition, and the Podemos, the new political force that is more anti-austerity than anti-Europe, is expected to emerge as the second largest political party. This would push the Socialists into third place. A coalition led by Podemos could work if the Socialist accept Catalonia’s right to a referendum on independence.

The ECB will announce the results of its first new TLTRO lending facility. Counting the rolling over of some outstanding loans, many expect the first round to see 350-450 bln euros drawn. Spanish and Italian banks are thought to be the largest participants.

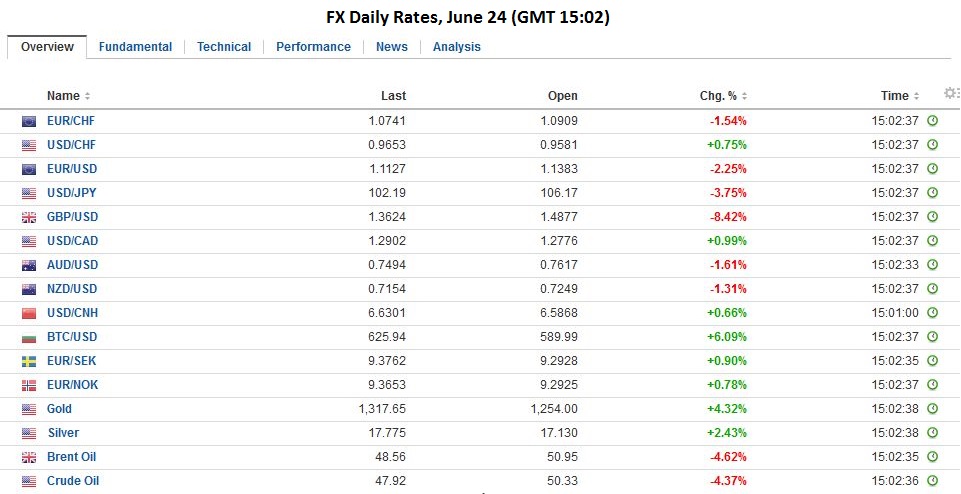

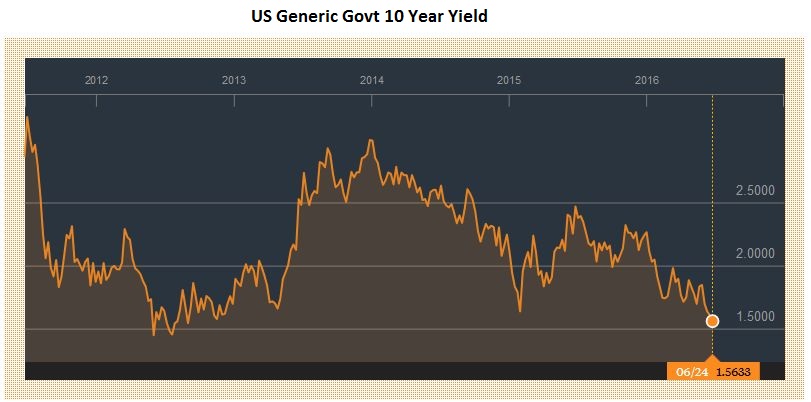

United StatesThe US S&P 500 that will trigger circuit breakers at the open. The US 10-year bond yield is off 21 bp to 1.53%. The sharp decline in US yields is not a reflection of new fears about the US growth or inflation outlook. It is a function of safe haven demand. The bulk of the decline in the US 10-year yield can be partly explained by the nearly identical decline in the two-year yield (now 58 bp). This reflects not only safe haven demand but also the ideas that the Fed will not hike rates this year. And more, the Fed funds have been averaging 37-38 bp and the implied yield on the December Fed funds futures contract is currently 35 bp. |

Comments on the Swiss Franc by George Dorgan, graphs by the SNBCHF team

Full story here Are you the author? Previous post See more for Next post

Tags: Article 50,Brexit,FX Daily,Germany IFO Business Climate Index,newslettersent