Tag Archive: China

FX Daily, February 25: Capital Markets Remain Fragile after Yesterday’s Bloodletting

Overview: Yesterday's bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday's moves were in excess. Japanese markets, which were closed on Monday, played catch-up today, and the Nikkei shed 3.3%.

Read More »

Read More »

FX Daily, February 24: Stocks Slammed and Yields Drop as Virus Containment Fails

Overview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a nearly 4% decline. The national holiday in Japan spared local equities.

Read More »

Read More »

FX Weekly Preview: Sources of Imbalance and the Pushback Against New Divergence

The US dollar's surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven

yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some...

Read More »

Read More »

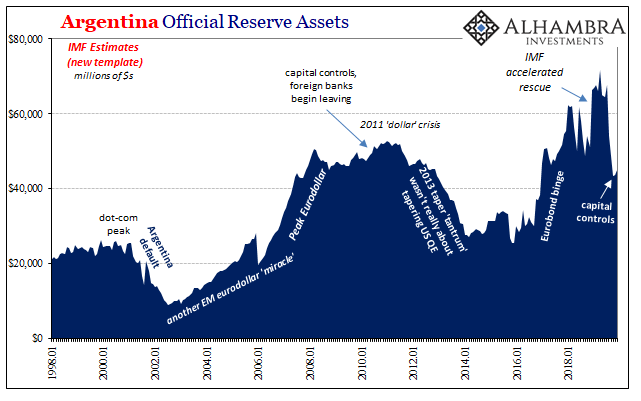

Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig.

Read More »

Read More »

FX Daily, February 19: Investors’ Confidence Snaps Back

Overview: After shunning risk yesterday, investors re-entered the fray today, and the animal spirits returned. The MSCI Asia Pacific Index snapped a four-day slide, and China's markets were among the few losers in the region today. Europe's Dow Jones Stoxx 600 recovered yesterday's losses in full and is again at record highs. US shares are also trading firmer and are poised to recoup yesterday's decline.

Read More »

Read More »

FX Daily, February 18: Apple’s Warning Weighs on Sentiment

Overview: Apple's warning that it will miss Q1 revenue due to the knock-on effects of the coronavirus seemed to be a modest wake-up call to investors, who, judging from the equity market, were looking beyond. Equities have fallen, and bonds have rallied. Japan, Hong Kong, and South Korean stocks fell by more than 1%, and only China and Indonesia were able to post gains.

Read More »

Read More »

FX Daily, February 17: Dismal Q4 Japanese GDP Fails to Spur Yen Movement

Overview: It is only a US holiday today, but the global capital markets are subdued. In the Asia-Pacific region, equities traded lower with China and Hong Kong, the main advancers. The MSCI Asia Pacific Index has fallen in only two weeks since the end of last November, and that was during the last two weeks of January. Europe's Dow Jones Stoxx 600 slipped in the previous two sessions but is recouping the losses fully today.

Read More »

Read More »

FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia, advanced. The MSCI Asia Pacific Index rose for the second week.

Read More »

Read More »

FX Daily, February 13: Surprise? China Undercounts Afflictions and Fatalities, Curbs Risk Taking

Overview: There is one overriding driver today, and that is the incorporation of CAT scan diagnoses of the virus in Hubei, ground-zero. This follows the arrival of WHO officials into China a couple days ago. Not only have the cases jumped, but so did the number of deaths. It plays on fears that China's figures are not reliable. But it is not just China.

Read More »

Read More »

FX Daily, February 12: The Greenback Slips in Subdued Activity

Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is at new record highs, led by consumer discretionary and materials sectors.

Read More »

Read More »

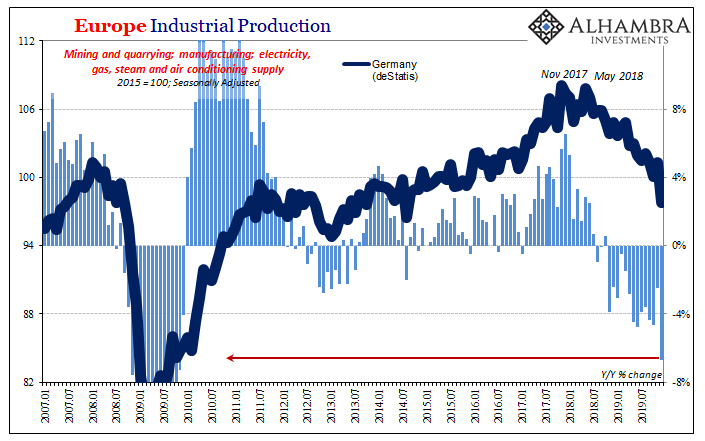

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

FX Daily, February 10: Quiet Start to the New Week in which Politics may Dominate

Overview: The global capital markets have begun the new week on a cautious tone as investors seek to assess the latest news on the new coronavirus. Nearly all the markets in Asia fell but China. European bourses are lower as well, with the Dow Jones Stoxx 600 off about 0.3%. US shares are soft but little changed.

Read More »

Read More »

FX Weekly Preview: US Soars while Rivals are Hobbled

We are approaching the mid-point of the first quarter, and the coronavirus from China is the new key development for businesses and investors. The economic impact appears to be still growing as the disruption to supply chains, production, and demand continues. The re-opening of China from the extended Lunar New Year holiday brought some relief to the markets as officials ensured ample liquidity, leaned against short selling, and offered...

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world's two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety.

Read More »

Read More »

FX Weekly Preview: The Week Ahead and Why the FOMC Meeting may not be the Most Interesting

The week ahead is arguably the most important here at the start of 2020. The Federal Reserve and the Bank of England meet. The US and the eurozone report initial estimates of Q4 19 GDP. The eurozone also reports its preliminary estimate of January CPI. China returns from the extended Lunar New Year celebration and reports its official PMI. Japan will report December retail sales and industrial production.

Read More »

Read More »

FX Daily, January 24: Coronavirus Hits Asia Hardest, Europe and the US Resilient

Overview: The new coronavirus in China has moved into the vacuum left by the US-China trade agreement and clear indications that the Bank of Japan, the European Central Bank, and the Federal Reserve are on hold as investors searched for new drivers. The World Health Organization refrained from calling it a public health emergency even though China has dramatically stepped up its efforts to contain the new virus.

Read More »

Read More »

FX Daily, January 23: ECB’s Strategic Review and the Coronavirus Command Investors’ Attention

The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China's week-long Lunar New Year celebration when markets will be closed, which may have also spurred today's drama that aw the Shanghai Composite tumbled 2.75%, bringing the week's loss to 3.2%, the most in five months.

Read More »

Read More »