Category Archive: 2) Swiss and European Macro

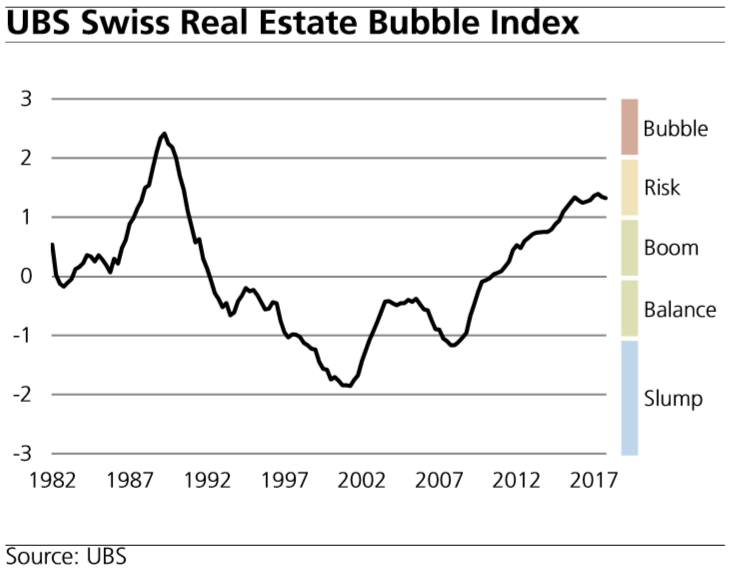

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2017

The UBS Swiss Real Estate Bubble Index declined in the fourth quarter of 2017, and is currently in the risk zone at 1.32 index points. This second fall in succession was driven by the persistently low increase of mortgage volumes. However, this may have been underestimated, as the records of mortgages granted by insurers and pension funds are inadequate. The majority of the sub-indicators remained unchanged in the last quarter.

Read More »

Read More »

Ist die Happy Hour an den Aktienmärkten vorbei?

So schnell kann eine Aktienstimmung von Dur in Moll umschlagen. Ist damit die nächste Aktienkrise eingeläutet? Und müsste sie aufgrund deutlich höherer Indexstände nicht dramatischer ausfallen als in der Vergangenheit? Krisenfaktoren sind sicherlich vorhanden. Aber wie viel Brisanz steckt in ihnen? Robert Halver mit seinem Aktien-Check aus dem Frankfurter Handelssaal

Read More »

Read More »

Pictet Perspectives – Volatility presents opportunities

A pick-up in inflation fears contributed to the recent spike in bond yields that spilled over into equities. But while inflation remains a risk, Cesar Perez Ruiz, CIO at Pictet Wealth Management, remains sanguine about the global economy and risk assets and sees volatility as an opportunity for tactical positioning.

More on http://perspectives.pictet.com/

https://www.group.pictet/wealth-management

Read More »

Read More »

Pictet Perspectives – Volatility presents opportunities

A pick-up in inflation fears contributed to the recent spike in bond yields that spilled over into equities. But while inflation remains a risk, Cesar Perez Ruiz, CIO at Pictet Wealth Management, remains sanguine about the global economy and risk assets and sees volatility as an opportunity for tactical positioning. More on http://perspectives.pictet.com/ https://www.group.pictet/wealth-management

Read More »

Read More »

Crash bei Lebensversicherungen?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Crash bei Lebensversicherungen – Das ist keine Prognose, sondern war der Titel einer der letzten Sendungen bei Hart aber Fair, in der ARD. Denkt ihr gerade darüber nach, eine Lebensversicherung zu kaufen oder eine bestehende zu kündigen? Schaut …

Read More »

Read More »

Yanis Varoufakis – Internationalism vs. Globalisation

Audio of the 2017 CAIT Annual International Theory Lecture November 29th, 2017. Yanis Varoufakis is a Greek economist, academic and politician, who served as the Greek Minister of Finance from January to July 2015. In 2016, Varoufakis co-founded DiEM25 – the Democracy in Europe Movement 2025. It now has almost 40,000 members in 56 countries.

Read More »

Read More »

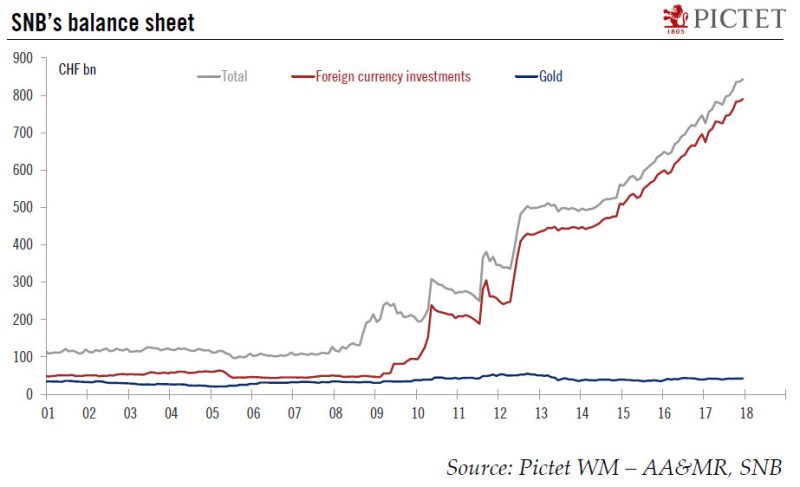

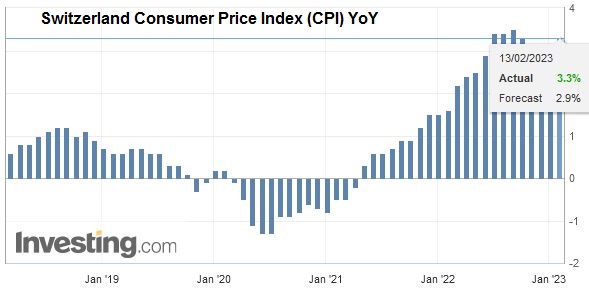

When will the SNB start the process of policy normalisation?

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of -...

Read More »

Read More »

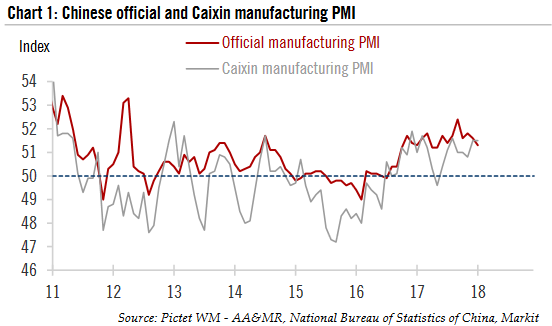

China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

Read More »

Read More »

Schuldgefängnis, John Maynard Keynes und die Doppelmoral der EU | Mit Yanis Varoufakis

Kostenlos acTVism abonnieren: https://www.youtube.com/user/acTVismMunich?sub_confirmation=1 In diesem Video spricht Yanis Varoufakis, der Gründer von Democracy in Europe Movement 2025 (DiEM25) und ehemalige Finanzminister Griechenlands, über den Begriff des “Schuldgefängnisses” und die ökonomischen Ideen von John Maynard Keynes. Dabei geht Varoufakis auch auf die Doppelmoral der Europäischen Union im Hinblick auf die Durchsetzung wirtschaftlicher...

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

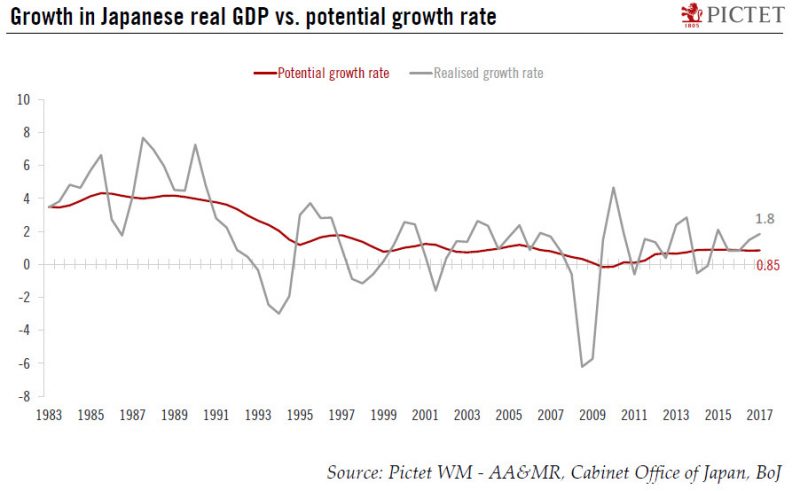

Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 - year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth, which currently stands at 0.85%, according to the Bank of Japan (BoJ, see...

Read More »

Read More »

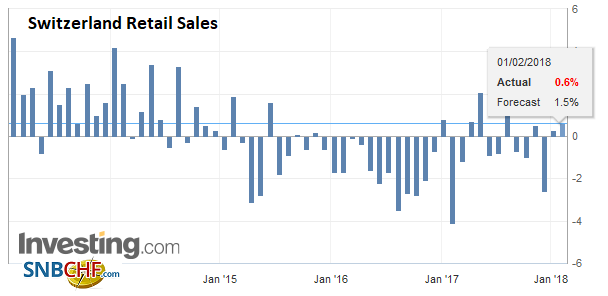

Swiss Retail Sales, December: +1.5 Percent Nominal and -0.8 Percent Real

Turnover in the retail sector rose by 1.5% in nominal terms in December 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.8% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

#29 100 % Erneuerbare Energien möglich? Ein Kommentar zu Hans Werner Sinn und Horst Lüning!

#29 100 % Erneuerbare Energien möglich? Ein Kommentar zu Hans Werner Sinn und Horst Lüning! ▬ Links▬▬▬▬▬▬▬▬▬▬▬▬ ► Vortrag Hans-Werner Sinn: http://bit.ly/2FCpjS5 ► Kommentar/Ergänzung von Horst Lüning: http://bit.ly/2ny2IOY ► Hubspeicher von Horst Lüning: http://bit.ly/2rY9Uto ► Desertec (Wüstenstrom aus Afrika): http://bit.ly/2EyGSDm ►Energieinsel: http://bit.ly/2nycb8Y ►Kugelpumpspeicher: http://bit.ly/2nvieMr ▬ Social Media ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Hans-Werner Sinn: Hoeveel Zappelstrom verdraagt het net?

Quick scan Inleiding: [0:20][1:10][1:40][1:50][2:20] Voordracht: [2:50][6:27][12:22][19:01] Discussie: [31:27][34:37][36:37][42:12][48:06][50:52] Na een inleiding over de Energiewendeplannen van Urgenda het slotdeel van “Wie viel Zappelstrom verträgt das Netz” waarin Hans-Werner Sinn de grenzen van wind en zon voor een breed publiek probeert uit te leggen. De voordracht kwam één dag na een debat bij Buitenhof waarin de problemen...

Read More »

Read More »

Silber oder Gold?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold & Silber – 100% gratis: http://lars-erichsen.de/ Silber oder Gold – das ist hier die Frage. Edelmetalle sind aktuell schwer angesagt und es scheint nur noch eine Frage der Zeit zu sein, bis der Befreiungsschlag gelingt und uns eine neue Hosse ins Haus steht. Sollte ich dafür … Continue...

Read More »

Read More »

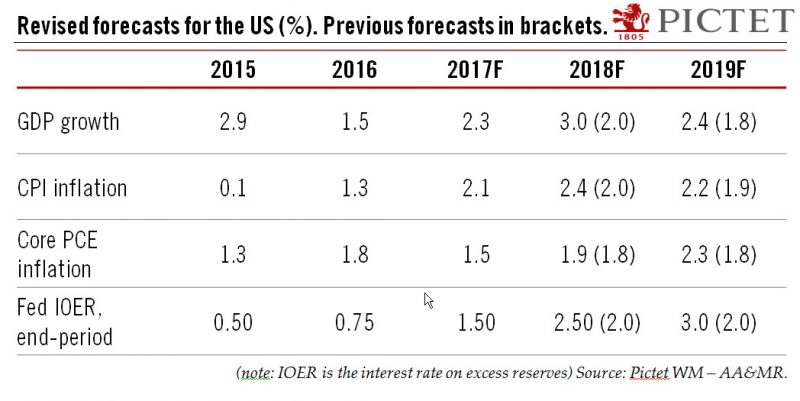

Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an estimated 4.6% in 2017. We...

Read More »

Read More »

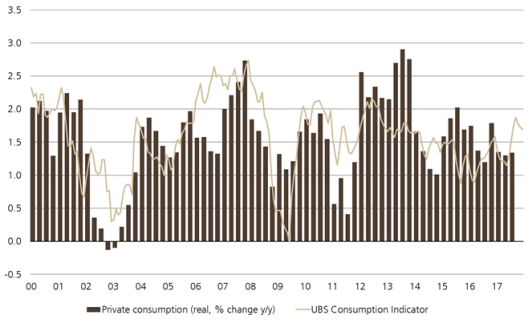

Switzerland UBS consumption indicator December: pleasing end to the year

At 1.69 points, the consumption indicator lay well above the long-term average in December 2017, conveying an optimistic snapshot of Swiss private consumption. Weaker figures for new car registrations prevented an even higher value. The consumption indicator fell slightly in December 2017 to 1.69 points from 1.73. However, values had been revised upward in the past few months.

Read More »

Read More »

Die Angst an den Aktienmärkten vor der Zinswende

Der Zins- und Renditeverfall war der maßgebliche Grund für die Aktienhausse der letzten Jahre. Aber ist jetzt Schluss mit Aktien-lustig, da die Zinsen in Deutschland bereits auf Zweijahres- und in Amerika auf Dreijahreshoch gestiegen sind? Wie weit kann der Zinssteigerungstrend noch anhalten und damit zu einer attraktiven Alternativanlage zu Aktien werden? Sind Aktien dann nicht …

Read More »

Read More »

Yanis Varoufakis – Brexit From The Perspective of a Committed Corbyn Supporter

Yanis Varoufakis arguing for a Norway Plus Brexit from the perspective of a committed Corbyn supporter – Audio of address at the UK House of Commons, January 29th, 2018 Delivered in front of an audience of Labour MP and staffers, at the kind invitation of Chuka Umunna MP.

Read More »

Read More »