Category Archive: 2) Swiss and European Macro

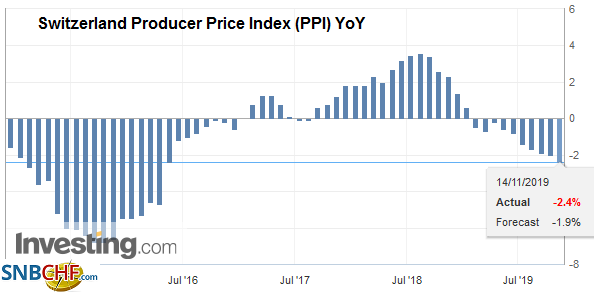

Swiss Producer and Import Price Index in October 2019: -2.4 percent YoY, -0,2 percent MoM

The Producer and Import Price Index fell in October 2019 by 0.2% compared with the previous month, reaching 100.9 points (December 2015 = 100). Compared with October 2018, the price level of the whole range of domestic and imported products fell by 2.4%.

Read More »

Read More »

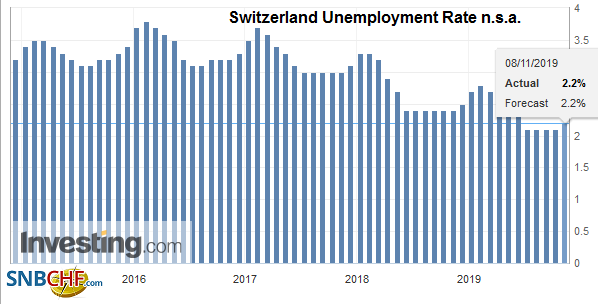

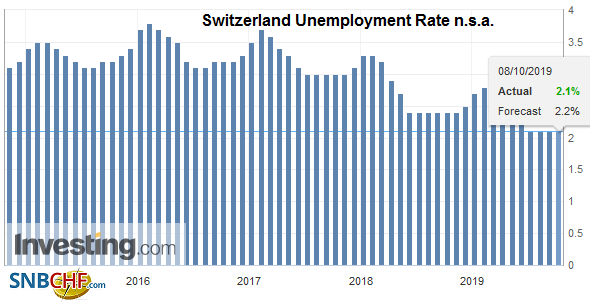

Switzerland Unemployment in October 2019: Up to 2.2 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment registered in October 2019 - According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of October 2019, 101'684 unemployed were registered at the regional employment agencies (RAV), 2 586 more than in the previous month. The unemployment rate rose from 2.1% in September 2019 to 2.2% in the month under review.

Read More »

Read More »

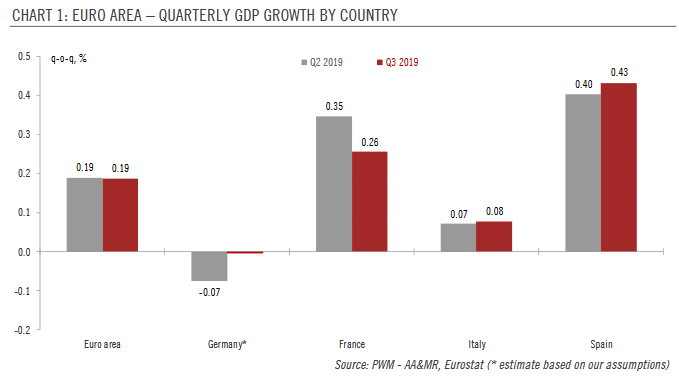

Steady euro area growth and rise in core inflation

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November.

Read More »

Read More »

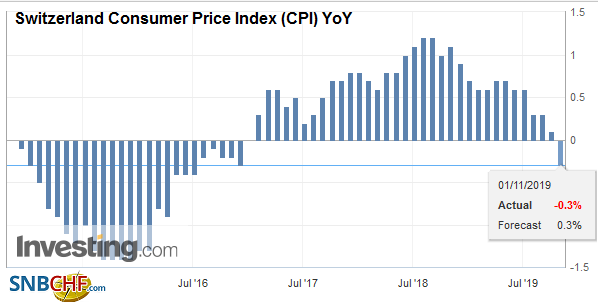

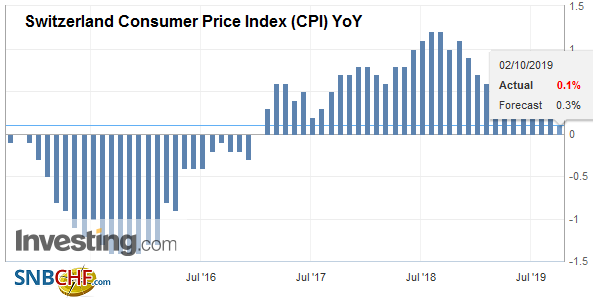

Swiss Consumer Price Index in October 2019: -0.3 percent YoY, -0.2 percent MoM

The consumer price index (CPI) fell by 0.2% in October 2019 compared with the previous month, reaching 101.8 points (December 2015 = 100). Inflation was –0.3% compared with the same month of the previous year.

Read More »

Read More »

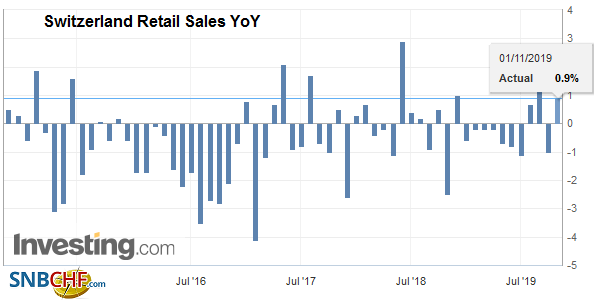

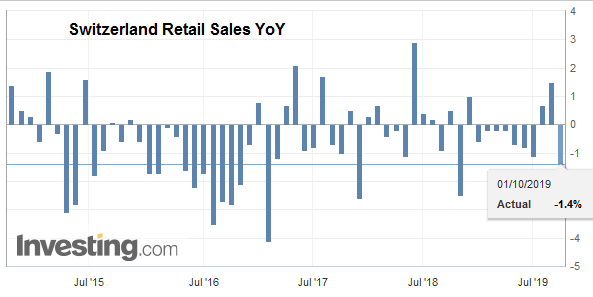

Swiss Retail Sales, September 2019: +0.6 percent Nominal and +0.9 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 0.6% in nominal terms in September 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. Real turnover adjusted for sales days and holidays rose in the retail sector by 0.9% in September 2019 compared with the previous year.

Read More »

Read More »

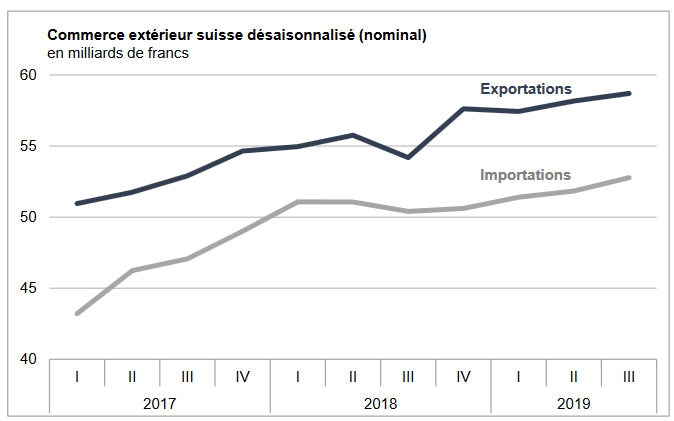

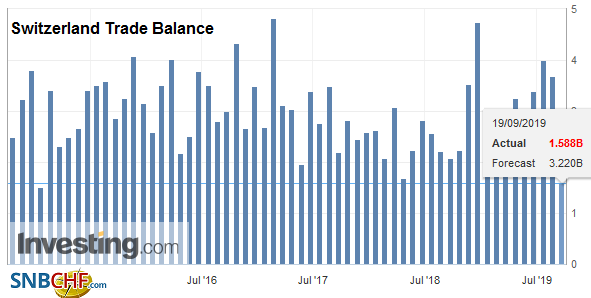

Swiss Trade Balance Q3 2019: exports still rising thanks to chemistry-pharma

In the third quarter of 2019, foreign trade showed a positive trend: while exports rose by 0.9%, imports posted double growth (+ 1.8%). Both the first and the second have achieved a record quarterly result. The trade balance is closing with a surplus of 5.9 billion francs.

Read More »

Read More »

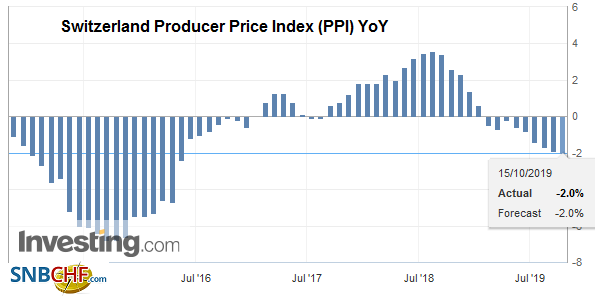

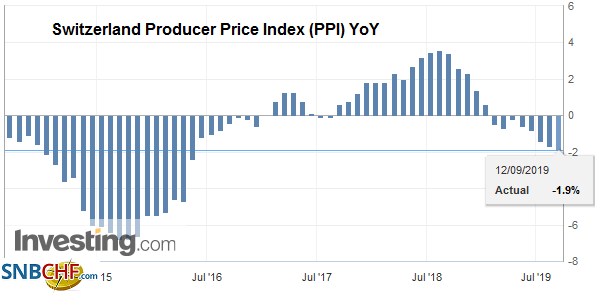

Swiss Producer and Import Price Index in September 2019: -2.0 percent YoY, -0,3 percent MoM

15.10.2019 - The Producer and Import Price Index fell in September 2019 by 0.3% compared with the previous month, reaching 101.1 points (December 2015 = 100). This decline is due in particular to lower prices for petroleum products and scrap. Compared with September 2018, the price level of the whole range of domestic and imported products fell by 2.0%.

Read More »

Read More »

Switzerland Unemployment in September 2019: Unchanged at 2.1 percent, seasonally adjusted unchanged at 2.3 percent

Registered unemployment in September 2019 - According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of September 2019, 99'098 unemployed people were enrolled in the Regional Employment Centers (RAV), 454 less than in the previous month. The unemployment rate remained at 2.1% in the month under review.

Read More »

Read More »

Swiss Consumer Price Index in September 2019: +0.1 percent YoY, -0.1 percent MoM

02.10.2019 - The consumer price index (CPI) fell by 0.1% in September 2019 compared with the previous month, reaching 102.0 points (December 2015 = 100). Inflation was +0.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss Retail Sales, August 2019: +1.3 percent Nominal and -1.4 percent Real

Turnover adjusted for sales days and holidays rose in the retail sector by 1.3% in nominal terms in August 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month. Real turnover adjusted for sales days and holidays fell in the retail sector by 1.4% in August 2019 compared with the previous year.

Read More »

Read More »

MMT, la nouvelle théorie en vogue à Washington

L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis.

Read More »

Read More »

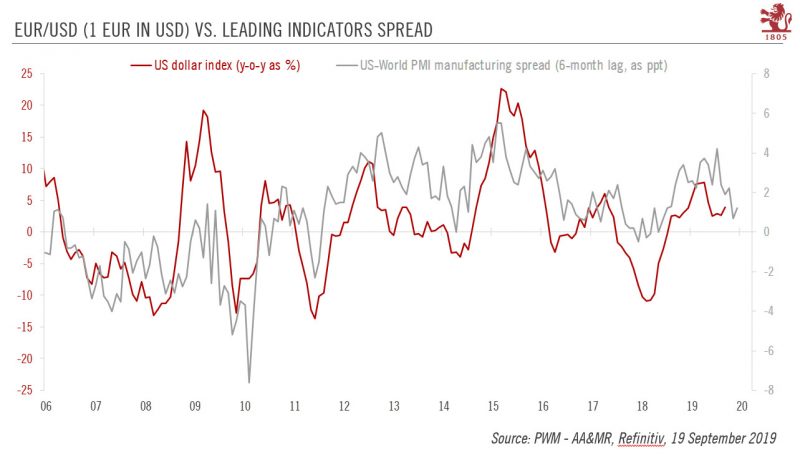

Euro/USD: things look pretty stable

Competing forces mean the two currencies could remain in a holding pattern for a while.The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.

Read More »

Read More »

Swiss Trade Balance August 2019: the decline in exports continues

In August 2019, Swiss exports fell for the second month in a row. Down 4.3% year-on-year, they dropped below 19 billion francs. On the other hand, imports rose by 3.4% and thus regained their level at the beginning of the year. The trade balance closed with a surplus of 1.2 billion francs.

Read More »

Read More »

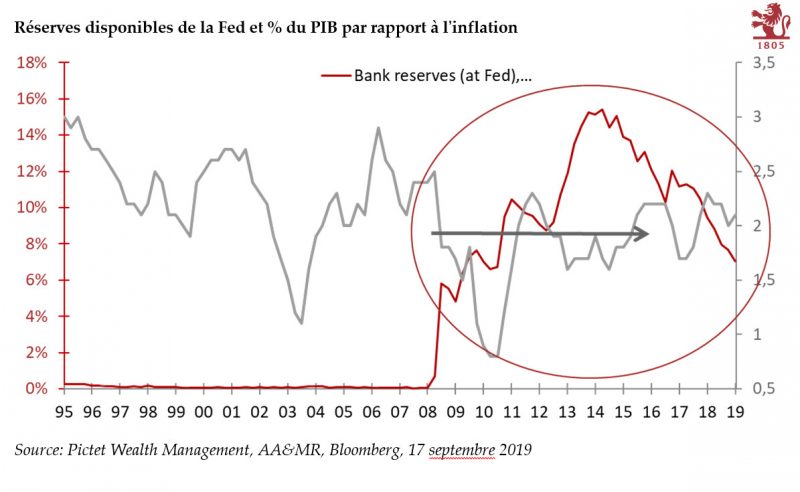

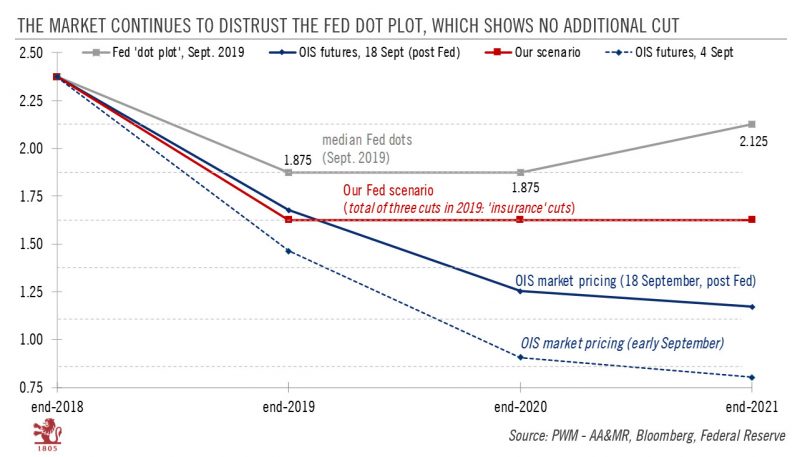

Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%.

Read More »

Read More »

Swiss Producer and Import Price Index in August 2019: -1.9 percent YoY, -0,2 percent MoM

12.09.2019 - The Producer and Import Price Index fell in August 2019 by 0.2% compared with the previous month, reaching 101.4 points (December 2015 = 100). The decline is due in particular to lower prices for rubber and plastic products as well as basic metals and semi-finished metal products. Compared with August 2018, the price level of the whole range of domestic and imported products fell by 1.9%.

Read More »

Read More »

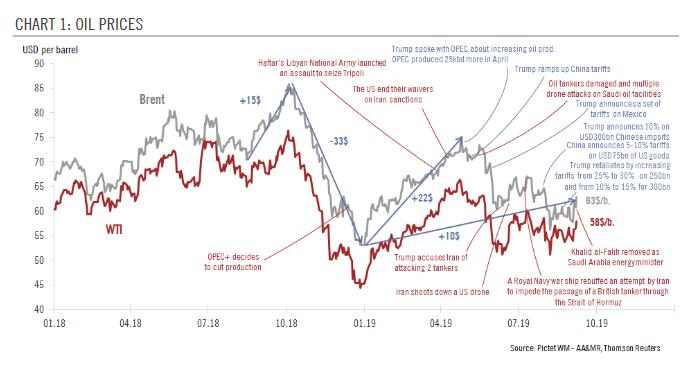

Oil prices and the global economy

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment.

Read More »

Read More »

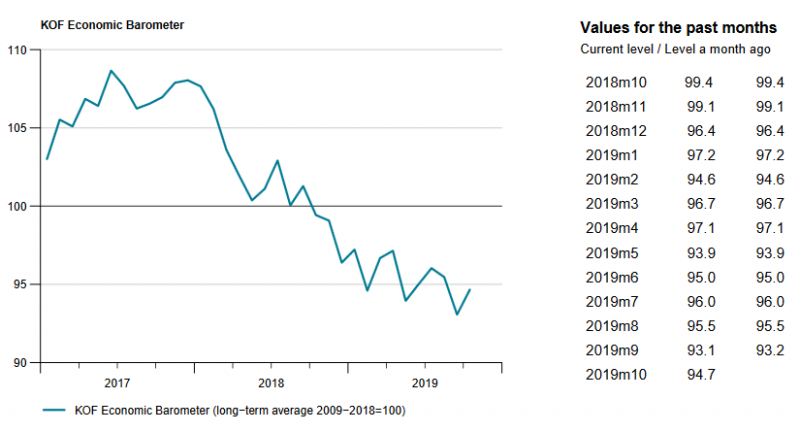

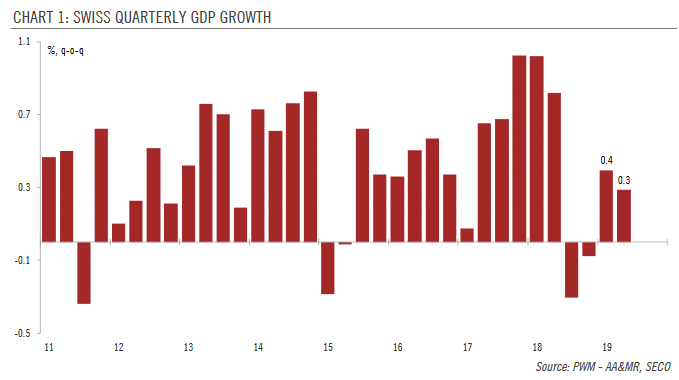

Swiss National Bank – Between a rock and a hard place

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings.Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy.

Read More »

Read More »

“The Eurozone faces the worst combination of economic and systemic risk”

The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally.

Read More »

Read More »

Switzerland GDP Q2 2019: +0.3 percent QoQ, -0.2 percent YoY

Switzerland’s GDP rose by 0.3% in the 2nd quarter of 2019, after increasing by 0.4% (revised) in the previous quarter.1 The development of domestic and foreign demand was weak, as in other European countries, which had a particularly negative impact on the service sectors.

Read More »

Read More »