|

Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down. Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in new orders, industrial production, an increase in inventories and, ultimately, a reduction in investments. All this process takes time. Hard data remained resilient for nine months. but the first signs of capitulation are now appearing. International trade weakened by only -0.2% between September 2018 and May 2019, but it dropped abruptly by -1.4% month on month (m-o-m) in June. One sees a similar pattern in industrial production, which actually increased by 0.6% between September 2018 and May 2019 before falling by -0.5% m-o-m in June. These developments tend to confirm our ideas about the sequence of events. A trade war is the kind of shock that takes time to impact economies. At first, the direct impact is quite negligible (10% tariffs on Chinese goods is equivalent to 0.1% of US GDP), but the longer the uncertainty lasts the greater the indirect impact. |

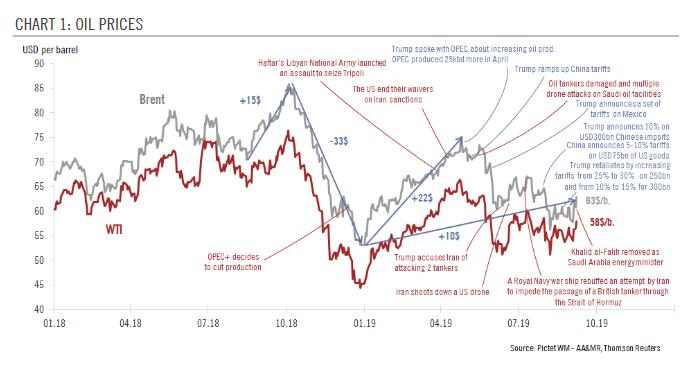

Oil Prices, 2018-2019 |

All this is worrying, as it means that we are only at the beginning of the deterioration process, even though global manufacturing sentiment has already suffered the longest deterioration on record (15 months to the end of July Accordingly, data releases in the months to come are likely to reflect the impact of the latest round of the trade war, with damaging consequences for international exchanges and industrial production.

Beyond all the worrying news, there is at least one positive development. Low oil prices offer some support to global activity and consumer demand. The prospect of oversupply, uncertain OPEC+ compliance with production limits and the global economic slowdown mean expect Brent to close 2019 at USD58 and WTI at USD55, with increasing US export capacity likely to narrow the gap between the price for the two types of oil. We continue to expect the Brent price to drop to USD50 in early 2020 and it to remain close to this level for the rest of the year. Low and stable oil prices tend to favour economic activity and investment as well as provide purchasing power to consumers. Despite recent volatility, we observe that the price of Brent in Indian rupees (other currencies could equally be used for comparison purposes) is still 14% below the 2018 average.

Combining different information sets, we see a marked risk of a deceleration in world GDP growth in the second half of this year. According to one of our models, based on international trade and manufacturing PMI, real global GDP growth could slow to 2.7% year on year in H2 2019. This includes a forecast of 1.5% quarter on quarter (q-o-q) annualised followed by 2.4% q-o-q in Q3 and Q4. World GDP growth below 2.5% is traditionally considered a global recession.

Full story here Are you the author? Previous post See more for Next postTags: International trade,Macroview,newsletter,Pictet