Category Archive: 5) Global Macro

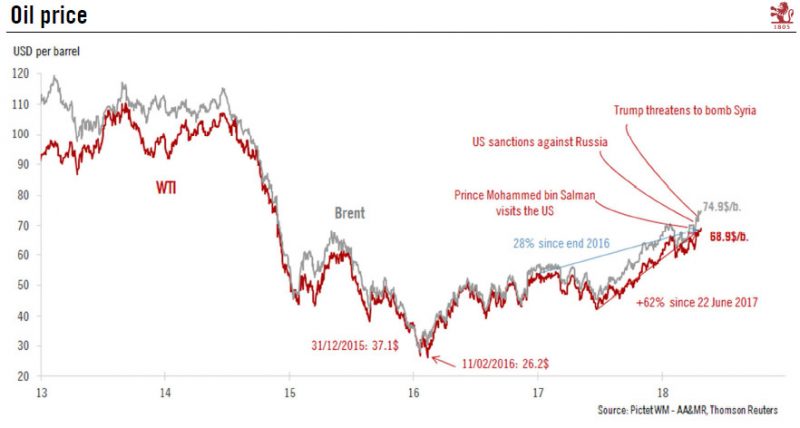

Where next for oil prices?

On 19 April, the price of a barrel of oil reached USD69.56 for West Texas Intermediate (WTI) and reached USD75.27 for Brent, today, the highest price since 2014. Since 9 April, oil prices have been significantly above their longterm fundamental equilibrium value. Three factors explain what has happened.

Read More »

Read More »

Exploring and protecting the Antarctic | The Economist

The Antarctic is one of the least explored places on the planet. For the first time ever a marine biologist has ventured to unexplored parts of the seabed in a submarine. Her discoveries have shocked the scientific community and could pave the way for the biggest no-fishing zone in the world Click here to subscribe …

Read More »

Read More »

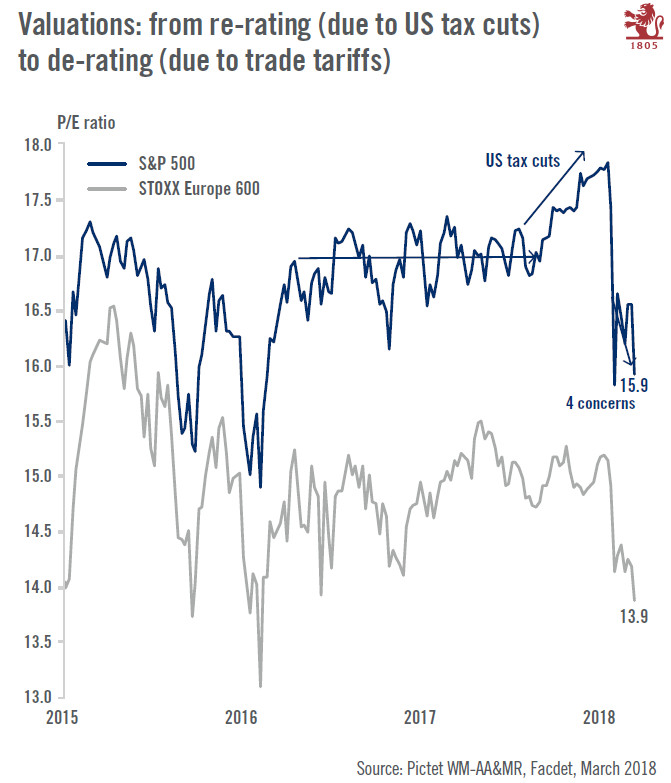

House View, April 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes. While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally.

Read More »

Read More »

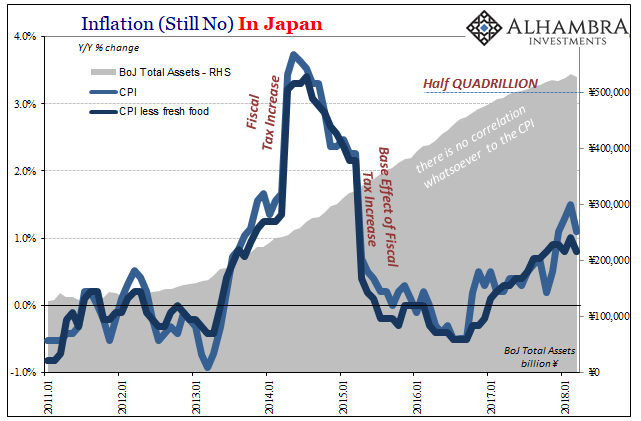

Transitory’s Japanese Cousin

Thomas Hoenig was President of the Federal Reserve’s Kansas City branch for two decades. He left that post in 2011 to become Vice Chairman of the FDIC. Before that, Mr. Hoenig as a voting member of the FOMC in 2010 cast the lone dissenting vote in each of the eight policy meetings that year (meaning he was against QE2, too). This makes him, apparently, the hawk of all hawks.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a firm note, capping off a generally softer week overall. TRY and PHP were the best performers last week, while CLP and ZAR were the worst. US core PCE, ISM manufacturing, FOMC meeting, and jobs data all pose risks to EM this week. We remain a bit defensive on risk assets in general now.

Read More »

Read More »

La dette bat des records et menace l’économie mondiale

L’endettement mondial, qui a atteint 164.000 milliards de dollars en 2016 et représente 225% du PIB mondial, représente un risque pour l’économie, a prévenu mercredi le FMI. L’endettement mondial atteint des records, sous l’impulsion de la Chine, au point de dépasser largement les niveaux de 2009, juste après la faillite de la banque Lehman Brothers, et de représenter un risque pour l’économie, a prévenu mercredi le FMI.

Read More »

Read More »

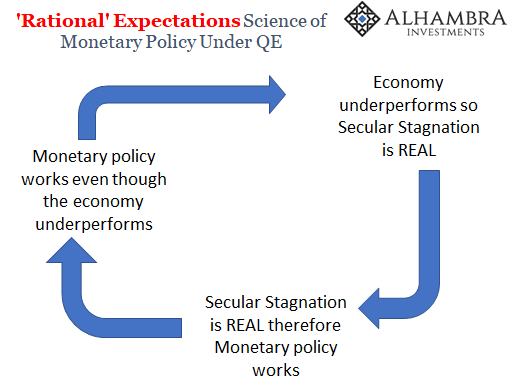

The Science of Japanification

The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts. The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y.

Read More »

Read More »

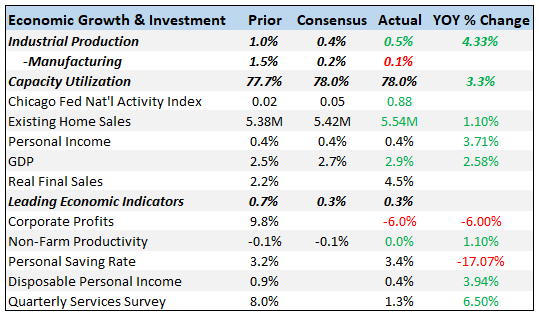

Bi-Weekly Economic Review: Interest Rates Make Their Move

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears.

Read More »

Read More »

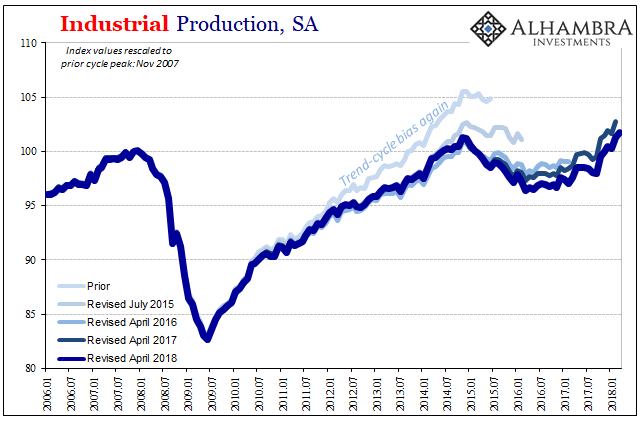

Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of operative history.

Read More »

Read More »

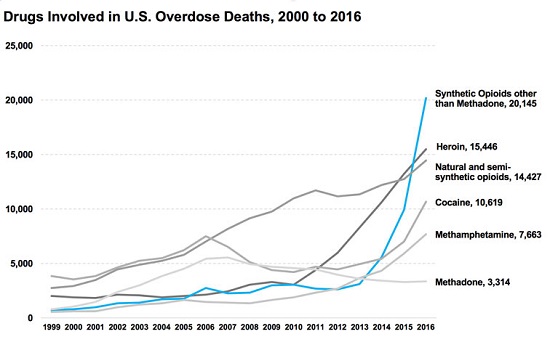

Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

Self-destruction isn't a bug, it's a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies.

Read More »

Read More »

Donald Trump’s attack on American justice | The Economist

President Trump is trying to influence what has traditionally been a non-partisan institution: the Department of Justice. In his first year in office he has appointed a record 18 federal judges and one supreme court justice. What does this mean for the future of the rule of law in the United States? Click here to …

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous.

Read More »

Read More »

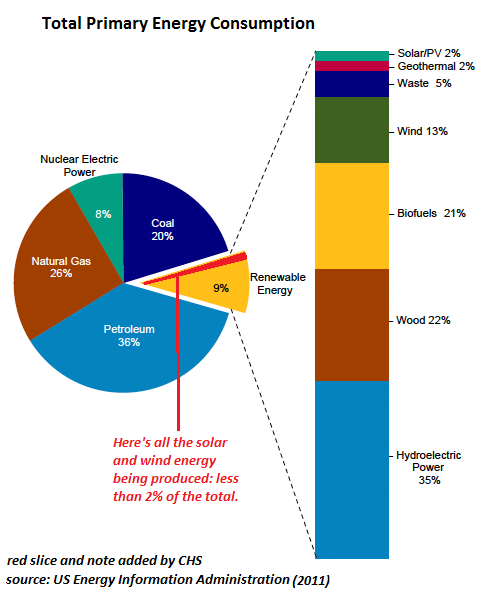

Charles Hugh Smith On The Developing Trade Wars

Click here for the full transcript: http://financialrepressionauthority.com/2018/04/23/the-roundtable-insight-charles-hugh-smith-on-the-developing-trade-wars/

Read More »

Read More »

Emerging Markets: What Changed

The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections.

Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador.

Read More »

Read More »

The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

What Do We Know About Syria? Next to Nothing

Anyone accepting "facts" or narratives from any interested party is being played. About the only "fact" the public knows with any verifiable certainty about Syria is that much of that nation is in ruins. Virtually everything else presented as "fact" is propaganda intended to serve one of the competing narratives or discredit one or more competing narratives.

Read More »

Read More »

US Stock Market: Happy Days Are Here Again? Not so Fast…

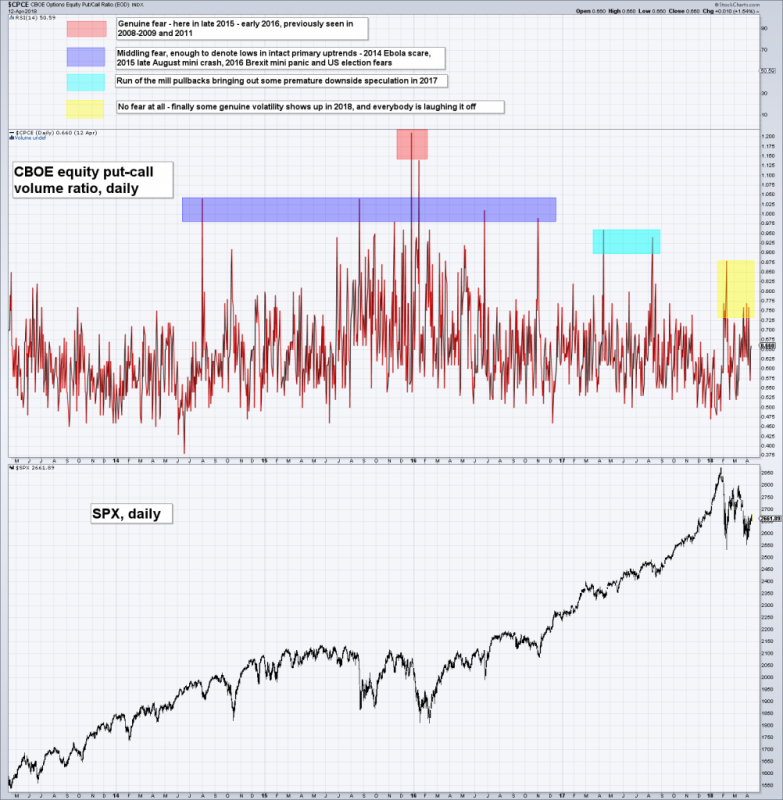

Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when they have a higher probability than otherwise, and we will certainly point those out...

Read More »

Read More »

How to solve the refugee crisis | The Economist

The refugee crisis is one of the most pressing challenges for the world today: around 1 person in 100 is a refugee. David Miliband, a former British foreign secretary, offers his thoughts on how to solve it. Click here to subscribe to The Economist on YouTube: http://econ.st/2F3OBrG #openfuture Daily Watch: mind-stretching short films throughout the …

Read More »

Read More »

China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really,...

Read More »

Read More »