Category Archive: 5) Global Macro

Here’s What We’ve Lost in the Past Decade

The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of "recovery" and "growth" has actually been a decade of catastrophic losses for our society and nation. Here's a short list of what we've lost: 1. Functioning markets. Free markets discover price and assess risk.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX.

Read More »

Read More »

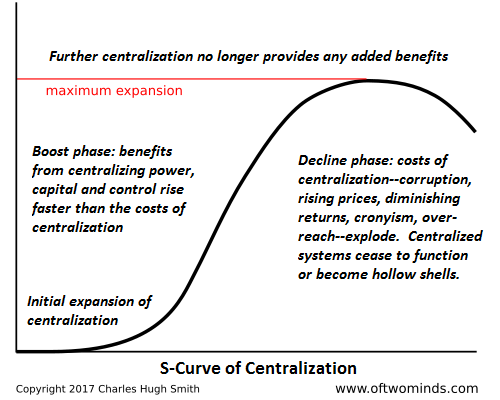

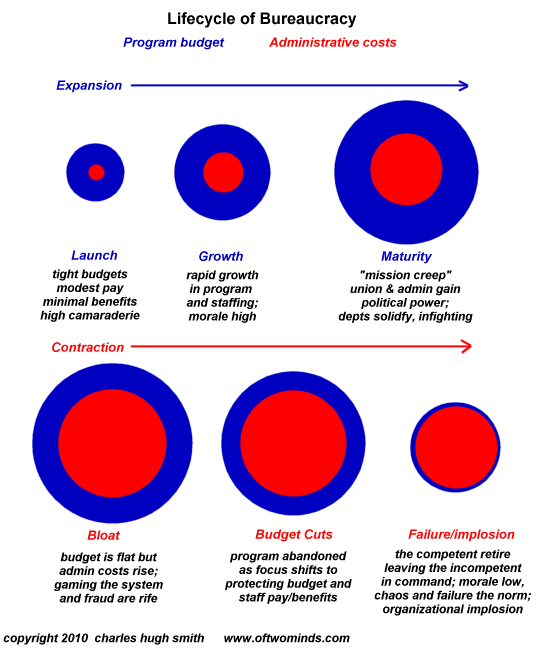

Here’s How Systems (and Nations) Fail

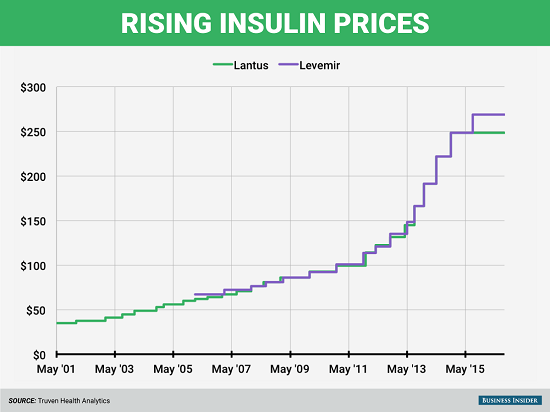

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America's broken healthcare system over a cheaper, more effective alternative?

Read More »

Read More »

When Long-Brewing Instability Finally Reaches Crisis

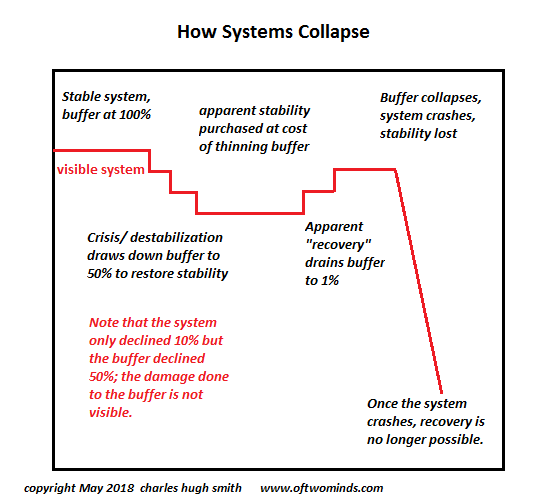

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Read More »

Read More »

ABBA star, Bjorn Ulvaeus, on Mamma Mia and Brexit sadness | The Economist Podcast

Bjorn Ulvaeus, one of the stars of ABBA, sits down with Anne McElvoy, head of Economist Radio, to talk about music, politics and what it is like to hear world-famous actors sing your world-famous songs. Chapter One: On “Mamma Mia Here We Go Again” 00:06 The Economist asks about what it is like to meet …

Read More »

Read More »

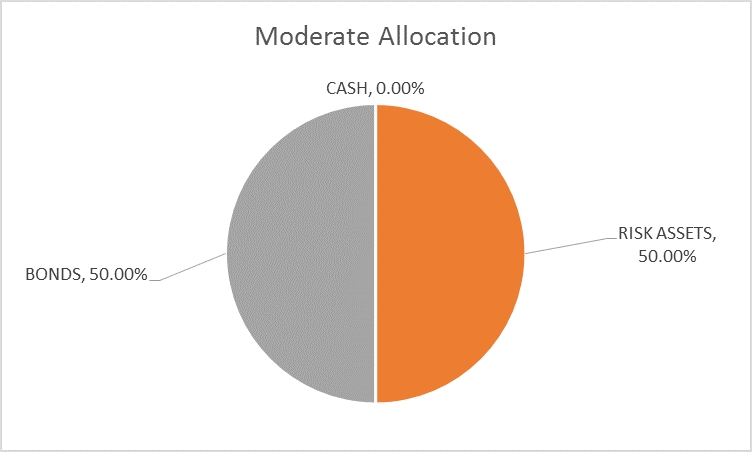

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

Mapping global population and the future of the world | The Economist

The world’s population has more than doubled since the 1970s. But a booming population is only part of the story—in some places populations are in decline. Click here to subscribe to The Economist on YouTube: https://econ.st/2tGuZ9h Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: https://econ.st/2tGuZGj Check out The …

Read More »

Read More »

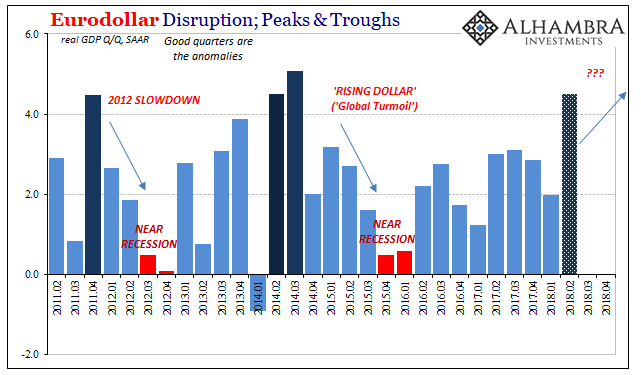

The Top of GDP

In 1999, real GDP growth in the United States was 4.69% (Q4 over Q4). In 1998, it was 4.9989%. These were annual not quarterly rates, meaning that for two years straight GDP expanded by better than 4.5%. Individual quarters within those years obviously varied, but at the end of the day the economy was clearly booming.

Read More »

Read More »

Are wildfires becoming more deadly? | The Economist

Wildfires have killed at least 74 people in Greece. In Sweden firefighters are tackling the biggest forest blazes in the country’s history. What causes wildfires and are they becoming more common? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Last year in America, around 71,000 fires burned through an area larger than that …

Read More »

Read More »

The Imperial Naivete of the American Public

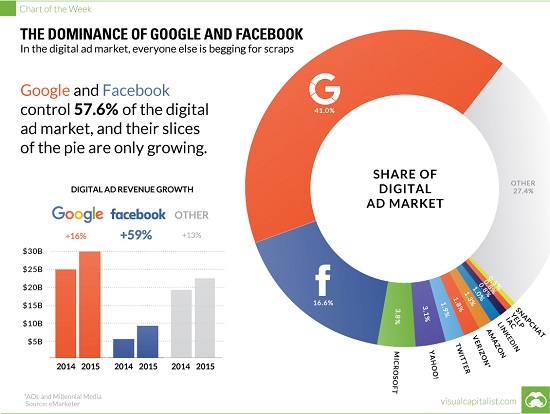

The nation's premier corporate profit engines / social media giants are the ideal platforms for undermining the U.S. via the sowing of disintegration. Whether it's stated or not, one source of the inchoate outrage triggered by Russian-sourced purchases of adverts on Facebook in 2016 (i.e. "meddling in our election") is the sense that the U.S. is sacrosanct due to our innate moral goodness and our Imperial Project.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US.

Read More »

Read More »

Solutions without Historical Templates: Cryptocurrencies and Blockchains

Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We're accustomed to three basic templates for system-wide solutions or improvements: 1. an individual "builds a better mousetrap" and starts a company to exploit this competitive advantage;

Read More »

Read More »

Tony Blair on Brexit’s second referendum | The Economist Podcast

Tony Blair, Britain’s former Prime Minister, spoke to Anne McElvoy, The Economist’s head of radio, for The Economist asks podcast. Timecoded chapters listed below: Chapter One – Should there be a second Brexit referendum? 3:00 – What would be the route to a second referendum? 5:40 – Did Cameron get it wrong to hold a …

Read More »

Read More »

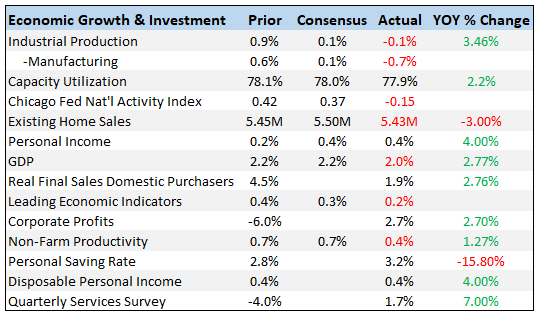

Bi-Weekly Economic Review

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to the tariffs.

Read More »

Read More »

Are identity politics dangerous? | The Economist

Some fear that politics based on protecting race, religion or other minority groups can threaten the rights of others. How did identity politics emerge and has it gone too far? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

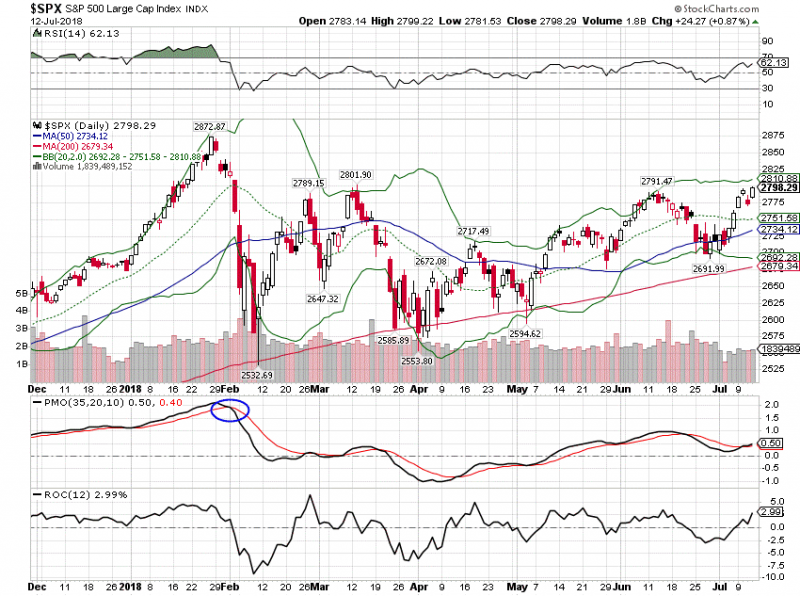

Mid-Year Global Markets Update

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some.

Read More »

Read More »

Putin’s Russia and the ghost of the Romanovs | The Economist

Tsar Nicholas II of Russia and his family, the Romanovs, were murdered 100 years ago today by Marxist revolutionaries. What does this anniversary mean for Vladmir Putin? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: https://econ.st/2zOWMe0 Check out …

Read More »

Read More »

Our Institutions Are Failing

Our institutional failure reminds me of the phantom legions of Rome's final days. The mainstream media and its well-paid army of "authorities" / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual.

Read More »

Read More »