Category Archive: 5) Global Macro

Understanding the Global Recession of 2019

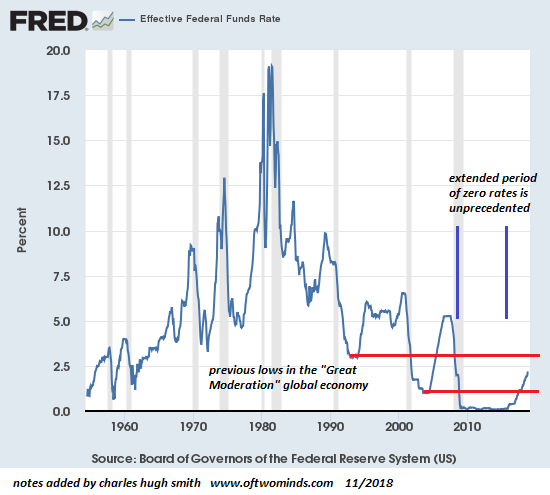

Isn't it obvious that repeating the policies of 2009 won't be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of dollars of bonds and iffy assets...

Read More »

Read More »

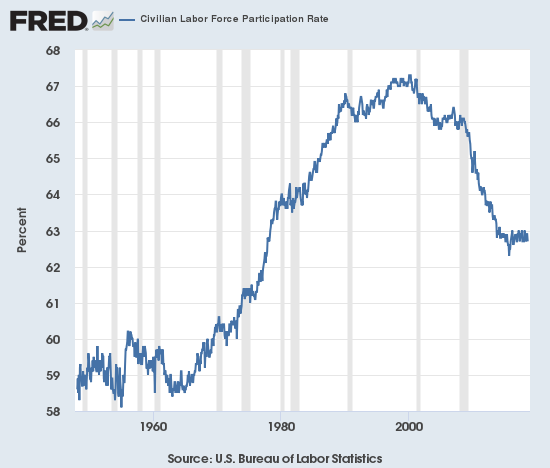

Why Are so Few Americans Able to Get Ahead?

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the "ownership society" and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children.

Read More »

Read More »

War is in decline, but for how long? | The Economist

One hundred years after the end of the first world war, battle-related deaths have fallen worldwide. But flashpoints remain and new threats are looming. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death.

Read More »

Read More »

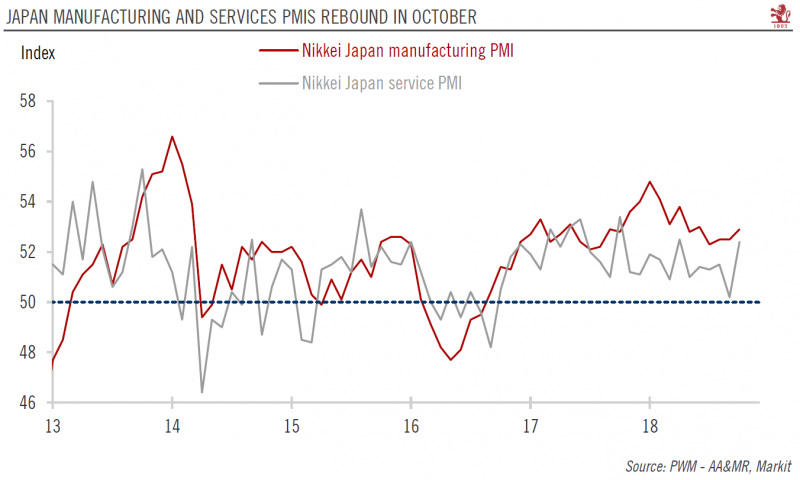

Japan services PMI rebounds strongly in October

The domestic economy is retaining its momentum, but external headwinds are building.The Japanese services purchasing managers index (PMI) rose sharply in October, surging by 2.2 points to 52.4, after a notable drop in September. The manufacturing PMI rose as well, but more moderately, reaching 52.9 in October from 52.4 in September.

Read More »

Read More »

Discover Hyderabad | The Economist

Hyderabad, India’s fourth biggest city, is fast becoming one of the most exciting visitor destinations in the country. Its booming tech scene is attracting global attention and transforming this ancient city into a cosmopolitan hotspot. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Discover Colombo: https://youtu.be/4COeTrjB6hA Discover Buenos Aires: https://youtu.be/q0pMg6rvc0s Discover Miami:...

Read More »

Read More »

Is This “The Most Important Election of our Lives” or Just Another Distraction?

The problem isn't polarization; the problem is neither flavor of the status quo is actually solving any of the nation's most pressing system problems. As I write this at 5 pm (Left Coast) November 6, the election results are unknown. While various media are trumpeting this as "the most important election of our lives," the less eyeball-catching, emotion-triggering reality is this election is nothing but another distraction.

Read More »

Read More »

CHARLES HUGH SMITH – Pension Funds Now Depend On Asset Bubbles

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

The Democrats in the age of Trump | The Economist

Since Donald Trump entered politics the Democrats have struggled to compete. The mid-term elections will see them employing a change in tactics that they hope will mobilise new voters and win over disillusioned moderates. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy It’s being called the most important midterm election in American history. …

Read More »

Read More »

Turn Off, Tune Out, Drop Out

An unknown but likely staggeringly large percentage of small business owners in the U.S. are an inch away from calling it quits and closing shop. Timothy Leary famously coined the definitive 60s counterculture phrase, "Turn on, tune in, drop out" in 1966. (According to Wikipedia, In a 1988 interview with Neil Strauss, Leary said the slogan was "given to him" by Marshall McLuhan during a lunch in New York City.)

Read More »

Read More »

What’s Behind the Erosion of Civil Society?

Rebuilding social capital and social connectedness is not something that can be done by governments or corporations. As the mid-term elections are widely viewed as a referendum of sorts, let's set aside politics and ask, what's behind the erosion of our civil society? That civil society in the U.S. and elsewhere is fraying is self-evident.

Read More »

Read More »

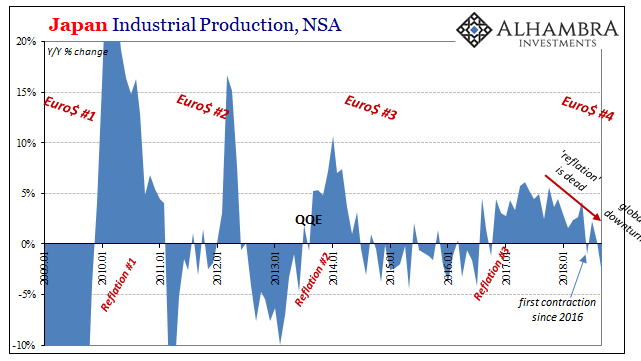

China Now Japan; China and Japan

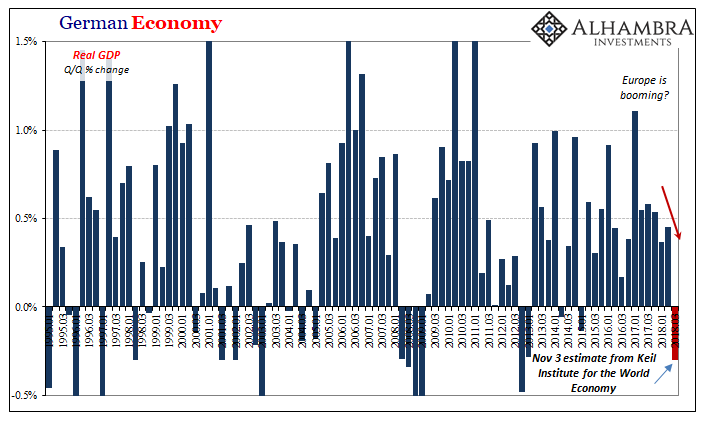

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

Bloomberg Interview with Jeffrey Snider

Why Eurodollars Might Be Key to the Market Sell-Off (Podcast). There’s a huge market out there that doesn’t get much attention: Eurodollars. These have nothing to do with the euro-dollar exchange rate. Instead, eurodollars are U.S. dollar-denominated deposits at foreign banks and overseas branches of American banks.

Read More »

Read More »

Fashion’s naked truths | The Economist

Half of all clothes are thrown away within one year—many have never been worn. The industry’s obsession with fast fashion comes with a steep environmental price tag. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Fashion is one of the fastest-growing industries on the planet. Around the world eighty billion new pieces of …

Read More »

Read More »

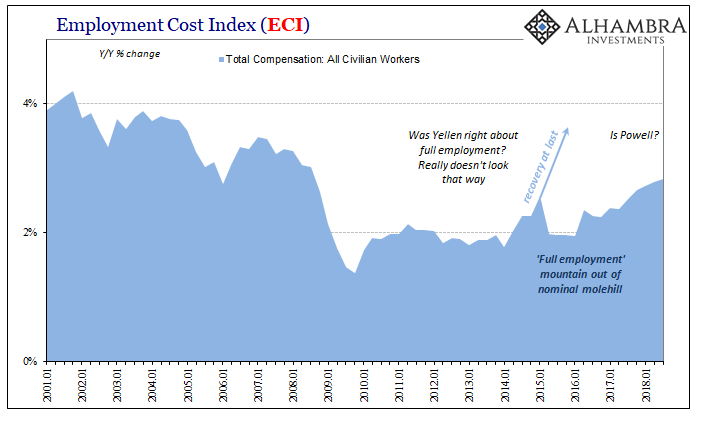

Another ‘Highest In Ten Years’

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers.

Read More »

Read More »

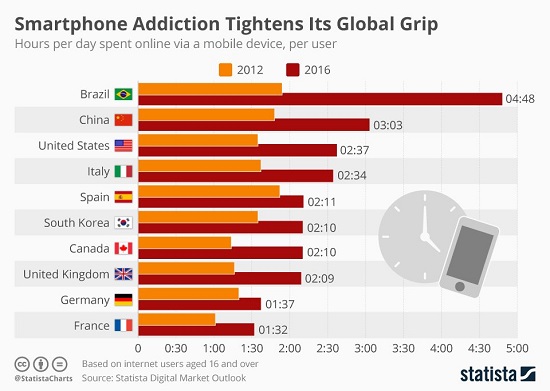

Why Is Social Media So Toxic?

The desire to improve our social standing is natural. What's unnatural is the toxicity of doing so through social media. It seems self-evident that the divisiveness that characterizes this juncture of American history is manifesting profound social and economic disorders that have little to do with politics. In this context, social media isn't the source of the fire, it's more like the gasoline that's being tossed on top of the dry timber.

Read More »

Read More »

Globalization Has Hollowed Out Rural America

What do we make of an economy in which a handful of bubblicious urban areas are magnets for jobs and capital while rural communities have been hollowed out? The short answer is that this progression of urbanization has been one of the core dynamics of civilization for thousands of years: opportunities are greater in cities, and so people move from rural areas with few opportunities to cities with greater opportunities.

Read More »

Read More »

What’s the Real Meaning of the Stock Market Swoon?

Economy has reached peak earnings so there's no fundamentals-driven upside left. Bond yields are now high enough to dampen enthusiasm for inherently risky stocks. Central banks curtailing / ending their quantitative easing programs have reduced liquidity in the financial system. US markets are catching up to the rest of the world's market slump.

Read More »

Read More »

Charles Hugh Smith On Why Many Millennials Are Promoting Socialism

Click here for the full transcript: http://financialrepressionauthority.com/2018/10/26/the-roundtable-insight-charles-hugh-smith-on-why-many-millennials-are-promoting-socialism/ Disclaimer: The views or opinions expressed in this blog post may or may not be representative of the views or opinions of the Financial Repression Authority.

Read More »

Read More »