Category Archive: 5) Global Macro

The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary task should it be found...

Read More »

Read More »

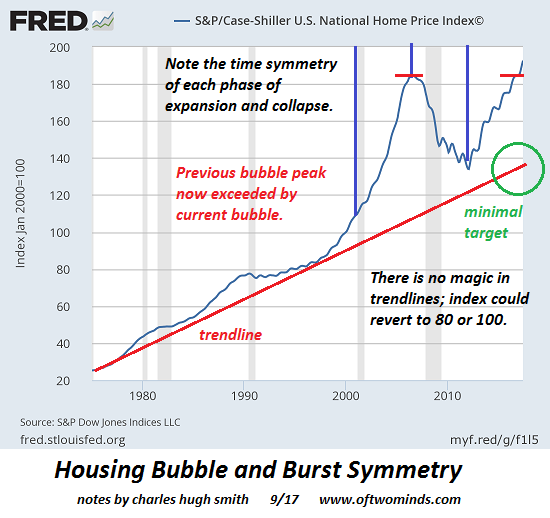

Housing Bubble Symmetry: Look Out Below

Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers. There are two attractive delusions that are ever-present in financial markets:One is this time it's different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data; furthermore, markets are now...

Read More »

Read More »

Emerging Markets: What has Changed

China plans to issue its first USD-denominated bond since 2004. China’s largest banks banned North Koreans from opening new accounts. The UN Security Council approved new sanctions on North Korea. Relations between Poland and the European Commission remain tense. Brazil’s central bank appears to be signaling discomfort with ongoing BRL strength.

Read More »

Read More »

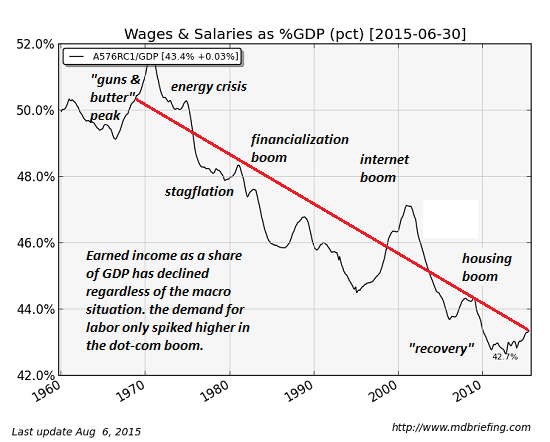

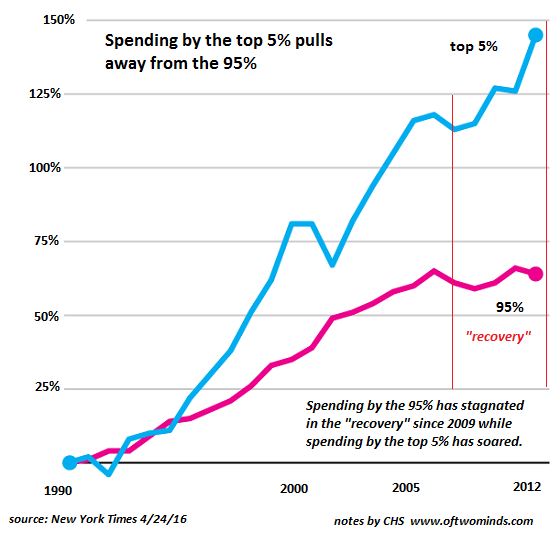

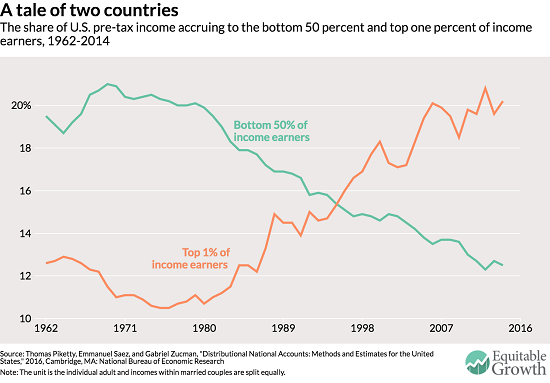

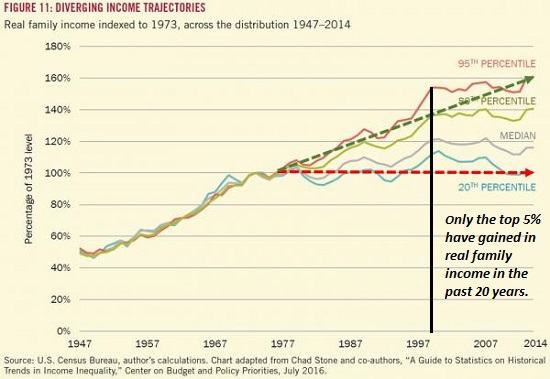

The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

Labor's share of the national income is in freefall as a direct result of the optimization of financialization. The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed...

Read More »

Read More »

Les «diamants de sang» zimbabwéens circulent librement sur les marchés internationaux. La Tribune

L’ONG britannique Global Witness vient de publier ce 11 septembre un rapport explosif qui met à nu des opérations de détournement des revenus du secteur minier zimbabwéen par l’élite militaire et politique du pays pour financer les opérations répressives du régime du président Mugabe.

Read More »

Read More »

Is the High Cost of Housing Crushing Wages?

The authors' thesis doesn't explain the 47-year downtrend of labor's share of the economy. A provocative essay, Don't Blame the Robots, makes the bold claim that "Housing Prices and Market Power Explain Wage Stagnation." (Foreign Affairs) In other words, the stagnation of the bottom 95% of wages isn't caused by automation or offshoring, but by the crushingly high cost of housing:

Read More »

Read More »

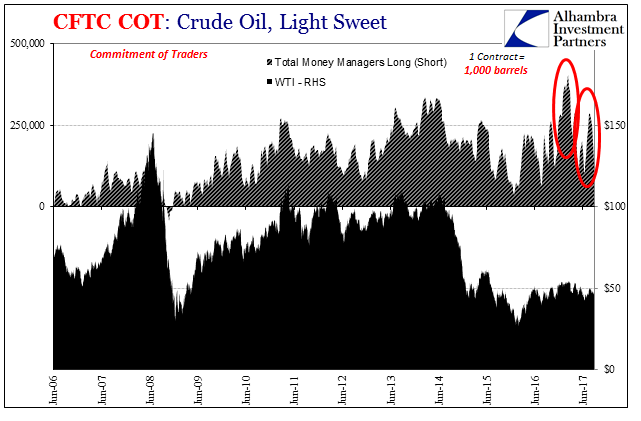

COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year.

Read More »

Read More »

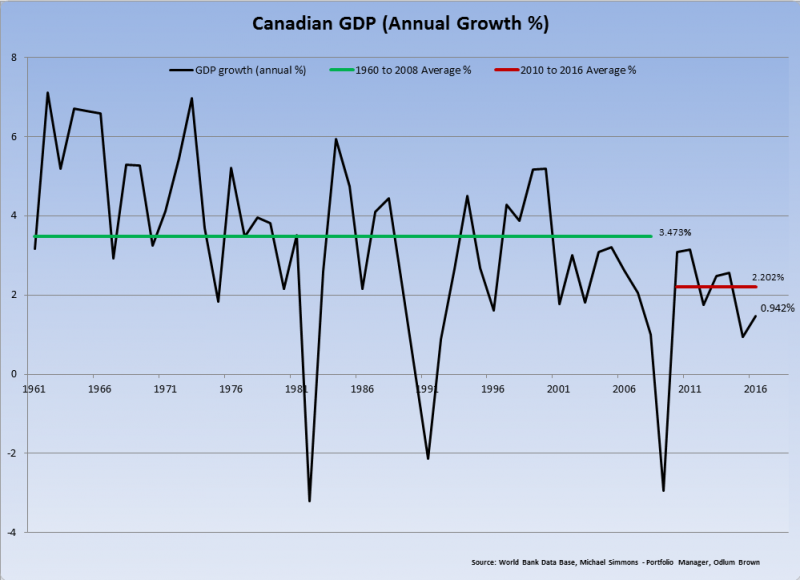

Canada’s RHINO(s)

The Bank of Canada “raised rates” again today, this time surprising markets and economists who were expecting more distance between the first and second policy adjustments. The central bank paid typical lip service to being data dependent. It has a vested interest if you, as any Canadian reader, believe that to be a fact.

Read More »

Read More »

Death is inevitable, but a bad death is not | The Economist

Death is inevitable, but for most people in rich countries it’s not sudden. Our Public Policy Editor, John McDermott, examines how terminally ill patients can have the death they want. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 How to have a better death. Michael Hunter was recently diagnosed with terminal cancer. He …

Read More »

Read More »

US Export/Import: ‘Something’ Is Still Out There

In January 2016, just as the wave of “global turmoil” was cresting on domestic as well as foreign shores, retired Federal Reserve Chairman Ben Bernanke was giving a series of lectures for the IMF. His topic wasn’t really the so-called taper tantrum of 2013 but it really was. Even ideologically blinded economists like Bernanke could see how one might have followed the other; the roots of 2016 in 2013.

Read More »

Read More »

The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don't keep pace with inflation will have lost a third...

Read More »

Read More »

The global arms trade is booming | The Economist

The global arms trade has reached its highest point since the Cold War. We reveal which countries are buying up weapons and explain why. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 We are in the midst of the biggest arms race since the Cold War. In 2016 World military spending accounted for …

Read More »

Read More »

Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse

Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse #charleshughsmithhealthcare #charleshughsmithpodcast

Read More »

Read More »

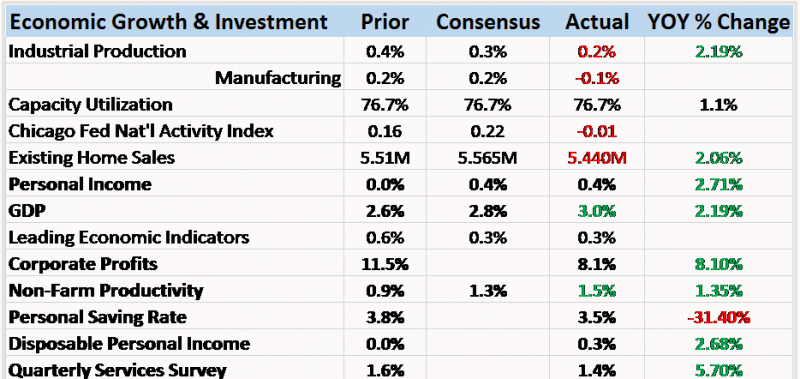

Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house that survived Andrew with barely...

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM.

Read More »

Read More »

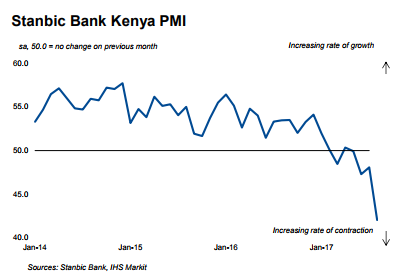

Global PMI Roundup; August 2017

The first few days of any calendar month are now flooded with PMI data. Mostly due to Markit’s ongoing and increasing partnerships, we now have access to economic or business sentiment from and for almost anywhere in the world. It isn’t clear, however, if that is a good or useful development. For example, we can see quite plainly that there is a whole bunch of trouble brewing in Kenya. The Stanbic Bank/Markit Kenya PMI fell to a record low 42.0 in...

Read More »

Read More »

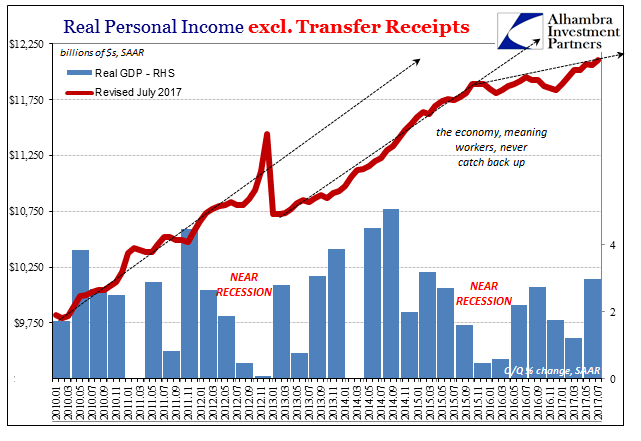

Why We’re Doomed: Stagnant Wages

The point is the present system cannot endure. Despite all the happy talk about "recovery" and higher growth, wages have gone nowhere since 2000--and for the bottom 20% of workers, they've gone nowhere since the 1970s. Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend.

Read More »

Read More »

Emerging Markets: What has Changed

South Korea completed installation of the THAAD missile shield. Indonesia is considering issuing its first global IDR-denominated sovereign bonds. Taiwan is undergoing a cabinet shuffle. Brazil has seen some positive political developments.

Brazil’s central bank signaled that the easing cycle is nearing an end and that the pace of easing will slow. Chile’s central bank boosted its growth forecasts.

Read More »

Read More »

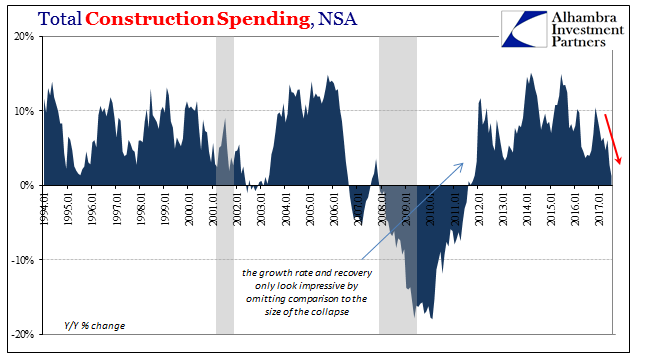

Now Capex?

Of all the high frequency data the Personal Savings Rate is probably the least reliable. It is subject to both regular and benchmark revisions that can change the estimates drastically one way or the other. One step up from that statistic is the figures for Construction Spending. The initial monthly estimates don’t survive very long, and lately they have been quite weak in the first run only to be revised sharply higher over subsequent months.

Read More »

Read More »