Category Archive: 5) Global Macro

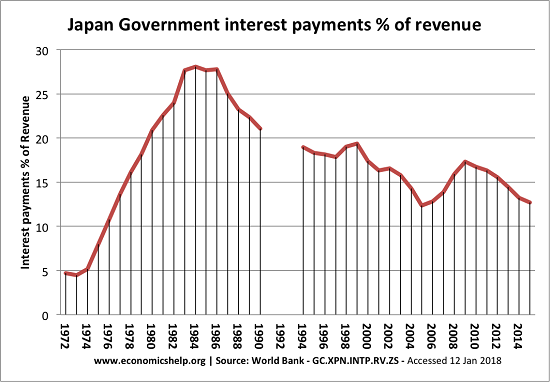

The Japanification of the World

Zombification / Japanification is not success; it is only the last desperate defense of a failing, brittle status quo by doing more of what's failed. A recent theme in the financial media is the Japanification of Europe. Japanification refers to a set of economic and financial conditions that have come to characterize Japan's economy over the past 28 years: persistent stagnation and deflation, a low-growth and low-inflation economy, very loose...

Read More »

Read More »

Are the Rise of Social Media and the Decline of Social Mobility Related?

Social media offers hope of achieving higher online social status without having to succeed financially in a winner-take-most economy. I've often addressed the decline of social mobility and the addictive nature of social media, and recently I've entertained the crazy notion that the two dynamics are related. Why Is Social Media So Toxic?

Read More »

Read More »

The truth about lies | The Economist

From little fibs to big fat whoppers, lying is part of human nature. Lane Greene, our language guru, examines the difference between lies, falsehoods and plain nonsense. To read more about why the press should call out politicians when they lie click here: https://econ.st/2FRdmJS Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For …

Read More »

Read More »

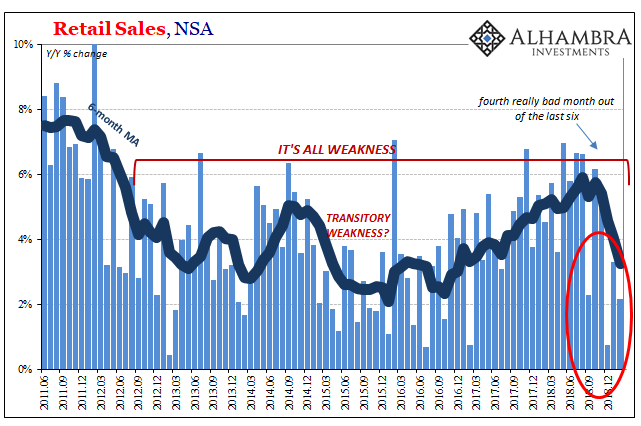

Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks.

Read More »

Read More »

Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst.

Read More »

Read More »

The Hidden Cost of Losing Local Mom and Pop Businesses

What cannot be replaced by corporate chains is neighborhood character and variety. There is much more to this article than first meets the eye: In a Tokyo neighborhood's last sushi restaurant, a sense of loss "Eiraku is the last surviving sushi bar in this cluttered neighborhood of steep cobblestoned hills and cherry trees unseen on most tourist maps of Tokyo.

Read More »

Read More »

The hunt for oceans in space | The Economist

Scientists believe there are oceans buried under thick crusts of ice on the moons of Saturn and Jupiter. Sampling them would raise hope of life beyond Earth https://econ.st/2WDdEe5 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The …

Read More »

Read More »

Charles Hugh Smith on the End Game for Monetary and Fiscal Policies

Click here for the full transcript: http://financialrepressionauthority.com/2019/04/01/the-roundtable-insight-charles-hugh-smith-on-the-end-game-for-monetary-and-fiscal-policies/

Read More »

Read More »

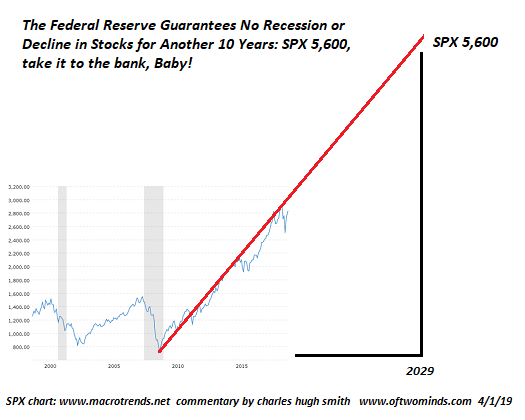

The Fed Guarantees No Recession for 10 Years, Permanent Uptrend for Stocks and Housing

A classified Federal Reserve memo sheds new light on the Fed's confidence in its control of the economy and the stock and housing markets. In effect, the Fed is guaranteeing that there will be no recession for another 10 years, and that stocks and housing will remain in a permanent uptrend.

Read More »

Read More »

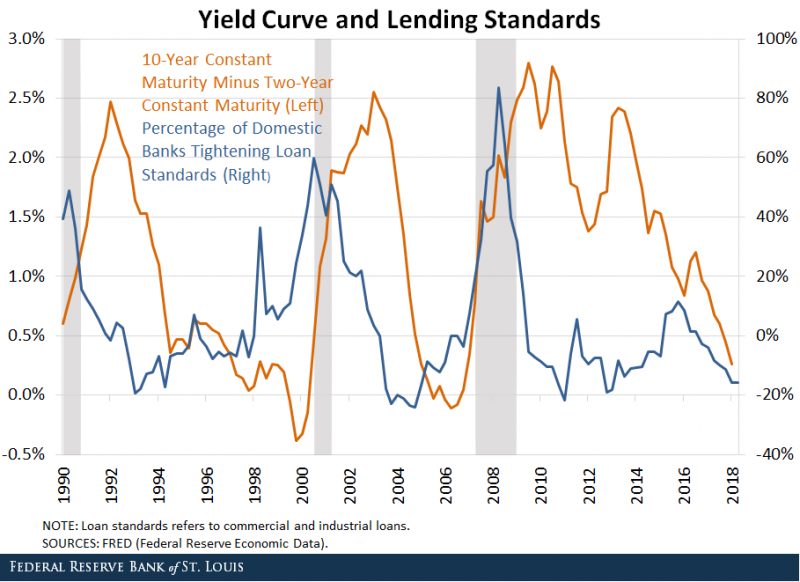

Monthly Macro Monitor – March 2019 (VIDEO)

Alhambra CEO discusses all the talk about the recent yield curve inversion and how he views it.

Read More »

Read More »

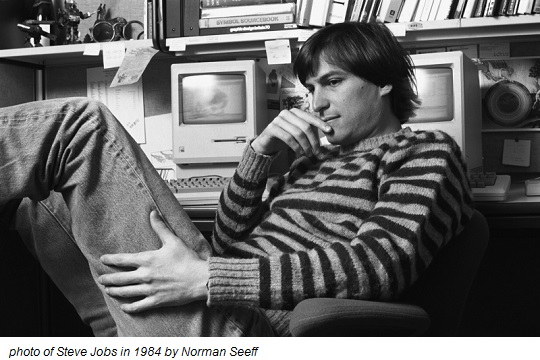

Apple’s Rotten Core

Entering commoditized, fiercely competitive low-margin services cannot substitute for the high-margin profits that will be lost as global recession and saturation erode iPhone sales. Apple has always been equally an enterprise and a secular religion. The Apple Faithful do not tolerate heretics or critics, and non-believers "just don't get it."

Read More »

Read More »

Trump’s post-Mueller victory spin | The Economist

The summary of Robert Mueller’s report appears to have cleared President Trump of collusion with Russia in the 2016 election campaign—though it did not exonerate him of obstructing justice. Kal, our cartoonist, contemplates “spinmeister” Trump’s joyous vindication. https://econ.st/2HNleQ8 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit:...

Read More »

Read More »

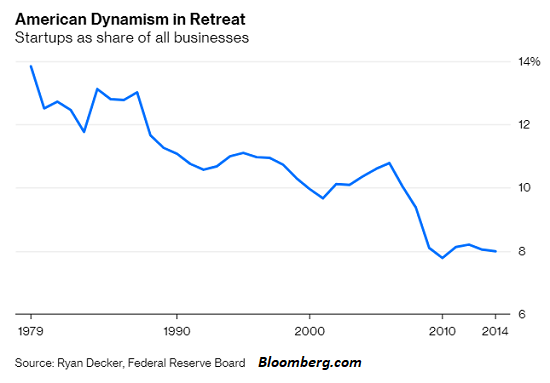

Is the World Becoming Wealthier or Poorer?

There is nothing intrinsically profitable about either robotics or AI. At the request of colleague/author Douglas Rushkoff (his latest book is Team Human), I'm publishing last week's Musings Report, which was distributed only to subscribers and patrons of the site.) The core assumption of Universal Basic Income (UBI) and other plans to redistribute wealth and income more broadly is that the world is becoming wealthier, and so the pool of income and...

Read More »

Read More »

Why is chicken so cheap? | The Economist

People eat 65 billion chickens every year. It is the fastest-growing meat product. Yet pound for pound the price of chicken has fallen sharply. How has this happened? Read more about Chickenomics here: https://econ.st/2Wtp04o Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Chickens are the most populous bird on the planet. There are …

Read More »

Read More »

Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting over.

Read More »

Read More »

How happy is your country? | The Economist

Money doesn’t buy happiness—or does it? In both India and China people have become richer in the past decade, but global data reveal that greater wealth does not necessarily lead to greater happiness Economic growth does not guarantee rising happiness. Read more here: https://econ.st/2HIlxLT Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy The …

Read More »

Read More »

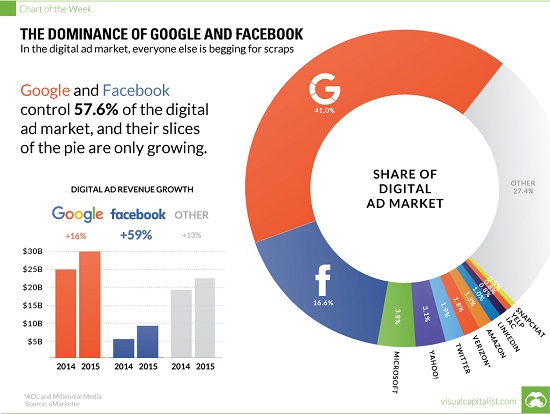

When Are We Going to Tackle the For-Profit Monopolies Which Censored RussiaGate Skeptics?

We either take down Facebook and Google and turn them into tightly regulated transparent public utilities available to all or they will destroy what little is left of American democracy. The RussiaGate Narrative has been revealed as a Big Con (a.k.a. Nothing-Burger), but what's dangerously real is the censorship that's being carried out by the for-profit monopolies Facebook and Google on behalf of the status quo's Big Con.

Read More »

Read More »

The Media, Mueller, the Big Con and the Democratization of Narrative

Falling for a con is painful. The first reaction is to deny being conned, of course. The second is to blame skeptics for being correct in their skepticism. Here's the fundamental "story" of the Mueller Investigation: elites don't like "the little people" democratizing public narratives.

Read More »

Read More »

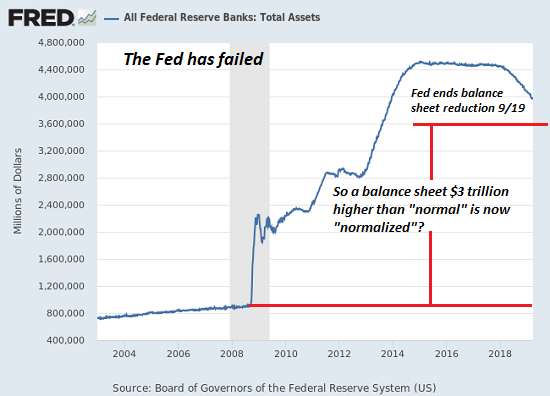

Politics Has Failed, Now Central Banks Are Failing

With each passing day, we get closer to the shift in the tide that will sweep away this self-serving delusion of the ruling elites like a crumbling sand castle. Those living in revolutionary times are rarely aware of the tumult ahead: in 1766, a mere decade before the Declaration of Independence, virtually no one was calling for American independence.

Read More »

Read More »

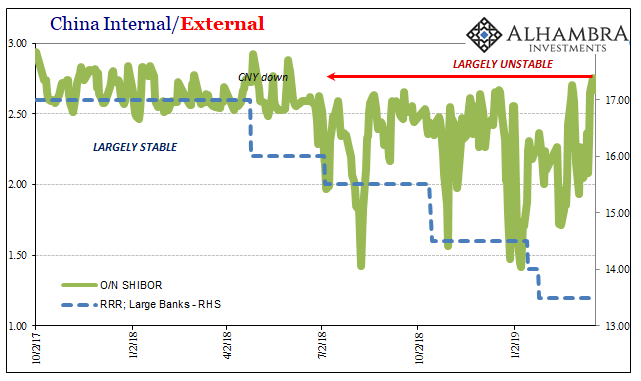

February 2019 PBOC/RMB Update

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions.

Read More »

Read More »