Category Archive: 4) FX Trends

USDJPY keeps a bullish bias, but can it break the 200 day MA

As the market trades up and down, traders need to look for technical clues that give bias clues. For the USDJPY, the pair traded up and down but the lows found support against a prior resistance level. That kept the bullish bias. However, there is also some key technical resistance that is stalling the run …

Read More »

Read More »

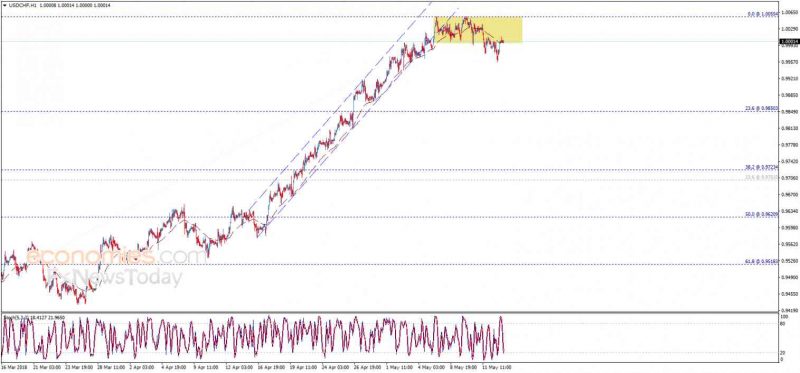

Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870.

Read More »

Read More »

EURUSD trades between defined technical support and resistance

The EURUSD traded between defined technical support and resistance in trading on June 5th. The support was defined by swing lows and the 38.2% retracement. The resistance was defined by the 100 bar MA on the 4-hour chart. Traders will be looking for a break one way or the other going forward into the new …

Read More »

Read More »

Dollar jumps on better US data, but gains are limited.

The dollar was goosed higher on the back of some decent data. The PMI, ISM and JOLTs data all beat expectations. Good news for the US economy. The Nasdaq moved to new record highs. The S&P and the Dow are less impressed. In the debt market, the yields remain in the red which is interesting. … Continue reading...

Read More »

Read More »

FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

The British pound is benefiting from the stronger than expected service and composite PMI readings, which among other things are serving as a distraction from the government's seemingly tortured approach to Brexit and the sales of part of its stake in RBS for a GBP2 bln loss. Financials are a drag on the FTSE 100 today (~-0.5% while other major bourses are higher).

Read More »

Read More »

FX Weekly Preview: Macro Matters Now, Just Not the Data

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new dollar gains.

Read More »

Read More »

Great Graphic: Euro Bulls Stir but Hardly Shaken

Euro has fallen 10.5 cents since mid-February. Net speculative longs in the futures market remain near record. Gross long euros have actually increased over the past month.

Read More »

Read More »

FX Daily, June 01: Ironic Twists to End the Tumultuous Week

The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade).

Read More »

Read More »

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »

USDJPY stalls at overhead resistance but keeps most of the gains

With the US stock market rebounding and yields also higher, the USDJPY is higher on the day. However, overhead resistance is putting a lid on the rally so far. Can that lid be broken?

Read More »

Read More »

FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday's lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves.

Read More »

Read More »

EURUSD corrects to 100 hour MA and stalls

The EURUSD corrected to the 100 hour MA and stalled. Is that the peak for the correction?

Read More »

Read More »

What Happened Monday?

Italian politics dominated Monday's activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections.

Read More »

Read More »

FX Weekly Preview: Political Crises in Europe Rivals Economic Data and Trade to Drive Capital Markets

The end of the Greek assistance program that allowed them to keep their primarily official creditors whole, and the broad expansion in the eurozone, was supposed to usher in a new period of convergence. Monetary union was once again feted as a success, and some observers were forecasting a substantial increase in the euro as a reserve asset.

Read More »

Read More »

Trade Like A Pilot and You Will Never Crash

My favorite question to ask new traders is this: What do you do when you make a mistake in trading? The answer to that question tells you everything you need to know whether they’re going to make money. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

The euro and sterling were sold through yesterday's lows in Asia, but rebounded in Europe, with the help of mildly constructive data in the form of the German IFO and details of UK Q1 GDP. The IFO climate measure matched the April reading and thereby snapped a five-month slide. The expectations component slipped, but the current assessment improved.

Read More »

Read More »

FX Daily, May 24: Greenback Pushes Lower

The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the Canadian dollar. It is also softer against most of the emerging market currencies. The chief exception is the Turkish lira. Yesterday's 300 bp rate hike could only stem the rot momentarily and the lira's 2.3% decline today, wipes out 2/3 of the annual rate increase.

Read More »

Read More »

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »

Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

The Swiss National Bank's decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not exactly clear where the euro bottomed in the frenzied activity that followed the SNB's surprise move. Bloomberg records the euro's low near CHF0.8520.

Read More »

Read More »

Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally upwards to breach 1.0055 level and...

Read More »

Read More »