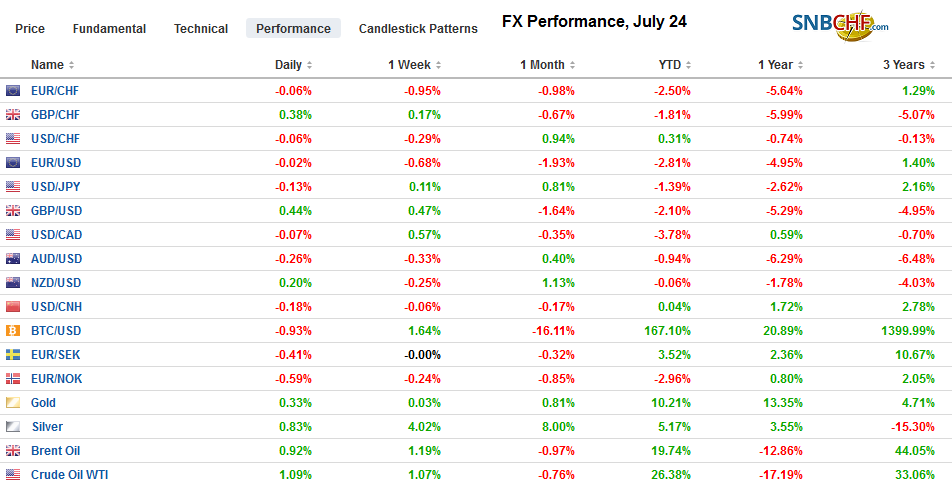

Swiss FrancThe Euro has fallen by 0.17% at 1.0966 |

EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow’s ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and Spanish 10-year benchmark yields are off four-six basis points, while core bond yields are off two-three basis points. Asian equities were mixed, with the biggest markets, including Japan, China, Hong Kong, and Australia advancing, while most of the others slipped lower. US shares are trading lower after the S&P 500 closed above 3000 for the first time in a week. Confirmation of an antitrust review of several large tech firms weighs down the benchmark. Oil prices are a little firmer following news late yesterday that API estimate of US oil stocks. It saw a nearly 11 mln barrel drawdown, the sixth consecutive drop, which is the longest streak since January 2018. |

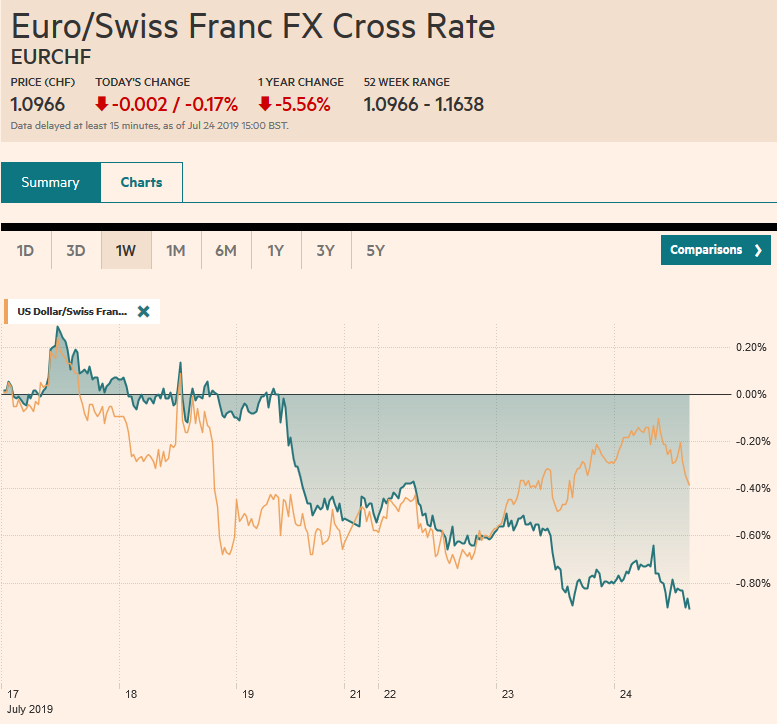

FX Performance, July 24 |

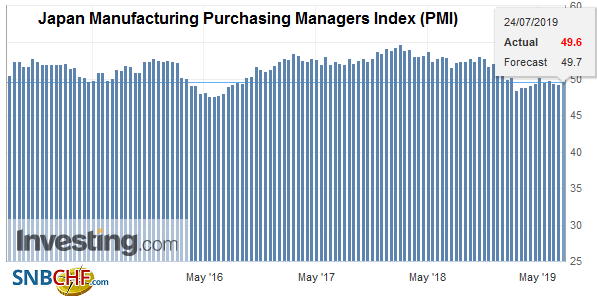

Asia PacificNews that US negotiators will be in Shanghai in the first part of next week to resume face-to-face talks were greeted optimistically by the market. However, the rhetoric around the negotiations has not improved. Previously, the US was saying that a deal was close and 90% of an agreement was in hand. Now, it is playing down the prospects. At the same time, it is noteworthy that China’s Commerce Minister will join the talks alongside Liu He. Some Chinese officials, like from the central bank, often have a liberal-reformer bias, while the Commerce Department is often less so and usually takes a seemingly harder line, and that is seen to be the case with Zhong Shan. The Bank of Japan meets next week. While it is not expected to ease, there is increased talk that it will likely reduce its outlook for inflation. Its 1.1% forecast seems too high. A downward adjust would lay the groundwork for some policy response if necessary after the sales tax increases in October. In yesterday’s IMF economic updated, Japan’s 2019 growth forecast was shaved by 0.1% to 0.9%. |

Japan Manufacturing Purchasing Managers Index (PMI), July 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

New Zealand reported a larger trade surplus (NZ$365 mln) from a revised NZD175 mln (from NZD264 mln). However, both imports and exports fell. Imports were at their lowest level since February 2018 and off 10% year-over-year. The decline was led by a 39% drop in fuel and a 16% drop in vehicles. A refinery shutdown in June 2018 may exaggerate the real decline in fuel. Imports in Q2 were off 1% on a seasonally adjusted basis. Exports in Q2 rose 1.5%, led by a rise in infant formula (18%) and aluminum (15%). Separately, the market is pricing in a higher chance of a rate cut by the Reserve Bank of Australia, with an October time frame the focus. The Reserve Bank of New Zealand is expected to cut at its next meeting on August 7.

The dollar is struggling to hold above JPY108.00. As we noted earlier this week, there are $4.3 bln in a JPY108 strike that is expiring today. Although mild support is seen in the JPY107.50-JPY107.80 band, stronger support is nearer JPY107.00. The Australian dollar is lower for the fourth consecutive session. It is fallen a cent since being turned back from around $0.7080 before last weekend. The next downside target is the $0.6930-$0.6960 area. The New Zealand dollar is also off for the fourth session. It is finding support bids near the 20-day moving average (~$0.6695), but the risk extends to $0.6680 and then $0.6650. The Chinese yuan continues to flatline-confined to narrow ranges as it has for the better part of the past two weeks.

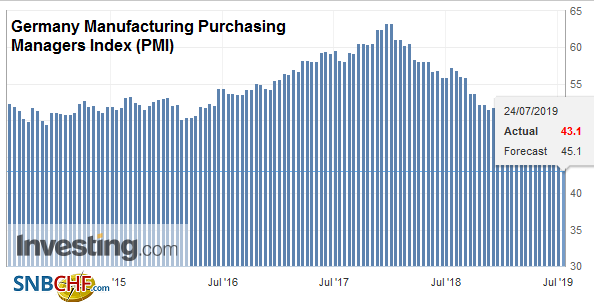

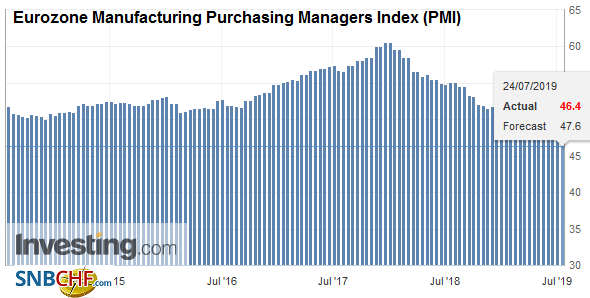

EuropeThe flash PMI from the eurozone disappointed and this is seen bolstering the case for the ECB to act as early as tomorrow on new support for the regional economy. Germany flash manufacturing PMI slumped to 43.1 from 45.0, as weak foreign demand was evident. The service PMI slipped to 55.4 from 55.8. This took the composite to 51.4, matching its cyclical low in March, down from 52.8 in June. France was not spared the pressure. Its flash manufacturing PMI fell back to 50.0 from 51.9. The service reading eased to 52.2 from 52.9. The combination took the composite to 51.7 from 52.7. Recall the composite started the year at 48.2. |

Germany Manufacturing Purchasing Managers Index (PMI), July 2019(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The aggregate readings for the eurozone were as what would imagine with the report from the largest two economies. Manufacturing fell to 46.4 from 47.6. Service fell to 53.3 from 53.6, and the composite stands at 51.5, down from 52.2. Interpolating from the overnight index swaps, the odds of a rate cut tomorrow increased to almost 43% from around 37% yesterday. |

Eurozone Manufacturing Purchasing Managers Index (PMI), July 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The UK focus is on Johnson formally replacing May today. A flurry of resignations is expected to clear the decks for Johnson’s new cabinet. According to a Reuters survey, the risks of a no-deal exit are at the highest level in nearly two years.

The euro has been sold down to near $1.1125, its lowest level since the end of May. Support is seen near the two-year low set in May nearer $1.1100. A bounce, of which the intraday technicals warn, need to overcome $1.1150, where a roughly 965 mln euro option is struck that will be cut today, to be anything of note. Even then, it needs to resurface above $1.12 to be meaningful. Sterling is confined mainly to yesterday ranges (~$1.2420-$1.2480) but is extending its recovery against the euro. The euro is near GBP0.8925 after peaking a week ago above GBP0.9050. After a record 11-week advance against sterling, the profit-taking is kicking. Below GBP0.8900 is a GBP0.8870 immediate objective, but over a little longer horizon, we suspect potential toward GBP0;8830.

America

While shaving its outlook for the world economy this year to 3.2% from 3.3%, the IMF lifted its US forecast to 2.6% from 2.3% but kept the 2020 forecast unchanged at 1.9%. Markit reports its flash July PMI reading today, and June new homes sales will be reported. Existing homes sales reported yesterday disappointed, falling 1.7% instead of the 0.4% dip that economists expected. New homes sales are expected to have increased by 5.1% after dropping 7.8% in May. Canada has no important reports, while Mexico releases its bi-weekly CPI. Mexico measured inflation is slowly edging back into the 2-4% range.

Yesterday, the US Justice Department confirmed what press reports have been speculating about-namely that a broad anti-trust investigation has been opened for large tech firms. These include Facebook, Google, Apple, and Amazon. The shares traded lower on the news. Facebook is to report earnings today, as is a slew of other companies, including Boeing, Caterpillar, and ATT. The S&P 500 may find initial support in the 2975-2980 area, but we suspect that the downside extends toward 2944, the bottom of a gap from the end of June.

The US dollar is consolidating its push to new highs for the month against the Canadian dollar near CAD1.3165. We peg supported near CAD1.3120. Our immediate target is the CAD1.3175-CAD1.3220 band. The greenback tested MXN19.20 yesterday. It has not closed above there this month. It has been pushed back below MXN19.15, but we suspect North American traders may be reluctant to extend the greenback’s losses much more. The daily technical readings warn of that the dollar’s upside against the peso may not have been exhausted. The Dollar Index is trading near two-month highs. Gains ahead of the ECB meeting were anticipated. The key is whether it peaks afterward and as the market turns its attention to the FOMC meeting next week.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movements,ECB,EMU,EUR/CHF,Eurozone Manufacturing PMI,Germany Manufacturing PMI,Japan Manufacturing PMI,newsletter,SPX,USD/CHF