Swiss FrancThe Euro has fallen by 0.05% at 1.1078 |

EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan, South Korea, and India. Europe’s Dow Jones Stoxx 600 is flattish, struggling to extend its three-day rally. US shares are also little changed after the S&P 500 rose for the fifth consecutive session yesterday to new record highs. It has risen in 10 of the last 12 sessions. Australian and New Zealand 10-year benchmark yields fell five basis points while European yields are off two-five basis points and US Treasuries are.little changed. The dollar is little changed though firmer against the major currencies. Sterling, weighed down by Brexit concerns, is the weakest. After being turned back from approaching $1.26 yesterday, the pound has turned toward the two-year low set last week, as the euro pushes above GBP0.9000 for the first time since January. |

FX Performance, July 16 |

Asia Pacific

Reports suggest little progress has been made in Chinese-American trade talks since the new tariff truce was announced last month. A conference call is expected between top negotiators this week, and if there is any progress, the US delegation led by Mnuchin and Lighthizer will go to Beijing soon. Separately, the NY Times reports that the aid to US farmers to blunt the effect of the retaliatory tariffs has more than offset the funds collected through the tariffs in the first place.

The Bank of Japan meets a day before the FOMC meeting concludes on July 31. Although, it is not expected to change policy, there is speculation that it may increase its bond buying at the start of the second half of the fiscal year (October 1) when the government may offer a supplemental budget to ensure that the sales tax increase (from 8% to 10%) does not spur an economic contraction, which has resulted from past tax hikes.

New Zealand’s Q2 CPI was in line with expectations, rising 0.6% on the quarter and 1.7% year-over-year (from 1.5%), and this is seen as posing no obstacle to a rate cut when the central bank meets on August 6. The market expects the RBNZ to pause after next month’s move, but is nearly 50/50 for another cut before the end of the year. The Reserve Bank of Australia has cut at the past two meetings and is widely seen on hold at its August 6 meeting. The minutes from the July 2 meeting continued to point investors toward the labor market and wage growth for insight into the next move, which is also likely later in Q4.

The dollar has forged a shelf in recent days near JPY107.80, and this may be reinforced by around $1.3 bln in options struck between JPY107.70-JPY107.90 that expire today. However, offers in the European morning near JPY108.10 proved a sufficient cap in the quiet turnover. The Australian dollar initially extended yesterday’s gains but ran into resistance near the highs saw earlier this month in front of $0.7050. Buying on dips suggests the Aussie’s advance may not be over, and our reading of the chart suggest potential toward $0.7100. The New Zealand dollar saw its best level in three-months today, but the expiring options at $0.6720 and $0.6740 (for NZD$225 and NZD$300 mln respectively) are in play.

Europe

EC President-nominee Von der Leyen gave an impassioned and visionary speech to the EU Parliament today, in which she reportedly switched between English, French, and German. She endorsed a European-style “green deal,” and, although there were not enough details to win over the Greens’ endorsement, she is expected to win the support of a majority (374 MPs) to replace Juncker. There will likely be a larger market reaction (euro negative) if she fails to secure a majority. Under such a scenario, an emergency summit would probably be necessary. The vote is expected toward after the close of European markets today.

| The strongest rise in wages in over a decade, failed to offset the negativity coming what appears to be the more aggressive stance by Johnson and Hunt, which is seen boosting the chance of a no-deal exit, which despite the attempts of some politicians and journalists to play down the adverse impact, continues to spook investors. Just as the media reports that the EU may be looking some areas it can compromise and soften its stance, Johnson and Hunt have come out swinging to court the last of the Tory voters by saying they would drop the backstop. To us, this still seems like jettisoning the Good Friday Agreement so it can withdraw from another treaty. |

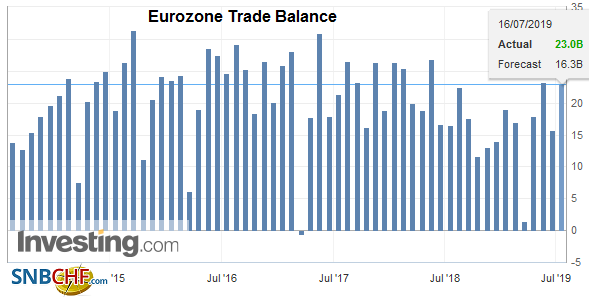

Eurozone Trade Balance, May 2019(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

| Average weekly earnings in the UK rose 3.6% (May) excluding bonuses and 3.4% with bonuses for the past three months on year-over-year compared with 3.4% and 3.2% respectively. However, the other details of the report suggest the labor market is cooling. The claimant count rose for the second consecutive month, and at 38k in June, was at its highest level in a decade. It has averaged a little more than 28k this year compared with less than 11k in H1 18. The growth in jobs was less than expected, though unemployment was unchanged at 3.8% (ILO). |

U.K. Unemployment Rate, May 2019(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

Germany’s ZEW survey was another disappointment. The assessment of the current situation plunged into negative territory (-1.1 from 7.8) for the first time in nine years. The expectations component returned to the trough seen in H2 18 (-24.5 from -21.1). It plays on fears that the largest economy in Europe and the fourth largest in the world may have contracted in Q2. Real sector data is holding up better than the survey data, but even the IMF has come out in favor of fiscal support.

The euro stalled last week and yesterday near $1.1280. In this range-trading affair, the lower end of the range should be tested next. There may be mild support near $1.1220, but a move back toward $1.1180-$1.1190 appears likely in the near-term. There are nearly 1.5 bln euros in options struck between around $1.1180 and $1.1195 expire today. Sterling has pushed below $1.2470, and a break of $1.2440 would signal the next leg down that could extend toward $1.2380.

America

There are three features to the US session today. First is the data: retail sales and industrial production. A survey by Action Economics found a median forecast of a 0.2% increase in retail sales, which would translate into a 0.3% average in Q2 after a 0.9% average in Q1. Although retail sales are a little more than 40% of personal consumption, one gets a sense of at least one dimension of the slow down that may have halved US growth in Q2. The Action Economics survey found a median forecast for industrial output of 0.2%, (compared with 0.1% in the Bloomberg survey). We argue that Q2 data is no longer relevant for investors and policymakers. A Fed cut at the end of the month is a foregone conclusion. What happens after that is not going to be driven by Q2 data.

That is a good segue into the second feature of the US session: No fewer than five Fed officials will speak today, including Powell. After Powell’s testimony last week and the FOMC minutes, little new can reasonably be expected. Collectively, the market is pricing in two cuts before the end of the year and is divided about a third. The third feature today is corporate earnings, where JP Morgan, Goldman, and Wells Fargo are the marquee names. Citi’s miss yesterday may have lowered the bar.

The US dollar recorded its lows for the year against the Canadian dollar before the weekend near CAD1.3020. We noted that the technical indicators did not confirm the new low and that the divergence could signal US dollar consolidation/correction. The low held yesterday and the greenback is edging slightly higher today. It has tested the (38.2%) retracement of last week’s decline (CAD1.3065), and the next technical objectives are found between CAD1.3080 and CAD1.3100. The Mexican peso has traded firmly in thin Asian and European turnover. The dollar has not traded above MXN19.00, and if this is sustained through the North American session, it would be the first time since May 1. We are concerned that the peso’s strength now may see the leveraged accounts pullback or even take some profits.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,Brexit,Currency Movements,EUR/CHF,Eurozone Trade Balance,newsletter,U.K. Unemployment Rate,USD/CHF