Category Archive: 4) FX Trends

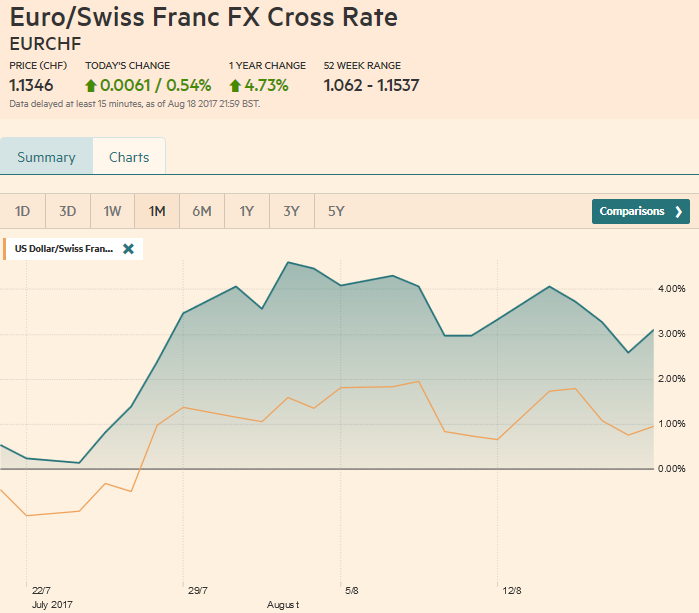

FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

The euro has lost some momentum, Draghi does not want to talk about an early end of his bond buying programming. Confirmed by economic data, 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swiss appreciated during the week.

Read More »

Read More »

Markets Exaggerate, That is what They Do

FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact.

Read More »

Read More »

FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week's gain in half. The Dow Jones Stoxx did not completely escape the US carnage yesterday, but losses are accelerating today, with a nearly 1% decline following a 0.6% decline yesterday.

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »

Is the Yen or Swiss Franc a Better Funding Currency?

Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution.

Read More »

Read More »

FX Daily, August 16: Swiss Franc and Yen Improve after Dovish Draghi Comments

Swiss Franc and Yen Improve after Dovish Draghi Comments, A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB's Draghi will not be discussing the central bank's monetary policy course at Jackson Hole confab, which will take place next week.

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »

FX Weekly Preview: Synthetic FX View — Macro and Prices

Economic data due out are unlikely to change macro views. Swiss franc's price action suggests some return to "normalcy" despite rhetoric remaining elevated. Sterling's 3.25 cent drop against the dollar looks over.

Read More »

Read More »

What I learned about trading from the waves in Hawaii

Maui, Hawaii — Adam Button from ForexLive talks about how nature is the best teacher and what he learned about currency trading and life watching the waves in Hawaii. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, August 11: Geopolitical Tensions Remain Elevated into the Weekend

There has been no apparent attempt by either North Korea or the United States to ease the rhetorical flourishes that have made global investors nervous. Risk assets were liquidated, and the funding currencies, particularly the Japanese yen and Swiss franc were bought back. The yen gained nearly 1.6% this week, ahead of the US session, while the Swiss franc gained 1.3%.

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, August 09: North Korea lets EUR/CHF Collapse

The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended. Turning to Asia first, the Korea's equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%).

Read More »

Read More »

FX Daily, August 08: Trade Featured as Dollar Drifts Lower

The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday's range today.

Read More »

Read More »

Great Graphic: Unemployment by Education Level

The US reports the monthly jobs data tomorrow. The unemployment rate stood at 4.4% in June, after finishing last year at 4.7%. At the end of 2015 was 5.0%. Some economists expect the unemployment rate to have slipped to 4.3% in July. Recall that this measure (U-3) of unemployment counts those who do not have a job but are looking for one.

Read More »

Read More »

FX Daily, August 07: Outlaw Mondays

The US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing against the Canadian dollar for the sixth consecutive session. The New Zealand dollar is weaker for the fifth time in six sessions.

Read More »

Read More »

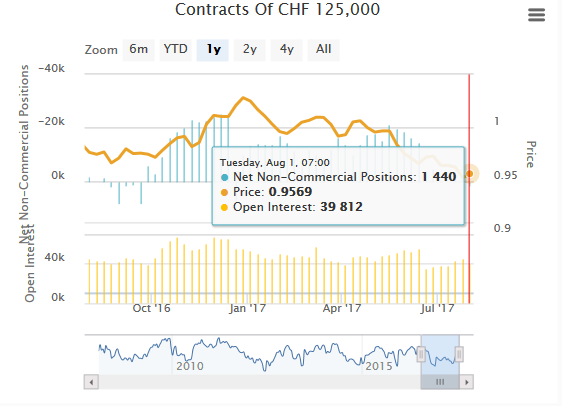

Weekly Speculative Positions (as of August 01): Speculators Press Ahead with Dollar-Bloc Currencies, but Hesitate with Euro and Yen

The net speculative CHF position has risen from -1.5K short to 1.4K contracts long (against USD). In the CFTC reporting week ending August 1, speculators in the futures market continued to build long exposure in the dollar-bloc currencies. In the three sessions after the reporting period closed, the dollar-bloc currencies have traded heavily.

Read More »

Read More »

FX Weekly Preview: Moving Toward September

The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France's Macron and Japan's Abe have sunk in the polls lower than Trump.

Read More »

Read More »

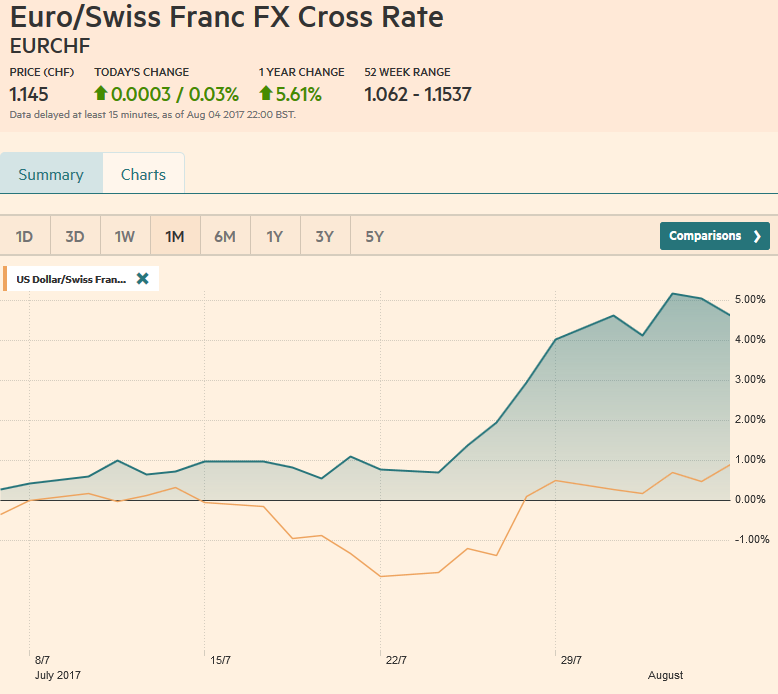

FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc 2% during this week.

Read More »

Read More »

Great Graphic: Italy-It is Not Just about Legacy

A little while back I was part of a small exchange of views on twitter. It was about Italy. I was arguing against a claim that Italy's woes are all about its past fiscal excesses. It is not just about about Italy's legacy.

Read More »

Read More »